December 8, 2016, 9:30pm EST

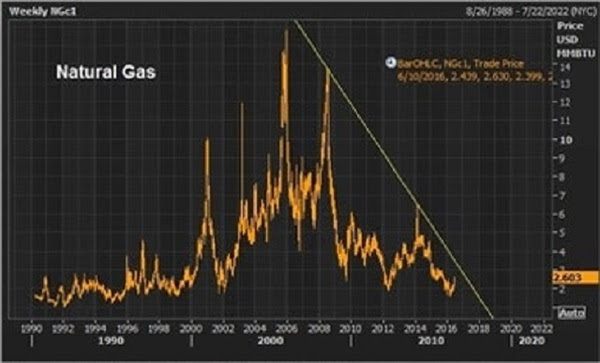

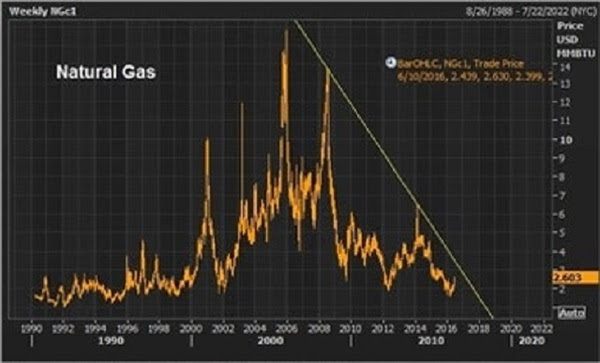

Back in early June I talked about the building story for a breakout in natural gas prices.

Oil had doubled off of the bottom, but natural gas had lagged the move. This created really compelling opportunities for the natural gas stocks that had survived the downturn–and for those that had emerged from bankrupcy positioned to be debt-free cash machines in a higher price environment.

We looked at this chart as it was setup for a big trend break …

It was trading at $2.60 at the time and, as I said, “it looked like the bounce was just getting started” and “could be looking at the early stages of a big run in nat gas prices,” especially given that it was trailing the double that had already taken place in oil.

That break happened in October. And natural gas traded above $3.70 today. Four bucks is near the midpoint of the $6.50-$1.65 range of the past three years. And we’re getting close.

Remember, I said natural gas stocks are a leveraged play on natural gas prices. And back in June I noted the move in Consol Energy (CNX), which had already quadrupled since January. It sounds like you missed the boat? It’s nearly doubled since June!

We have 15% exposure to natural gas related companies in our Billionaire’s Portfolio. Follow me and look over my shoulder as I follow the world’s best investors into their best stocks – they tend to be in first, before stocks like Consol make their moves. Our portfolio is up more than 27% this year. You can join me here and get positioned for a big 2017.

September 28, 2016, 4:30pm EST

Oil popped over $3 from the lows of the day (as much as 7%) on news OPEC has agreed to a production cut.

We’ve talked a lot throughout the year about the price of oil. When it collapsed to the $20s, it put the entire energy industry on bankruptcy watch.

Of course, oil bounced sharply from those lows of February as central banks stepped in with a coordinated response to stabilize confidence. Not so coincidentally, oil bottomed the same day the Bank of Japan intervened in the currency markets.

The oil price bust all started back in November of 2014, the evening of Thanksgiving Day, when OPEC pulled the rug out from under the oil market by vowing not to make production cuts, in an attempt to crush the nascent shale industry. At that time, oil was trading around $73.

You can see in this chart, it never saw that price again.

OPEC was successful in heavily damaging the U.S. shale industry through low oil prices, but it has damaged OPEC countries, too.

What will the news of an agreement on a production cut mean?

A policy shift from OPEC can be very powerful. In 1986, the mere hint of an OPEC policy move sent oil up 50% in just 24 hours. And as we discussed earlier in the year, the relationship between the price of oil and stocks this year has been tight. At times, stocks have traded almost tick for tick with oil.

Take a look at this chart.

An oil price back in the $60s would be a catalyst for a big run in stocks into the year end. For a stock market that has been rudderless surrounding a confused Fed and an important election, this oil news could kick it into gear.

If you’re looking for great ideas that have been vetted and bought by the world’s most influential and richest investors, join us at Billionaire’s Portfolio. We have just exited an FDA approval stock for a quadruple. And we’ll be adding a two new high potential billionaire owned stocks to the portfolio very soon. Don’t miss it. Join us here.

September 2, 2016, 12:00pm EST

This time last month, the famed oil trader—and oil bull—Andy Hall was dealing with a sub-$40 oil market again. And he was again explaining losses to investors in his multi-billion dollar hedge fund.

A guy that has made a career, and hundreds of millions of dollar in personal wealth, picking tops and bottoms in oil, had entered 2016 coming off his worst year ever. And 2016 started even worse.

I’ve talked about the oil price bust extensively, at the depths of the decline in January and February. While most were glorifying the benefits of a few extra bucks in the pockets of consumers from low gas prices, we walked through the ugly outcome of persistently low oil prices. It would be another global financial crisis, as failing energy companies and defaulting oil producing countries would crush banks, and the dominos would fall from there. Unfortunately, the central banks don’t have the ammunition to pull the world back from the edge of disaster for a second time.

With that, central banks stepped in with more easing in the face of the oil price threat, and oil bounced sharply.

Hall’s fund bounced sharply too, running up nearly 25% for the year, by the end of June. But he gave a lot of it back by the time July ended. And now, again, oil is closer to $40 than $50. Thanks to a report yesterday, that oil supplies were bigger than expected, the price of crude has fallen 10% since Friday of last week.

Hall was the Citigroup C +0.13% oil trader who made billions of dollars for the bank energy trading arm, Phibro, in the early-to mid-2000s. He was one of the first to load up on oil futures in 2002, when oil was sub-$30, on the thesis that a boom in demand was coming from China.

He reportedly made $800 million in profits for Citi in 2005 from his original bullish bet. He then made more than $1 billion in 2008 for the bank, as oil prices soared to $147 a barrel and then abruptly crashed. He profited handsomely from both sides, earning a payout from Citi of more than $100 million.

So he’s a guy that has been very right about turning points, and big trends. And he’s been pounding the table for much higher oil prices. He thinks oil prices are in for a “violent reversal” (higher). With an important OPEC meeting scheduled for later this month, Hall, in a past investor letter, reminded people how powerful an OPEC policy shift can be. In 1986, the mere hint of an OPEC policy move sent oil up 50% in just 24 hours.

In our Billionaire’s Portfolio, we’re positioned in deep value stocks that have the potential to do multiples of the broader market—all stocks that are owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and get yourself in line with our portfolio. You can join here.