January 10, 5:00 pm EST

The coordinated response to market turmoil continues to reverse the tide of what was becoming an increasingly ugly global financial market meltdown.

Remember, we had a response from the U.S. Treasury Secretary on the days leading up to Christmas, which included call outs to the major banks and a meeting of the “President’s Working Group” on financial markets. Coincidentally, by the next Wednesday, a new item hit the agenda for the American Economic Association Annual Meeting. It was the January 4 live interview with the three most powerful central bankers in the world over the past ten years: Bernanke, Yellen and Powell. These three sat on stage together and massaged market sentiment on the path of interest rates, fortifying the market recovery that was started by the efforts of the Treasury.

Just in case we didn’t get the message, we’ve since had six Fed officials publicly dialing down expectations on the rate outlook, in response to financial markets. And we’ve had minutes from the Fed’s last meeting that clearly gave the message that the Fed could pause, sit and watch. And then today Powell was on stage again for another public interview, reiterating the Fed’s new position: on hold.

Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now.

December 14, 5:00 pm EST

We’ve talked about the struggling Chinese economy this week.

As I’ve said, much of the key economic data in China is running at or worse than 2009 levels (the depths of the global economic crisis).

And the data overnight confirmed the trajectory: lower.

As we’ve discussed, this lack of bounce in the Chinese economy (relative to a U.S. economy that is growing at better than 3%) has everything to do with Trump squeezing China.

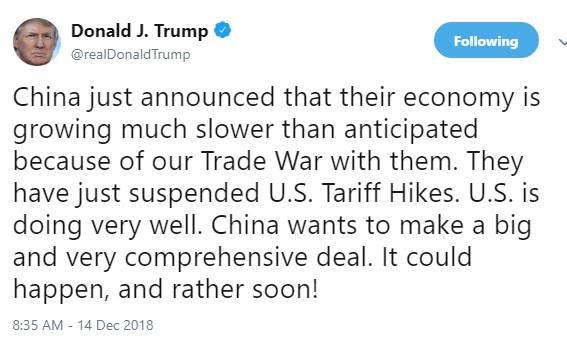

He acknowledged it today in a tweet ….

The question: Has China retaliated with more than just tit-for-tats on trade? Have they been the hammer on U.S. stocks? It’s one of the few, if not only, ways to squeeze Trump. As we discussed last week, when the futures markets re-opened (at 6pm) on the day of mourning for the former 41st President, there was a clear seller that came in, in a very illiquid period, with an obvious motive to whack the market. It worked. Stocks were down 2% in 2 minutes. The CME (Chicago Mercantile Exhange) had to halt trading in the S&P futures to avert a market crash at six o’clock at night.

Now, cleary stocks have a significant influence on confidence. You can see confidence wane, by the day, as stocks move lower. And, importantly, confidence fuels the decisions to spend, hire and invest. So stock market performance feeds the economy, just as the economy feeds stock market performance. The biggest threat to a fundamentally strong economy, is a persistently unstable stock market. In addition, sustaining 3% growth in the U.S. will be difficult if the rest of the world isn’t participating in prosperity.

With that in mind, in my December 1 note, I said “it may be time for Trump to get a deal done (with China) and solidify the economic momentum needed to get him to a second term, where he may then readdress the more difficult structural issues with China/U.S. relations.” That seems even more reasonable now.

We end the week with this chart of the S&P.

We have two 12% declines in stocks this year. And you can see the fear beginning to set in. With that, the best investors in the world have made their careers by “being greedy when others are fearful” (Warren Buffett) or “buying when most people are selling and selling when most people are buying” (Howard Marks). There is clear value in stocks right now.

Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

December 12, 5:00 pm EST

We talked about the China trade story yesterday.

In a nutshell, Trump has capitalized on an aligned Congress (in the first half of the mid-term) to stoke the U.S. economy. And that has strengthened the leadership position of the U.S. coming out of the decade long post-global economic crisis period.

With that, Trump has used the leverage of global economic leadership (in a vulnerable global economic period) to force change in China. And as we observed yesterday (in the charts of Chinese GDP, industrial production, domestic investment and retail sales), he’s getting movement because the Chinese economy was sputtering before the trade crackdown, and is now running out of gas. Much of the key economic data in China is running at or worse than 2009 levels (the depths of the global economic crisis). We get new data on industrial production, domestic investment and retails sales out of China tonight. This should provide more information on how the Chinese economy is being squeezed.

As for stocks, we have eleven trading days remaining for the year. The S&P 500 finishes today down about 1% for the year, and down 3.4% month-to-date. On the quarter, stocks are down 9% — the worst fourth quarter since 2008. If we look back at monthly returns, dating back to 1950, stocks have finished UP in December 75% of the time, for an average gain of 1.5%. Only two times have stocks has worse December performance over the near 70 year period (2002 and 1957).

And remember, as we discussed earlier this week, it’s not just stocks. It’s a zero (or near zero) return year for all major asset classes this year. Stocks, bonds, gold, real estate … nothing is working. The winner on the year has been cash.

Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

We had another big swing in stocks today, from down about 2%, to finish UP on the day.

On Friday we talked about the rise in market volatility, and what’s driving it.

It’s regime change. For the better part of a decade we had an economy driven by monetary stimulus (and loads of central bank intervention to absorb any potential shocks to markets). And since the election, we now have an economy driven by fiscal stimulus and structural reform.

With the idea that we now have a test to see if the economy will stand on its own two feet, without the benefit of central bank intervention, market volatility is up — an indicator of the uncertainty outcomes.

But as I said Friday, with dramatic change, the pendulum can often swing a little too far in the opposite direction at first (from little-to-no volatility to a lot, in this case).

As it stands, stocks are now down about 1% on the year. In normal times you would see other alternative asset classes (to stocks) performing well. Bonds would be the obvious winner — but if you owned 10-year notes you would be down about 3% on the year (about flat after the yield). When stocks are down, and uncertainty is rising, gold tends to do well. Not this year. Gold is down 4.5% on the year. What about real estate. The Dow Jones Real Estate index is up, but small (+1.8%). Among the best investments of the year is cash. If you owned 1-month T-bills all year, you would be up close to 2%. I suspect this dynamic of little-to-no return asset class alternatives will change very soon.

What stocks do you buy? Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.