|

January 8, 4:00 pm EST

Heading into the end of last year, we talked about the regulatory scrutiny starting to emerge toward the big tech giants (Facebook, Apple, Amazon, Netflix, Google… Tesla, Uber, Airbnb…) – and the risk that the very hot run they’ve had “could be coming to an end.”

These companies have benefited from a formula of favor from the Obama administration, which included regulatory advantages and outright government funding (in the case of Tesla). That created a “winner takes all” environment where this group of startups and loss-laden ventures, some with questionable business models, were able to amass war chests of capital, sidestep enduring laws, and operate without the constraints of liabilities (including taxes, in some cases) that burdened its competitors.

With the screws now beginning to tighten, under a new administration, and with the tailwinds of economic stimulus heading into the new year, I thought 2018 may be the year of the bounce back in the industries that have been crushed by the internet giants.

Among the worst hit, and left for dead industry, has been retail.

Last year, retail stocks looked a lot like energy did in the middle of 2016. If you were an energy company and survived the crash in oil prices to see it double off of the bottom, you were looking at a massive rebound. Some of those stocks have gone up three-fold, five-fold, even ten-fold in the past 18 months.

Similarly, if you’re a big-brand bricks and mortar retailer, and you’ve survived the collapse in global demand–and a decade long stagnation in the global economy–to see prospects of a 4% growth economy on the horizon, there’s a clear asymmetry in the upside versus the downside in these stocks. These are stocks that can have magnificent comebacks.

Remember, back in November we talked about the comeback underway in Wal-Mart and the steps it has made to challenge Amazon (you can see that again, here). In support of that thesis, the earnings numbers that came in for retail for the third quarter were strong. And now we’re getting a glimpse of what the fourth quarter will look like, as several retailers this morning reported strong holiday sales, and upped guidance on the fourth quarter.

Just flipping through a number of charts on retail stocks, the bottom appears to be in on retail – with many bottoming out in the September-November period last year. Since then, to name a few, Ralph Lauren is up 26%, Michael Kors is up 36%, Under Armour is up 42% and Footlocker is up 64%. The survivors have been comebacks as they’ve weathered the storm and now are blending their physical presence with an online presence.

By the time you get a ETF designed to bet against the survival of bricks and mortar retail, the bottom is probably in. That ETF, the Decline Of The Retail Store (EMTY), launched on November 17 and has gone straight down since.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. And 25% of our portfolio is in commodities stocks. You can join me here and get positioned for a big 2018.

January 4, 4:00 pm EST

We are off to what will be a very exciting year for markets and the economy.

Over the past two years I’ve written this daily piece, discussing the bigslow-moving themes that drive markets, the catalysts for change, and the probable outcomes. When we step back from all of the day to day noise that has distracted many throughout the time period, the big themes have been clear, and the case for higher stocks has been very clear. That continues to be the case as we head into the New Year.

As I’ve said, I think we’re in the early stages of an economic boom. And I suspect this year, we will feel it — Main Street will feel it, for the first time in a long time.

And I suspect we’ll see a return of “animal spirits.” This is what has been destroyed over the past decade, driven primarily by the fear of indebtedness (which is typical of a debt crisis) and mis-trust of the system. All along the way, throughout the recovery period, and throughout a quadrupling of the stock market off of the bottom, people have continually been waiting for another shoe to drop. The breaking of this emotional mindset has been tough. But with the likelihood of material wage growth coming this year (through a hotter economy and tax cuts), we may finally get it. And that gives way to a return of animal spirits, which haven’t been calibrated in all of the economic and stock market forecasts.

With this in mind, we should expect hotter demand and some hotter inflation this year (to finally indicate that the global economy has a pulse, that demand is hot enough to create some price pressures). With that formula, it’s not surprising that commodities have been on the move, into the year-end and continuing today (as the New Year opens). Oil is above $60. The CRB (broad commodities index) is up 8% over the past two weeks – and a big technical breakout is nearing.

This is where the big opportunities lie in stocks for the New Year. Remember, despite a very hot performance by the stock market last year, the energy sector finished DOWN on the year (-6%). Commodity stocks remain deeply discounted, even before we add the influence of higher commodities prices and hotter global demand. With that, it’s not surprising that the best billionaire investors have been spending time building positions in those areas.

This year is set up to handsomely reward the best stock pickers.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. And 25% of our portfolio is in commodities stocks. You can join me here and get positioned for a big 2018.

December 15, 9:00 pm EST

Last week we had the merger of Fox and Disney, and the repeal of the Net Neutrality rule. And the tax bill continues to inch toward the finish line.

That said, this would typically be the time of year when markets go quiet as money managers close the books on the year, decision makers at companies go on holiday and politicians do the same.

But that wasn’t the case last year, as President-elect Trump was holding meetings in Trump towers and telegraphing policy changes. And it may not be the case this year, as the tax plan may be approved before year end. The final votes are said to come next week, and the bill is tracking to be on the President’s desk by Christmas.

With that, and with the lack of market liquidity into the year end, we may get a further melt-up in last trading days of the year.

Yesterday we talked about the other side of the Net Neutrality story that doesn’t get much acknowledgement in the press. In short, the tech giants that have emerged over the past decade, to dominate, have done so because of regulatory favor. This favor has decimated industries and has dangerously consolidated power into the hands of few. The repeal of this rule is turning that regulatory tide.

It looks like the playing field might be leveling. That means a higher cost of doing business may be coming for Silicon Valley, with fewer advantages and more competition from the old-economy brands that have been investing to compete online. That means potentially slower earnings growth for the big internet giants, for those that are making money, and an even more uncertain future for those that aren’t (e.g. Tesla).

With this in mind, at the moment Amazon is valued at twice the size of Walmart. Uber is valued at almost 40 times the size of Hertz. And Tesla, which has lost $2.5 billion over the past five years is valued the same as General Motors, which has made $43 billion over the same period.

Next year could be the year these valuation anomalies correct.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click her

September 19, 2017, 6:00 pm EST Invest Alongside Billionaires For $297/Qtr

With a Fed decision queued up for tomorrow, let’s take a look at how the rates picture has evolved this year.

With a Fed decision queued up for tomorrow, let’s take a look at how the rates picture has evolved this year.

The Fed has continued to act like speculators, placing bets on the prospects of fiscal stimulus and hotter growth. And they’ve proven not to be very good.

Remember, they finally kicked off their rate “normalization” plan in December of 2015. With things relatively stable globally, the slow U.S. recovery still on path, and with U.S. stocks near the record highs, they pulled the trigger on a 25 basis point hike in late 2015. And they projected at that time to hike another four times over the coming year (2016).

Stocks proceeded to slide by 13% over the next month. Market interest rates (the 10 year yield) went down, not up, following the hike — and not by a little, but by a lot. The 10 year yield fell from 2.33% to 1.53% over the next two months. And by April, the Fed walked back on their big promises for a tightening campaign. And the messaging began turning dark. The Fed went from talking about four hikes in a year, to talking about the prospects of going to negative interest rates.

That was until the U.S. elections. Suddenly, the outlook for the global economy changed, with the idea that big fiscal stimulus could be coming. So without any data justification for changing gears (for an institution that constantly beats the drum of “data dependence”), the Fed went right back to its hawkish mantra/ tightening game plan.

With that, they hit the reset button in December, and went back to the old game plan. They hiked in December. They told us more were coming this year. And, so far, they’ve hiked in March and June.

Below is how the interest rate market has responded. Rates have gone lower after each hike. Just in the past couple of days have, however, we returned to levels (and slightly above) where we stood going into the June hike.

But if you believe in the growing prospects of policy execution, which we’ve been discussing, you have to think this behavior in market rates (going lower) are coming to an end (i.e. higher rates).

As I said, the Hurricanes represented a crisis that May Be The Turning Point For Trump. This was an opportunity for the President to show leadership in a time people were looking for leadership. And it was a chance for the public perception to begin to shift. And it did. The bottom was marked in Trump pessimism. And much needed policy execution has been kickstarted by the need for Congress to come together to get the debt ceiling raised and hurricane aid approved. And I suspect that Trump’s address to the U.N. today will add further support to this building momentum of sentiment turnaround for the administration. With this, I would expect to hear a hawkish Fed tomorrow.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

February 22, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

We had new record highs again in the Dow today. But remember, yesterday we talked about this dynamic where stocks, commodities and the dollar were strong. But a missing piece in the growing optimism about growth has been yields.

Clearly the 10 year at 2.40ish is far different than the pre-election levels of 1.75%-1.80%. But the extension was quick and has since been a non-participant in the full-on optimism vote given across other key markets.

Why? While stocks can get ahead of better growth, yields can’t in this environment. Higher stocks can actually feed higher growth. Higher yields, on the other hand, can kill it.

But there’s something else at work here. As we know Japan’s policy to target the their 10 year at zero provides an anchor to our interest rates, as the BOJ is in unlimited QE mode. Some of that freshly produced liquidity, and the money displaced by their bond buying, undoubtedly finds a happier home in U.S. Treasuries (with a rising dollar, and a 2.4% yield). That caps yields.

But in large part, the quiet drag on U.S. yields has also come from the rising risks in Europe. The election cycle in Europe continues to threaten a populist Trump-like movement, which is very negative for the European Union and for the survival of the single currency (the euro). That creates capital flight, which has been contributing to dollar strength and flows into the parking place of U.S. Treasuries (which pressures yields, which is keeping mortgage and other consumer rates in check).

These flows are also showing up clearly in the safest bond market in Europe: the German bunds. The 2-year German bund hit an all-time record LOW, today of -91 basis points. Yes, while the U.S. mindset is adjusting for the idea of a 3%-4% growth era, German yields are reflecting crisis and money is plowing into the safest parking place in Europe. The spread between German and French bonds are reflecting the mid-2012 levels when Italy and Spain where on the brink of insolvency — only to be saved by a bold threat/backstop from the European Central Bank.

We talked last week about the prospects for higher gold and lower yields as questions arise about the execution of (or speed of execution) Trump’s growth policies, some of the inflation optimism that has been priced in, may begin to soften. That would also lead to a breather for the stock market. I suspect we will begin to see the coming elections in Europe also contribute to some de-risking for the next couple of months. We already have a good earnings season and some solid economic data and optimism about the policy path priced in. May be time for a dip. But as I’ve said, it would create opportunities– to buy any dip in stocks, and sell any rally in bonds.

To peek inside the portfolio of Trump’s key advisor, join me in our Billionaire’s Portfolio. When you do, I’ll send you my special report with all of the details on Icahn, and where he’s investing his multibillion-dollar fortune to take advantage of Trump policies. Click here to join now.

February 1, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

I talked yesterday about the Fed. As I said, I think we’ll find that the Fed will shift gears again to stay behind the curve on inflation, to let the economy run a little hot. They met today and it was a non-event. They said nothing to build momentum on their rate hike from December.

The news of the day has been Apple (NASDAQ:AAPL) earnings. People over the past couple of years have been calling for the decline in Apple. They’ve said it’s topped. They can’t innovate in the post-Steve Jobs era. The iPhone was magic. But reproducing magic isn’t easy. Once you put a computer in everyone’s pocket, there’s not much more they can do to it with it. These are all of the quips about Apple’s peak. They may be right. But Apple’s peak, at least as a stock, is greatly exaggerated.

They reported a huge positive surprise on earnings yesterday after the close. The stock was up 6% on the day. But even before that, I suspect it has become a much loved stock in the past two months in the “smart money” investor community.

We should see in the coming weeks, as big investors disclose their positioning for the end of Q4, Apple will have returned to a lot of portfolios again. Warren Buffett, an investor that has made his fortune buying when others are selling, built a big stake at the lows of the year last year. And it’s a perfect Buffett stock.

It’s incredibly cheap compared to the market.

The stock still trades at 15x earnings. Much cheaper than the market. Apple trades at 13x next year’s projected earnings. The S&P 500 trades at 16.5x. What about Apple’s monster cash position? Apple has even more cash now — a record $246 billion. If we excluded the cash from the valuation, Apple market cap goes down from $675 billion to $429 billion. That would equate to Apple trading at closer to 9x earnings. Though not an “apples to apples” that valuation would group Apple with the likes of these S&P 500 components that trade around 9 times earnings, like: Dow Chemical, Prudential Financial, Bed Bath & Beyond, a Norwegian chemical company (LBY), and Hewlett Packard Enterprise. It’s safe to say no one is debating whether or not Hewlett Packard is at the pinnacle of its business. Yet, if we strip out the cash in Apple, AAPL shares are trading closer to an HPE valuation.

Add to that, Apple now has a fresh catalyst coming in, Trump policies. The new President Trump is incentivizing Apple (and others) to bring offshore cash hoards back home with a flat 10% tax. And Apple makes money – a lot of it. A cut in the corporate tax rate will be a boon for earnings. Two years ago, Carl Icahn argued that Apple should use (a lot more of) their cash to buyback shares – and, with that, valued the stock at double its current levels.

For help building a high potential portfolio for 2017, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

January 9, 2017, 4:30pm EST

Over the past year we’ve had a wild ride in global yields. Today I want to take a look at the dramatic swing in yields and talk about what it means for the inflation picture, and the Fed’s stance on rates.

When oil prices made the final leg lower early last year, the Japanese central bank responded to the growing deflationary forces with a surprise cut of their benchmark interest rate into negative territory.

That began the global yield slide. By mid-year, more than $12 trillion dollars with of government bond yields across the world had a negative interest rate. Even Janet Yellen didn’t close the door to the possibility of adopting NIRP (negative interest rate policies).

So investors were paying the government for the privilege of loaning it their money. You only do that when 1) you think interest rates will go even further negative, and/or 2) you think paying to park your money is the safest option available.

And when you’re a central banker, you go negative to force people out of savings. But when people think the world is dangerous and prices will keep falling, they tend to hold tight to their money, from the fear a destabilized world.

But this whole dynamic was very quickly flipped on its head with the election of a new U.S. President, entering with what many deem to be inflationary policies. But as you can see in the chart below, the U.S. inflation rate had already been recovering, and since November is now nudging closer to the Fed’s target of 2%.

Still, the expectations of much hotter U.S. inflation are probably over done. Why? Given the divergent monetary policies between the U.S. and the rest of the world, capital has continued to flow into the dollar (if not accelerated). That suppresses inflation. And that should keep the Fed in the sweet spot, with slow rate hikes.

Meanwhile, there’s more than enough room for inflation to run in other developed economies. You can see in Europe, inflation is now back above 1% for the first time in three years. That, too, is in large part because of its currency. In this case, a stronger dollar has meant a weaker euro. This (along with the UK and Japan) is where the real REflation trade is taking place. And it’s where it’s needed most, because it also means growth is coming with it, finally.

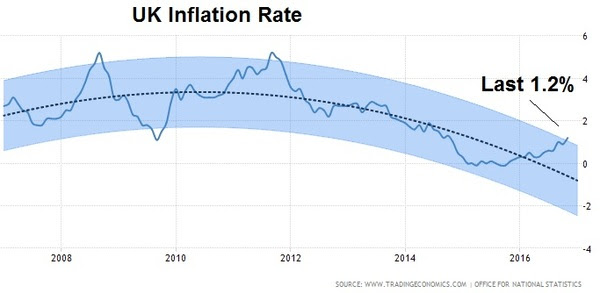

You can see, following Brexit, the chart looks similar in the UK – prices are coming back, again fueled by a sharp decline in the pound, which pumps up exports for the economy.

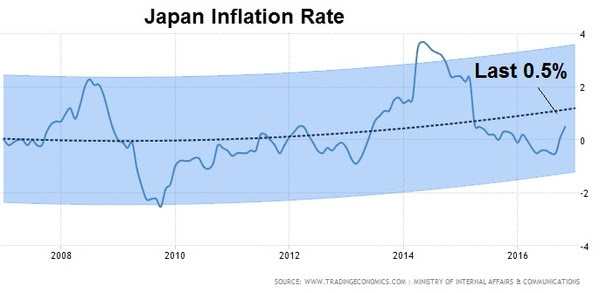

And, here’s Japan.

Japan’s deflation fight is the most noteworthy, following the administrations 2013 all-out assault to beat 2 decades of deflation. It hasn’t worked, but now, post-Trump, the stars may be aligning for a sharp recovery.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2017. You can join me here and get positioned for a big 2017.

January 6, 2017, 7:00pm EST

With the Dow within a fraction of 20,000 today, and with the first week of 2017 in the books, I want to revisit my analysis from last month on why stocks are still cheap.

Despite what the media may tell you, the number 20,000 means very little. In fact, it’s amusing to watch interviewers constantly probe the experts on TV to get an anwer on why 20,000 for the Dow is meaningful. They demand an answer and they tend to get them when the lights and a camera are locked in on the interviewee.

Remember, if we step back and detach from the emotions of market chatter, speculation and perception, there are simple and objective reasons to believe the broader stock market can go much higher from current levels.

I want to walk through these reasons again for the new year.

Reason #1: To return to the long-term trajectory of 8% annualized returns for the S&P 500, the broad stock market would still need to recovery another 49% by the middle of next year. We’re still making up for the lost growth of the past decade.

Reason #2: In low-rate environments, the valuation on the broad market tends to run north of 20 times earnings. Adjusting for that multiple, we can see a reasonable path to a 16% return for the year.

Reason #3: We now have a clear, indisputable earnings catalyst to add to that story. The proposed corporate tax rate cut from 35% to 15% is estimated to drive S&P 500 earnings UP from an estimated $132 per share for next year, to as high as $157. Apply $157 to a 20x P/E and you get 3,140 in the S&P 500. That’s 38% higher.

Reason #4: What else is not factored into all of this simple analysis, nor the models of economists and Wall Street strategists? The prospects of a return of ‘animal spirits.’ This economic turbocharger has been dead for the past decade. The world has been deleveraging.

Reason #5: As billionaire Ray Dalio suggested, there is a clear shift in the environment, post President-elect Trump. The billionaire investor has determined the election to be a seminal moment. With that in mind, the most thorough study on historical debt crises (by Reinhardt and Rogoff) shows that the deleveraging of a credit bubble takes about as long as it took to build. They reckon the global credit bubble took about ten years to build. The top in housing was 2006. That means we’ve cleared ten years of deleveraging. That would argue that Trumponomics could be coming at the perfect time to amplify growth in a world that was already structurally turning. A pop in growth, means a pop in corporate earnings–and positive earnings surprises is a recipe for higher stock prices.

For these five simple reasons, even at Dow 20,000, stocks look extraordinarily cheap.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2017. You can join me here and get positioned for a big 2017.

January 5, 2017, 4:00pm EST

We talked yesterday about the bad start for global markets in 2016. It was led by China. Today, it was a move in the Chinese currency that slowed the momentum in markets. Yields have fallen back. The dollar slid. And stocks took a breather.

China’s currency is a big deal to everyone. It’s the centerpiece of the tariff threats that have been levied from the U.S. President-elect. I’ve talked quite a bit about that posturing (you can see it again here: Why Trump’s Tough Talk On China May Work).

As we know, China, itself, sets the value of its currency every day. It’s called a managed float. They determine the value. And for the past two years, they’ve been walking it lower — weakening the yuan against the dollar. That’s an about face to the trend of the prior nine years. In 2005, in agreement with their major trading partners (primarily the U.S.), they began slowly appreciating their currency, in an effort to allay trade tensions, and threats of trade sanctions (tariffs).

So what happened today? The Chinese revalued its currency — pegged ithigher by a little more than a percent against the dollar. That doesn’t sound like a lot, but as you can see in the chart, it’s a big move, relative to the average daily volatility. That became big news and stoked a little bit of concern in markets, mostly because China was the sore spot at the open of last year, and the PBOC made a similar move around this time, when global marketswere spiraling.

Why did they do it? This time around, the Chinese have complained about the threat of capital flowing out of the country – it’s a huge threat to their economy in its current form. That’s where they’ve laid the blame, on the two year slide in the value of the yuan. With that, they’ve allegedly been fighting to keep the yuan stable and have been stepping up restrictions on money leaving the country. Today’s move, which included a spike in the overnight yuan borrowing rate, was a way to crush speculators that have been betting against the currency, putting further downward pressure on the currency. But it also likely Trump related – the beginning of a crawl higher in the currency as we head toward the inauguration of the new President Trump. It’s very typical for those under the gun for currency manipulation to make concessions before they meet with trade partners.

So, should we be concerned about the move today in China? No. It’s not another January 2016 moment. But the move did drive profit taking in twobig trends of the past two months: the dollar and U.S. Treasuries. With that, the first jobs report of the year comes tomorrow. It should provide more evidence that the Fed will hike a few times this year. And that should restore the climb in the dollar and in rates.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2017. You can join me here and get positioned for a big 2017.