January 7, 5:00 pm EST

The Fed sent a message to markets on Friday that they will pause on rates hikes, if not stand ready to act (i.e. cut rates or stop shrinking the balance sheet), unless market conditions improve.

With that support, stocks continue to rebound. But as the market focus is on stocks, the quiet big mover in the coming months might be commodities.

Over the weekend, the President confirmed that the $5 billion+ border wall would be made of steel — produced by U.S. steel companies. Add to that, it’s fair to expect that the next item on the Trumponomics agenda, will be a big trillion-dollar infrastructure spend (an initiative believed to be supported by both parties in Congress).

Trump has also threatened to move forward with the wall under an executive order, citing national security. With that, the execution on the wall, regardless of the state of negotiations on Capitol Hill should be coming sooner rather than later.

Let’s take a look today at a few domestic steel companies that should benefit.

Nucor Corp (NUE)

Nucor corp is the largest steel producer in the United States.

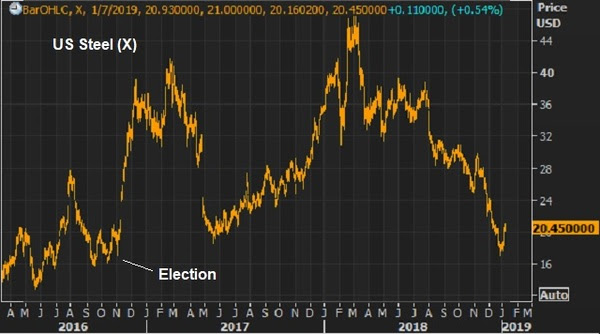

U.S. Steel (X)U.S. Steel is the second largest domestic steel producer.

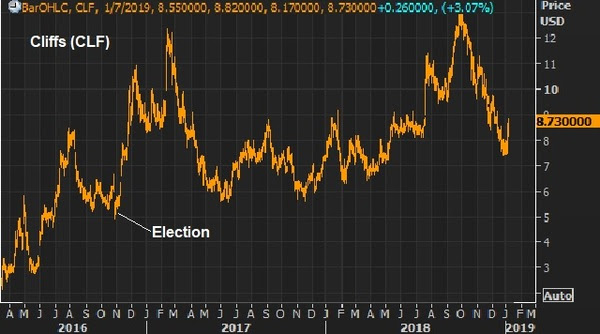

Cleveland-Cliffs (CLF)Cliffs is the largest supplier of iron units to North American steel mills.

As you can see, these stocks all benefited early on (post election) on the prospects of Trump’s America First economic plan. But, like the broader market, these stocks are all well off of the 2018 highs now — driven by the intensified trade dispute with China over the past year, the uptick in global economic risks, and the concern over Trumponomics policy execution with a split Congress. They look very, very cheap considering the outlook for domestic steel demand.

Disclosure: We are long Cliffs (CLF) in our Billionaire’s Portfolio.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

May 23, 5:00 pm EST

There has been a lot of attention over the past couple of days on China and trade relations.

China has moved down tariffs on auto and auto parts imports. And a source today said the government has “encouraged” China’s largest oil refiner to buy more U.S. crude oil. Based on the reports, China is now taking about 8 times the daily volume of U.S. crude imports, compared to averages a few months ago.

These are concessions! This is a distinct power shift. Not long ago, the world was afraid to rattle the cage of China. They (global trading partners) tiptoed around touchy matters like Chinese currency manipulation prior to the global financial crisis a decade ago, and even more so after the crisis.

But now, you can see the leverage that has been created by Trump. This is exactly what we talked about the day after the election.

Here’s an excerpt from my November 9, 2016 Pro Perspectives note, back when the experts were predicting Draconian outcomes for poking the China giant: “As we’ve seen with Grexit and Brexit, the votes came with dire warnings, but have resulted in creating leverage. Trump’s complaints about China are right. And a threat of slapping a tariff on Chinese goods creates leverage from which to negotiate.”

Now, we have an economy that is leading the global economic recovery. China wants and needs to be part of it. And we have a President that has a loud bark, and the credibility to bite. And that is creating movement. Let’s revisit, also from one of my 2016 notes, why this China negotiation is so important …

TUESDAY, SEPTEMBER 27, 2016

China’s biggest and most effective tool is and always has been its currency. China ascended to the second largest economy in the world over the past two decades by massively devaluing its currency, and then pegging it at ultra-cheap levels.

Take a look at this chart …

In this chart, the rising line represents a weaker Chinese yuan and a stronger U.S. dollar. You can see from the early 1980s to the mid-1990s, the value of the yuan declined dramatically, an 82% decline against the dollar. China trashed its currency for economic advantage—and it worked, big time. And it worked because the rest of the world stood by and let it happen.

In this chart, the rising line represents a weaker Chinese yuan and a stronger U.S. dollar. You can see from the early 1980s to the mid-1990s, the value of the yuan declined dramatically, an 82% decline against the dollar. China trashed its currency for economic advantage—and it worked, big time. And it worked because the rest of the world stood by and let it happen.

For the next decade, the Chinese pegged its currency against the dollar at 8.29 yuan per dollar (a dollar buys 8.29 yuan).

With the massive devaluation of the 1980s into the early 1990s, and then the peg through 2005, the Chinese economy exploded in size. It enabled China to corner the world’s export market, and suck jobs and foreign currency out of the developed world. This is precisely what Donald Trumpis alluding to when he says ‘China is stealing from us.’

China’s economy went from $350 billion to $3.5 trillion through 2005, making it the third largest economy in the world.

This next chart is U.S. GDP during the same period. You can see the incredible ground gained by the Chinese on the U.S. through this period of mass currency manipulation.

This next chart is U.S. GDP during the same period. You can see the incredible ground gained by the Chinese on the U.S. through this period of mass currency manipulation.

And because they’ve undercut the world on price, they’ve become the world’s Wal-Mart (sellers to everyone) and have accumulated a mountain for foreign currency as a result. China is the holder of the largest foreign currency reserves in the world, at more than $3 trillion dollars (mostly U.S. dollars). What do they do with those dollars? They buy U.S. Treasurys, keeping rates low, so that U.S. consumers can borrow cheap and buy more of their goods—adding to their mountain of currency reserves, adding to their wealth and depleting the U.S. of wealth (and the cycle continues).

And because they’ve undercut the world on price, they’ve become the world’s Wal-Mart (sellers to everyone) and have accumulated a mountain for foreign currency as a result. China is the holder of the largest foreign currency reserves in the world, at more than $3 trillion dollars (mostly U.S. dollars). What do they do with those dollars? They buy U.S. Treasurys, keeping rates low, so that U.S. consumers can borrow cheap and buy more of their goods—adding to their mountain of currency reserves, adding to their wealth and depleting the U.S. of wealth (and the cycle continues).

This is the recipe for big trade imbalances — lopsided economies too dependent upon either exports or imports. And it’s the recipe for more cycles of booms and busts … and with greater frequency.”

Again, China has to be dealt with. And we’re starting to see signs of progress on that front. Good news.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

March 7, 3:00 pm EST

As we discussed yesterday, stocks have fully recovered the decline that people were attributing to Trump’s trade barrier announcement last week.

With that, the tariff hysteria seems to have subsided a bit, as they struggle for evidence to support their hyperbole. Perhaps people may start acknowledging that we are now in a higher volatility environment, and that we will be slowly working out of this recent price correction until corporate earnings and economic growth data start confirming the benefits of tax cuts.

Interestingly, they seem to hate the trade threat, far more than the love the tax incentives and the pro-growth initiatives. And while trade is a complicated issue, everyone seems to suddenly have an expert opinion on it. And everyone is an expert on the Smoot-Hawley Act (which, by the way was a tariff on over 20,000 goods) and depression-era economics.

If they indeed were reflective about the economy, I think they would agree that we (and the world) desperately need growth initiatives to save us from terminal central bank life support (which wouldn’t be so terminal given they have fired all of their bullets to keep us afloat as long as they did). And they would know that we are in for a perpetual cycle of booms and busts (repeat of the credit bubble and burst) if the trade imbalances (mainly between China overproducing and the U.S. overconsuming) ultimately are not corrected.

Now, as more of the conversation on trade turns more toward China, I want to revisit an excerpt from my note in December of 2016 (when Trump was President-elect):

MONDAY, DECEMBER 19, 2016 — “While many think Trump will provoke a military conflict, that’s far from a certainty. With the credibility to act, however, Trump’s tough talk on China creates leverage. And from that leverage, there may be a path to a mutually beneficial agreement, where the U.S. can win in trade with China, and China can win. But it may get uglier before it gets better. In the end, growth solves a lot of problems. A hotter growing U.S. economy (driven by reform and fiscal stimulus), will ultimately drive much better growth in the global economy. And China has a lot to gain from both. Though in a fair-trade environment, they won’t get as much of the pie as they’ve gotten over the past two decades. But it has the chance of leading to a more balanced and sustainable economy in China, which would also be a win for everyone.”

Now, why not just focus on China now? Because they will continue to abuse other countries. And those open trade channels will still allow that product to enter the U.S. As we discussed yesterday, the global economy has been damaged by China’s currency/trade policy, yet the rest of the world has been relying on the U.S. to lead the fight. They need to join the fight to create the leverage to make it ultimately work – so that the global economy can find a sustainable path of recovery and robust growth.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

March 4, 9:00 pm EST

Stocks continue to swing around, and in wider ranges than we’ve seen in a while. We should expect this type of action following a sharp technical correction–a correction that shook many of the players out of the market, that were contributors to suppressing volatility in recent years (the short vol ETFs among them).

Now, as I’ve said in the past, people always search for a story to fit the price. Despite the fact that stocks have been swinging around, with little or no story for them to attribute, they were quick to pounce on Trump’s announcement about steel tariffs, and have since blamed every down tick in the stock market for it. And they’ve run wild with trade war scenarios. For those trying to capitalize on that fear scenario, it shows how uninformed, naive or intellectually dishonest they are (most the latter). They like to evaluate it as if there is no context or history.

Where have they all been the past 20-plus years?

China has been manipulating the global markets through their cheap currency policy for the better part of the past 25 years. In pinning down their currency, they cornered the world’s export market. And in the process, they emerged as the second largest economy in the world. They also accumulated the world’s largest reserve of foreign currencies, which they plowed into global credit markets (mainly our Treasurys) to fuel cheap credit, which ultimately led to the global credit bubble and bust (the global financial crisis). We buy their cheap stuff. They take our dollars and buy Treasurys, supplying more credit to us to buy more of their cheap stuff. And so the cycle goes.

Currencies are the natural balancing mechanism to prevent this bubble/global imbalance from forming. When freely traded in an open economy, the market demand for yuan, given the aggressive growth in the economy, would have driven the value of China’s currency higher, making its exports less attractive, and therefore slowing their breakneck growth and wealth accumulation in China, and its ability to fuel global credit. But of course, the government determines the value of the yuan, and keeping the currency cheap is part of the economic model in China (still).

For those that fear retaliation (a historic response to protectionism), this is retaliation… for 20 years of wealth transfer.

The tariff threats address metals, but the currency is a key tool that makes it all happen. For those that like to play it as a political football, Trump is not the architect of the plan. A staunch democratic Senator from New York, Charles Schumer, led the push in Congress for a bill in 2005 to impose a 35% tariff on China. That’s what ultimately led to the agreement by the Chinese to allow their currency to weaken (somewhat). With that, I want to revisit my note from late September 2016 (prior to the elections) for a little more backstory on Why Trump Is Right About China (read more here).

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers. You can add these stocks at a nice discount to where they were trading just a week ago.

January 23, 2017, 4:30pm EST

The new President Trump has wasted no time on carrying out his plan on trade. He met with 12 major U.S. company leaders today and told them that they would pay to build outside of the U.S., but (importantly) they would save to build here. And he wrote an executive order to withdraw from the Trans-Pacific Partnership, and one to renegotiate NAFTA.

There are plenty of people that have focused on the risks and the dangers with the Trump trade policies. Meanwhile, those most directly affected aren’t quite as draconian on the outlook — quite the opposite. The executives that have walked out of Trump Tower, and now the White House have largely been optimistic. The same is said for trade partners. Whether they mean it or not, they understand the value of doing business with the U.S. consumer.

As I’ve said, there are clear opportunities for win-wins – especially in a world that must rebalance trade to avoid more cycles of the booms and busts, like the boom-bust we experienced over the past two decades. The administration has the leverage of power (with a Republican Congress), but they also have the leverage of rewards. Despite what the media tells us, behind closed doors the new administration seems to negotiate by carrot rather than stick. Trump comes to meetings bearing gifts, and that creates buy-in.

When you bring American CEOs in and tell them that you’re going to give them a 20 percentage point tax cut, you’re going to slash the regulation burden (by “75%” as he said today), you’re going to give them a 30+ percentage point tax cut on repatriating offshore money, and your going to launch a trillion dollar infrastructure spend, all in an effort to juice the economy to a 4%+ growth rate, they’re going to be very excited — even if you tell them they can no longer access the cheapest production in the world.

In the end, they’d rather have a hot economy to sell into, than a stagnant economy, even if it comes with a higher cost of production. And we may find that, in the end, the after-tax profit margins of these big U.S. corporates may be better given all of these incentives, even if they make things here. Better revenues, and maybe better margins to go with it.

Remember, the optimism of U.S. small business owners made the biggest jump since 1980 on the prospects of growth-friendly Trump policies. GDP equals Consumption + Investment + Government Spending + Net Exports. Ultra easy monetary policies have made borrowing cheap, saving expensive and created the economic stability necessary to get hiring over the past several years. That has all kept consumption going.

The “build it here” policies are a recipe for capital investment to finally ramp up. Add to that, a big government infrastructure spend, and we’re getting the pieces of the puzzle in place to see much better economic growth. A hotter U.S. economy will mean a hotter global economy. With that, I suspect net exports will ultimately pick up as well, with a healthier, more sustainable global economy.

On that note, if we look at the USD/Mexican Peso exchange rate as a gauge of trade partner health, we’ve seen the peso hit hard through the campaigning period under the protectionist fears of a Trump administration. Interestingly, since the inauguration, the peso has been strengthening, even as President Trump signed an executive order today to renegotiate NAFTA. The message behind that usually means: the U.S. does better, Mexico does better.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

dell, whirlpool, ford, johnson and johnson, lockheed, arconic, u.s. steel, tesla, under armour, international paper, corning, trump, white house