|

Downgrades on growth today weighed on global markets. First, the European Commission slashed growth expectations for 2019 for all the major euro economies. For the EU overall, they are looking for 1.3% growth, versus 1.9% a few months ago. Next up was the Bank of England decision on rates this morning. They left rates unchanged, but downgraded growth for ’19 and ’20. Keep in mind, this all incorporates the reset of expectations on global interest rates that have taken place over the past month (i.e. acommodative and staying that way). So, why the downgrades? It’s all driven by fears of the worst case scenario on Brexit and U.S./China trade negotations. That worst case scenario would be “no deal.” Importantly, if we get these deals, the upgrades will come, quickly. For the moment, though, we’re continuing to see an environment that looks much like 2016. Central banks responded to the crash in oil prices by resetting expectations on monetary policy (easier). And then the growth downgrades followed. By the end of 2016, the U.S. election had swung sentiment from pessimism to optimism, and the growth upgrades came in — the Fed actually raised rates before the year-end. I suspect if the fog of uncertainty clears, we will see the same. But in the meantime, promoting the worst case scenario for growth may get policymakers in Europe motivated to follow the lead of the U.S. with some needed fiscal stimulus. That would be good for European and global growth.

|

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

We’ve now heard from about half of the S&P 500 companies on Q4 earnings. And about 70% of those companies have beat Wall Street’s earnings estimates. We’ve heard from the banks, early on, which broadly painted the picture of a healthy economy. And now we’ve heard from the dominant tech giants/ disrupters of the past decade. Facebook beat. Amazon beat. Google beat. But times are changing. Remember, the regulatory screws have tightened on the tech giants over the past year. It was a matter of when the market would finally price OUT the idea that these industry killers would be left unchallenged, to become monopolies. With that in mind, back in early October, when market risks were building (from China, to interest rates, to Italy, to Saudi Arabia), we looked at this big and vulnerable trendline in Amazon.

|

|

|

Here’s the chart on Amazon now … |

|

|

The break of that line gave way to a 30% plunge in what was the biggest company in the world. Bottom line: Amazon, Facebook and Google have entered into regulatory purgatory — after being largely left alone for the past decade to nearly destroy industries with little-to-no regulatory oversight. Costs are going UP and will keep going up.. With all of this said, the stocks of these tech giants might take a breather, but given their scale and maturity, more regulation actually strengthens their moat. There will never be a competitor to Facebook Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

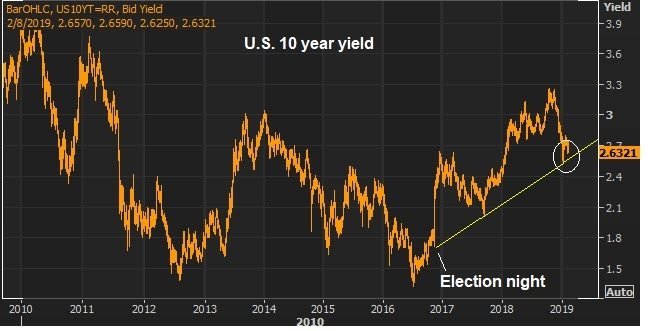

February 4, 5:00 pm EST U.S. stocks are being valued right at the long-term P/E, just under 16x forward earnings. And remember, that’s in an ultra-low interest rate environment (still). Historically, in low rate environments stocks trade north of 20 times earnings. With the Fed now on hold, and the 10-year yield back below 3%, if we continue to see this sweet spot of good economic activity and subdued inflation, we should see this multiple on stocks expand toward 20 this year. If we multiply Wall Street’s 2019 earnings estimate on the S&P 500 ($172) times a P/E of 20, we get 3,440 in the S&P 500. That’s 26% higher than current levels. Now, stocks in the U.K., Germany and Japan are all trading closer to 12x forward earnings. That’s cheap relative to long-term averages, and especially cheap relative to U.S. stocks. For perspective, Japanese stocks are recovering back toward the highest levels in more than 25 years, yet the forward P/E on Japanese stocks is closer to the lowest levels over the period. From a technical perspective, Japanese stocks should follow the lead of this big trend break in U.S. stocks…

|

|

|

Here’s a look at the Nikkei and the opportunity to see this “laggard” catch up … |

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

January 29, 5:00 pm EST Today let’s take a look at the recent moves the U.S. administration has made against Venezuela, and what that means for oil prices. It was August of 2017, when Trump first stepped up pressure on Venezuela. Venezuela is (and has been) in a humanitarian, political and economic crisis–led by what the U.S. administration has officially called a dictator. Trump slapped sanctions on the Venezuelan President back in 2017 (freezing his U.S assets) and was said to be considering broad oil sanctions. That finally came yesterday (seventeen months later). For a country that relied heavily on oil exports (ninety-five percent of export revenues in Venezuela come from oil), the U.S. will no longer be sending money to Venezuela for oil. This is a crushing blow for an already suffering country. What does it mean for oil prices? Venezuela has the world’s largest oil reserves. With oil sanctions, should come supply disruptions for the oil market, which could likely send oil aggressively higher. Back in 2017, when Trump threatened sanctions, oil broke out of its $40-$55 range, and ultimately traded up to $76. Today, we’re nearing the top end of that same range. |

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

January 28, 5:00 pm EST

This is a huge week. We’re following a down 9% month for stocks with a big bounceback. But it will all hinge on the events of the week.

We get Q4 earnings from about quarter of the companies in the S&P 500 – and a third of the Dow. We have the Fed on Wednesday. And the U.S. hosts trade talk meetings with China on Wednesday and Thursday. And then on Friday, we’ll get the jobs report.

We kicked off earnings season with reports from the big banks two weeks ago. And the reports broadly painted the picture of a healthy consumer and healthy economy.

This week, we hear from a broad swath of blue chips, including big multinational businesses. Among them: We heard from Caterpillar today. We’ll hear from Apple and Boeing tomorrow. McDonalds and 3M report on Wednesday. Amazon is on Thursday.

Expect a lot of discussions about “concerns” on the outlook (as we heard from Caterpillar today), but with a picture about Q4 that looked good (continuing with the theme of 2018).

Remember, much of the talk about slowdown has been about what might happen, in the year (or two) ahead – which primarily assumes a long-term stalemate on the Trump trade war. With that, never underestimate Wall Street and corporate America’s willingness to set the bar low (when given the opportunity), so that they can jump over a very low bar (i.e. set up for earnings beats in future quarters).

Far more important than those “concerns” voiced by CEO’s, is what the Fed has already done, and what will come out of the U.S./China talks this week.

Remember on January 4th, the Fed responded to the calamity in financial markets by backing down from their rate hiking plans. This week, the Fed Chair will likely use his post-meeting press conference to further massage markets. The Fed, the ECB and the BOJ have already positioned themselves (in recent weeks) to be the shock absorbers if the trade war continues to drag out.

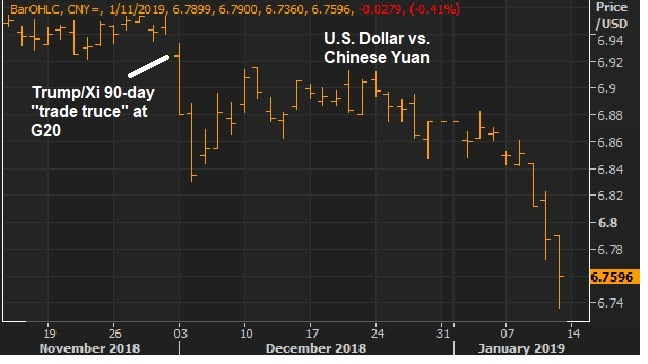

As for trade talks, the calendar continues to approach the March 1 deadline on the tariff truce. And China has been gasping for air. I suspect we will get progress — maybe an official agreement on trade, leaving the intellectual property and technology transfer negotiations still on the table. That would be good progress.

|

January 10, 5:00 pm EST

The coordinated response to market turmoil continues to reverse the tide of what was becoming an increasingly ugly global financial market meltdown.

Remember, we had a response from the U.S. Treasury Secretary on the days leading up to Christmas, which included call outs to the major banks and a meeting of the “President’s Working Group” on financial markets. Coincidentally, by the next Wednesday, a new item hit the agenda for the American Economic Association Annual Meeting. It was the January 4 live interview with the three most powerful central bankers in the world over the past ten years: Bernanke, Yellen and Powell. These three sat on stage together and massaged market sentiment on the path of interest rates, fortifying the market recovery that was started by the efforts of the Treasury.

Just in case we didn’t get the message, we’ve since had six Fed officials publicly dialing down expectations on the rate outlook, in response to financial markets. And we’ve had minutes from the Fed’s last meeting that clearly gave the message that the Fed could pause, sit and watch. And then today Powell was on stage again for another public interview, reiterating the Fed’s new position: on hold.

Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now.

|