May 15, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

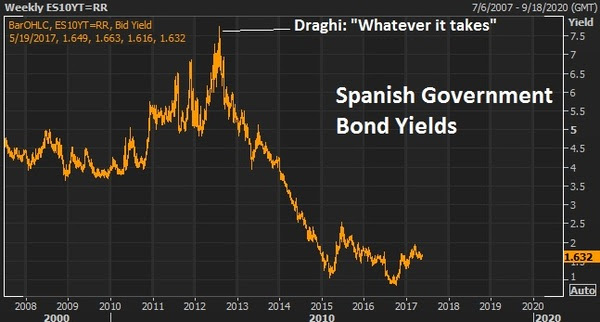

Last week we discussed the building support for a next leg higher in commodities prices. China is clearly a very important determinant in where commodities go. And with the news last week about cooperation between the Trump team and China, on trade, we may have the catalyst to get commodities moving higher again.It just so happens that oil (the most traded commodity in the world) is rebounding too, on the catalyst of prospects of an OPEC extension to the production cuts they announced last November.In fact, overnight, Saudi Arabia and Russia said they would do “whatever it takes” to cut supply (i.e. whatever it takes to get oil prices higher). Oil was up big today on that news.When you hear these words spoken from policy-makers (those that can dictate outcomes), it should get everyone’s attention. Those are the exact words uttered by ECB head Mario Draghi, that ended the bond market assault in Spain and Italy that were threatening the existence of the euro and euro zone. The Spanish 10-year yield collapsed from 7.8% (unsustainable borrowing rate for the Spanish government, and threatening imminent default) to 1% over the next three years — and the ECB, while threatening to buy an unlimited amount of bonds to push those yields lower, didn’t have to buy a single bond. It was the mere threat of ‘whatever it takes’ that did the trick. Last week we discussed the building support for a next leg higher in commodities prices. China is clearly a very important determinant in where commodities go. And with the news last week about cooperation between the Trump team and China, on trade, we may have the catalyst to get commodities moving higher again.It just so happens that oil (the most traded commodity in the world) is rebounding too, on the catalyst of prospects of an OPEC extension to the production cuts they announced last November.In fact, overnight, Saudi Arabia and Russia said they would do “whatever it takes” to cut supply (i.e. whatever it takes to get oil prices higher). Oil was up big today on that news.When you hear these words spoken from policy-makers (those that can dictate outcomes), it should get everyone’s attention. Those are the exact words uttered by ECB head Mario Draghi, that ended the bond market assault in Spain and Italy that were threatening the existence of the euro and euro zone. The Spanish 10-year yield collapsed from 7.8% (unsustainable borrowing rate for the Spanish government, and threatening imminent default) to 1% over the next three years — and the ECB, while threatening to buy an unlimited amount of bonds to push those yields lower, didn’t have to buy a single bond. It was the mere threat of ‘whatever it takes’ that did the trick.

As for oil: From the depths of the oil price crash last year, remember, we discussed the prospects for a huge bounce. Oil prices at $26 were threatening to undo the trillions of dollars of work central banks and governments had done to stabilize the global economy. Central banks couldn’t let it happen. After a series of coordinated responses (from the BOJ, China, ECB and the Fed), oil bottomed and quickly doubled. Also at that time, two of the best oil traders in the world were calling the bottom and calling for $70-$80 oil by this year (Pierre Andurand and Andy Hall). Another commodities king that called the bottom: Leigh Goehring. Goehring, one of the best commodities investors on the planet, has also laid out the case for $100 oil by next year. He says he’s “wildly bullish” oil in his recent quarterly investor letter at his new fund, Goehring & Rozencwajg. Goehring argues that the IEA inventory numbers are flawed. He thinks oil the market is already over-supplied and is in a draw, as of May of last year. With that, he thinks the OPEC cuts will ultimately exacerbate the deficit and send prices aggressively higher. He says “we remain ‘wildly’ bullish and believe that there is a very high probability of oil prices reaching triple digits in the first half of 2018.” Follow This Billionaire To A 172% WinnerIn our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO. |