October 5, 2017, 4:00 pm EST

We looked at small caps last week when the the Russell 2000 broke to new highs.

We looked at small caps last week when the the Russell 2000 broke to new highs.

Remember, at that point, small–caps had done only 9% on the year at this point. That’s against 13% for the S&P and Dow.

Here’s the chart now…

The Russell 2000 is now up 12% since the lows of August (up 11% ytd) and if you bought the small cap index on the Monday before the elections last year, you’re up 26%. But small caps continue to lag the bigger cap market. And that makes the last quarter a very intriguing opportunity to own small caps.

Bull markets tend to lift all boats. And with that, equal-dollar weighted small caps tend to outperform equal-dollar weighted large caps in bull markets (in some cases by a lot). This one (bull market) looks like plenty of room to go in that regard. And small cap companies should have more to gain from a corporate tax cut as the tend to have fewer ways to shelter income (relative to big multinationals).

Now, with that bull market assertion, let’s talk about the general uneasiness that seems to exist (and has for a while) from watching the continued climb in stocks.

As we’ve discussed, you often here the argument that the fundamentals don’t support the level of stocks. It’s just not true. The fundamental backdrop continues to justify and favor higher stocks. We have the prospects of fiscal stimulus building, which will be poured onto an already fertile economic backdrop — with low rates, cheap commodities, record consumer high credit worthiness and low unemployment.

As the old market adage goes, “bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.” I don’t think anyone could argue we are currently in the state of euphoria for stocks. And as the great macro trader Paul Tudor Jones has said, “the last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic” (i.e. euphoria can last for a while).

Finally, let’s revisit this analysis from billionaire Larry Robbins on the influence of low interest rates, Fed policy and oil on markets. He says every time ONE of these (following) conditions has existed, the market has produced positive returns.

Here they are:

- When the 30 year bond yield begins the year below 4%, stocks go up 22.1%.

- When investment grade bonds yield below 4%, stocks go up 16%.

- When high yield bonds yield below 8%, stocks go up 11.6%.

- When cash as a % of asset for non-financials is above 10%, stocks go up 17.6%.

- When the Fed tightens 0-75 basis points in the year, stocks go up 22%.

- When oil falls more than 20%, stocks go up 27.5%.

Again, his study showed that there has NEVER been a down year stocks, when any ONE of the above conditions is met.

It worked in 2015. It worked in 2016. And now, not only does ONE of these conditions exist, but ALL of these conditions are (or have been) met for 2017.

September 19, 2017, 6:00 pm EST Invest Alongside Billionaires For $297/Qtr

With a Fed decision queued up for tomorrow, let’s take a look at how the rates picture has evolved this year.

With a Fed decision queued up for tomorrow, let’s take a look at how the rates picture has evolved this year.

The Fed has continued to act like speculators, placing bets on the prospects of fiscal stimulus and hotter growth. And they’ve proven not to be very good.

Remember, they finally kicked off their rate “normalization” plan in December of 2015. With things relatively stable globally, the slow U.S. recovery still on path, and with U.S. stocks near the record highs, they pulled the trigger on a 25 basis point hike in late 2015. And they projected at that time to hike another four times over the coming year (2016).

Stocks proceeded to slide by 13% over the next month. Market interest rates (the 10 year yield) went down, not up, following the hike — and not by a little, but by a lot. The 10 year yield fell from 2.33% to 1.53% over the next two months. And by April, the Fed walked back on their big promises for a tightening campaign. And the messaging began turning dark. The Fed went from talking about four hikes in a year, to talking about the prospects of going to negative interest rates.

That was until the U.S. elections. Suddenly, the outlook for the global economy changed, with the idea that big fiscal stimulus could be coming. So without any data justification for changing gears (for an institution that constantly beats the drum of “data dependence”), the Fed went right back to its hawkish mantra/ tightening game plan.

With that, they hit the reset button in December, and went back to the old game plan. They hiked in December. They told us more were coming this year. And, so far, they’ve hiked in March and June.

Below is how the interest rate market has responded. Rates have gone lower after each hike. Just in the past couple of days have, however, we returned to levels (and slightly above) where we stood going into the June hike.

But if you believe in the growing prospects of policy execution, which we’ve been discussing, you have to think this behavior in market rates (going lower) are coming to an end (i.e. higher rates).

As I said, the Hurricanes represented a crisis that May Be The Turning Point For Trump. This was an opportunity for the President to show leadership in a time people were looking for leadership. And it was a chance for the public perception to begin to shift. And it did. The bottom was marked in Trump pessimism. And much needed policy execution has been kickstarted by the need for Congress to come together to get the debt ceiling raised and hurricane aid approved. And I suspect that Trump’s address to the U.N. today will add further support to this building momentum of sentiment turnaround for the administration. With this, I would expect to hear a hawkish Fed tomorrow.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

September 18, 2017, 4:30 pm EST Invest Alongside Billionaires For $297/Qtr

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

We constantly hear about how the fundamentals don’t support the move in stocks. Yet, we’ve looked at plenty of fundamental reasons to believe that view (the gloom view) just doesn’t match the facts.

Remember, the two primary sources that carry the megahorn to feed the public’s appetite for market information both live in economic depression, relative to the pre-crisis days. That’s 1) traditional media, and 2) Wall Street.

As we know, the traditional media business, has been made more and more obsolete. And both the media, and Wall Street, continue to suffer from what I call “bubble bias.” Not the bubble of excess, but the bubble surrounding them that prevents them from understanding the real world and the real economy.

As I’ve said before, the Wall Street bubble for a very long time was a fat and happy one. But the for the past ten years, they came to the realization that Wall Street cash cow wasn’t going to return to the glory days. And their buddies weren’t getting their jobs back. And they’ve had market and economic crash goggles on ever since. Every data point they look at, every news item they see, every chart they study, seems to be viewed through the lens of “crash goggles.” Their bubble has been and continues to be dark.

Also, when we hear all of the messaging, we have to remember that many of the “veterans” on the trading and the news desks have no career or real-world experience prior to the great recession. Those in the low to mid 30s only know the horrors of the financial crisis and the global central bank sponsored economic world that we continue to live in today. What is viewed as a black swan event for the average person, is viewed as a high probability event for them. And why shouldn’t it? They’ve seen the near collapse of the global economy and all of the calamity that has followed. Everything else looks quite possible!

Still, as I’ve said, if you awoke today from a decade-long slumber, and I told you that unemployment was under 5%, inflation was ultra-low, gas was $2.60, mortgage rates were under 4%, you could finance a new car for 2% and the stock market was at record highs, you would probably say, 1) that makes sense (for stocks), and 2) things must be going really well! Add to that, what we discussed on Friday: household net worth is at record highs, credit growth is at record highs and credit worthiness is at record highs.

We had nearly all of the same conditions a year ago. And I wrote precisely the same thing in one of my August Pro Perspective pieces. Stocks are up 17% since.

And now we can add to this mix: We have fiscal stimulus, which I think (for the reasons we’ve discussed over past weeks) is coming closer to fruition.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

September 15, 2017, 4:00 pm EST Invest Alongside Billionaires For $297/Qtr

We’ve past yet another hurdle of concern for markets this past week. Last Friday this time, we had a potential catastrophic category 5 hurricane projected to decimate Florida.

We’ve past yet another hurdle of concern for markets this past week. Last Friday this time, we had a potential catastrophic category 5 hurricane projected to decimate Florida.

Though there was plenty of destruction in Irma’s path, the weakening of the storm through the weekend ended in a positive surprise relative what could have been.

So we end with stocks on highs. And remember, we’ve talked over past month about the quiet move in copper (and other base metals) as a signal that the global economy (and especially China) might be stronger than people think. Reuters has a piece today where they overlay a chart of economist Ed Yardeni’s “boom-bust barometer” over the S&P 500. It looks like the same chart.

What does that mean? The boom-bust barometer measures the strength of industrial commodities relative to jobless claims. Higher commodities prices and lower unemployment claims equals a rising index as you might suspect (i.e. suggesting economic boom conditions, not bust). And that represents the solid fundamental back drop that is supporting stocks.

With that in mind, consider this: In the recent earnings quarter, earnings and revenue growth came in as good as we’ve seen in a long time for S&P 500 companies. We have 4.4% unemployment. The rise in equities and real estate have driven household net worth to $94 trillion – new record highs and well passed the pre-crisis peaks (chart below).

Now, people love to worry about debt levels. It’s always an eye-catching headline.

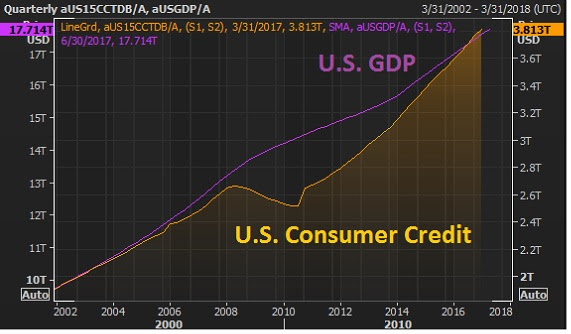

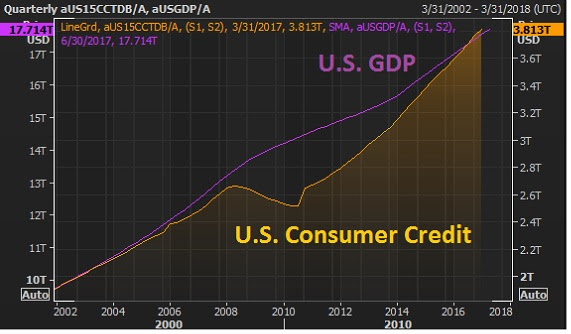

But what happens to be the key long-term driver of economic growth over time? Credit creation (debt). The good news: The appetite for borrowing is back. And you can see how closely GDP (the purple line, economic output) tracks credit growth.

Meanwhile, and importantly, consumers have never been so credit worthy. FICO scores in the U.S. have reached all-time highs. So despite what the media and some of Wall Street are telling us, things look pretty darn good. Low interests have produced recovery, without a ramp up in inflation.

But as I’ve said, it has proven to have its limits. We need fiscal stimulus to get us over the hump – on track for a sustainable recovery. And we now have, over the past two weeks, improving prospects that we will see fiscal stimulus materialize — i.e. policy execution in Washington.

To sum up: People continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

September 14, 2017, 4:00 pm EST Invest Alongside Billionaires For $297/Qtr

Yesterday we looked at the charts on oil and the U.S. 10 year yield. Both were looking poised to breakout of a technical downtrend. And both did so today.

Here’s an updated look at oil today.

And here’s a look at yields.

We talked yesterday about the improving prospects that we will get some policy execution on the Trumponomics front (i.e. fiscal stimulus), which would lift the economy and start driving some wage pressure and ultimately inflation (something unlimited global QE has been unable to do).

No surprise, the two most disconnected markets in recent months (oil and interest rates) have been the early movers in recent days, making up ground on the divergence that has developed with other asset classes.

Now, oil will be the big one to watch. Yields have a lot to do, right now, with where oil goes.

Though the central banks like to say they look at inflation excluding food and energy, they’re behavior doesn’t support it. Oil does indeed play a big role in the inflation outlook – because it plays a huge role in financial stability, the credit markets and the health of the banking system. Remember, in the oil price bust last year the Fed had to reverse course on its tightening plan and other major central banks coordinated to come to the rescue with easing measures to fend off the threat of cheap oil (which was quickly creating risk of another financial crisis as an entire shale industry was lining up for defaults, as were oil producing countries with heavy oil dependencies).

So, if oil can sustain above the $50 level, watch for the inflation chatter to begin picking up. And the rate hike chatter to begin picking up (not just with the Fed, but with the BOE and ECB). Higher oil prices will only increase this divergence in the chart below, making the interest rate market a strong candidate for a big move.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

January 13, 2017, 3:00pm EST

We’re getting into the heart of earnings season now, with Q4 earnings rolling in. Remember, earnings guidance is set by management to be beat. And estimates are set by Wall Street to be beat. That’s the way Wall Street works. And it’s a built-in bullish force for the stock market.

With that, for the better part of the second half of last year, I said “we were set up for a big run for stocks into the year end given that expectations had been ratcheted down on earnings and the economic data. That creates opportunities for positive surprises, which is fuel for higher stocks.”

The dynamic continues.

Last quarter, 71% of earnings beat estimates for the quarter. And despite the analyst expectations that there would be an overall decline in S&P 500 earnings, the overall earnings reported by companies grew by 3%. Sounds positive, right?

Still, management, on whole, was downbeat on their guidance for what the fourth quarter would bring. They set the bar low. And with that, the early Wall Street expectations for earnings growth on the quarter has been dialed back, setting up for positive surprises.

As I’ve said, historically, about 68% of S&P 500 companies earnings beat estimates. Let’s assume the positive surprises will be even higher for Q4 numbers, especially given the rise of optimism following the November election. That’s more fuel for stocks.

We’ve heard from some of the biggest banks in the country today. JP Morgan stole the show, beating on earnings by 20%. PNC beat by 6%. Bank of America beat by 5%. Wells Fargo earnings came in lower, but deposits and loans grew despite its PR nightmare.

This is all positive for the trajectory of banks. Especially when you consider that we are in the very early innings of one of the tailwinds (rising interest rates) and the first inning is coming for the second tailwind (de-DoddFranking the banking business).

Fed raising rates is a money printing recipe for banks. Bank of America has said that a point higher on Fed Funds will add more than $5 billion of core earnings for the bank.

But the story here for the bank stocks is even more exciting when you consider that many of the regulations, that have turned banks into utility companies since the financial crisis, will be reversed by the Trump administration. To what extent will banks return to the business of risk-taking? Probably not to pre-crisis levels. But will it be dramatically different than the business of the post-crisis era? Highly likely, given the contingent of Wall Street bankers entering government in the Trump administration. With this, banks still look cheap.

Even last year, the health of the banks was looking as good as it has been in a long time. Loan balances were growing at the fastest 12-month rate since 2008, the share of unprofitable banks had fallen to an 18-year low, and the number of ‘problem banks’ continued to decline.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

September 28, 2016, 4:30pm EST

Oil popped over $3 from the lows of the day (as much as 7%) on news OPEC has agreed to a production cut.

We’ve talked a lot throughout the year about the price of oil. When it collapsed to the $20s, it put the entire energy industry on bankruptcy watch.

Of course, oil bounced sharply from those lows of February as central banks stepped in with a coordinated response to stabilize confidence. Not so coincidentally, oil bottomed the same day the Bank of Japan intervened in the currency markets.

The oil price bust all started back in November of 2014, the evening of Thanksgiving Day, when OPEC pulled the rug out from under the oil market by vowing not to make production cuts, in an attempt to crush the nascent shale industry. At that time, oil was trading around $73.

You can see in this chart, it never saw that price again.

OPEC was successful in heavily damaging the U.S. shale industry through low oil prices, but it has damaged OPEC countries, too.

What will the news of an agreement on a production cut mean?

A policy shift from OPEC can be very powerful. In 1986, the mere hint of an OPEC policy move sent oil up 50% in just 24 hours. And as we discussed earlier in the year, the relationship between the price of oil and stocks this year has been tight. At times, stocks have traded almost tick for tick with oil.

Take a look at this chart.

An oil price back in the $60s would be a catalyst for a big run in stocks into the year end. For a stock market that has been rudderless surrounding a confused Fed and an important election, this oil news could kick it into gear.

If you’re looking for great ideas that have been vetted and bought by the world’s most influential and richest investors, join us at Billionaire’s Portfolio. We have just exited an FDA approval stock for a quadruple. And we’ll be adding a two new high potential billionaire owned stocks to the portfolio very soon. Don’t miss it. Join us here.

September 12, 2016, 5:00pm EST

We headed into the weekend with a market that was spooked by a sharp run up in global yields. On Friday, we looked at the three most important markets in the world at this very moment: U.S. yields, German yields and Japanese yields.

On the latter two, both German and Japanese yields had been deeply in negative yield territory. And the perception of negative rates going deeper (a deflation forever message), had been an anchor, holding down U.S. market rates.

But in just three days, the tide turned. On Friday, German yields closed above the zero line for the first time since June 23rd. Guess what day that was?

Brexit.

And Japanese 10-year yields had traveled as low as 33 basis points. And in a little more than a month, it has all swung back sharply. As of today, yields on Japanese 10-year government debt are back in positive territory – huge news.

So why did stocks rally back sharply today, as much as 2.6% off of the lows of this morning – even as yields continued to tick higher? Why did volatility slide lower (the VIX, as many people like to refer to as, the “fear” index)?

Here’s why.

First, the ugly state of the government bond market, with nearly 12 trillion dollars in negative yield territory as of just last week, served as a warning signal on the global economy. As I’ve discussed before, over the history of Fed QE, when the Fed telegraphed QE, rates went lower. But when they began the actual execution of QE (buying bonds), rates went higher, not lower (contrary to popular expectations). Because the market began pricing in a better economic outlook, given the Fed’s actions.

With that in mind, the ECB and the BOJ have been in full bore QE execution mode, but rates have continued to leak lower.

That sends a confusing, if not cautionary, signal to markets, which is adding to the feedback loop (markets signaling uncertainty = more investor uncertainty = markets signaling uncertainty).

Now, with government bond yields ticking higher, and key Japanese and German debt benchmarks leaving negative yield territory, it should be a boost for sentiment toward the global economic outlook. Thus, we get a sharp bounce back in stocks today, and a less fearful market message.

Keep in mind, even after the move in rates on Friday, we’re still sitting at 1.66% in the U.S. 10-year. Before the Fed pulled the trigger on its first rate hike, in the post-crisis period, the U.S. 10-year was trading around 2.25%. As of last week, it was trading closer to 1.50%. That’s 75 basis points lower, very near record lows, AFTER the Fed’s first attempt to start normalizing rates. Don’t worry, rates are still very, very low.

Still, the biggest risk to the stability of the bond market is, positioning: The bond market is extremely long. If the rate picture swung dramatically and quickly higher, the mere positioning alone (as the longs all ran for the exit door) would exacerbate the spike. That would pump up mortgage rates, and all consumer interest rates, which would grind the economy to a halt and likely destabilize the housing market again. And, of course, the Fed would be stuck with another crisis, and little ammunition.

As Bernanke said last month, the Fed has done damage to their own cause by so aggressively telegraphing a tighter interest rate environment. In that instance, he was referring to the demand destruction caused by the fear of higher rates and a slower economy. But as we discussed above, the Fed also has risk that their hawkish messaging can run market rates up and create the same damage.

Bottom line: The Fed is walking a fine line, which is precisely why they continue to sway on their course, leaning one way, and then having to reverse and shift their weight the other way.

In our Billionaire’s Portfolio, we’re positioned in deep value stocks that have the potential to do multiples of the broader market—all stocks that are owned and influenced by the world’s smartest and most powerful billionaire investors.

Join us today and get yourself in line with our portfolio.

August 27, 2016, 12:00pm EST

The Fed’s Janet Yellen was the focal point for markets for the week. She had a scheduled speech at the annual Fed conference at Jackson Hole.

When her speech was finally made public Friday morning, the response in markets was uncertainty (the most used word for the past nine years).

Stocks went up, then down. Yields went down, then up.

So what do we make of it? Let’s start with the headlines that hit the wire Friday morning.

The world was wondering if Yellen would support the messaging from some of her fellow Fed members–that a September rate hike is on the table. Or would she continue the backstepping (dovish speak) the Fed has done for the past five months. The answer was ‘yes.’ She did both.

Yellen said the case for rate hikes has strengthened (yellow marker) because the data is nearing their goals (employment and inflation–the white marker). Ah, rate hike. But then she said the Fed expects inflation to hit the target 2% in the next few years (circled)! And then talked about the strategy for more QE. Huh? And then to top it off, she said they might move the goalposts. They might move the inflation target higher, and start targeting GDP. That means they would be happy to leave conditions ultra accommodative until those higher targets are met. Clearly dovish.

As I said Thursday, they want to raise rates to get the financial system closer to proper functioning, but they don’t want to cause a recession. The Fed wants to raise short-term rates, but promote a flatter yield curve (i.e. promote expectations that the economy will continue to be soft) to keep the market interest rates low, which keeps the housing market on the rails and the economic activity on the rails.

Remember, we talked about the piece Bernanke wrote a couple of weeks ago, where he suggested exactly this type of perception manipulation from the Fed, to balance the need to raise rates, without killing the economy.

That looks like the game plan.

Have a great weekend!

In our Billionaire’s Portfolio, we’re positioned in deep value stocks that have the potential to do multiples of the broader market—all stocks that are owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and get yourself in line with our portfolio. You can join here.

Stocks have roared back in the past several days. It’s been led by commodity stocks, the area that has been beaten up and left for dead. Not surprisingly, the bounce in that area has been multiples of the broader stock market bounce (which is 7% in less than a week).

As we’ve discussed in recent weeks, in the world we live in, global economic stability continues to rely on central bank influence. And, indeed, after one of the worst starts for stocks in a New Year ever, it was central bank verbal posturing to open the week that has turned the tide for global markets. On Sunday, the head of the BOJ spoke, warning that they were watching markets closely and stood ready to act, and then on Monday, the head of the European Central Bank said, effectively, the same. The result: the BOJ comments sparked a 10% rally in Japanese stocks in a matter of hours. With that lead, the S&P 500 has now rallied 7% in three days, crude oil has bounced 20%, and global interest rates are bouncing back (which, last week, were pricing in recession).

To follow the stock picks of the world’s best billionaire investors, subscribe at Billionaire’s Portfolio.

Like it or not, in a world where the economy remains structurally fragile after the global financial and economic crisis, the central banks remain in the driver’s seat and they know that promoting stability is the key to recovery and ultimately returning to sustainable economic growth. As we approach the March ECB and BOJ meetings, with weak oil prices persisting, we continue to think the central banks may outright buy oil and commodities to remove the risk of oil industry bankruptcies and the domino effect that it would spark. As an additional benefit, it would likely turn out to be a very profitable investment.

Today we want to talk about the quarterly SEC filings that came in this week. All big investors that are managing over $100 million are required to publicly disclose their holdings every quarter. They have 45 days from the end of the quarter to file that disclosure with the SEC. It’s called a form 13F. While these filings have become very popular fodder for the media, what we care more about is 13D filings. Those are disclosures these big investors have to make within 10 days of taking a controlling stake in a company. When you own 5% or more of a company’s stock, it’s considered a controlling stake. In a publicly traded company, with that sized position, you typically become the largest shareholder and, as we know, with that comes influence. Another key attribute of this 13D filing, for us, is that these investors also have to file amendments to the 13D within 10 days of making any change to their position.

By comparison, the 13F filings only offer value to the extent that there is some skilled analysis applied. Thousands of managers file 13Fs every quarter. And the difference in manager talent, strategies and portfolio sizes run the gamut.

With that caveat, there are nuggets to be found in 13Fs. Let’s talk about how to find them, and the take aways from the recent filings.

First, it’s important to understand that some of the positions in 13F filings can be as old as 135 days. Filings must be made 45 days after the previous quarter ends, which is 90 days. We only look at a tiny percentage of filings—just the investors that we know have long and proven track records, distinct approaches, and who have concentrated portfolios.

Through our research over 15 years, here’s what we’ve found to be most predictive:

Clustering in stocks and sectors by good hedge funds is bullish. Situations where good funds are doubling down on stocks is bullish. This all can provide good insight into the mindset of the biggest and best investors in the world, and can be a predictor of trends that have yet to materialize in the market’s eye.

For specialist investors (such as a technology focused hedge fund) we take note when they buy a new technology stock or double down on a technology stock. This is much more predictive than when a generalist investor, as an example, buys a technology stock.

The bigger the position relative to the size of their portfolio, the better. Concentrated positions show conviction. Conviction tends to result in a higher probability of success. Again, in most cases, we will see these first in the 13D filings.

New positions that are of large, but under 5%, are worthy of putting on the watch list. These positions can be an indicator that the investor is building a position that will soon be a “controlling stake.”

Trimming of positions is generally not predictive unless a hedge fund or billionaire cuts a position by 75% or more, or cuts below 5% (which we will see first in 13D filings). Funds also tend to trim losers into the fourth quarter for tax loss benefits, and then they buy them back early the following year.

With that in mind, we want to talk about a few things we did glean from these recent filings.

First, the old adage “buy when there is blood in the streets” was evident last quarter, as many of the top billionaire investors loaded up on stocks in the fourth quarter. That was BEFORE the further declines this year.

Top billionaire investors Paul Singer, David Tepper and Chase Coleman of Tiger Global all increased their equity exposure (buying more stocks) over the last quarter. And billionaire investors still love health care stocks. John Paulson, Bill Ackman, Dan Loeb and Larry Robbins loaded up, with Paulson putting 56% of his portfolio in health care.

Billionaires are starting to bottom fish in energy. Seth Klarman, David Tepper, Carl Icahn and Warren Buffett all either added to, or initiated new stakes in energy stocks. Tepper now has 12% of his entire equity portfolio in energy stocks! This obviously coincides well with the theme that energy and commodity stocks are starting to bottom.

Also notable, in recent weeks, the 13D filings have been coming in fast and furious as investors are taking advantage of the decline this year.

Analyzing these filings is part of our process in our Billionaire’s Portfolio. With that in mind, this week we followed one of the best billion dollar (plus) activist hedge funds into a stock where they own 12.5%, have three board seats, and are in the process of replacing the CEO. These are are three key ingredients in the success of activist campaigns: 1) a big concentrated position (12.5% stake), 2) control (board seats), and 3) change (a new CEO). This activist fund has won on 82% of its campaigns since 2002 and has a price target on this stock that’s more than 150% higher than the current share price. To join us you can subscribe to our Billionaire’s Portfolio (here).

We looked at small caps last week when the the Russell 2000 broke to new highs.

We looked at small caps last week when the the Russell 2000 broke to new highs.

![]()