May 9, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Over the past few days, some of the most influential investors in the world have publicly shared views on some of their best ideas.First, over the weekend, it was Buffett at his annual shareholders meeting. The take away, as I said yesterday, “stocks are dirt cheap” if you think rates will stay low for longer (i.e. below long term averages). His assumption in that statement is that the Fed’s benchmark rate goes to 3ish% and done – well below the long run average neutral rate of 5%. Over the past few days, some of the most influential investors in the world have publicly shared views on some of their best ideas.First, over the weekend, it was Buffett at his annual shareholders meeting. The take away, as I said yesterday, “stocks are dirt cheap” if you think rates will stay low for longer (i.e. below long term averages). His assumption in that statement is that the Fed’s benchmark rate goes to 3ish% and done – well below the long run average neutral rate of 5%.

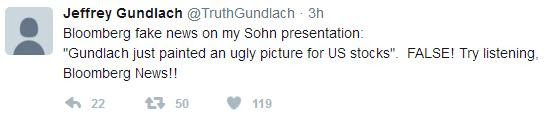

In addition, he was quite vocal on Apple, a stake he picked up as others were selling in fear in the first half of last year (i.e. being greedy when others are fearful). And he doubled his stake earlier this year, now holding north of $20 billion worth of the stock. The analyst community thinks Apple is a juggling act, with balls that will drop if they don’t come up with another revolutionary product every quarter. Buffett thinks Apple is cheap even if they don’t have another single new invention in the future. Why? Because they’ve developed a services business around their hardware that has quickly become one of the biggest and fastest growing businesses in the world. Remember, back on February 1, I made the case for why Apple could double. You can see that here. It’s gone from a $560 billion company to an $800 billion company since we added it in our Billionaire’s Portfolio early last year. Even at $154 a share (today’s levels) if we strip out the quarter of a trillion dollars in cash, we get the existing business for 12 times earnings. Now, let’s talk about one of the big ideas presented yesterday at the annual Sohn Conference in New York, where many of top billionaire investors and hedge fund managers give their outlook on the stock market, the economy and talk about their favorite long and/or short picks. Billionaire investor Jeff Gundlach, who oversees the world’s largest bond fund likes selling the S&P 500 against emerging market stocks. He thinks value is distorted relative to global GDP. But it’s more a view on undervaluation of EM, rather than overvaluation of U.S. stocks. He took to Twitter to defend that view…

Assuming a stable to improving world economy, emerging market stocks have lagged and offer a great opportunity to catch up with the strength in the U.S. stock market. It also requires that emerging market currencies are a good bet against the dollar, if policy makers around the world are able to follow the lead of the Fed, where rising interest rate cycles follow. This is a very similar view to the one we discussed yesterday, where Spanish stocks (supported by a stronger euro) present a big catch up trade opportunity (to the tune of about 40% to revisit the 2007 highs), with the destabilization risk of the French elections in the rear-view mirror. Follow This Billionaire To A 172% Winner In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock! Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now. So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip. Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO. |