January 7, 5:00 pm EST

The Fed sent a message to markets on Friday that they will pause on rates hikes, if not stand ready to act (i.e. cut rates or stop shrinking the balance sheet), unless market conditions improve.

With that support, stocks continue to rebound. But as the market focus is on stocks, the quiet big mover in the coming months might be commodities.

Over the weekend, the President confirmed that the $5 billion+ border wall would be made of steel — produced by U.S. steel companies. Add to that, it’s fair to expect that the next item on the Trumponomics agenda, will be a big trillion-dollar infrastructure spend (an initiative believed to be supported by both parties in Congress).

Trump has also threatened to move forward with the wall under an executive order, citing national security. With that, the execution on the wall, regardless of the state of negotiations on Capitol Hill should be coming sooner rather than later.

Let’s take a look today at a few domestic steel companies that should benefit.

Nucor Corp (NUE)

Nucor corp is the largest steel producer in the United States.

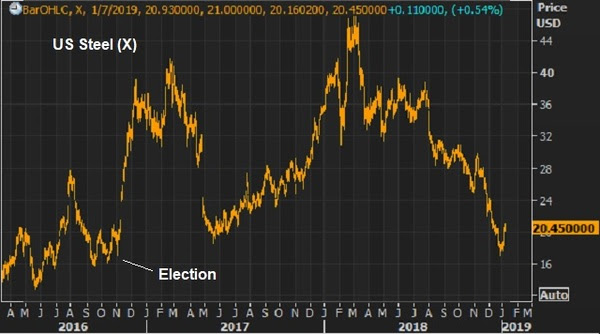

U.S. Steel (X)U.S. Steel is the second largest domestic steel producer.

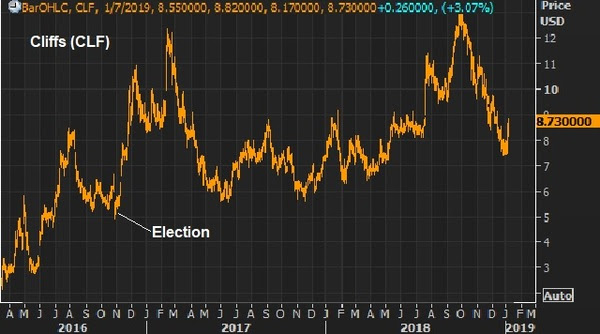

Cleveland-Cliffs (CLF)Cliffs is the largest supplier of iron units to North American steel mills.

As you can see, these stocks all benefited early on (post election) on the prospects of Trump’s America First economic plan. But, like the broader market, these stocks are all well off of the 2018 highs now — driven by the intensified trade dispute with China over the past year, the uptick in global economic risks, and the concern over Trumponomics policy execution with a split Congress. They look very, very cheap considering the outlook for domestic steel demand.

Disclosure: We are long Cliffs (CLF) in our Billionaire’s Portfolio.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

We had another big swing in stocks today, from down about 2%, to finish UP on the day.

On Friday we talked about the rise in market volatility, and what’s driving it.

It’s regime change. For the better part of a decade we had an economy driven by monetary stimulus (and loads of central bank intervention to absorb any potential shocks to markets). And since the election, we now have an economy driven by fiscal stimulus and structural reform.

With the idea that we now have a test to see if the economy will stand on its own two feet, without the benefit of central bank intervention, market volatility is up — an indicator of the uncertainty outcomes.

But as I said Friday, with dramatic change, the pendulum can often swing a little too far in the opposite direction at first (from little-to-no volatility to a lot, in this case).

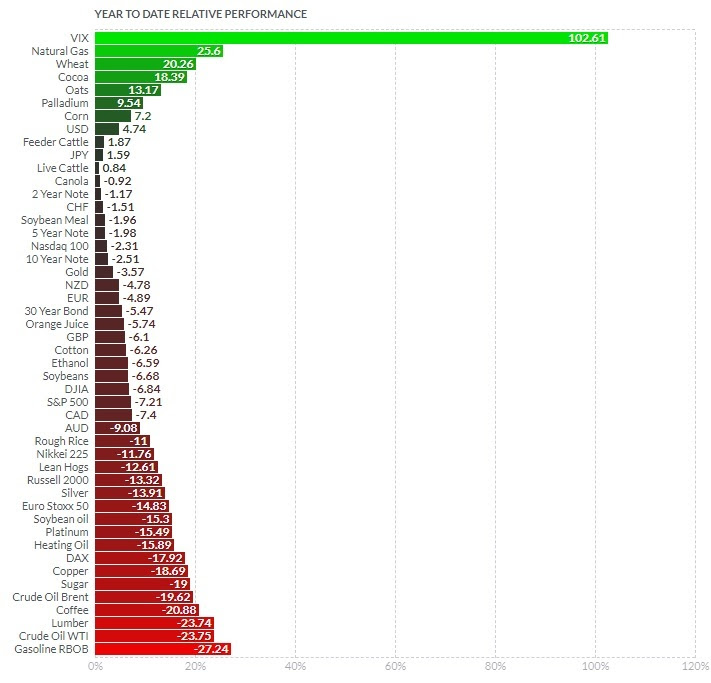

As it stands, stocks are now down about 1% on the year. In normal times you would see other alternative asset classes (to stocks) performing well. Bonds would be the obvious winner — but if you owned 10-year notes you would be down about 3% on the year (about flat after the yield). When stocks are down, and uncertainty is rising, gold tends to do well. Not this year. Gold is down 4.5% on the year. What about real estate. The Dow Jones Real Estate index is up, but small (+1.8%). Among the best investments of the year is cash. If you owned 1-month T-bills all year, you would be up close to 2%. I suspect this dynamic of little-to-no return asset class alternatives will change very soon.

What stocks do you buy? Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

December 7, 5:00 pm EST

Last year, the stock market broke a 21-year old record of the most consecutive days without a 3% intraday drawdown — some 240+ straight days.

We’ve now had a 3% intraday drawdown (open to low) three times since just early October.

So, what is responsible for the rise in volatility? Why such a contrast from last year?

It’s regime change. After nine years of zero interest rates and trillions of dollars of QE, the torch was passed this year. We entered the year with big tax cuts to implement.

This was the official transition from a monetary policy-driven economic recovery, to a fiscal stimulus-driven recovery. The Fed passed the economic stimulus torch to the White House.

Now, there was good reason that volatility remained subdued under the Fed’s emergency level zero-interest-rate policy. Why? The Fed told us, explicitly, that they (and other major global central banks) stood “ready to act” against any potential shocks that could disrupt the global economic recovery. That was an explicit promise to absorb risks so that investors (businesses, consumers, etc) would keep economic activity moving, by spending, hiring and investing.

The Fed (and other central banks, namely the ECB) had to be the backstop, so that people would pursue higher risk/return assets, in a world where risk-free assets yielded nothing. That was good enough to secure an economic recovery, but only at stall-speed levels of growth.

With that, as we entered the year, the U.S. economy was, for the first time in more than nine years, removing the central bank backstop (removing the life support for the economy). The gameplan: To replace low interest rates and QE with a $1.5 trillion fiscal stimulus package to catapult the economy out of the economic rut of 1% growth, and back toward sustainable 3% (trend) growth. And with that influence, the economy might have a chance to sustainably mend and breath on its own again.

So far we’ve gotten the growth (whether or not it’s sustainable has yet to be seen). But this regime change has also introduced uncertainty (and shock risks) back into the economy and markets. That resets the scale on volatility. And I think that adjustment has been underway.

With that said, the pendulum often swings a little too far in the opposite direction at first (from little-to-no volatility to a lot, in this case).

What stocks do you buy? Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.