March 13, 5:00 pm EST

We talked yesterday about the important inflation data. That was in line this morning. And with that, the big 3% level on the benchmark 10-year government bond yield remains well preserved.

But stocks soured anyway on the day, and it was led by the Nasdaq.

Let’s take a closer look at the Nasdaq.

This is where the big tech giants, Apple, Microsoft and Amazon have led the charge back in the index back to new record highs over the past couple of days. Those three stocks represent about a third of the index (and contribute heavily to the S&P 500 too).

But as the three tech giants led the way up, they cracked today, and we now have some very compelling signals that another down leg for stocks may be here.

First, as the broader financial markets are still licking the wounds of the sharp correction, and still jittery, Apple hit a record high valuation of $925 billion this week (sniffing near the trillion dollar valuation mark). And then it did this today…

As you can see in this chart above, Apple put in a huge bearish reversal signal (an outside day).

So did Microsoft (a huge bearish reversal signal).

So did Amazon, after breaching record levels of $1600 over the past two days …

And, not surprisingly, same is said for the Nasdaq – a big reversal signal…

The S&P 500 had the same reversal pattern.

For perspective, if we avoided the distraction of the big cap weighted indices, the Dow chart tells us the downtrend in stocks from the late January highs remains well intact.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

December 28, 12:00 pm EST

While the President’s pro-growth plan had some wins this year, it was a slow start.

Going after healthcare first was a mistake. Fortunately, a pivot was made, and we now have a big tax bill delivered. And we have what will likely exceed a couple hundred billion dollars in government spending on hurricane/natural disaster aid underway (the early stages of a big government spending/ infrastructure package).

Last year this time, I predicted that Trump’s corporate tax cut would cause stocks to rise 39%. That’s a big number, that’s only been done a handful of times since the 1920s. We got a little better than half way there.

But, here’s the good news: We got there on earnings growth, ultra-low rates and an improving economy. All of that still stands for next year, PLUS we will have the addition of an aggressive tax cut that will be live day one of 2018.

With that, my analysis from last year still stands! Let’s walk through it (yet) again.

S&P 500 earnings grew by 10% this year. S&P 500 earnings are expected to grow at about the same rate next year. And that’s before the impact of a huge cut in the corporate tax rate. The corporate tax rate now goes from 35% to 21% – and for every percentage point cut in that rate, we should expect it to add at least a dollar to S&P 500 earnings.

With that, the forecast on S&P 500 earnings for next year is $144. If we add $14 to that (for 14 percentage points in the corporate tax rate) we get $158. That would value stocks on next year’s earnings, at today’s closing price on the S&P 500, at just 17 times earnings (just a touch higher than the long-term average). BUT, the Fed has told us that rates will continue to be ultra-low next year (relative to history). When we look back at ultra–low interest rate periods, the valuation on stocks runs higher than average—usually north of 20 times earnings.

If we take the corporate tax cut driven earnings of $158 and multiply it times 20, we get 3,160 on the S&P 500. That’s 18% higher than current levels. This analysis doesn’t incorporate the impact of a potentially hotter than expected economy next year (thanks to the many other areas of fiscal stimulus). So, as we’ve discussed throughout the year, the backdrop continues to get better and better for stocks.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

Bryan Rich

June 9, 2017, 3:45 pm EST Invest Alongside Billionaires For $297/Qtr

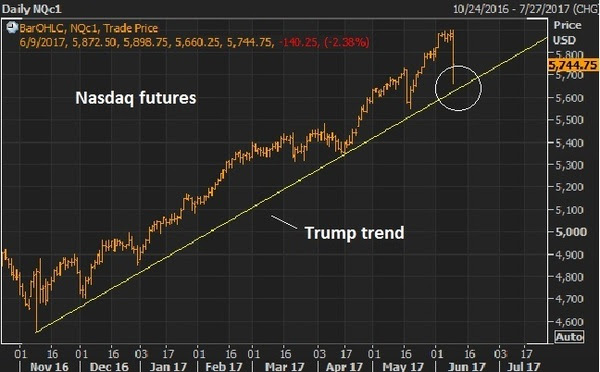

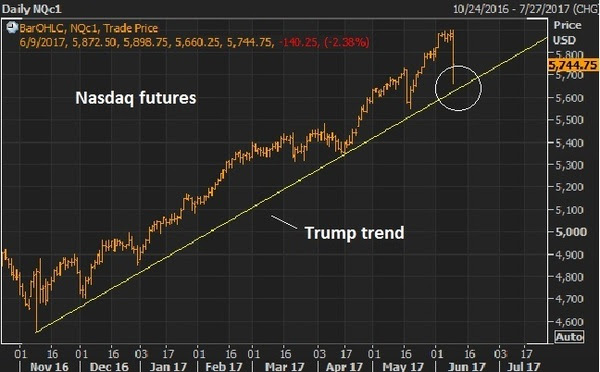

The Nasdaq trade unwound some today. From the peak this morning in the futures of 5898 the tumble started around 11am, falling to as low as 5660. That’s 238 Nasdaq futures points or 4% – quite a sharp move.

Remember, it seems like an overdone trade (driven by the big tech stocks). But as we discussed last week, the tech heavy Nasdaq has simply been a catch up trade — something that has lagged the strength in the broader market.

Here’s the chart we looked at last week.

This chart goes back to the lows driven by the oil price crash that bottomed out earlier last year.

Still, with the Nasdaq at +18% ytd and S&P 500 +9% ytd, as of this morning, as we’ve seen many times in this post-crisis era, the air pockets of illiquidity in stocks can give back gains very, very quickly. As they say, stocks go up on an escalator and down in an elevator.

The Trump trend, in the chart above, was nearly tested today — the same day a new all-time high was marked!

If we get another few days of sharp downside, it will be a tremendous buying opportunity – get your shopping list ready. And if that downside slide does indeed come, it could come at a very interesting time. It would add another (but very signficant) reason the Fed may balk on a rate hike next week. The other reasons? We discussed them yesterday (here).

Have a great weekend.

What stocks should be on your shopping list, to buy on a big market dip? Join my Billionaire’s Portfolio to find out. It’s risk-free. If for any reason you find it doesn’t suit you, just email me within 30-days.

May 16, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

The noise surrounding the Trump administration continues by the day, as the media tries desperately to prosecute the elected President at daily briefings.The chaos and dysfunction message is loud, but markets aren’t hearing it. The real story is very different. Stocks continue to surge. Stock market volatility continues to sit 10-year (pre-crisis) lows. The interest rate market is much higher than it was before the election, but now quiet and stable. Gold, the fear-of-the-unknown trade, is relatively quiet. This all looks very much like a world that believes a real economic expansion is underway, and that a long-term sustainable global economic recovery has supplanted the shaky post-crisis (central bank-driven) recovery that was teetering back toward recession. The noise surrounding the Trump administration continues by the day, as the media tries desperately to prosecute the elected President at daily briefings.The chaos and dysfunction message is loud, but markets aren’t hearing it. The real story is very different. Stocks continue to surge. Stock market volatility continues to sit 10-year (pre-crisis) lows. The interest rate market is much higher than it was before the election, but now quiet and stable. Gold, the fear-of-the-unknown trade, is relatively quiet. This all looks very much like a world that believes a real economic expansion is underway, and that a long-term sustainable global economic recovery has supplanted the shaky post-crisis (central bank-driven) recovery that was teetering back toward recession.

Why is the messaging so different? Remember, the financial media and Wall Street are easily distractible. Not only do they have short attention spans, but they’ve been trained throughout their careers to find new stories to obsess about. They need to interpret, pontificate, strategize to feel valued. Approaching their jobs with the idea that a slow moving dominant theme is at work is just too boring.

This is the disconnect between markets and the narrative. We have major central banks around the world that continue to print money. These central banks buy assets with that freshly printed money. That means, stocks, bonds, commodities go higher. And now we have everyone’s fate (the global economy) tied to the outcome of new policies from the leading economy in the world – efforts to restore sustainable growth through structural reform and fiscal stimulus. That hopeful outlook does nothing but underpin the rise in asset prices (stocks, bonds, commodities, real estate).

Yesterday we got a look under the hood of the portfolios of the biggest money managers in the world, via their 13F filings (required quarterly portfolio disclosures to the SEC). It’s been clear that the biggest and best, embrace this big theme, and have been aggressively positioning to take advantage of the very bullish proposed policy tailwinds for stocks, which are: 1) a corporate tax rate cut, which will go right to the bottom line for profitable companies. Not surprisingly, which stocks have been leading the way in the climb in the indicies? The one’s that make a lot of money (Apple, Microsoft, Google). 2) a repatriation tax holiday that will bring back trillions of dollars onshore, to be paid back to shareholders and put to work in the economy through investment and projects. 3) a trillion dollar infrastructure spend that, regardless of how difficult it may be to legislate, should happen in one form or another.

Among the reports on portfolio holdings yesterday, we heard from the Swiss National Bank. As I said above, don’t forget there are still central banks deeply entrenched in QE and, beyond local government bonds, are buying foreign assets (in large amounts). Switzerland’s central bank has more freshly printed money to put to work every quarter, and has been increasing their allocation to equities dramatically – $80 billion of which is now (as of the end of Q1) in U.S. stocks! That’s a 29% bigger stake than they had at the end of 2016. The SNB is the world’s eighth biggest public investor.

So keep this big theme in mind: Central banks remain involved, but the baton has been passed, from a central bank-driven recovery to a fiscal stimulus-driven recovery. And everyone needs it to work.

Follow This Billionaire To A 172% Winner

In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!

Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.

So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO.

|

February 23, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

Yesterday we talked about the warning signal flashing from the German bond market. That continues today.

While global stocks and commodities are reflecting broad optimism about the new pro-growth government in the U.S., the yield on 2-year German government bonds is sending a negative message — it hit record lows yesterday, and again today — trading to negative 90 basis points. You pay almost 1% to loan the German government money for two years.

Here’s a longer term look at German yields, for perspective…

And here’s the divergence since the election between German and U.S. 2 year yields…

This divergence is partially driven by rising U.S. yields on optimism about the outlook, about inflationary policies, and about the Fed’s response. On the other hand, German yields have gone the other way because 1) the ECB is still outright buying government bonds through its QE program (bond prices go up, yields go down), and 2) capital flows into bonds, in search of safety, because a Trump win makes another populist vote in Europe more likely when the French elections role around in May.

So that bleed to new lows in the German 2-year yield sends a warning signal to global markets. Today we have a few more reasons to think this could be a signal that the optimism being priced into U.S. markets at the moment could take a breather here.

Trump’s Secretary of Treasury, Mnuchin, was doing his first rounds on financial TV this morning and gave us some guidance on a timeline for policies and impact. Most importantly, he says we’ll see limited impact from Trump policies in 2017, and that the growth impact won’t come until 2018.

Let’s consider how that can impact where the Fed stands on their forecasts for monetary policy.

Remember, they spent the better part of 2016 walking back on the promises they had made for 4 rate hikes last year. And then, when they finally moved for thefirst time this past December, following the election and a rallying stock market, they reversed course on all of the dovish talk of the past months, and re-upped on another big rate hiking plan for 2017.

Though they don’t like to admit it, we can only assume that when they considered a massive fiscal stimulus package coming, like any human would, they became more bullish on the economy and more hawkish on the inflation outlook.

So now as Mnuchin tells us not to expect a growth impact from Trump policies until next year, maybe the Fed lays off the tightening rhetoric for a while.

With all of this in mind, another interesting dynamic in markets today, the Dow shrugged off some weakness early on to trade higher most of the day, posting another new record high. Meanwhile small caps diverged, trading weaker all day. And gold traded to the highest level since November 11. Remember this chart we’ve looked at, which looks like higher gold to come (a lower purple line), and lower yields.

This would all project a calming for the inflation outlook, which would be good for the health of markets. Among the biggest risk to Trumponomics is hot inflation, too fast, and a race higher in interest rates to chase it.

To peek inside the portfolio of Trump’s key advisor, join me in our Billionaire’s Portfolio. When you do, I’ll send you my special report with all of the details on Icahn, and where he’s investing his multibillion-dollar fortune to take advantage of Trump policies. Click here to join now.

February 22, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

We had new record highs again in the Dow today. But remember, yesterday we talked about this dynamic where stocks, commodities and the dollar were strong. But a missing piece in the growing optimism about growth has been yields.

Clearly the 10 year at 2.40ish is far different than the pre-election levels of 1.75%-1.80%. But the extension was quick and has since been a non-participant in the full-on optimism vote given across other key markets.

Why? While stocks can get ahead of better growth, yields can’t in this environment. Higher stocks can actually feed higher growth. Higher yields, on the other hand, can kill it.

But there’s something else at work here. As we know Japan’s policy to target the their 10 year at zero provides an anchor to our interest rates, as the BOJ is in unlimited QE mode. Some of that freshly produced liquidity, and the money displaced by their bond buying, undoubtedly finds a happier home in U.S. Treasuries (with a rising dollar, and a 2.4% yield). That caps yields.

But in large part, the quiet drag on U.S. yields has also come from the rising risks in Europe. The election cycle in Europe continues to threaten a populist Trump-like movement, which is very negative for the European Union and for the survival of the single currency (the euro). That creates capital flight, which has been contributing to dollar strength and flows into the parking place of U.S. Treasuries (which pressures yields, which is keeping mortgage and other consumer rates in check).

These flows are also showing up clearly in the safest bond market in Europe: the German bunds. The 2-year German bund hit an all-time record LOW, today of -91 basis points. Yes, while the U.S. mindset is adjusting for the idea of a 3%-4% growth era, German yields are reflecting crisis and money is plowing into the safest parking place in Europe. The spread between German and French bonds are reflecting the mid-2012 levels when Italy and Spain where on the brink of insolvency — only to be saved by a bold threat/backstop from the European Central Bank.

We talked last week about the prospects for higher gold and lower yields as questions arise about the execution of (or speed of execution) Trump’s growth policies, some of the inflation optimism that has been priced in, may begin to soften. That would also lead to a breather for the stock market. I suspect we will begin to see the coming elections in Europe also contribute to some de-risking for the next couple of months. We already have a good earnings season and some solid economic data and optimism about the policy path priced in. May be time for a dip. But as I’ve said, it would create opportunities– to buy any dip in stocks, and sell any rally in bonds.

To peek inside the portfolio of Trump’s key advisor, join me in our Billionaire’s Portfolio. When you do, I’ll send you my special report with all of the details on Icahn, and where he’s investing his multibillion-dollar fortune to take advantage of Trump policies. Click here to join now.

The noise surrounding the Trump administration continues by the day, as the media tries desperately to prosecute the elected President at daily briefings.The chaos and dysfunction message is loud, but markets aren’t hearing it. The real story is very different. Stocks continue to surge. Stock market volatility continues to sit 10-year (pre-crisis) lows. The interest rate market is much higher than it was before the election, but now quiet and stable. Gold, the fear-of-the-unknown trade, is relatively quiet. This all looks very much like a world that believes a real economic expansion is underway, and that a long-term sustainable global economic recovery has supplanted the shaky post-crisis (central bank-driven) recovery that was teetering back toward recession.

The noise surrounding the Trump administration continues by the day, as the media tries desperately to prosecute the elected President at daily briefings.The chaos and dysfunction message is loud, but markets aren’t hearing it. The real story is very different. Stocks continue to surge. Stock market volatility continues to sit 10-year (pre-crisis) lows. The interest rate market is much higher than it was before the election, but now quiet and stable. Gold, the fear-of-the-unknown trade, is relatively quiet. This all looks very much like a world that believes a real economic expansion is underway, and that a long-term sustainable global economic recovery has supplanted the shaky post-crisis (central bank-driven) recovery that was teetering back toward recession.