April 8, 5:00 pm EST

As we discussed on Friday, the overhang of risks to markets, to the Trump administration and to the economy are as light as we’ve seen in quite some time.

With this in mind, we have a fairly light data week – which means the likelihood of a disruption in the rise in stocks and risk appetite remains low.

We get some inflation data this week, which should be tame, justifying the central bank dovishness we’ve seen in recent months. The ECB meets this week. They’ve already walked back on the idea that they might hike rates this year. Expect Draghi to hold the line on that. The Chinese negotiations have positive momentum, with reports over the weekend that talks last week advanced the ball. And we have another week before Q1 earnings season kicks in.

So, expect the upward momentum to continue for stocks. Just three months into the year and stocks are up big, and back near record highs in the U.S.. The S&P 500 is up 15% year-to-date. The DJIA is up 13%. Nasdaq is up 20%. German stocks are up 13%. Japanese stocks are up 11%. And Chinese stocks are up 32%.

Remember, we’ve talked about the signal Chinese stocks might be giving us, putting in a low on the day the Fed did it’s about face on the rate path, back on January 4th.

The aggressive bounce we’ve since had in Chinese stocks appears to be telegraphing the bottoming in the Chinese economy. That’s a big relief signal for the global economy. Commodities prices are supporting that view (sending the same signal). Oil is now up 42% on the year. And the CRB industrial metals index is up 24%.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors.

Join now and get your risk free access by signing up here.

January 28, 5:00 pm EST

This is a huge week. We’re following a down 9% month for stocks with a big bounceback. But it will all hinge on the events of the week.

We get Q4 earnings from about quarter of the companies in the S&P 500 – and a third of the Dow. We have the Fed on Wednesday. And the U.S. hosts trade talk meetings with China on Wednesday and Thursday. And then on Friday, we’ll get the jobs report.

We kicked off earnings season with reports from the big banks two weeks ago. And the reports broadly painted the picture of a healthy consumer and healthy economy.

This week, we hear from a broad swath of blue chips, including big multinational businesses. Among them: We heard from Caterpillar today. We’ll hear from Apple and Boeing tomorrow. McDonalds and 3M report on Wednesday. Amazon is on Thursday.

Expect a lot of discussions about “concerns” on the outlook (as we heard from Caterpillar today), but with a picture about Q4 that looked good (continuing with the theme of 2018).

Remember, much of the talk about slowdown has been about what might happen, in the year (or two) ahead – which primarily assumes a long-term stalemate on the Trump trade war. With that, never underestimate Wall Street and corporate America’s willingness to set the bar low (when given the opportunity), so that they can jump over a very low bar (i.e. set up for earnings beats in future quarters).

Far more important than those “concerns” voiced by CEO’s, is what the Fed has already done, and what will come out of the U.S./China talks this week.

Remember on January 4th, the Fed responded to the calamity in financial markets by backing down from their rate hiking plans. This week, the Fed Chair will likely use his post-meeting press conference to further massage markets. The Fed, the ECB and the BOJ have already positioned themselves (in recent weeks) to be the shock absorbers if the trade war continues to drag out.

As for trade talks, the calendar continues to approach the March 1 deadline on the tariff truce. And China has been gasping for air. I suspect we will get progress — maybe an official agreement on trade, leaving the intellectual property and technology transfer negotiations still on the table. That would be good progress.

Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

November 5, 5:00 pm EST

The elections tomorrow are said to be a referendum on Trump’s Presidency.

And given the sentiment, I think it’s fair to say the surprise scenario for markets would be for Republicans to retain control of Congress. For that to happen, it looks like the Republicans would need to win 61% of the “toss up” races in the house. Of those, 84% are currently Republican held.

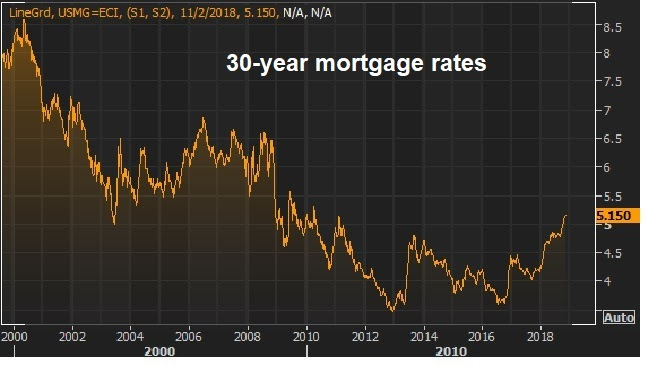

That scenario would be a vote of confidence for the Trump economic agenda. And for markets, it would be “risk on,” which would likely draw more attention to the inflation outlook, and the speed at which market interest rates will move. Trump would retain his leverage over China on trade concessions.

Scenario two, would be a split Congress. If we get a split Congress, the Trump economic plan would likely turn to infrastructure. The belief is that a Democrat led house would likely be a partner to Trump on a big infrastructure spend.

Though I suspect, given the political atmosphere, they may work to block any further progress on the economic stimulus front, in effort to position themselves for the 2020 Presidential election. On China trade negotiations, I suspect a split Congress would begin to fight against Trump’s executive order-driven trade wars. This scenario would mean, gridlock in Washington.

However, after the cloud of election uncertain lifts, both scenarios should be a greenlight for stocks.

Remember, we already have an economy running north of 3%, with record low unemployment, and consumers are sitting on record high household net worth and record low debt service ratios. Companies are growing earnings at over 20% (yoy), and growing revenues at over 8% (yoy). And corporate credit market debt is near the lowest levels (relative to market value of corporate equities) of the past 70 years.

So there is plenty of fuel in the economy to continue the trajectory of economic boom. Maybe most importantly, following the October correction, the tech giants have been pricing out the “monopoly scenario” which paves the way for a broader-based bull market for stocks.

Join me

here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now.

April 2, 7:00 pm EST

As we’ve discussed, the proxy on the “tech dominance” trade is Amazon. That’s the proxy on the stock market too. And it’s not going well. The President hammered Amazon again over the weekend, and again this morning.

Here’s what he said …

Remember, we had this beautiful heads-up on March 13, with the reversal signal in Amazon.

That signal we discussed in my March 13 note has now predicted this 15.8% decline in the fourth largest publicly traded company. And it’s dictating the continued correction in the broader market.

If you’re a loyal reader of this daily note, you’ll know we’ve been discussing this theme for the better part of the last year. The regulatory screws are tightening. And the tech giants, which have been priced as if they are, or would become, perfect monopolies, are now in the early stages of repricing for a world that might have more rules to follow, hurdles to overcome and a resurrection of the competition they’ve nearly destroyed.

As we know, Uber has run into bans in key markets. We’ve had the repeal of “net neutrality” which may ultimate lead big platforms like Google, Twitter, Facebook and Uber, to transparency of their practices and accountability for the actions of its users. Trump is going after Amazon, as a monopoly and harmful to the economy. Tesla, a money burning company, is being scrutinized for its inability to mass produce — to deliver on promises. For Tesla, if sentiment turns and people become unwilling to continue plowing money into a company that’s lost $6 billion over the past five years (while contributing to the $18 billion wealth of its CEO), it’s game over.

With that said, this all creates the prospects for a big bounce back in those industries that have been damaged by tech “disruption.” And this should make a stock market recovery much more broad-based than we’ve seen.

With the sharp decline in stocks today, we’ve retested and broken the 200-day moving average in the S&P 500. And we close, sitting on this huge trendline that describes the rise in stocks from the oil-crash induced lows of 2016.

Today we neared the lows of the sharp February decline. I suspect we’ll bottom out near here and begin the recovery. And that recovery should be fueled by very good Q1 earnings and a good growth number — brought to us by the big tax cuts.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.