January 4, 2023

On this day a year ago the stock market posted the all-time high.

If you recall, coming into 2022, the Fed, staring down the barrel of 7% inflation, told us that they would tame inflation, and land close to their target of 2% by the end of 2022. And, they told us that they would do so while producing a 4% growth economy (well above trend) at 3.5% unemployment (near record levels) — all while keeping the Fed Funds rate under 1%.

What did they do? They took rates above 4%, crushed growth (induced a technical recession) and didn’t get near their inflation target.

As I said in my Pro Perspectives note last year this time, a new year can often come with regime change in markets.

We had the extreme of regime change.

Not only did we go from an easing to a tightening cycle, for global monetary policy. But we went from a long-era of low inflation, and ultra-easy money, to a high inflation, and inflation fighting policy.

We went from a fed that was a fervent defender of financial market stability, and promoter of economic prosperity, to a Fed that explicitly attacked jobs and demand, and went to great lengths to talk down the stock market (in effort to tighten financial conditions).

With that about face, for anyone looking to earn investment returns, much less preserve buying power against inflation, there were few places to hide. Not only did stocks do poorly, but bonds did worse — an outcome with few historical reference points in down stock markets and higher uncertainty environments.

The good news: The rate-of-change in monetary policy tightening will slow dramatically this year (and could possibly be a zero rate-of-change, which would be a positive surprise for markets). The rate-of-change in the fiscal policy madness will be zero, with a split Congress (= gridlock). The latter takes pressure off of the Fed.

Remember, the Fed was ready to pause on rates at 2.25% back in July. That was before the Biden White House and democrat-controlled Congress decided to greenlight another $1 trillion-plus spending binge. The Fed won’t get sideswiped with any more ofthese surprises, with a split Congress.

On a related note, remember, going back to 1950, there has never been a 12-month period, following a midterm election, in which stocks were down. And the average one-year return following the eighteen midterm elections of the past seventy years was 15% (about double the long-term average return of the S&P 500).

Keep in mind, markets have priced in a lot of negative expectations (from the rate path, to earnings erosion, to recession). That sets up for positive surprises. Stocks like positive surprises.

What is among the best performing asset coming out of a bear market in stocks? Small cap value stocks. That’s precisely what we hold in our Billionaire’s Portfolio (with the extra kicker of a catalyst, often from the direct influence of a billionaire investor). We significantly outperformed broader markets in 2022, and are positioned to have an explosive bounce in 2023 (perhaps similar to what we saw in 2016, where we bounced 40 percentage points from the low point of the broader market correction — outpacing the S&P by 2 to 1).

Click here to join me, and get your portfolio in line with ours.

June 5, 5:00 pm EST

We’ve talked the past couple of days about economic growth and the likelihood that we’re just beginning to see the positive surprises from Trumponomics materialize in the economic data.

The formula for GDP is consumption + investment + government spending + net exports. So you can see in these components, the direct targeting of economic stimulus in the Trump economic plan to drive growth: tax cuts, deregulation, repatriation, infrastructure and trade negotiations.

Now, consumption makes up about two-thirds of GDP. Let’s look at consumption today, and we’ll step through the other contributors to GDP over the next few days.

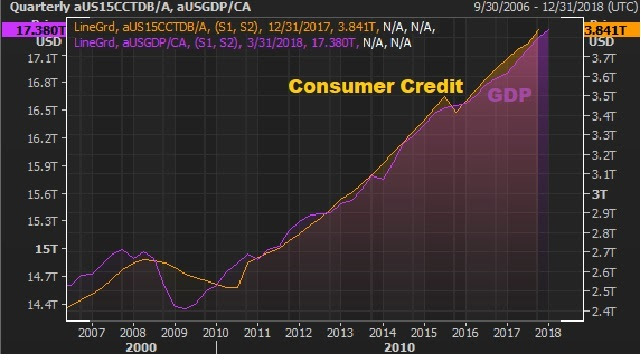

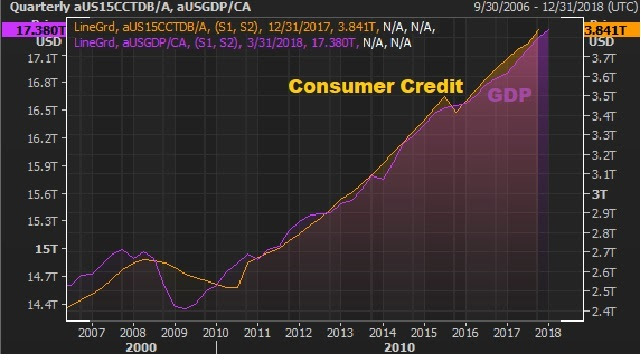

First, what is the key long-term driver of economic growth over time? Credit creation. When credit is used to buy productive resources, wealth goes up. And when wealth goes up consumption tends to go up. With that in mind, in the chart below you can see the sharp recovery in consumer credit (in orange) since the depths of the economic crisis (this excludes mortgages). And you can see how closely GDP (the purple line, economic output) tracks credit growth.

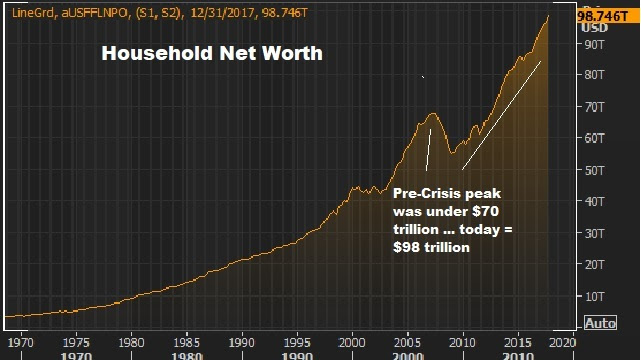

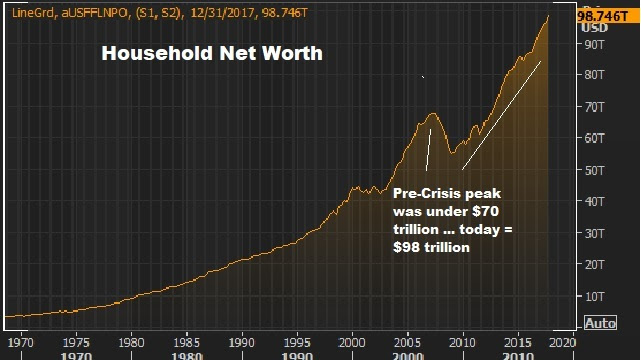

And we have well recovered and surpassed pre-crisis levels in household net worth — sitting at record highs now (up another $2 trillion since we last looked at it) …

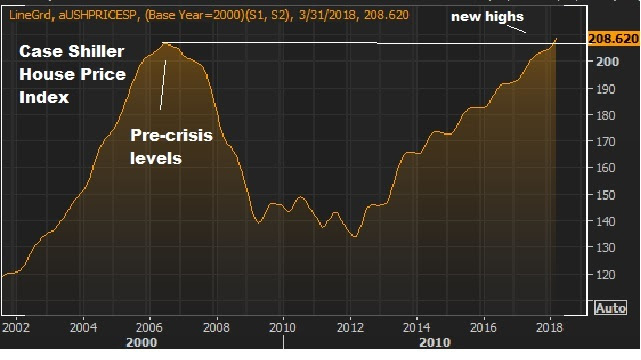

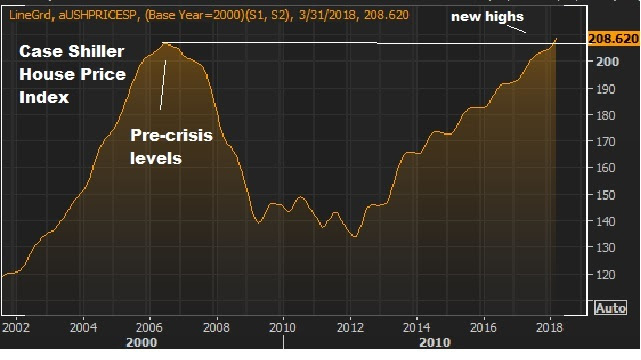

A large contributor to the state of consumption is the recovery and stability in housing. We are now back to new highs on the broad housing index …

When we consider this solid backdrop, remember, we’ve yet to have a return of ‘animal spirits’ — a level of trust and confidence in the economy that fuels more aggressive hiring, spending and investing.

And with that, as we discussed yesterday, while we are in the second longest post-War economic expansion, we’ve yet to have the aggressive bounce back in growth that is characteristic of post-recession recoveries.

But we now have the pieces in place to see the return of animal spirits and a big pop in economic growth. And that should continue to fuel for much higher stock prices. And there are stocks that will do multiples of what the broader stock market does.

May 21, 5:00 pm EST

Last week, rising market interest rates in the U.S. were becoming a concern. But as we discussed on Friday, we ended the week with a big bearish reversal signal in the 10-year yield. This week, the market focus seems to be shifting toward a lower dollar and higher commodities.

Friday’s bearish signal in rates seems to have foreshadowed the news coming into today’s session, that Italy is putting forward an agreement for a coalition government that would break compliance from EU rules (an “Italy first” approach to an economic and social agenda).

That has created some flight to safety in the bond market. You can see in this chart below, money moving out of Italian bonds (yields go up) and into German bonds (yields go down).

And that means money goes into U.S. Treasuries too. So you can see U.S. yields (the purple line in the chart below) backing off of the highs of last week, and with room to move back toward 3% (or below) if this dynamic in Italy continues to elevate the risk environment.

Now, with the rate picture softening, the dollar may be on the path of softening too. That would be a welcome site for emerging market currencies. We discussed last week how the push higher in U.S. yields was putting pressure on emerging market currencies. And the combination of weaker currencies and higher dollar-denominated oil prices was a recipe for economic strain.

Today, Larry Kudlow, the Chief Economic Advisor to the White House, carefully crafted a response on the dollar, as to not say they favored it “stronger.” That’s probably enough, given the rising risks in emerging markets, to get the dollar moving lower (to alleviate some of the pain of buying dollar-denominated oil for some of the EM countries).

And it may be the signal for commodities to start moving again. Because most commodities are priced in dollar, commodities prices tend to be inversely correlated to the dollar.

Today we had a fresh three-year high in the benchmark commodities index (the CRB Index).

Here’s an excerpt from one of my Forbes Billionaire’s Portfolio notes back in June, on the building momentum for commodities: “The technology sector minted billionaires over the past decade. It’s in commodities that I think we’ll see the new billionaires minted over the next decade. The only two times commodities have been this cheap relative to stocks was at the depths of the Great Depression in the early 30s and at the end of the Bretton Woods currency system in the early 70s. Commodities went on a tear both times.”

We’ll take a closer look at this tomorrow.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

April 23, 5:00 pm EST

Yields continue to grind higher toward 3%. That has put some pressure on stocks, despite what continues to be a phenomenal earnings season. This creates another dip to buy.

Yesterday, we talked about a reason that people feel less good about stocks, with yields heading toward 3%. [Concern #1] It conjures up memories of the “taper tantrum” of 2013-2014. Yields soared, and stocks had a series of slides.

My rebuttal: The domestic and global economies are fundamentally stronger and much more stable. But maybe most importantly, the economy (still) isn’t left to stand on its own two feet, to survive (or die) in a normalizing interest rate environment. We have fiscal stimulus doing a lot of heavy lifting.

Let’s look at a couple of other reasons people are concerned about stocks as yields climb:

[Concern #2] Maybe this is the beginning of a sharp run higher in market interest rates — like 3% quickly becomes 4%?

My Rebuttal: Very unlikely given the global inflation picture, but more unlikely with the Bank of Japan still buying up global assets in unlimited amounts (Treasuries among them, through a variety of instruments). They can/and are controlling the pace, for the benefit of stimulating their own economy and for the benefit of stimulating and maintaining stability in, the global economy.

[Concern #3] I hear the chatter about how a 3% 10-year note suddenly creates a high appetite for Treasuries over stocks at this point, especially from a risk-reward perspective (i.e. people are selling stocks in favor of capturing that scrumptious 3% yield).

My Rebuttal: In this post-crisis environment, a rise toward 3% promotes the exact opposite behavior. If you are willing to lend for 10-years locked in at a paltry rate, you are forgoing what is almost certainly going to be a higher rate decade than the past decade. If you need to exit, you’re going to find the price of your bonds (very likely) dramatically lower down the road. Coming out of a zero-interest rate world, bond prices are going lower/not higher.

Remember this chart …

The bond market has become a high risk-low reward investment. Meanwhile, with earnings set to grow more than 20% this year, and stock prices already down 7% from the highs of the year, we have a P/E on stocks that continues to slide lower and lower, making stocks cheaper and cheaper. That makes stocks a far superior risk/reward investment, relative to bonds – especially with the prospects of the first big bounce back in economic growth we’ve seen since the Great Recession.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.