June 22, 2017, 4:15 pm EST Invest Alongside Billionaires For $297/Qtr

Healthcare was the story of the day today. With the Senate having had its go at the house healthcare bill, it goes back to the house, then back through Senate before it gets to the President’s desk.

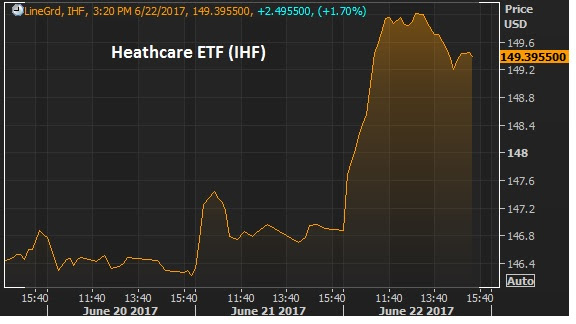

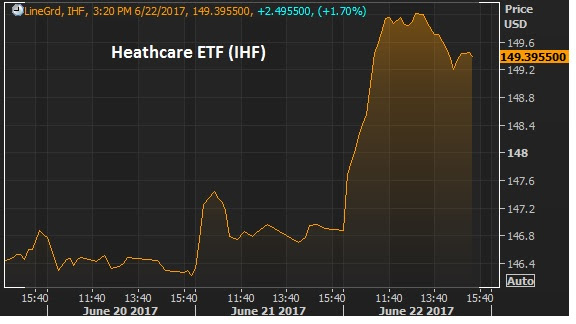

Still, policy progression is very positive in this environment. Healthcare stocks were up big today — the IHF healthcare ETF was up over 2%. This is the ETF that tracks insurers, diagnotic and specialized treatment companies.

And despite all of the debate around healthcare, it has been the hottest sector to invest in since the election.Since election day, the IHF is up 35% since the lows of November 9th, the day after the election. Here’s a look at S&P sector performance over the past

sixmonths.

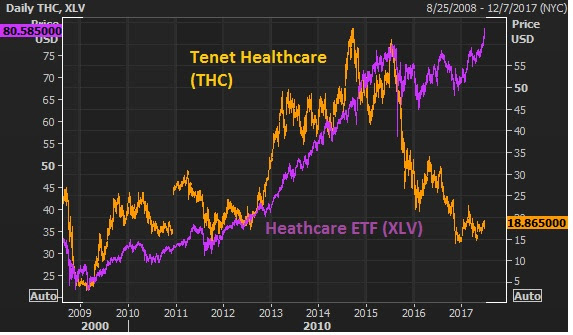

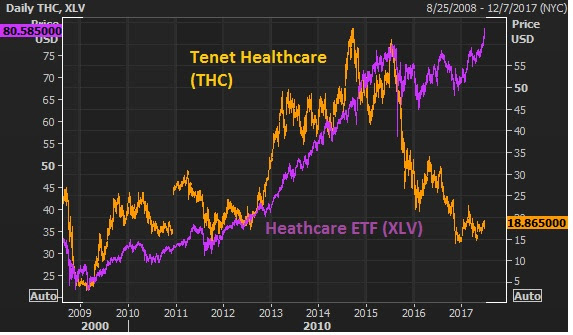

Most interesting, the healthcare sector has been beaten up badly since the cracks in Obamacare became clear back in 2014. But as of the past week, the healthcare sector trackers have finally broken back above those 2014 Obamacare–optimism–driven highs. With that, the divergence in this next chart of one of the biggest hospital companies in the country becomes quite an intriguing trade.

Join the Billionaire’s Portfolio to hear more of my big picture analysis and get my hand-selected, diverse stock portfolio following the lead of the best activist investors in the world.

March 21, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Over the past week, I’ve talked about the potential for disruption in what has been very smooth sailing for financial markets (led by stocks). While the picture has grown increasingly murkier, markets had been pricing in the exact opposite – which makes things even more vulnerable to a shakeout of the weak hands.

With that, it looked like we are indeed working on a correction in stocks. But it’s not just because stocks are down. It’s because we have some very important technical developments across key markets. The Trump trend has been broken.

Let’s take a look at the charts …

The above chart is the S&P 500. We looked at a break in the futures market last week. Today we get a big break in the cash market. This trendline represents the nice 45 degree climb in stocks since election night on November 8th. We have a clean break today.

Stocks ran up on the prospects that Trumponomics can end the decade long malaise in, not just the U.S. economy, but the global economy too. With that, the money that has been parked in U.S. Treasuries begins to leave. Moreover, any speculators that were betting the U.S. would follow the world into negative rate territory run for the exit doors. That sends Treasury bond prices lower and yields higher (as you can see in the chart above). So today, we also get a break of this “Trump trend” in rates as well (the yellow line). Remember, this is after the Fed’s rate hike last week — rates are moving lower, not higher.

Next up, gold …

I talked about gold yesterday — as being the clearest trade (higher) in an increasingly murkier picture for global financial markets. You can see in the chart above, gold is now knocking on the door of a break in this post-election Trump trend.

Remember, we’ve talked about the buy-the-rumor sell-the-fact phenomenon in markets. The beginning of the Trump trend in stocks started on election night (buying “the rumor” in anticipation of pro-growth policies). The top in stocks came the day following the President’s speech to the joint sessions of Congress (selling “the fact”, entering the “show me” phase).

In our Billionaire’s Portfolio, we’re positioned in a portfolio of deep value stocks that all have the potential to do multiples of what broader stocks do — all stocks owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and we’ll send you our recent addition to the portfolio – a stock that one of the best activist investors in the world thinks will double.

January 24, 2017, 4:30pm EST

The S&P 500 traded up to new record highs today. This morning the new President had three more big American business leaders (the car makers) in the White House for a face-to-face.

The three big American car makers all had big stock performance on the day, and their leaders walked away with very positive remarks (not dismay). It turns out that logical business operators like the prospects of doing business with the tailwinds of pro-growth economic policies.

Now, with Obamacare on the chopping block for the new administration, today let’s take a look what healthcare stocks might do.

Healthcare stocks in general have been beaten up since July of 2015, when a Republican Congress brought a vote to repeal Obamacare. The S&P 500 is up 7% from that date. The XLF (the ETF that tracks healthcare stocks) is down 9% in the same period.

Before that, Obamacare had been a money printing machine for much of the healthcare industry.

In this chart below, of the health insurance provider, Aetna, you can see the impact of Obamacare on the stock.

And here’s a look at the hospital company, HCA, also a big winner under Obamacare.

So what happens under Trump care? Trump has said he wants to keep people insured. It sounds like a rework to a more competitive system, rather than a tear down and rebuild. The first sign of visibility on a new plan is probably the greenlight to buy the healthcare ETF, and maybe the under performers in the Obamacare era.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

November 3, 2016, 4:00pm EST

As we head into the election, there’s one sector in the stock market that looks especially interesting.

Healthcare stocks have been beaten up over the past two years. It’s the worst performing sector on the year. Biotech is down around 20% over the past two years. And it’s driven by fear of price regulations and threats from the Democratic presidential race and nominee. Clinton cracked biotech stocks about a year ago when she tweeted that she would take on price gouging in the industry. But that was after Bernie Sanders presented a bill to curb prices. The perception for the industry is that Clinton would try to curb “excessive” profits at the pharma and biotech companies.

With that, you can see in the chart above, the damage that has been done to pharma and biotech stocks – and healthcare in general.

That said, it’s probably time to buy. It looks like a classic “sell the rumor, buy the fact.” As we know, regardless of who wins the White House, the promises and threats on the campaign trail rarely become policy. And Clinton is known to be friendly to the industry (collecting money for industry speeches in the past). A Trump win would almost certainly send this sector on a tear higher.

Warren Buffett wrote a famous op-ed piece in the New York Times in October 2008 in which he that said the following:

“A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. And most certainly, fear is now widespread, gripping even seasoned investors.”

This is the mindset of a great investor and how great investors react when there are opportunities like we’re seeing in this beaten down sector. They buy when others are selling.

The point of Buffet’s piece is that you don’t get rich buying into a high market or selling into a falling market. You can get rich though, buying into market corrections and beaten-down markets. When everyone was running from bank stocks in 2008-2009, Buffett was buying. When everyone was running out of energy stocks earlier this year, Buffett was buying. I suspect the same is happening with healthcare stocks as we head into the election, and will continue in the aftermath.

If you haven’t joined our Billionaire’s Porfolio yet, you can click here to get started.