We kick off fourth quarter earnings this week. We’ll hear from the big banks on Friday: JP Morgan, Citi and Wells Fargo.

Bank of America and Goldman Sachs earnings will come early next week.

Last year, across the broad market, the table was set for positive earnings surprises, against a backdrop of deliberately dialed down expectations. And those low expectations were against a low base of 2020, pandemic/lockdown numbers.

With that, we’ve had positive earnings surprises throughout the first three quarters of 2021. The expectation is for 21% earnings growth for Q4, which would give us four consecutive quarters of 20%+ earnings growth and 40% earnings growth on the year.

That said, of the nearly 100 S&P 500 companies that have issued guidance for Q4, 60% are negative. That’s straight from the corporate America playbook: Using the cover of the Omicron news from late November to lower expectations, to position themselves to manufacture positive earning surprises OR withhold some earnings power for next quarter.

So, in addition to the changing interest rate cycle, could the slide in stocks to open the year have something to do with weaker Q4 earnings? Maybe.

On that note, let’s take a look at the big technical support hit today …

In the chart above, the S&P 500 hit this big trendline that comes in from election day. This rise in stocks, of course, has everything to do with an agenda that entailed even more massive fiscal spending programs — AND a central bank that remained in an ultra-easy stance.

Indeed, we’ve since had another $1.9 trillion spend passed in late January of last year, plus a $1.2 trillion infrastructure package later in 2021.

Now we have a Fed that has flipped the script, and the additional bazooka agenda-driven fiscal package has been blocked — and we get a test of this big trendline.

The good news: The line held today, and stocks bounced aggressively (about 100 S&P points) into the close.

As you can see in the chart below, we have a similar line in the Nasdaq, dating back to the election. This breached but closed back above the line today.

With the above in mind, we should expect the banks to continue putting up big numbers to kick off the earnings season later this week. That will be fuel for stocks.

Remember, the banks set aside a war chest of loan loss reserves early in the pandemic, and they have been moving those reserves to the bottom line since, at their discretion. As an example, both Citi and JP Morgan have another $5 billion to release, to bring their loan loss reserves back in line with pre-pandemic levels. That’s $5 billion (each) that will be turned into earnings.

July 1, 5:00 pm EST

Predictably, Trump extended the timeline on new tariffs in his meeting with China’s President Xi over the weekend.

This is kicking the trade war can down the road. That extends the timeline on the trade war and resets the opportunity to force the Fed’s hand this coming month–to get a rate cut at the July 30-31 Fed meeting.

As we’ve discussed, with a rate cut under his belt, this would clear the way for Trump to, then, claim victory on the China trade war by doing ‘a’ deal, giving himself enough runway into the 2020 elections to have a booming stock market and booming economy.

Since December, we’ve been talking about the parallels between the current period and the 1994-1995 period. It’s worth repeating again. The script continues to play out. In 1994, an overly aggressive Fed raised rates into a recovering, low inflation economy. By 1995, they were cutting. That led to a 36% rise in stocks in 1995. And it led to 4% growth in the economy through late 2000–18 consecutive quarters of more than 4% growth. Stocks tripled over the five-year period.

Think about that, and then remove the overhang of a trade war with the two biggest economies of the world and you can see the path to some very good times ahead. Moreover, if the above scenario plays out, Trump would then likely turn back to Congress and green-light a $2 trillion infrastructure plan.

While many have been predicting economic bust, this is a formula for an economic boom!

June 26, 5:00 pm EST

This morning Mnuchin was interviewed by CNBC. He was the headline of the day, despite saying nothing new.

When trade talks broke down in early May, the Trump administration said they were 90% of the way to a deal. But China balked and reneged on concessions. Mnuchin said the same thing today (we were 90% there), and the media presented it as if he said progress was made this week, heading into the meetings. That’s not what he said.

Let’s talk about the backdrop heading into the weekend negotiations. Remember, Trump is in the driver’s seat in this negotiation. He can’t force a good deal, but he can claim victory on the trade front just by doing ‘a’ deal.

With that in mind, as we’ve discussed over the past month, he seems to be attempting to surgically optimize the economy heading into next year’s election. He’s been fighting for a Fed rate cut, and through introducing heightened risks of a standstill on trade, he’s gotten what looks like Fed compliance coming down the pike (for a July cut).

The timeline set up perfectly for a June rate cut, and then for Trump to settle on a China deal at the G20 meeting. The economy would have launched like a rocket-ship. The Fed didn’t comply.

With that, at this weekends Trump/Xi meeting, let’s see if Trump extends the timeline on new tariffs, to get through the July Fed meeting (in hopes of getting his Fed fuel for the economy). At this point, the market has backed the Fed into the corner, with high expectations of not just 25 bps, but a 50 bps cut. Without an extension of trade uncertainty, those expectations will sustain if not grow.

Now, we’ve discussed over the past month, the prospects for this trade war with China ending with a grand and coordinated currency agreement — perhaps a big depreciation of the dollar, similar to the 80s “Plaza Accord.”

As I said a couple of weeks ago, we may wake up one day and find a similar agreement has been made between the U.S. and major global trading partners (which may include China, or not). It might be a deal between the U.S. and China to “revalue” the yuan (i.e. strengthen it). Or it may exclude China (just G3 economies). An interesting takeaway from this morning’s interview with Mnuchin: Mnuchin did make a point to emphasize that they look forward to many bi-lateral meetings at the G-20 — not just with China.

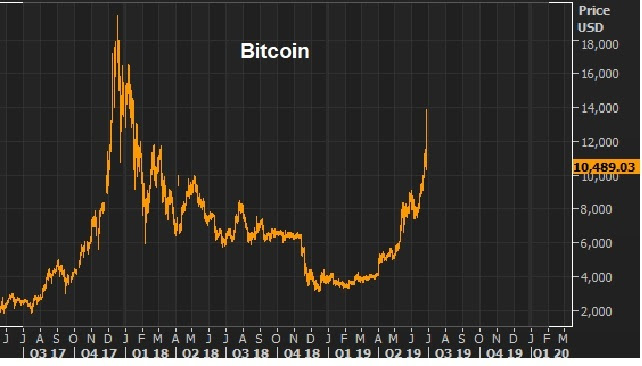

How do you position for a dollar devaluation? Buy commodities. Is that what the move in gold is telling us (and Bitcoin)? Maybe.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

June 21, 5:00 pm EST

As we end the week, any questions on whether or not the central banks have your back, have been answered.

Just as they have for the better part of a decade, they have no choice but to respond to any shocks that might knock the global economic recovery off path. And as I said yesterday, the major central banks of the world have lined up, because they are unable to predict what Trump will do on trade. To maintain market confidence, they have to posture as if they assume the trade war will go on indefinitely.

On that note, it seems to be priced into the global treasury markets and the gold market that China can’t accept Trump’s deal (or at least can’t deliver on the current demands of the deal). It’s politically unpalatable and an existential threat to the Chinese Communist Party. So, the question is, will Trump end the trade dispute with more bark than bite? Will he do a deal (not the deal) and remove the overhang of uncertainty from the global economy, and an election coming next year. Next week should be interesting, as we await the Trump/Xi meeting at the G20 (scheduled for Friday 6/28 and Saturday 6/29).

As we head into this weekend, markets hang around big levels: record highs in stocks, the big 1,400 level in gold, just above 2% on the 10-year, and closing in on 10k in Bitcoin (a haven for Chinese capital flight).