December 5, 5:00 pm EST

I was away from the markets yesterday, on a big down day. With markets closed today to honor the 41st President, let’s take a look at what happened on Tuesday.

Why the ugly and persistent plunge in stocks?

Many of the reasons that have been attributed to the two stock market corrections this year, bubbled up again yesterday. But as we’ve discussed, the stock declines this year appear to have had everything to do with Saudi capital flows–and less to do with all of the hand-wringing issues you hear and read in the financial media. Same can be said for yesterday.

When prospects rise that Saudi assets may be threatened by sanctions(or seizures in the case earlier this year, related to the Crown Prince’s corruption crackdown) indiscriminate and aggressive selling of U.S. assets hit immediately (likely led by the Saudi sovereign wealth fund, which has assets over half a trillion dollars).

We had it again yesterday. Stocks had a big gap up on Monday on movement on U.S./China trade. It was after the close on Monday that the news hit that the CIA would brief the special Senate committee on Tuesday. Stocks immediately started moving lower. The Dow futures were down 250 points by midnight. And then of course, yesterday, when news hit that the briefing was underway (just after noon), the bottom immediately fell out of stocks. A little more than half an hour later, U.S. Senators were standing in front of cameras telling the world that the Crown Prince was involved in the murder and that Congress should invoke the Magnitsky Act. This law authorizes the government to sanction human rights offenders, freeze their assets, and ban them from entering the U.S.

That sounds ominous for the Crown Prince.

But the Magnitsky Act comes in the form of a request from Congress, and the President has the discretion to act or not (but must decide within 120 days).

With that, I suspect this was nothing more than grandstanding. Trump will not (can not) act for the reasons we discussed last month.

From a security standpoint, Saudi Arabia is a critical alliance in the fight to defeat ISIS and check of Iran. Maybe more importantly, pushing Saudi Arabia toward an alignment with China and Russia in the long game would be a grave danger for the U.S.

Taking action against the Crown Prince would jeopardize both.

So, as I said last month, Trump has been leveraging the Saudi crisis to get oil prices lower. And he’s gotten it – to the tune of a 35% decline in oil prices. And to this point, it appears Trump has settled on the sanctions that have already been levied already on Saudi individuals involved in the Khashoggi murder (which don’t include the Crown Prince).

If he sanctioned the Saudi government over this, oil prices would probably explode and stocks would crash (not really an option).

We’ll see how stocks react tomorrow after a day of reflection. I suspect Tuesday created another buying opportunity.

What stocks do you buy? Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

October 23, 5:00 pm EST

As we discussed yesterday, despite all of the drama about China, Italy,

Brexit, rates and the elections, what seems more likely to have driven the recent correction in stocks is Saudi selling.

In fact, I think it’s clear that there has been a Saudi liquidation (of U.S. and global assets) which was the catalyst for the correction in stocks earlier this year, and this recent decline.

Remember, in November of last year, the Saudi Crown Prince Salam, successor to the King, ordered the arrest of many of the most powerful Saudi Princes, country ministers and business people in Saudi Arabia on corruption charges. Over $100 billion in assets were claimed to be under investigation (a third frozen) in what was called the “Saudi purge.”

These subjects were detained for nearly three months. The timing of their release and the market correction of early this year is where it all begins to align.

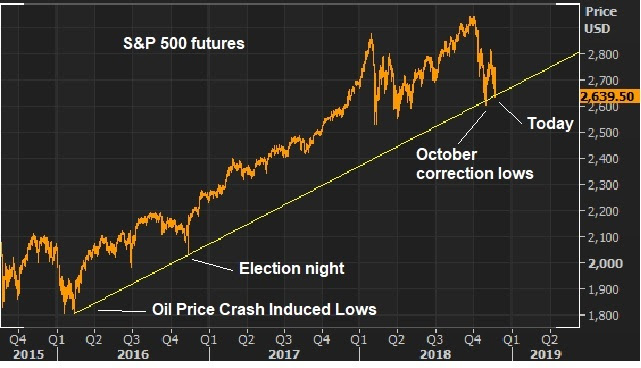

They were released on Saturday, January 27. S&P futures open for trading on Sunday night. Stocks topped that night and proceeded to drop 12% in six days. And rallies in stocks were sold aggressively for the better part of the next seven months.

Fast forward to this month, and we have the murder of the journalist that was a public critic of the Crown Prince Salam. As the details of story pointed back to Salam, on Oct 3, U.S. bond markets got hit (to the hour of news hitting the wires) and stocks topped that day, and have proceeded to drop by more than 8%.

Clearly, the destabilization in Saudi Arabia has put considerable assets in jeopardy. With that, those in control of those assets have likely been scrambling to protect them, as U.S. Congress pushes for sanctions, which could include freezing Saudi assets.

November 22, 2016, 7:30pm EST

Stocks continue to new highs today. But with the holiday approaching, the big focus is oil. It was two years ago on Thanksgiving day evening that the Saudis blocked a move by their fellow OPEC members to cut production, to put a floor under oil prices around $70. Oil plunged in a thin market and never looked back.

Of course, we traded as low as $26 earlier this year. That proved to be the bottom in that OPEC rigged oil price bust, which was intended to crush the competitive U.S. shale industry.

It worked. The emerging shale industry was brought to its knees and we’ve seen plenty of bankruptcies as a result. But OPEC countries have been hurt badly too, taking a huge hit to their oil revenues. That put some heavily oil dependent economies on default watch. So it finally became clear that cheap oil was a big net negative, not just for the U.S. economy, but for the global economy. The risk of continued fallout in the oil industry was a direct threat to the financial system and, therefore, a risk to another global economic crisis.

With that, we head into next week’s official OPEC meeting with expectations set for a first production cut in eight years. And we have the below chart, which would suggest that we could see oil back in the $70 area next year.

In 1986, the mere hint of an OPEC policy move sent oil up 50% in just 24 hours. They’ve more than hinted this time around, but the markets remain skeptical. That skepticism should serve to exacerbate the speed and magnitude of a move higher if they follow through.

Follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio is up 20% this year. That’s almost 3 times the performance of the broader stock market. Join me here.

September 28, 2016, 4:30pm EST

Oil popped over $3 from the lows of the day (as much as 7%) on news OPEC has agreed to a production cut.

We’ve talked a lot throughout the year about the price of oil. When it collapsed to the $20s, it put the entire energy industry on bankruptcy watch.

Of course, oil bounced sharply from those lows of February as central banks stepped in with a coordinated response to stabilize confidence. Not so coincidentally, oil bottomed the same day the Bank of Japan intervened in the currency markets.

The oil price bust all started back in November of 2014, the evening of Thanksgiving Day, when OPEC pulled the rug out from under the oil market by vowing not to make production cuts, in an attempt to crush the nascent shale industry. At that time, oil was trading around $73.

You can see in this chart, it never saw that price again.

OPEC was successful in heavily damaging the U.S. shale industry through low oil prices, but it has damaged OPEC countries, too.

What will the news of an agreement on a production cut mean?

A policy shift from OPEC can be very powerful. In 1986, the mere hint of an OPEC policy move sent oil up 50% in just 24 hours. And as we discussed earlier in the year, the relationship between the price of oil and stocks this year has been tight. At times, stocks have traded almost tick for tick with oil.

Take a look at this chart.

An oil price back in the $60s would be a catalyst for a big run in stocks into the year end. For a stock market that has been rudderless surrounding a confused Fed and an important election, this oil news could kick it into gear.

If you’re looking for great ideas that have been vetted and bought by the world’s most influential and richest investors, join us at Billionaire’s Portfolio. We have just exited an FDA approval stock for a quadruple. And we’ll be adding a two new high potential billionaire owned stocks to the portfolio very soon. Don’t miss it. Join us here.

Into the latter part of last week, we had some indiscriminate selling in some key markets. First it was Japanese stocks that followed a new 25-year high with a 1,100 point drop. Then we had some significant selling in junk bonds and U.S. Treasuries. And then four million ounces of gold was sold in about a 10 minute period

Into the latter part of last week, we had some indiscriminate selling in some key markets. First it was Japanese stocks that followed a new 25-year high with a 1,100 point drop. Then we had some significant selling in junk bonds and U.S. Treasuries. And then four million ounces of gold was sold in about a 10 minute period