June 22, 2017, 4:15 pm EST Invest Alongside Billionaires For $297/Qtr

Healthcare was the story of the day today. With the Senate having had its go at the house healthcare bill, it goes back to the house, then back through Senate before it gets to the President’s desk.

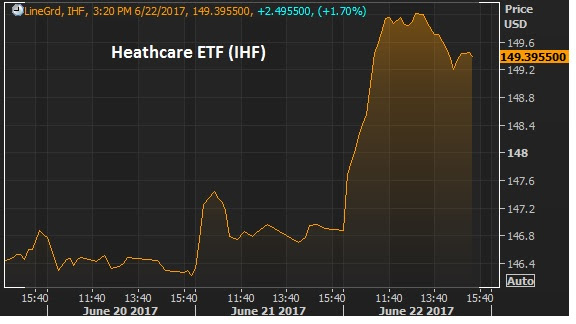

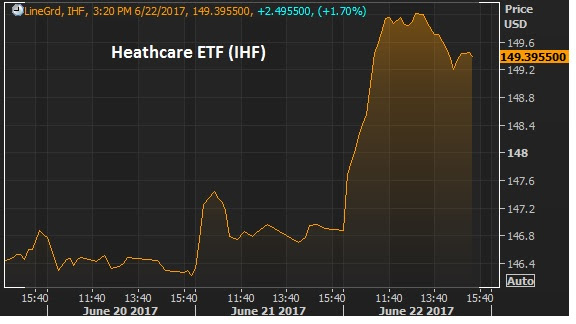

Still, policy progression is very positive in this environment. Healthcare stocks were up big today — the IHF healthcare ETF was up over 2%. This is the ETF that tracks insurers, diagnotic and specialized treatment companies.

And despite all of the debate around healthcare, it has been the hottest sector to invest in since the election.Since election day, the IHF is up 35% since the lows of November 9th, the day after the election. Here’s a look at S&P sector performance over the past

sixmonths.

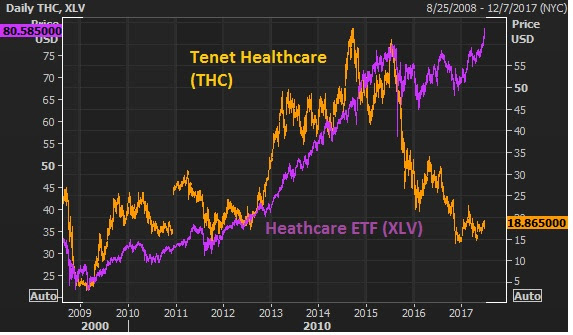

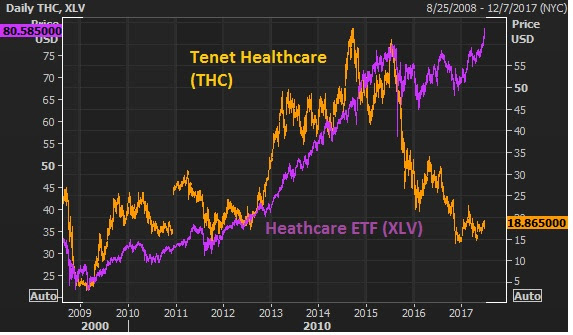

Most interesting, the healthcare sector has been beaten up badly since the cracks in Obamacare became clear back in 2014. But as of the past week, the healthcare sector trackers have finally broken back above those 2014 Obamacare–optimism–driven highs. With that, the divergence in this next chart of one of the biggest hospital companies in the country becomes quite an intriguing trade.

Join the Billionaire’s Portfolio to hear more of my big picture analysis and get my hand-selected, diverse stock portfolio following the lead of the best activist investors in the world.

January 24, 2017, 4:30pm EST

The S&P 500 traded up to new record highs today. This morning the new President had three more big American business leaders (the car makers) in the White House for a face-to-face.

The three big American car makers all had big stock performance on the day, and their leaders walked away with very positive remarks (not dismay). It turns out that logical business operators like the prospects of doing business with the tailwinds of pro-growth economic policies.

Now, with Obamacare on the chopping block for the new administration, today let’s take a look what healthcare stocks might do.

Healthcare stocks in general have been beaten up since July of 2015, when a Republican Congress brought a vote to repeal Obamacare. The S&P 500 is up 7% from that date. The XLF (the ETF that tracks healthcare stocks) is down 9% in the same period.

Before that, Obamacare had been a money printing machine for much of the healthcare industry.

In this chart below, of the health insurance provider, Aetna, you can see the impact of Obamacare on the stock.

And here’s a look at the hospital company, HCA, also a big winner under Obamacare.

So what happens under Trump care? Trump has said he wants to keep people insured. It sounds like a rework to a more competitive system, rather than a tear down and rebuild. The first sign of visibility on a new plan is probably the greenlight to buy the healthcare ETF, and maybe the under performers in the Obamacare era.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.