January 23, 5:00 pm EST

The financial media has been focused on Davos this week — the host of the World Economic Forum, which is attended by the world’s top global government and corporate leaders.

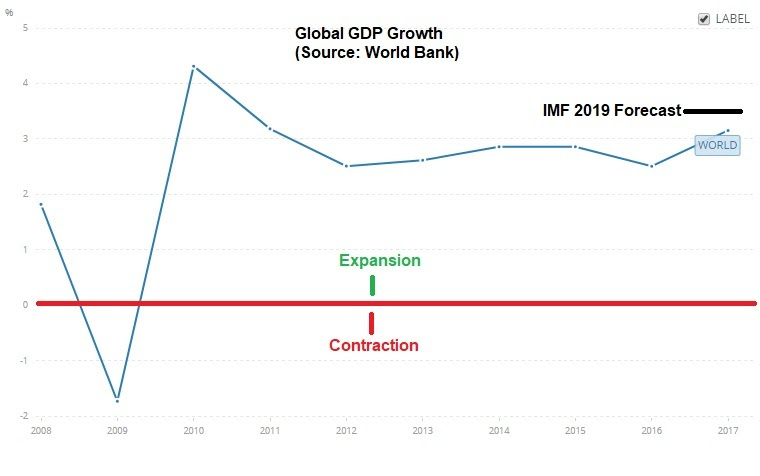

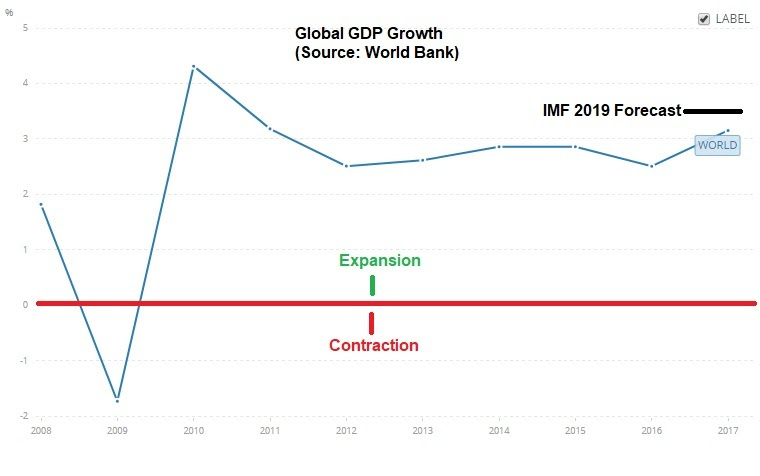

Coming off of an ugly December for global financial markets, it’s no surprise the conversation is all about “slowdown.” It’s an odd conversation, given that the U.S. economy is growing at 3%, corporate earnings are running at record levels, inflation is low and unemployment is low. Even the IMF could only justify a small markdown on their 2019 global GDP forecast — from an already high level.

For perspective, the IMF is now looking for 3.5% growth for 2019. Here’s how that looks relative to the past ten years ….

|

|

So, what’s the story?

As we discussed yesterday, it’s China, and the pressure of tariffs and reform demands on a vulnerable large economy that’s already drowning.

And the broader view is that trade is being hampered by the Trump/China standoff – and therefore dragging on growth. With that in mind, listening to some interviews from Davos, the one that stuck out to me was the DHL CEO (the world’s leading mail and logistics company). He said trade is not at all on the back foot, rather its flowing more than ever before.

So, the global growth slowdown talk is all about what might happen, not about what is happening. It’s about risk. With that, if China does make the concessions necessary to get a deal done (and they seem to have few options), we may end up getting a big upside surprise in global growth – especially given the very accomodative global monetary policy backdrop.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

September 18, 5:00 pm EST

Yesterday Trump made good on his promise by announcing another $200 billion in tariffs on China.

To the surprise of many, stocks went up. Why?

Perhaps it’s because reforming the way the world deals with China is a good thing. Remember, China’s currency manipulation over the past two decades led to the credit bubble, which ultimately led to the financial crisis. And as long as the rest of the world continues to allow China to maintain a trade advantage (dictated by their currency manipulation): 1) they will manufacture hot economic growth through exports, 2) the global cycle of booms and bust will continue, and 3) the wealth transfer from the rest of the world to China will continue.

With this in mind, as I’ve said, the trade dispute is all about China – everything else Trump has taken on (Canada, Mexico, Europe) has been to gain leverage on getting movement in China.

With Trump now making it very clear that he won’t back down until major structural change takes place in China, it’s no surprise that one of the biggest winners of the day (following the further economic sanctions on China) was Japan!

The Nikkei was up big today. And it was Japanese stocks that set the tone for global markets on the day. As a signal that China’s days of cornering the world’s export markets may be coming to an end, Japan is in position to be a big winner.

Remember, while much of the world has returned to new record highs following the global financial crisis, Japan remains 40% away from the record highs set nearly 30 years ago.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

March 13, 5:00 pm EST

We talked yesterday about the important inflation data. That was in line this morning. And with that, the big 3% level on the benchmark 10-year government bond yield remains well preserved.

But stocks soured anyway on the day, and it was led by the Nasdaq.

Let’s take a closer look at the Nasdaq.

This is where the big tech giants, Apple, Microsoft and Amazon have led the charge back in the index back to new record highs over the past couple of days. Those three stocks represent about a third of the index (and contribute heavily to the S&P 500 too).

But as the three tech giants led the way up, they cracked today, and we now have some very compelling signals that another down leg for stocks may be here.

First, as the broader financial markets are still licking the wounds of the sharp correction, and still jittery, Apple hit a record high valuation of $925 billion this week (sniffing near the trillion dollar valuation mark). And then it did this today…

As you can see in this chart above, Apple put in a huge bearish reversal signal (an outside day).

So did Microsoft (a huge bearish reversal signal).

So did Amazon, after breaching record levels of $1600 over the past two days …

And, not surprisingly, same is said for the Nasdaq – a big reversal signal…

The S&P 500 had the same reversal pattern.

For perspective, if we avoided the distraction of the big cap weighted indices, the Dow chart tells us the downtrend in stocks from the late January highs remains well intact.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

March 7, 3:00 pm EST

As we discussed yesterday, stocks have fully recovered the decline that people were attributing to Trump’s trade barrier announcement last week.

With that, the tariff hysteria seems to have subsided a bit, as they struggle for evidence to support their hyperbole. Perhaps people may start acknowledging that we are now in a higher volatility environment, and that we will be slowly working out of this recent price correction until corporate earnings and economic growth data start confirming the benefits of tax cuts.

Interestingly, they seem to hate the trade threat, far more than the love the tax incentives and the pro-growth initiatives. And while trade is a complicated issue, everyone seems to suddenly have an expert opinion on it. And everyone is an expert on the Smoot-Hawley Act (which, by the way was a tariff on over 20,000 goods) and depression-era economics.

If they indeed were reflective about the economy, I think they would agree that we (and the world) desperately need growth initiatives to save us from terminal central bank life support (which wouldn’t be so terminal given they have fired all of their bullets to keep us afloat as long as they did). And they would know that we are in for a perpetual cycle of booms and busts (repeat of the credit bubble and burst) if the trade imbalances (mainly between China overproducing and the U.S. overconsuming) ultimately are not corrected.

Now, as more of the conversation on trade turns more toward China, I want to revisit an excerpt from my note in December of 2016 (when Trump was President-elect):

MONDAY, DECEMBER 19, 2016 — “While many think Trump will provoke a military conflict, that’s far from a certainty. With the credibility to act, however, Trump’s tough talk on China creates leverage. And from that leverage, there may be a path to a mutually beneficial agreement, where the U.S. can win in trade with China, and China can win. But it may get uglier before it gets better. In the end, growth solves a lot of problems. A hotter growing U.S. economy (driven by reform and fiscal stimulus), will ultimately drive much better growth in the global economy. And China has a lot to gain from both. Though in a fair-trade environment, they won’t get as much of the pie as they’ve gotten over the past two decades. But it has the chance of leading to a more balanced and sustainable economy in China, which would also be a win for everyone.”

Now, why not just focus on China now? Because they will continue to abuse other countries. And those open trade channels will still allow that product to enter the U.S. As we discussed yesterday, the global economy has been damaged by China’s currency/trade policy, yet the rest of the world has been relying on the U.S. to lead the fight. They need to join the fight to create the leverage to make it ultimately work – so that the global economy can find a sustainable path of recovery and robust growth.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

March 4, 9:00 pm EST

Stocks continue to swing around, and in wider ranges than we’ve seen in a while. We should expect this type of action following a sharp technical correction–a correction that shook many of the players out of the market, that were contributors to suppressing volatility in recent years (the short vol ETFs among them).

Now, as I’ve said in the past, people always search for a story to fit the price. Despite the fact that stocks have been swinging around, with little or no story for them to attribute, they were quick to pounce on Trump’s announcement about steel tariffs, and have since blamed every down tick in the stock market for it. And they’ve run wild with trade war scenarios. For those trying to capitalize on that fear scenario, it shows how uninformed, naive or intellectually dishonest they are (most the latter). They like to evaluate it as if there is no context or history.

Where have they all been the past 20-plus years?

China has been manipulating the global markets through their cheap currency policy for the better part of the past 25 years. In pinning down their currency, they cornered the world’s export market. And in the process, they emerged as the second largest economy in the world. They also accumulated the world’s largest reserve of foreign currencies, which they plowed into global credit markets (mainly our Treasurys) to fuel cheap credit, which ultimately led to the global credit bubble and bust (the global financial crisis). We buy their cheap stuff. They take our dollars and buy Treasurys, supplying more credit to us to buy more of their cheap stuff. And so the cycle goes.

Currencies are the natural balancing mechanism to prevent this bubble/global imbalance from forming. When freely traded in an open economy, the market demand for yuan, given the aggressive growth in the economy, would have driven the value of China’s currency higher, making its exports less attractive, and therefore slowing their breakneck growth and wealth accumulation in China, and its ability to fuel global credit. But of course, the government determines the value of the yuan, and keeping the currency cheap is part of the economic model in China (still).

For those that fear retaliation (a historic response to protectionism), this is retaliation… for 20 years of wealth transfer.

The tariff threats address metals, but the currency is a key tool that makes it all happen. For those that like to play it as a political football, Trump is not the architect of the plan. A staunch democratic Senator from New York, Charles Schumer, led the push in Congress for a bill in 2005 to impose a 35% tariff on China. That’s what ultimately led to the agreement by the Chinese to allow their currency to weaken (somewhat). With that, I want to revisit my note from late September 2016 (prior to the elections) for a little more backstory on Why Trump Is Right About China (read more here).

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers. You can add these stocks at a nice discount to where they were trading just a week ago.