May 18, 5:00 pm EST

We’ve talked this week about the pressure that rising U.S. market interest rates are putting on emerging markets.

The fear surrounding the big 3% marker for U.S. 10-year yields is that 3% may quickly become 4%. And a 4% yield, much less a quick adjustment in this key benchmark interest rate, would cause some problems.

Not only does it create capital flight out of areas of the world where rates are low, and monetary policy is heading the opposite direction of the Fed, but a quick move to a 4% yield on the 10-year would certainly cloud the U.S. economic growth picture, as higher mortgage and consumer borrowing rates would start chipping away at economic activity.

With that said, we may have a reprieve with the action today in the bond market.

As we head into the weekend, today we get a softening in the rates market. And that came with a big technical reversal pattern (an outside day).

You can see in the chart above, the engulfing range of the day. This technical phenomenon, when closing near the lows, is a very good predictor of tops and bottoms in markets, especially with long sustained trends.

You can see in the chart above, the engulfing range of the day. This technical phenomenon, when closing near the lows, is a very good predictor of tops and bottoms in markets, especially with long sustained trends.

I suspect we may have seen some global central bank buyers of our Treasurys today (which puts downward pressure on yields) to take a bite out of the momentum. We will see if this quiets the rate market next week, for a drift back down to 3%. That would calm some of the nerves in global currencies, and global markets in general.

If you are hunting for the right stocks to buy on this dip, join me in my Billionaire’s Portfolio. We have a roster of 20 billionaire-owned stocks that are positioned to be among the biggest winners as the market recovers.

December 19, 4:00 pm EST

Remember, the Fed met last week and hiked rates for the third time this year, and the fifth time in the post-crisis hiking cycle. But as we discussed, the big event for interest rates wasn’t last week, it’s this week.

The Bank of Japan meets on Wednesday and Thursday. Japan‘s policy on pegging their 10-year yield at zero has been the anchor on global interest rates (weighing on global interest rates). When they signal a change to that policy, that’s when rates will finally move – and maybe very quickly.

With that in mind, we have the stock market continuing to climb north of +20% on the year. Economic growth is going to get very close to 3% for the full year of 2017, and yet the benchmark longer term interest rates determined by the market are unchanged for the year. The yield on the 10 year Treasury is 2.43% this morning (ticking UP today). We came into the year at 2.43%.

Again, this is the flattening yield curve we discussed last week. For a world that is constantly looking for the next potential danger or signal for doom, the flattening of the yield curve has been the latest place they’ve been hanging their hats (as what they believe to be a predictor of recession). But those people seem happy to assume this yield curve indicator is driven by the same behaviors that have led to recessions in past economic periods, ignoring the unprecedented and coordinated global central bank manipulation that has gotten us here and continues to warp the interest rate market.

So now we have the Fed, which has been moving away from emergency policies. The ECB has signaled an end to QE next year. And the Bank of Japan is next in line — it’s a matter of when.

So how do things look going into this week’s meeting? We know the architect of Japan’s economic reform plan, Prime Minister Shinzo Abe, has just followed the American fiscal stimulus movement with a corporate tax cut of his own, but only for companies that will start raising wages for their employees. He said today that Japan is no longer in a state of deflation. The head of the Bank of Japan has said the economy is in “very good shape.” And that they would consider what is the best level of rate targets to align with changes n the economy, prices and financial conditions. The recent Tankan survey showed sentiment in the manufacturing community hitting decade and multi-decade highs.

But inflation continues to undershoot in Japan, as it is in the U.S. Japan is targeting a 2% inflation rate and is running at just 0.8% annualized.

So it’s unlikely that they will give any signal of taking the foot off of the gas this week. But that signal is probably not far off — maybe in January, after U.S. tax cuts are in effect. What does that mean? It means our market rates probably make an aggressive move higher early next year (10s in the mid 3s and rates on consumer loans probably jump 150 to 200 basis points higher).

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

July 13, 2017, 4:00 pm EST Invest Alongside Billionaires For $297/Qtr

With some global stock barometers hitting new highs this morning, there is one spot that might benefit the most from this recently coordinated central bank promotion of a higher interest environment to come. It’s Japanese stocks.

With some global stock barometers hitting new highs this morning, there is one spot that might benefit the most from this recently coordinated central bank promotion of a higher interest environment to come. It’s Japanese stocks.

First, a little background: Remember, in early 2016, the BOJ shocked markets when it cut its benchmark rate below zero. Counter to their desires, it shook global markets, including Japanese stocks (which they desperately wanted and needed higher). And it sent capital flowing into the yen (somewhat as a flight to safety), driving the value of the yen higher and undoing a lot of the work the BOJ had done through the first three years of its QE program. And that move to negative territory by Japan sent global yields on a mass slide.

By June, $12 trillion worth of global government bond yields were negative. That put borrowers in position to earn money by borrowing (mainly you are paying governments to park money in the “safety” of government bonds).

The move to negative yields, sponsored by Japan (the world’s third largest economy), began souring global sentiment and building in a mindset that a deflationary spiral was coming and may not be leaving, ever—for example, the world was Japan.

And then the second piece of the move by Japan came in September. It was a very important move, but widely under-valued by the media and Wall Street. It was a move that countered the negative rate mistake.

By pegging its ten-year yield at zero, Japan put a floor under global yields and opened itself to the opportunity to doing unlimited QE. They had the license to buy JGBs in unlimited amounts to maintain its zero target, in a scenario where Japan’s ten-year bond yield rises above zero. And that has been the case since the election.

The upward pressure on global interest rates since the election has put Japan in the unlimited QE zone — gobbling up JGBs to push yields back down toward zero — constantly leaning against the tide of upward pressure. That became exacerbated late last month when Draghi tipped that QE had done the job there and implied that a Fed-like normalization was in the future.

So, with the Bank of Japan fighting a tide of upward pressure on yields with unlimited QE, it should serve as a booster rocket for Japanese stocks, which still sit below the 2015 highs, and are about half of all-time record highs — even as its major economic counterparts are trading at or near all-time record highs.

June 5, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

| Last week we looked at the some of the clear evidence that the economy is as primed as it can possibly get for a catalyst to come in and pop growth.That catalyst, despite all of the scrutiny, will be Trumponomics.

At the very least, a corporate tax cut will directly hit the bottom line of corporate America. And one of the huge drags on demand, structurally, is the lack of wage growth. And as we discussed, the big winner in a corporate tax cut will be workers/wage growth — a non-partisan tax think tank thinks it can pop wage growth, by as much as doublethe current growth rate. That would be huge, especially for one of the key pillars of the recovery — housing.Remember, the two biggest drivers of recovery have been: 1) stocks, and 2) housing. Those two assets have done the lion’s share of work when it comes to restoring confidence. And a lot of other key pieces fall into place when confidence comes back.

On the housing front, over the past year, both mortgage rates and house prices have gone UP – a new dynamic in the post crisis recovery (adding higher rates into the mix). So owning a house has become more expensive over the past year. But how much?

Let’s take a look at how that has affected the monthly outlay for new homeowners over the course of the past year.

From March 2016 to March 2017, the average 30 year fixed mortgage went from 3.70% to 4.20%.

The Case-Shiller housing price index of the top 20 markets in the U.S. is up 6% over that twelve month period (the most recent data). That’s increased the monthly outlay (principal and interest) for new homeowners by 11% over the past year.

Now, with that said, we look at the recent behavior of the 10 year note (the benchmark government bond yield that heavily influences mortgage rates). It’s been in world of its own — sliding back to seven month lows, while stocks are hitting record highs. Manipulation? Likely. As I’ve said before, don’t underestimate the value of QE that is still in full force around the world — namely in Japan and Europe. That’s freshly printed money that can continue to buy our Treasuries, keeping a cap on interest rates, which keeps a cap on mortgage rates, which keeps the housing recovery and the recovery in consumer credit demand intact.

What stocks are cheap? Join me today to find out what stocks I’m buying in my Billionaire’s Portfolio. It’s risk-free. If for any reason you find it doesn’t suit you, just email me within 30-days.

|

May 12, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

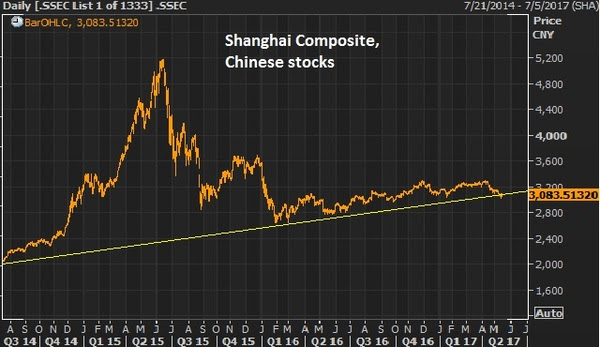

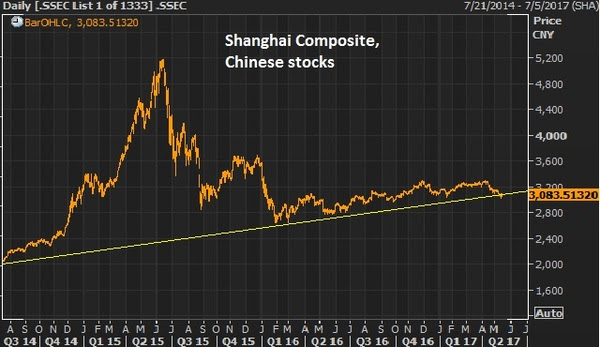

As we ended this past week, stocks remain resilient, hovering near highs. The Nasdaq had a visit to the 200-day moving average intraweek for a slide of a whopping (less than) 1%, and quickly it bounced back.It’s a Washington/Trump policies-driven market now, and while the media carries on with narratives about Russia and the FBI, the market cares about getting health care done (which there was progress made last week), getting tax reform underway, and getting the discussion moving on an infrastructure spend.We looked at oil and commodities yesterday. Chinese stocks look a lot like the chart on broader commodities. With that, the news overnight about some cooperation between the Trump team and China on trade has Chinese stocks looking interesting as we head into the weekend. As we ended this past week, stocks remain resilient, hovering near highs. The Nasdaq had a visit to the 200-day moving average intraweek for a slide of a whopping (less than) 1%, and quickly it bounced back.It’s a Washington/Trump policies-driven market now, and while the media carries on with narratives about Russia and the FBI, the market cares about getting health care done (which there was progress made last week), getting tax reform underway, and getting the discussion moving on an infrastructure spend.We looked at oil and commodities yesterday. Chinese stocks look a lot like the chart on broader commodities. With that, the news overnight about some cooperation between the Trump team and China on trade has Chinese stocks looking interesting as we head into the weekend.

Let’s take at the chart…

While the agreements out of China were said not to touch on steel and industrial metals, the first steps of cooperation could put a bottom in the slide in metals like copper and iron ore. These are two commodities that should be direct beneficiaries in a world with better growth prospects, especially with prospects of a $1 trillion infrastructure spend in the U.S. With that, they had a nice run up following the election but have backed off in the past couple of months, as the infrastructure spend appeared not to be coming anytime soon.

Here’s copper and the S&P 500…

Trump policies are bullish for both. Same said for iron ore…

This is right in the wheelhouse of Wilbur Ross, Trump’s Secretary of Commerce. He’s made it clear that he will fight China’s dumping of steel on the U.S. markets, which has driven steel prices down and threatened the livelihood of U.S. steel producers. Keep an eye on these metals next week, and the stocks of producers.

Follow This Billionaire To A 172% Winner

In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!

Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.

So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO.

|

May 10, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

As we’ve discussed, we’re in a world where the baton has been passed from a central bank driven economy (post-financial crisis) to a fiscal and public policy driven economy (Trumponomics).One of the pillars of the Trump plan is deregulation. On that note, there’s been plenty of carnage across industries since the financial crisis, but no area has been crushed more and been crushed more by regulation more than Wall Street. And under the Trump administration, those regulations look like they are going to be slashed.Dodd-Frank and the fiduciary rule are bubbling up toward the top of the administrations confrontation list. With a former Goldman president heading the economic team for the President and a former Goldman guy running Treasury, I suspect they will give proprietary risk taking back to banks. The bank’s trading businesses will be back on-line and it will be restoring a huge profit engine. As we’ve discussed, we’re in a world where the baton has been passed from a central bank driven economy (post-financial crisis) to a fiscal and public policy driven economy (Trumponomics).One of the pillars of the Trump plan is deregulation. On that note, there’s been plenty of carnage across industries since the financial crisis, but no area has been crushed more and been crushed more by regulation more than Wall Street. And under the Trump administration, those regulations look like they are going to be slashed.Dodd-Frank and the fiduciary rule are bubbling up toward the top of the administrations confrontation list. With a former Goldman president heading the economic team for the President and a former Goldman guy running Treasury, I suspect they will give proprietary risk taking back to banks. The bank’s trading businesses will be back on-line and it will be restoring a huge profit engine.

Those that oppose it warn that it will lead to another financial crisis. On that note, I want to revisit my take from earlier this year on the cause of the crisis that almost destroyed the global economy.

“With all of the complexities of the housing bubble and the subsequent global financial crisis, it can seem like a web of deceit. But it all boils down to one simple actor. It wasn’t Wall Street. It wasn’t hedge funds. It wasn’t mortgage brokers. These entities were operating, in large part, from the natural force of economics: incentives.

It wasn’t even the government’s initiative to promote home ownership that led to the proliferation of mortgages being given to those that couldn’t afford them.

So who was the culprit?

It was the ratings agencies.

Housing prices were driven sky high by the availability of mortgages. Mortgages were made easily available because the demand to invest in mortgages, to fund those mortgages, was sky high.

But what drove that demand to such high levels?

When the mortgages were combined together in a package (securitized as a mix of good mortgages, and a lot of bad/higher yielding mortgages), they were bought, hand over fist, by the massive multi-trillion dollar pension industry, banks and insurance companies. Yes, the guys that are managing your pension funds, deposit accounts and insurance policies were gobbling up these mortgage securities as fast as they could, but ONLY because the ratings agencies were stamping them all with a top AAA rating. Who would encourage such a thing? Congress. In 1984 they passed a law making it okay for banks, pension funds and insurance companies to buy/treat high rated secondary mortgages like they would U.S. Treasuries.

So as investment managers, in the business of building the best performing risk-adjusted portfolio possible, and in direct competition with their peers, they couldn’t afford NOT to buy these securities. They came with the safest ratings, and with juicy returns. If you don’t buy these, you’re fired.

To put it all very simply, if these securities were not AAA rated, the pension funds would not have touched them (certainly not to the extent). With that, if the there’s no appetite to fund the mortgages (no money chasing it), then the ultra-easy lending practices never happen, and housing prices never skyrocket on unwarranted and unsustainable demand. The housing bubble doesn’t build, doesn’t bust, and the financial crisis doesn’t happen.

That begs the question: Why did the ratings agencies give a top rating to a security that should have received a lower rating, if not much lower?

First, it’s important to understand that the ratings agencies get paid on the products they rate BY the institutions that create them. That’s right. That’s their revenue model. And only a group of these agencies are endorsed by the government, so that, in many cases, regulatory compliance on a financial product requires a rating from one of these endorsed agencies.”

Keep this in mind as the fear mongering over the talk of repeal of rework of Dodd Frank heats up.

Follow This Billionaire To A 172% Winner

In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!

Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.

So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO.

|

March 21, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Over the past week, I’ve talked about the potential for disruption in what has been very smooth sailing for financial markets (led by stocks). While the picture has grown increasingly murkier, markets had been pricing in the exact opposite – which makes things even more vulnerable to a shakeout of the weak hands.

With that, it looked like we are indeed working on a correction in stocks. But it’s not just because stocks are down. It’s because we have some very important technical developments across key markets. The Trump trend has been broken.

Let’s take a look at the charts …

The above chart is the S&P 500. We looked at a break in the futures market last week. Today we get a big break in the cash market. This trendline represents the nice 45 degree climb in stocks since election night on November 8th. We have a clean break today.

Stocks ran up on the prospects that Trumponomics can end the decade long malaise in, not just the U.S. economy, but the global economy too. With that, the money that has been parked in U.S. Treasuries begins to leave. Moreover, any speculators that were betting the U.S. would follow the world into negative rate territory run for the exit doors. That sends Treasury bond prices lower and yields higher (as you can see in the chart above). So today, we also get a break of this “Trump trend” in rates as well (the yellow line). Remember, this is after the Fed’s rate hike last week — rates are moving lower, not higher.

Next up, gold …

I talked about gold yesterday — as being the clearest trade (higher) in an increasingly murkier picture for global financial markets. You can see in the chart above, gold is now knocking on the door of a break in this post-election Trump trend.

Remember, we’ve talked about the buy-the-rumor sell-the-fact phenomenon in markets. The beginning of the Trump trend in stocks started on election night (buying “the rumor” in anticipation of pro-growth policies). The top in stocks came the day following the President’s speech to the joint sessions of Congress (selling “the fact”, entering the “show me” phase).

In our Billionaire’s Portfolio, we’re positioned in a portfolio of deep value stocks that all have the potential to do multiples of what broader stocks do — all stocks owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and we’ll send you our recent addition to the portfolio – a stock that one of the best activist investors in the world thinks will double.

February 7, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Yesterday we looked at the slide in yields (U.S. market interest rates — the 10-year Treasury yield). That continued today, in a relatively quiet market.

Let’s take a look at what may be driving it.

If you take a look at the chart below, you can see the moves in yields and gold have been tightly correlated since election night: gold down, yields up.

As markets began pricing in a wave of U.S. growth policies, in a world where negative interest rates were beginning to emerge, the benchmark market-interest-rate in the U.S. shot up and global interest rates followed. The German 10-year yield swung from negative territory back into positive territory. Even Japan, the leader of global negative interest rate policy early last year, had a big reversal back into positive territory.

And as growth prospects returned, people dumped gold. And as you can see in the chart above of the “inverted price of gold,” the rising line represents falling gold prices.

Interestingly, gold has been bouncing pretty aggressively since mid December. Why? To an extent, it’s pricing in some uncertainty surrounding Trump policies. And that would also explain the slow down and (somewhat) slide in U.S. yields. In fact, based on that chart above and the gold relationship, it looks like we could see yields back below 2.10%. That would mean a break of the technical support (the yellow line) in this next chart …

Another reason for higher gold, lower yields (i.e. higher bond prices), might be the capital flight in China. Where do you move money if you’re able to get it out in China? The dollar, U.S. Treasuries, U.S. stocks, Gold.

The data overnight showed the lowest levels reached in the countries $3 trillion currency reserve stash in 6 years. That, in large part, comes from the Chinese central banks use of reserves to slow the decline of their currency, the yuan. Of course a weakening yuan only inflames U.S. trade rhetoric.

For help building a high potential portfolio for 2017, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

December 9, 2016, 9:00pm EST

We’ve talked a lot about the set ups for big moves in Japanese and German stocks, as these major stock markets have lagged the recovery in the U.S.

Many have yet to come to the realization that a higher growth, healthier U.S. economy is good for everyone — starting with developed marketeconomies. And it unquestionably applies to emerging market economies, despite the fears of trade constraints.

Billionaire’s Portfolio Registration

A trillion dollars of U.S. money to be repatriated, has the dollar on a run that will likely end with USDJPY dramatically higher, and the euro dramatically lower (maybe all-time lows of 0.83 cents, before it’s said and done). This is wildly stimulative for those economies, and inflation producing for two spots in the world that have been staring down the abyss of deflation.

This currency effect, along with the higher U.S. growth effect on German and Japanese stocks will put the stock markets in these countries into aggressive catch up mode. I think the acceleration started this week.

As I said last week, Japanese stocks still haven’t yet taken out the 2015 highs. Nor have German stocks, though both made up significant ground this week. Yen hedged Nikkei was up 4.5% this week. The euro hedged Dax was up 7.6%.

What about U.S. stocks? It’s not too late. As I’ve said, it’s just getting started.

We’ve talked quite a bit about the simple fundamental and technical reasons stocks are climbing and still have a lot of upside ahead, but it’s worth reiterating. The long-term trajectory of stocks still has a large gap to close to restore the lost gains of the past nine-plus years, from the 2007 pre-crisis highs. And from a valuation standpoint, stocks are still quite cheap relative to ultra-low interest rate environments. Add to that, a boost in growth will make the stock market even cheaper. As the “E” in the P/E goes up, the ratio goes down. It all argues for much higher stocks. All we’ve needed is a catalyst. And now we have it. It’s the Trump effect.

But it has little to do with blindly assuming a perfect presidential run. It has everything to do with a policy sea change, in a world that has been starving (desperately needing) radical structural change to promote growth.

Not only is this catch up time for foreign stocks. But it’s catch up time for the average investor. The outlook for a sustainable and higher growth economy, along with investor and business-friendly policies is setting the table for an era of solid wealth creation, in a world that has been stagnant for too long. That stagnation has put both pension funds and individual retirement accounts in mathematically dire situations when projecting out retirement benefits. So while some folks with limited perspective continue to ask if it’s too late to get off of the sidelines and into stocks, the reality is, it’s the perfect time. For help, follow me and look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio is up more than 27% this year. You can join me here and get positioned for a big 2017.

With some global stock barometers hitting new highs this morning, there is one spot that might benefit the most from this recently coordinated central bank promotion of a higher interest environment to come. It’s Japanese stocks.

With some global stock barometers hitting new highs this morning, there is one spot that might benefit the most from this recently coordinated central bank promotion of a higher interest environment to come. It’s Japanese stocks.

As we ended this past week, stocks remain resilient, hovering near highs. The Nasdaq had a visit to the 200-day moving average intraweek for a slide of a whopping (less than) 1%, and quickly it bounced back.It’s a Washington/Trump policies-driven market now, and while the media carries on with narratives about Russia and the FBI, the market cares about getting health care done (which there was progress made last week), getting tax reform underway, and getting the discussion moving on an infrastructure spend.We looked at oil and commodities yesterday. Chinese stocks look a lot like the chart on broader commodities. With that, the news overnight about some cooperation between the Trump team and China on trade has Chinese stocks looking interesting as we head into the weekend.

As we ended this past week, stocks remain resilient, hovering near highs. The Nasdaq had a visit to the 200-day moving average intraweek for a slide of a whopping (less than) 1%, and quickly it bounced back.It’s a Washington/Trump policies-driven market now, and while the media carries on with narratives about Russia and the FBI, the market cares about getting health care done (which there was progress made last week), getting tax reform underway, and getting the discussion moving on an infrastructure spend.We looked at oil and commodities yesterday. Chinese stocks look a lot like the chart on broader commodities. With that, the news overnight about some cooperation between the Trump team and China on trade has Chinese stocks looking interesting as we head into the weekend.

As we’ve discussed, we’re in a world where the baton has been passed from a central bank driven economy (post-financial crisis) to a fiscal and public policy driven economy (Trumponomics).One of the pillars of the Trump plan is deregulation. On that note, there’s been plenty of carnage across industries since the financial crisis, but no area has been crushed more and been crushed more by regulation more than Wall Street. And under the Trump administration, those regulations look like they are going to be slashed.Dodd-Frank and the fiduciary rule are bubbling up toward the top of the administrations confrontation list. With a former Goldman president heading the economic team for the President and a former Goldman guy running Treasury, I suspect they will give proprietary risk taking back to banks. The bank’s trading businesses will be back on-line and it will be restoring a huge profit engine.

As we’ve discussed, we’re in a world where the baton has been passed from a central bank driven economy (post-financial crisis) to a fiscal and public policy driven economy (Trumponomics).One of the pillars of the Trump plan is deregulation. On that note, there’s been plenty of carnage across industries since the financial crisis, but no area has been crushed more and been crushed more by regulation more than Wall Street. And under the Trump administration, those regulations look like they are going to be slashed.Dodd-Frank and the fiduciary rule are bubbling up toward the top of the administrations confrontation list. With a former Goldman president heading the economic team for the President and a former Goldman guy running Treasury, I suspect they will give proprietary risk taking back to banks. The bank’s trading businesses will be back on-line and it will be restoring a huge profit engine.