|

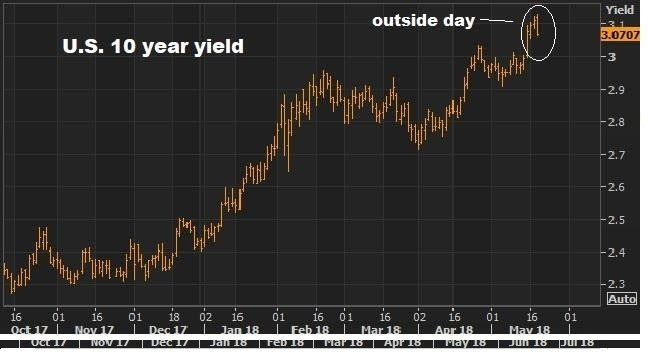

July 5, 5:00 pm EST I hope everyone had a great Fourth of July yesterday. Today, the markets continue to be thinly traded as we head into the jobs report tomorrow. We did get minutes from the recent Fed meeting today. This is a closer look into the views of the Fed from their June meeting. Of course, we already had a lot of information from that June meeting: the Fed hiked rates for the second time this year, they telegraphed an additional hike for the year in their projections, plus the June meeting was also accompanied by a press conference from Fed chair Jay Powell. And his explicit “main takeaway” was … “the economy is doing very well.” With this in mind, as we head into tomorrow’s jobs numbers, the 10-year yield is probably the most important chart to watch. While inflation isn’t near reflecting an economy that’s running hot, the interest rate market is even more disconnected. Remember, back on May 18, in my Pro Perspectives note, we discussed this chart …

|

|

|

As the world was becoming concerned with the speed and level of market interest rates, we had this big technical reversal signal hit for the key 10-year government bond yield.

We focused on this in my May 18th piece, where I said “this technical phenomenon, when closing near the lows, is a very good predictor of tops and bottoms in markets, especially with long sustained trends.” And I said, “I suspect we may have seen some global central bank buyers of our Treasuries today (which puts downward pressure on yields) to take a bite out of the momentum.”

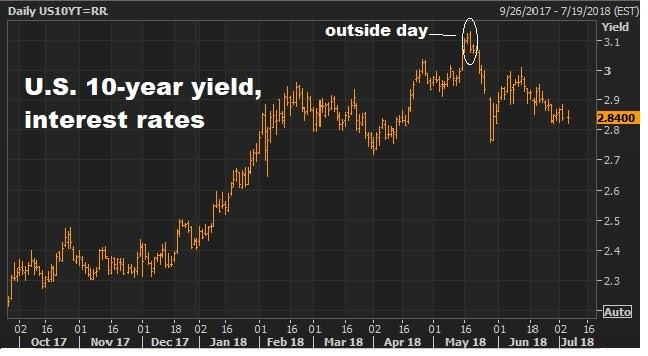

Today the chart looks like this … |

|

|

So, that outside day did indeed predict a reversal. And we head into tomorrow’s job report with the benchmark 10-year yield at just 2.84%. That’s in a world where the economy is running at 3% growth and unemployment is under 4%.

But this disconnect may be changing tomorrow. The key data point tomorrow will be wages (Average Earning), not jobs. A hot number there will likely turn this around, and bring higher rates back into the picture.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

|