|

We’ve now heard from about half of the S&P 500 companies on Q4 earnings. And about 70% of those companies have beat Wall Street’s earnings estimates. We’ve heard from the banks, early on, which broadly painted the picture of a healthy economy. And now we’ve heard from the dominant tech giants/ disrupters of the past decade. Facebook beat. Amazon beat. Google beat. But times are changing. Remember, the regulatory screws have tightened on the tech giants over the past year. It was a matter of when the market would finally price OUT the idea that these industry killers would be left unchallenged, to become monopolies. With that in mind, back in early October, when market risks were building (from China, to interest rates, to Italy, to Saudi Arabia), we looked at this big and vulnerable trendline in Amazon.

|

|

|

Here’s the chart on Amazon now … |

|

|

The break of that line gave way to a 30% plunge in what was the biggest company in the world. Bottom line: Amazon, Facebook and Google have entered into regulatory purgatory — after being largely left alone for the past decade to nearly destroy industries with little-to-no regulatory oversight. Costs are going UP and will keep going up.. With all of this said, the stocks of these tech giants might take a breather, but given their scale and maturity, more regulation actually strengthens their moat. There will never be a competitor to Facebook Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

February 4, 5:00 pm EST U.S. stocks are being valued right at the long-term P/E, just under 16x forward earnings. And remember, that’s in an ultra-low interest rate environment (still). Historically, in low rate environments stocks trade north of 20 times earnings. With the Fed now on hold, and the 10-year yield back below 3%, if we continue to see this sweet spot of good economic activity and subdued inflation, we should see this multiple on stocks expand toward 20 this year. If we multiply Wall Street’s 2019 earnings estimate on the S&P 500 ($172) times a P/E of 20, we get 3,440 in the S&P 500. That’s 26% higher than current levels. Now, stocks in the U.K., Germany and Japan are all trading closer to 12x forward earnings. That’s cheap relative to long-term averages, and especially cheap relative to U.S. stocks. For perspective, Japanese stocks are recovering back toward the highest levels in more than 25 years, yet the forward P/E on Japanese stocks is closer to the lowest levels over the period. From a technical perspective, Japanese stocks should follow the lead of this big trend break in U.S. stocks…

|

|

|

Here’s a look at the Nikkei and the opportunity to see this “laggard” catch up … |

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

|

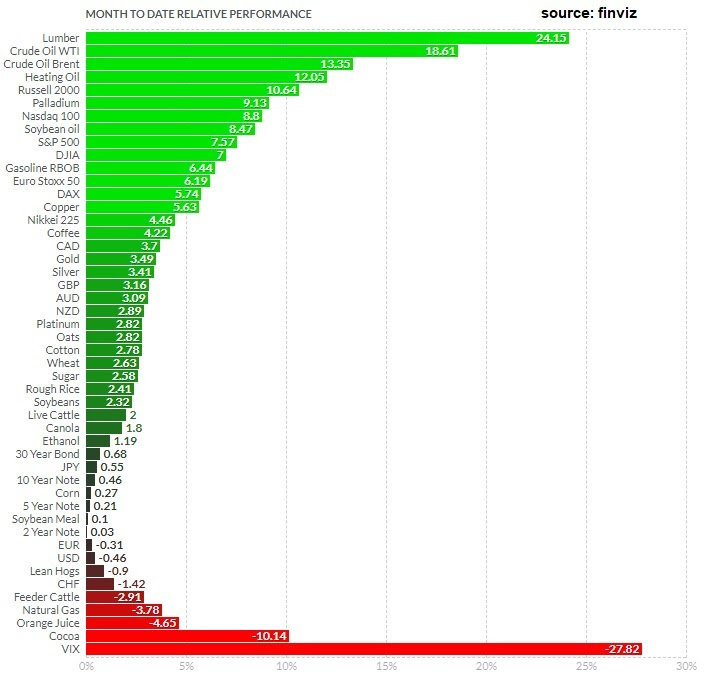

January 31, 5:00 pm EST With the Fed officially on hold, asset prices continue to lift-off. But with U.S./China talks concluding today, there was the potential for a spoiler. Trump quickly stepped in front of that risk this morning, saying that no final deal would be made until he and President Xi meet “in the very near future.” So the expectations of a final “yea or nay” on a China deal today were managed down. And with that, the recovery in global markets finished the month of January on a strong note. What a difference a month makes. In December, people were beginning to worry that collapsing global financial markets would kill the global economic recovery — and maybe fuel another financial crisis. A month later, and the S&P 500 sits just 2% lower than the close of November (before the December rout). And in January, almost every market is in the green (from stocks to bonds to commodities to currencies).

|

|

|

Remember, if we compare this to last year, cash was the best performing major asset class (returning just less than 2% in dollar terms). On Friday, we talked about the set up for a big run in commodities this year. Commodities continue to lead the way. Crude is up close to 20%on the month. Copper is up 6% for January (the commodity known to be a early indicator of turning points in the economy), and gold is up 3.5% just in the past week. We also end the month with another very solid opening to earnings season. Despite all of the pessimism of the past quarter. The Q4 earnings continue to beat expectations. Importantly, the widely held tech giants have posted good reports: Facebook, Apple and Amazon. Importantly, with the expectations bar set low coming into 2019 (for earnings, the economy and a China deal), I’d say we finish the first month of the year in position to exceed expectations on those fronts – thanks, in no small part, to the pivot by the Fed.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

January 30, 5:00 pm EST Remember, over the past three weeks, the major central banks in the world (the Fed, the ECB and the BOJ) reminded us of the script they have followed, and continue to follow, since the global financial crisis. They will do ‘whatever it takes‘ to keep the economic recovery going. It took an ugly decline in stocks in December to resurrect the defensive stance from the architects of the decade-long global economic recovery. Confidence matters, as it relates to the economic outlook. And stocks heavily influence confidence. With that, the Fed raised the white flag on January 4th when they marched out Bernanke, Yellen and Powell at an economic conference to reset the market expectations on monetary policy (moving from a four rate hike forecast for 2019 to a ‘wait and see’ approach). They solidified that stance today. Removing this risk, of the Fed offsetting the benefits of fiscal stimulus, is continuing to prime global markets. And we get a break of this trendline today in stocks — from the correction that originated from the record highs of October. |

|

|

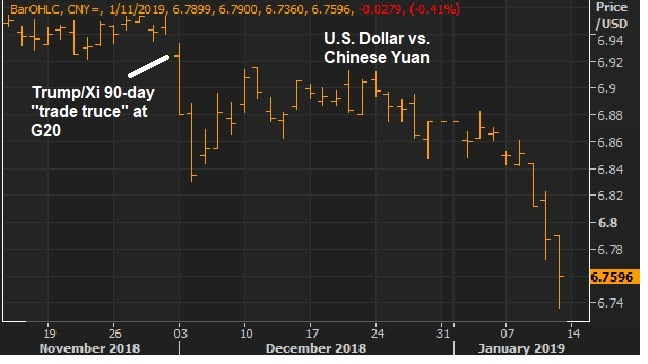

With the Fed behind us, the attention turns to the U.S./China meetings, which are underway. Let’s revisit the one indicator from China that they are working to pacify the Trump administration. It’s the Chinese currency. Remember, we looked at this chart back on January 11 of the U.S. dollar/Chinese yuan exchange rate … |

|

|

In this chart, the falling orange line represents the Chinesestrengthening their currency. And, as we can see, they have been showing a willingness to make concessions, walking it higher since the December “trade truce.” Make no mistake, the trade war is all about China’s currency. Ultimately, a free floating currency in China would be the solution to the trade imbalances and dangerous wealth transfer of the past few decades. To this point, it has been reported that they are presenting a plan to balance trade with the U.S. in six years. Maybe currency is part of it. We shall see.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

|

January 10, 5:00 pm EST

The coordinated response to market turmoil continues to reverse the tide of what was becoming an increasingly ugly global financial market meltdown.

Remember, we had a response from the U.S. Treasury Secretary on the days leading up to Christmas, which included call outs to the major banks and a meeting of the “President’s Working Group” on financial markets. Coincidentally, by the next Wednesday, a new item hit the agenda for the American Economic Association Annual Meeting. It was the January 4 live interview with the three most powerful central bankers in the world over the past ten years: Bernanke, Yellen and Powell. These three sat on stage together and massaged market sentiment on the path of interest rates, fortifying the market recovery that was started by the efforts of the Treasury.

Just in case we didn’t get the message, we’ve since had six Fed officials publicly dialing down expectations on the rate outlook, in response to financial markets. And we’ve had minutes from the Fed’s last meeting that clearly gave the message that the Fed could pause, sit and watch. And then today Powell was on stage again for another public interview, reiterating the Fed’s new position: on hold.

Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now.

|

January 9, 5:00 pm EST We discussed yesterday how markets might look by the end of the year, if the pontifications about a global slowdown and impending crisis are dead wrong. The reality: That is the low probability outcome. The higher probability outcome is another 3%+ year growth in the U.S. in 2019, a resolution on the Chinese trade dispute, and a rebound in emerging market growth. With the “high probability scenario” in mind, let’s take a look at some key charts that look very vulnerable to a sharp squeeze. Remember, oil and stocks have been in a synchronized decline since October 3. On Friday we looked at this chart on oil, and the break of the big downtrend that accompanied some rate-hike relief jawboning from the Fed. |

|

|

Today the chart looks like this …up almost 9% from Friday.

|

|

|

Here’s the chart on stocks we looked at on Friday …

|

|

|

We broke a big level on Friday at 2,520. We’re up another 2.3% since. What about yields? The fear in the interest rate market hasn’t been/wasn’t that the economy can’t withstand a 3% ten-year yield. The fear has been the speed at which the interest rate market was moving, and the methodical tightening process of the Fed. Would 3% quickly become 4%? The Fed has now backed off. That quells the fears of a “too far, too fast” adjustment in rates. But the interest rate market had already been pricing in the worst case scenario (another recession and crisis, in part thanks to the Fed policy). If that was an over-reaction, I suspect we’ll see a move back toward 3%-3.25% in the 10s in the coming months. As you can see in the chart, this big line is being tested today. And as long as the Fed stays data dependent, not telegraphing another series of hikes, the market should accept a 3% ten year yield just fine. |

|

|

To sum up: Markets tend to be caught wrong-footed at the extremes — leaning too hard in one direction, with sentiment too depressed or too exuberant. And I suspect we’ve seen that extreme in Q4. Sentiment was deeply shaken by the sharp decline in stocks, and that spilled over into the outlook for global economic stability.

But as we discussed yesterday, we have a Q4 earnings season upon us that is set up for positive surprises (given the sharp downward adjustment in expectations). And if Trump gives some ground to get a deal done with China, these key markets are set up for big and sharp recoveries. Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|