April 29, 5:00 pm EST

We ended last week with a positive surprise for Q1 GDP. Today, we had more soft inflation data.

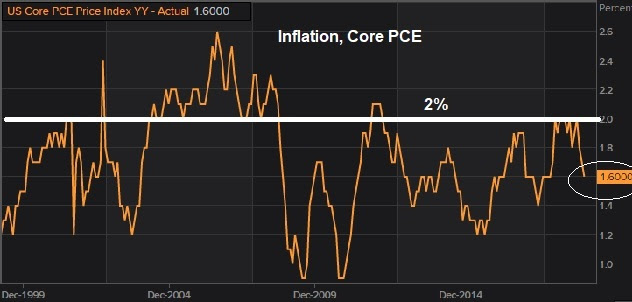

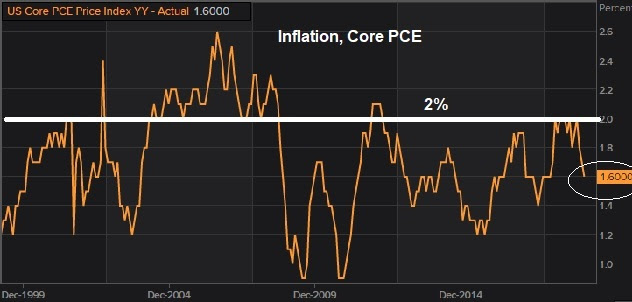

The Fed’s favored inflation gauge, core PCE, continues to fall away from it’s target of 2%.

Here’s a look at the chart …

|

|

With a Fed meeting this week, they remain in the sweet spot. They have trend economic growth, subdued inflation and a 10-year yield at 2.5%. They can sit and watch. They could cut! That’s highly unlikely, but less unlikely by the summer, if current conditions persist.

The market is pricing in about a 60% chance that we’ll see a rate cut by year-end. It doesn’t sound so crazy, if you consider that it would underpin/if not ensure the continuation of the economic expansion — perhaps even fueling an economic boom period.

Remember, we’ve talked about the 1994-1995 parallels. In 1994, an overly aggressive Fed raised rates into a recovering, low inflation economy. By 1995, they were cutting. That led to a 36% rise in stocks in 1995. And it led to 4% growth in the economy through late 2000 — 18 consecutive quarters of 4%+ growth. Stocks tripled over the five-year period.

This, as the S&P 500 is already sitting on new record highs? As I said earlier this year, with yields back (well) under 3%, we should see multiples on stocks expand back toward 20x in this environment.

The forward 12-month P/E on the S&P 500 is currently 16.8. If we multiply Wall Street’s earnings estimate on the S&P 500 ($175) times a P/E of 20, we get 3,500 in the S&P 500. That’s 19% higher than current levels.

But keep in mind, the earnings estimate bar has been set low. And already 77% of companies are beating estimates on Q1 earnings. I suspect, we’ll see higher earnings over the next twelve months than Wall Street has estimated, AND a higher multiple paid on those earnings (i.e. an outlook for an S&P 500 > 3,500).

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

|

|

February 1, 5:00 pm EST

We had a big rebound for global markets (and economic sentiment) in January. Today we had the jobs report and some manufacturing data from the past month.

The data continues to show an economy that is in the sweet spot for the Fed. Economic activity is solid. And inflation is tame.

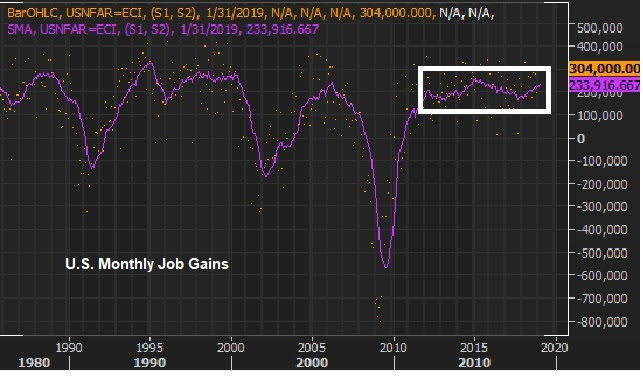

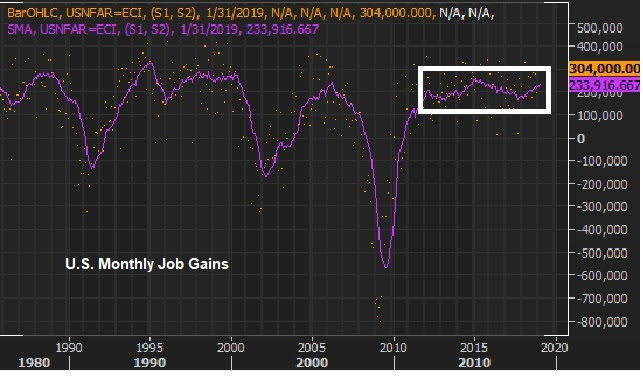

The jobs report has been good for a long time now. Just because stocks collapsed in December, it would make little sense to dial down expectations for the important January jobs numbers. After all, we’ve seen the chart of roughly 200k new jobs added every month (on average) for the past eight years or so. And that includes some very turbulent times, over that period.

|

|

But Wall Street tends to quickly get sucked into emotional ebb and flow. In the case of the past couple of months, they’ve been adjusting down the bar for earnings and the economy, and we get positive surprises, which are good for stocks. Today’s number was a big positive surprise — 304k added jobs.

Maybe a more interesting number was the manufacturing number.

The economic activity in the manufacturing sector continued to expand in January, and came in hotter than expected. In a month of January, where all we heard was the story of slowdown, the nation’s supply executives broadly reported the manufacturing sector to be growing, and a faster clip.

Meanwhile, the inflation component came in softer. And as you can see in the chart below, it has been on the slide.

|

|

Again, this is the sweet spot for the Fed. The economy doing well, without inflation pressures. That means they sit and watch (i.e. rates in a holding pattern for the foreseeable future).

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

|

|

|

May 22, 5:00 pm EST

Yesterday we talked the set up for a turn in the dollar (lower) and in commodities (higher). The broad commodities index hit a fresh three-year high yesterday, and hit another one today – led by natural gas and copper.

This is where we will likely see the next big boom: commodities.

Throughout the post-financial crisis period, we’ve had a disconnect between what has happened in global asset prices (like the recovery in stocks and real estate) and commodities.

Stocks have soared back to record highs. Real estate has fully recovered in most spots, if not set new records. But commodities have been dead. That’s because inflation has been dead.

And that has created this massive dislocation in valuation between commodities and stocks.

You can see in this chart below from Goehring and Rozenzwajg.

The only two times commodities have been this cheap relative to stocks was at the depths of the Great Depression in the early 30s and at the end of the Bretton Woods currency system in the early 70s. Commodities went on a tear both times.

The last time commodities were this cheap, relative to stocks, a broad basket of commodities returned 50% annualized for the next four years – up seven-fold over 10 years. With the economy heating up, and inflation finally nearing the Fed’s target, it’s time for commodities prices to finally catch up.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

May 17, 5:00 pm EST

We talked yesterday about the building pressure in emerging markets, driven by weakening currencies and rising dollar-denominated oil prices.

With that bubbling up as a potential shock risk, gold hasn’t exactly been telling the story of elevated risks.

You can see in this chart above, since the tax cuts were passed in late 2017, rates have been rising (the purple line). This is a hotter economy, pick-up in inflation story. And, as it should, gold stepped higher with rates all along–until the last few weeks. You can see the divergence in the chart above.

You can see in this chart above, since the tax cuts were passed in late 2017, rates have been rising (the purple line). This is a hotter economy, pick-up in inflation story. And, as it should, gold stepped higher with rates all along–until the last few weeks. You can see the divergence in the chart above.

I suspect we’ll see gold snap back to reflect some increasing market risks, and especially to reflect a world where central banks are beginning to finally see inflation pressures build. The gold bugs loved gold when inflation was dead. And now that it’s building, they are surprisingly very quiet.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

February 13, 7:00 pm EST

On Friday, stocks bottomed into two big technical levels: 1) the two-year rising trendline that represented the recovery from the lows of 2016, which were induced by the oil price crash, and 2) the 200-day moving average.

We’ve since seen a 5.5% bounce off of the bottom.

Interestingly, the market that has had so many people concerned over the past two weeks–interest rates–were tame and lower on the day. But only after printing a new high (at 2.90%, which is the highest since January of 2014).

That climb in rates, of course, has had everyone uptight about the inflation outlook. But the market you would expect to reflect inflation fears hasn’t been telling the inflation story at all. I’m talking about the price of gold. And gold has been lower, not higher, since stocks have fallen.

Here’s a look at that chart …

With this in mind, the psychology always changes when stocks go down. People search for stories to fit the price–for trouble to fit the price. Even some of the more rational market practitioners were succumbing to this over the weekend, trying to conjure up a negative scenario unfolding for markets.

Having been involved in markets for 20 years, I’ve seen, within both short- and long-term cycles, thousands of turning points, trend changes, phases of a cycles, trends and corrections of trends. Markets can and do have technical corrections. And they can and do correct for no reason, other than price.

So, for perspective, things are good. We will have the hottest economy this year that we’ve seen in a decade. The benchmark 10-year yield, at 2.90%, remains very low relative to history. That means, although borrowing costs are ticking higher, money is still cheap. Gas is cheap. Consumer and corporate balance sheets are as good as they’ve been in a long time. And we’ve just gotten a blue light special on stocks–marking down prices from 18 times to something closer to 16 times earnings. And with the prospects for earnings to come in better than expected, given influence of tax cuts, we are probably looking at a P/E on the S&P 500 forward earnings closer to 15.

If you are hunting for the right stocks to buy, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers. You can add these stocks at a nice discount to where they were trading just a week ago.

NYSE:GLD, NYSE:GG, NYSE:WFC, NYSE:BAC, NYSE:NEM, NYSE:SPY

January 29, 7:00 pm EST

For the first time in a decade, the mood at the World Economic Forum in Davos was of optimism and opportunity. And Trump economic policies have had a lot to do with it.

That optimism has continued to drive markets higher this year: global stocks, global interest rates, global commodities – practically everything.

The S&P 500 is up nearly 7% on the year now — just a little less than a month into the New Year. And we’ve yet to see the real impact of tax incentives hit earnings and investment.

But, with the rising price of oil (now above $65), and improving consumption (on the better outlook), we will likely start seeing the inflation numbers tick up.

Now, what will be the catalyst to cap this very sharp run higher in stocks to start the year? It will probably be the first “hotter than expected” inflation number.

That would start the speculation that the Fed might need to move rates faster, and it might speed-up the exit talks from QE in Europe and Japan.

If the inflation outlook triggers a correction (which would be healthy), that would set the table for hotter earnings and hotter economic growth (coming down the pike) to ultimately drive the remainder of stock returns for the year.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

October 31, 2017, 4:00pm EST

Let’s take a look today at what fiscal stimulus might do to inflation.

Let’s take a look today at what fiscal stimulus might do to inflation.

The central banks have been able to boost asset prices. They’ve been able to restore stability so that people felt confident enough to hire, spend and invest again. But the scars from over-indebtedness have left demand weak. And because of that, despite the recovery of the unemployment to under 5%, the quality of jobs haven’t returned. And, therefore, the leverage to command higher wages hasn’t been there. That’s been the missing piece of the recovery puzzle.

And with that, we’ve had an ultra-low inflation recovery. That sounds great (low inflation).

But inflation at these low levels has had us (through much of the past decade) teetering on the edge of deflation. That’s bad news.

Among the many threats throughout the crisis period, a deflationary spiral was one of the Fed’s most feared. Central bankers can fight inflation (by raising rates). But they can’t fight deflation when consumer psychology takes over. When people hold on to their money thinking things will be cheaper tomorrowthan they are today, that mindset can bring the economy to a dead halt. It’s a formula that can become irreversible.

And that’s what has kept the Fed (and global central banks) sitting at ultra-low levels of interest rates – to keep the recovery momentum moving so that they don’t have to fight a deflationary spiral (as they have in Japan, unsuccessfully, for two decades).

Now, enter fiscal stimulus. We’re getting fiscal stimulus into an already tight employment market.

Real wages (employee purchasing power) has barely budged for two decades. Introducing big tax cuts and government spending into an economy that has low unemployment and the best consumer credit worthiness on record should pop demand. And that should finally give us some wage growth – maybe bigwage growth.

All of the inflationists that thought QE was going to cause hyper-inflation were wrong – they didn’t understand the severity and breadth of the crisis. Now, after global unlimited QE has barely moved the needle on inflation, the inflation hawks have been lulled to sleep. It may be time to wake them up.

Join our Billionaire’s Portfolio subscription service today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

September 18, 2017, 4:30 pm EST Invest Alongside Billionaires For $297/Qtr

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

We constantly hear about how the fundamentals don’t support the move in stocks. Yet, we’ve looked at plenty of fundamental reasons to believe that view (the gloom view) just doesn’t match the facts.

Remember, the two primary sources that carry the megahorn to feed the public’s appetite for market information both live in economic depression, relative to the pre-crisis days. That’s 1) traditional media, and 2) Wall Street.

As we know, the traditional media business, has been made more and more obsolete. And both the media, and Wall Street, continue to suffer from what I call “bubble bias.” Not the bubble of excess, but the bubble surrounding them that prevents them from understanding the real world and the real economy.

As I’ve said before, the Wall Street bubble for a very long time was a fat and happy one. But the for the past ten years, they came to the realization that Wall Street cash cow wasn’t going to return to the glory days. And their buddies weren’t getting their jobs back. And they’ve had market and economic crash goggles on ever since. Every data point they look at, every news item they see, every chart they study, seems to be viewed through the lens of “crash goggles.” Their bubble has been and continues to be dark.

Also, when we hear all of the messaging, we have to remember that many of the “veterans” on the trading and the news desks have no career or real-world experience prior to the great recession. Those in the low to mid 30s only know the horrors of the financial crisis and the global central bank sponsored economic world that we continue to live in today. What is viewed as a black swan event for the average person, is viewed as a high probability event for them. And why shouldn’t it? They’ve seen the near collapse of the global economy and all of the calamity that has followed. Everything else looks quite possible!

Still, as I’ve said, if you awoke today from a decade-long slumber, and I told you that unemployment was under 5%, inflation was ultra-low, gas was $2.60, mortgage rates were under 4%, you could finance a new car for 2% and the stock market was at record highs, you would probably say, 1) that makes sense (for stocks), and 2) things must be going really well! Add to that, what we discussed on Friday: household net worth is at record highs, credit growth is at record highs and credit worthiness is at record highs.

We had nearly all of the same conditions a year ago. And I wrote precisely the same thing in one of my August Pro Perspective pieces. Stocks are up 17% since.

And now we can add to this mix: We have fiscal stimulus, which I think (for the reasons we’ve discussed over past weeks) is coming closer to fruition.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

October 4, 2016, 5:00pm EST

Stocks continue to chop around as we head into the big jobs report this week. But the dollar has been a mover today, so has gold.

Let’s take a look at the chart of gold. It has broken down technically.

You can see the longer term downtrend in gold since it topped out in 2011. And we’ve had a corrective bounce this year, which was contained by this descending trendline. And today we broke the trend that describes this bullish technical correction (i.e. the trend continues lower).

A lot of people own gold. And it’s a very emotional trade. Whenever I talk about negative scenarios for gold, the hate mail is sure to follow.

We’ve talked quite a bit about the drivers of the gold trade. I want to revisit that today.

Gold has been a core trade for a lot of people throughout the crisis period. When Lehman failed in 2008, it shook the world, global credit froze, banks were on the verge of collapse, the global economy was on the brink of implosion—people ran into gold. Gold was a fear–of–the–unknown–outcome trade.

Then the global central banks responded with massive backstops, guarantees, and unprecedented QE programs. The world stabilized, but people ran faster into gold. Gold became a hyperinflation–fear trade.

Gold went on a tear from sub–$700 bucks to over $1,900 following the onset of global QE (led by the Fed).

Gold ran up as high as 182%. That was pricing in 41% annualized inflation at one point (as a dollar for dollar hedge). Of course, inflation didn’t comply.

Still eight years after the Fed’s first round of QE (and massive global responses), we have just 13% cumulative inflation over the period.

So the gold bugs overshot in a big way. We’ve looked at this next chart a few times over the past several months. This tells the story on why inflation hasn’t met the expectations of the “run-away inflation” theorists.

This chart above is the velocity of money. This is the rate at which money circulates through the economy. And you can see to the far right of the chart, it hasn’t been fast. In fact, it’s at historic lows. Banks used cheap/free money from the Fed to recapitalize, not to lend. Borrowers had no appetite to borrow, because they were scarred by unemployment and overindebtedness. Bottom line: we get inflation when people are confident about their financial future, jobs, earning potential…and competing for things, buying today, thinking prices might be higher, or the widget might be gone tomorrow. It’s been the opposite for the past eight years.

When this reality of low-to-no inflation and global economic malaise became clear, even after rounds of Fed QE, there were a LOT of irresponsible people continuing to tout gold as an important place in everyone’s portfolio, even at stratospheric levels. People bought gold at $1900 and have since lost as much as 40% on the value of their investment – an investment that was supposed to “hedge” against inflation.

On that note, today the IMF downgraded U.S. growth estimates for the year from 2.2% to just 1.6% — in a year that many were initially expecting to be a good year, nearing trend growth levels (3%-3.5%). So eight years from the inception of the Fed’s extraordinary policies, the case for gold remains weak and an investment with more risk than reward.

The Billionaire’s Portfolio is up 23% year-to-date — that’s nearly four times the return of the S&P 500 during the same period. We recently exited a big FDA approval stock for a quadruple, and we’ve just added a new pick to the portfolio — following Warren Buffett into one of his favorite stocks. If you haven’t joined yet, please do. Click here to get started and get your portfolio in line with our Billionaire’s Portfolio.

Gold has been a core trade for a lot of people throughout the crisis period. When Lehman failed in 2008, it shook the world, global credit froze, banks were on the verge of collapse, the global economy was on the brink of implosion – people ran into gold. Gold was a fear-of-the-unknown-outcome trade.

Then the global central banks responded with massive backstops, guarantees, and unprecedented QE programs. The world stabilized, but people ran faster into gold. Gold became a hyperinflation-fear trade.

Source: Billionaire’s Portfolio

In the chart above, you can see gold went on a tear from sub-$700 bucks to over $1,900 following the onset of global QE (led by the Fed).

Gold ran up as high as 180%. That was pricing in 41% annualized inflation at one point (as a dollar for dollar hedge). Of course, inflation didn’t comply. Still eight years after the Fed’s first round of QE (and massive global responses), we have just 13% cumulative inflation over the period.

So the gold bugs overshot in a big way.

Why? The next chart tells the story…

This chart above is the velocity of money. This is the rate at which money circulates through the economy. And you can see to the far right of the chart, it hasn’t been fast. In fact, it’s at historic lows. Banks used cheap/free money from the Fed to recapitalize, not to lend. Borrows had no appetite to borrow, because they were scarred by unemployment and overindebtedness. Bottom line: we get inflation when people are confident about their financial future, jobs, earning potential … and competing for things, buying today, thinking prices might be higher, or the widget might be gone tomorrow. It’s been the opposite for the past eight years.

So, no inflation – what does that mean for gold?

Source: Billionaire’s Portfolio

After three rounds of Fed QE, and now mass scale QE from the BOJ and the ECB, the world is still battling DE-flationary pressures. If gold surged from sub-$700 to $1,900 on Fed/QE-driven hyperinflation fears, and QE has produced little to no inflation, it’s fair to think we can return to pre-QE levels. That’s sub-$700.

We head into the weekend with stocks down 3% for the month. This follows a bad January. In fact, the stock market is working on a fifth consecutive negative month. The likelihood, however, of it finishing down for February is very low. It’s only happened 18 times since 1928. So the S&P 500 has five consecutive losing months just 1.7% of the time, historically.

To follow the stock picks of the world’s best billionaire investors, subscribe at Billionaire’s Portfolio.

gold,inflation,banks,fed,boj,ecb,rates,economy,business,finance,investing,stock market,stocks,bonds,bank of america

Let’s take a look today at what fiscal stimulus might do to inflation.

Let’s take a look today at what fiscal stimulus might do to inflation. As I said

As I said