December 5, 5:00 pm EST

I was away from the markets yesterday, on a big down day. With markets closed today to honor the 41st President, let’s take a look at what happened on Tuesday.

Why the ugly and persistent plunge in stocks?

Many of the reasons that have been attributed to the two stock market corrections this year, bubbled up again yesterday. But as we’ve discussed, the stock declines this year appear to have had everything to do with Saudi capital flows–and less to do with all of the hand-wringing issues you hear and read in the financial media. Same can be said for yesterday.

When prospects rise that Saudi assets may be threatened by sanctions(or seizures in the case earlier this year, related to the Crown Prince’s corruption crackdown) indiscriminate and aggressive selling of U.S. assets hit immediately (likely led by the Saudi sovereign wealth fund, which has assets over half a trillion dollars).

We had it again yesterday. Stocks had a big gap up on Monday on movement on U.S./China trade. It was after the close on Monday that the news hit that the CIA would brief the special Senate committee on Tuesday. Stocks immediately started moving lower. The Dow futures were down 250 points by midnight. And then of course, yesterday, when news hit that the briefing was underway (just after noon), the bottom immediately fell out of stocks. A little more than half an hour later, U.S. Senators were standing in front of cameras telling the world that the Crown Prince was involved in the murder and that Congress should invoke the Magnitsky Act. This law authorizes the government to sanction human rights offenders, freeze their assets, and ban them from entering the U.S.

With that, I suspect this was nothing more than grandstanding. Trump will not (can not) act for the reasons we discussed last month.

If he sanctioned the Saudi government over this, oil prices would probably explode and stocks would crash (not really an option).

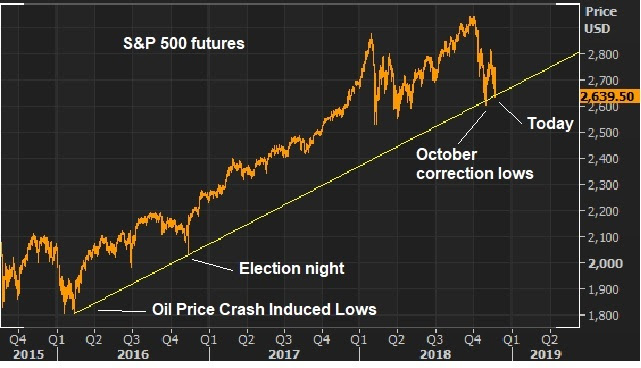

We’ll see how stocks react tomorrow after a day of reflection. I suspect Tuesday created another buying opportunity.