|

|

April 10, 5:00 pm EST The minutes were released from the March Fed meeting today. But we already know very clearly where they stand. Remember, they spent the better part of the first three months of the year marching out Fed officials (one after another) to give us a clear message that they would do nothing to kill the economic recovery. Just in case there was any question, Jay Powell stepped in just ahead of the March Fed meeting with an exclusive 60 Minutes interview, where he spoke directly to the public, to reassure everyone that the economy was in good shape, and that the Fed was there to promote stability (i.e. rates on hold and even prepared to act if the environment were to turn for the worse). As expected, the ECB echoed that position today, following their meeting on monetary policy. As we’ve discussed, the major global central banks have again coordinated both messaging and policy to ward off an erosion of confidence in the global economy. No surprises. And I’m sure managing the U.S. 10-year yield has been part of that coordinated response. In addition to the speculative flows that have pushed yields lower, I suspect there has been a healthy dose of central bank buying (Bank of Japan and others through sovereign wealth funds). With that, even though stocks have bounced back, commodities are on the move, and we’ve had improvements in global economic data, we still have European 10-year yields (Germany) at zero and U.S. yields at 2.50%. That is promoting the global central bank stability plan. |

|

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors. Join now and get your risk free access by signing up here. |

|

April 9, 5:00 pm EST A key piece in the continuation of the global economic recovery will be a weaker dollar. It will drive a more balanced U.S. and global economy, and it will reflect strength in emerging markets (i.e. capital flows to emerging markets). To this point, as we’ve discussed, higher U.S. rates have meant a stronger dollar. With global central banks moving in opposite directions in recent years, capital has flowed to the United States. But the emerging markets have suffered under this dynamic. As money has moved OUT of emerging market economies, their economies have weakened, their currencies have weakened, and their foreign currency denominated debt has increased. But now we have a retrenchment from the Fed. And we have coordinated global monetary policy (facing in the same direction). This sets up to solidify a long-term bear market for the dollar. Let’s take a look at a couple of charts that argue the long-term trend is already lower, and the next leg will be much lower. First, here’s a revisit of the long-term dollar cycles, which we’ve looked at quite a bit in this daily note. Since the failure of the Bretton-Woods system, the dollar has traded in six distinct cycles – spanning 7.6 years on average. Based on the performance and duration of past cycles, the bull cycle is over, and the bear cycle is more than two years in. |

|

|

With this in mind, if we look within this current bear cycle, technically the dollar is trading into a major resistance area – a 61.8% retracement. The next leg should be lower, and for a long period of time. |

|

|

Trump wants a weaker dollar, and I suspect he’s going to get it.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors. Join now and get your risk free access by signing up here. |

April 8, 5:00 pm EST

As we discussed on Friday, the overhang of risks to markets, to the Trump administration and to the economy are as light as we’ve seen in quite some time.

With this in mind, we have a fairly light data week – which means the likelihood of a disruption in the rise in stocks and risk appetite remains low.

We get some inflation data this week, which should be tame, justifying the central bank dovishness we’ve seen in recent months. The ECB meets this week. They’ve already walked back on the idea that they might hike rates this year. Expect Draghi to hold the line on that. The Chinese negotiations have positive momentum, with reports over the weekend that talks last week advanced the ball. And we have another week before Q1 earnings season kicks in.

So, expect the upward momentum to continue for stocks. Just three months into the year and stocks are up big, and back near record highs in the U.S.. The S&P 500 is up 15% year-to-date. The DJIA is up 13%. Nasdaq is up 20%. German stocks are up 13%. Japanese stocks are up 11%. And Chinese stocks are up 32%.

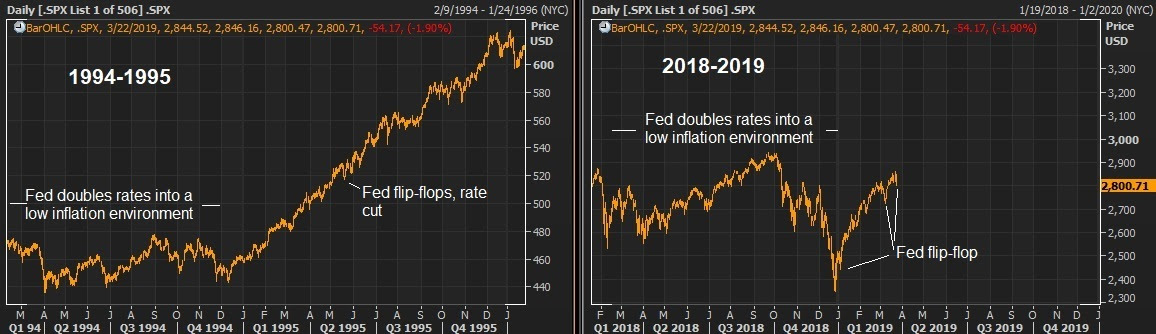

Remember, we’ve talked about the signal Chinese stocks might be giving us, putting in a low on the day the Fed did it’s about face on the rate path, back on January 4th.

The aggressive bounce we’ve since had in Chinese stocks appears to be telegraphing the bottoming in the Chinese economy. That’s a big relief signal for the global economy. Commodities prices are supporting that view (sending the same signal). Oil is now up 42% on the year. And the CRB industrial metals index is up 24%.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors.

Join now and get your risk free access by signing up here.

|

|

|

|

|

|