|

|

|

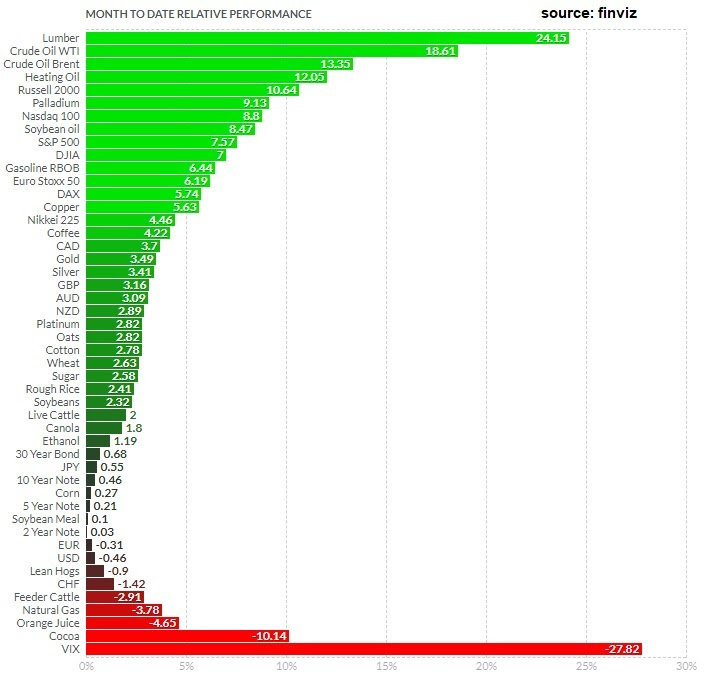

January 31, 5:00 pm EST With the Fed officially on hold, asset prices continue to lift-off. But with U.S./China talks concluding today, there was the potential for a spoiler. Trump quickly stepped in front of that risk this morning, saying that no final deal would be made until he and President Xi meet “in the very near future.” So the expectations of a final “yea or nay” on a China deal today were managed down. And with that, the recovery in global markets finished the month of January on a strong note. What a difference a month makes. In December, people were beginning to worry that collapsing global financial markets would kill the global economic recovery — and maybe fuel another financial crisis. A month later, and the S&P 500 sits just 2% lower than the close of November (before the December rout). And in January, almost every market is in the green (from stocks to bonds to commodities to currencies).

|

|

|

Remember, if we compare this to last year, cash was the best performing major asset class (returning just less than 2% in dollar terms). On Friday, we talked about the set up for a big run in commodities this year. Commodities continue to lead the way. Crude is up close to 20%on the month. Copper is up 6% for January (the commodity known to be a early indicator of turning points in the economy), and gold is up 3.5% just in the past week. We also end the month with another very solid opening to earnings season. Despite all of the pessimism of the past quarter. The Q4 earnings continue to beat expectations. Importantly, the widely held tech giants have posted good reports: Facebook, Apple and Amazon. Importantly, with the expectations bar set low coming into 2019 (for earnings, the economy and a China deal), I’d say we finish the first month of the year in position to exceed expectations on those fronts – thanks, in no small part, to the pivot by the Fed.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

January 29, 5:00 pm EST Today let’s take a look at the recent moves the U.S. administration has made against Venezuela, and what that means for oil prices. It was August of 2017, when Trump first stepped up pressure on Venezuela. Venezuela is (and has been) in a humanitarian, political and economic crisis–led by what the U.S. administration has officially called a dictator. Trump slapped sanctions on the Venezuelan President back in 2017 (freezing his U.S assets) and was said to be considering broad oil sanctions. That finally came yesterday (seventeen months later). For a country that relied heavily on oil exports (ninety-five percent of export revenues in Venezuela come from oil), the U.S. will no longer be sending money to Venezuela for oil. This is a crushing blow for an already suffering country. What does it mean for oil prices? Venezuela has the world’s largest oil reserves. With oil sanctions, should come supply disruptions for the oil market, which could likely send oil aggressively higher. Back in 2017, when Trump threatened sanctions, oil broke out of its $40-$55 range, and ultimately traded up to $76. Today, we’re nearing the top end of that same range. |

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

January 24, 5:00 pm EST

With two big central bank meetings behind us this week, and the Fed on deck for next week, let’s remind ourselves of where the global central banks stand, more than 10 years after the crisis.

There’s one thing we know, following the events of the past decade: The global central banks will do “whatever it takes” to preserve stability and manufacture economic growth. As long as global economies remain interconnected (which they are), this is the script they (global central banks, in coordination) will follow. They crossed the line long ago. There’s no turning back.

So, with all of the continual talk in past years about another big shock or “shoe to drop,” people have failed to acknowledge the key difference between the depths of the financial crisis and now. Back then, we didn’t know how policymakers would respond. That’s a lot of uncertainty. Now we know. They will change the rules when they need to. That removes a lot of uncertainty.

With this in mind, remember on January 4th, in response to an ugly December for the stock market, the Fed marched out Bernanke, Yellen and Powell to walk back on the tightening cycle. For a world that was expecting four rote rate hikes this year, that was an official response – effectively easing, intermeeting.

Next up, the Bank of Japan. They met this week. With the ECB now done with QE, the BOJ is now the lone global economic shock absorber. Not only have they been executing on their massive QQE plan since 2013, in 2016 they crafted a plan that gave them greenlight to do unlimited QE as long as their 10-year government bond yield drifted above the zero line. So, as global yields pull Japanese yields higher, the BOJ responds by buying bonds in unlimited amounts to push it all back down. That has been the anchor on global interest rates. And given that they see inflation continuing to run well below their target of 2%, through 2020, the BOJ will be printing for the foreseeable future (remaining that anchor on global interest rates).

What about Europe? A few months ago, some thought the ECB might be following the Fed footsteps — with a first post-QE rate hike by the middle of this year. Today, Draghi put that to bed, saying risks are now to the downside, and that the market has it right pricing in a rate hike for next year – assuming all goes well. But Draghi also wants us to know that the ECB stands ready to act if the economy falters (i.e. they can/will go the other way).

So, for perspective on where the global economy stands, we still have central banks pulling the levers to keep it all together. That’s why Trump’s big and bold fiscal stimulus and structural reform was/is absolutely necessary. And that’s why the rest of the world will likely have to follow the U.S., with fiscal stimulus, if we are to ultimately and sustainably put the crisis period behind us.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

January 10, 5:00 pm EST

The coordinated response to market turmoil continues to reverse the tide of what was becoming an increasingly ugly global financial market meltdown.

Remember, we had a response from the U.S. Treasury Secretary on the days leading up to Christmas, which included call outs to the major banks and a meeting of the “President’s Working Group” on financial markets. Coincidentally, by the next Wednesday, a new item hit the agenda for the American Economic Association Annual Meeting. It was the January 4 live interview with the three most powerful central bankers in the world over the past ten years: Bernanke, Yellen and Powell. These three sat on stage together and massaged market sentiment on the path of interest rates, fortifying the market recovery that was started by the efforts of the Treasury.

Just in case we didn’t get the message, we’ve since had six Fed officials publicly dialing down expectations on the rate outlook, in response to financial markets. And we’ve had minutes from the Fed’s last meeting that clearly gave the message that the Fed could pause, sit and watch. And then today Powell was on stage again for another public interview, reiterating the Fed’s new position: on hold.

Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now.

|

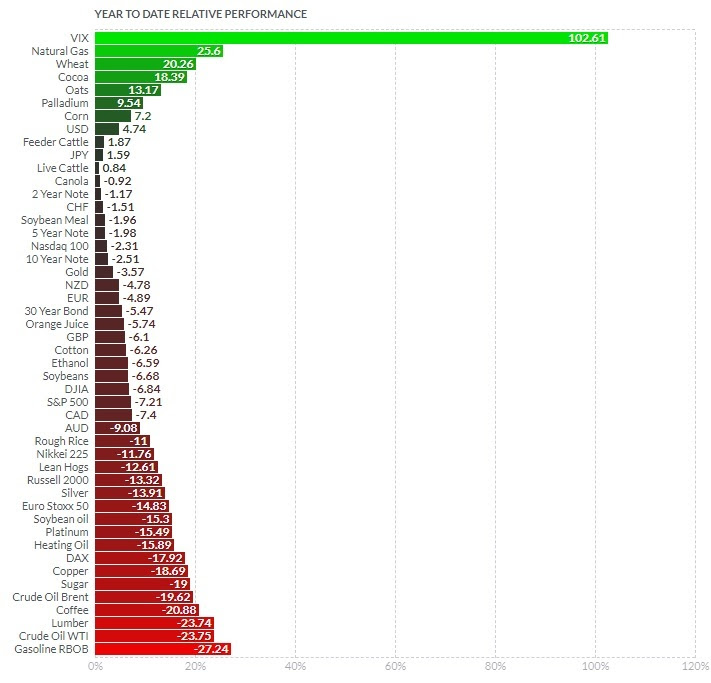

December 21, 5:00 pm EST As we head into the holidays and the end of the year, let’s take a look at the 2018 performance for the world’s biggest asset classes, currencies and commodities. |

|

|

As you can see, there’s a lot of red. Global stocks are down. Bonds are down. Major commodities, down. Gold, down. Foreign currencies, down. Now, as we’ve discussed, major moves in markets are often triggered by a very specific catalyst, and then prices tend to drive sentiment change, and sentiment then tends to exacerbate the move in markets. There are always plenty of stories, at any given time, that can sound like rational explanations to fit to the price. In the case of the declines across asset classes this year, we’ve heard many viewpoints from very smart and accomplished investors over the past week, with concerns about the Fed, debt, deficits, slowdown, the end of an expansionary cycle, etc. With all of this said, often times the driver behind these moves in markets is specific capital flows (forced liquidations), not an economic narrative. With that, in rear view mirror, a lot of times (historically) all of the pontifications surrounding markets like these end up looking very silly. For example, let’s take a look at the run-up in oil prices back in 2007-08. Oil prices ran from $50 to almost $150 in about 18 months. Everyone was telling the world was running out of oil — “peak oil.” Did everyone get supply and demand so wrong that the market was adjust with a three-fold move that quickly? The reality: the price of oil was being driven by nefarious activities (manipulation). A major oil distributor was betting massively on lower oil prices and ran out of cash to meet margin requirements, as they were consequently squeezed (forced to liquidate) by predatorial traders that pushed the market higher. Among the predatorial traders, the largest oil trading company in the world, Vitol, was found to have been essentially controlling the oil futures market. When the CFTC (the regulators) finally came knocking to investigate, that was the top in oil prices. In the case of recent declines, the catalyst looks to be geopolitical (not economic), which then has given way to an erosion in sentiment (which can become self-fulfilling). The geopolitics: We’ve talked about the timeline of the top in stocks back in January, and how it aligns perfectly with the release of very wealthy Saudi royal family members and government officials, after being detained by the Crown Prince for three months on corruption charges. And then the decline from the top on October 3rd (both stocks and oil prices) aligns, to the hour, with the news that the Crown Prince would be implicated in the Khashoggi murder. These two events look like clear forced liquidations by the Saudis to retrieve assets invested in U.S. (and global) markets (assets that are vulnerable to asset seizures or sanctions). Beyond this selling, we also have a party that might have an interest in seeing the U.S. stock market lower: China. Trump has backed them into a corner with demands they can’t possibly fully agree to. If they did, their economy would suffer dramatically, and the ruling party would be highly exposed to an uprising. Could China be behind the persistence in the selling. Quite possibly. Bottom line: The lower stock market has put pressure on the Trump agenda, which makes it more likely that concessions will be made on China demands. My bet is that a deal on China would unleash a massive global financial market rally for 2019, and lead to a big upside surprise in global economic growth. Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

December 20, 5:00 pm EST

In recent days we’ve discussed the parallels between this year and 1994. In ’94 the Fed was hiking rates into a low inflation, recovering economy.

The Fed has done the same this year, methodically raising rates into a low inflation, recovering economy. And like in 1994, the persistent tightening of credit has sent signals that the Fed is threatening economic growth. Asset prices have swooned, and we have a world where cash is the best performing asset class (just as we experienced in 1994).

But remember, the Fed was forced to stop and reverse by early 1995. Stock prices exploded 36% higher that year.

With this in mind, over the past couple of weeks, several of the best investors in the world have publicly commented on the state of markets.

Among them, was billionaire Paul Tudor Jones. Jones is one of the great global macro traders of all-time. He’s known for calling the 1987 crash, where he returned over 125% (after fees). And he’s done close to 20% a year (again, after fees) spanning four decades.

Let’s take a look at what Jones said in an interview on December 10th …

He said the Fed has gone too far (tightened too aggressively). But he thinks the Fed is near the end of its tightening cycle.

With that, he expected to see more swings in stocks. He said he thinks we could be down 10% or up 10% from the levels of December 10th. But historically when the Fed ends a tightening cycle, after going too far, he says it has been a great time to be in the stock market.

The sentiment that the Fed has gone “too far” increased dramatically across the market this week — in the days up to yesterday’s Fed meeting. As such, because the Fed followed through with another hike yesterday, and telegraphed more next year, stocks continued to slide today. In fact, stocks have now/already declined 9.4% from the levels where Paul Tudor Jones made his comments about down 10%/up 10%. Again, he made those comments just 10 days ago.

With the above in mind, here’s what he said he would do if he saw itdown 10%: “I’m going to buy the hell out of ten percent lower, for sure. To me, that’s an absolute lay-up.”

|

|