|

The midterm elections are behind us, and I’ve suspected that the lift of that cloud of uncertainty would be the greenlight for stocks to make a run into the end of the year.

We’re seeing it start today.

Remember, the big work on economic stimulus has been done, and that will continue to drive the best growth we’ve had since 2006.

Add to that, there is the potential that Trump can get infrastructure done with a split Congress. With that, it would be a matter of how hot the economy will get.

But as I said, there’s probably a better chance that the Democrats will block any more progress on the economic front, to best position themselves for a run at the 2020 Presidential election.

Interestingly, this gridlock scenario could actually be the optimal scenario for stocks here.

The notion that the economy might be on the verge of accelerating too fast/ running too hot, has dialed UP the inflation-risk-premium for the stock and bond markets. The hot trajectory for the economy has kept pressure on the Fed to continue the path higher in interest rates.

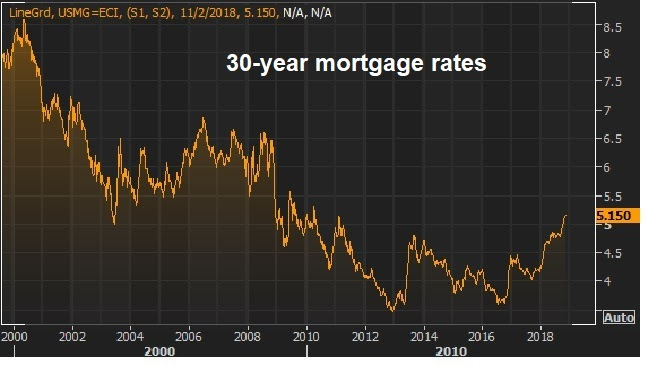

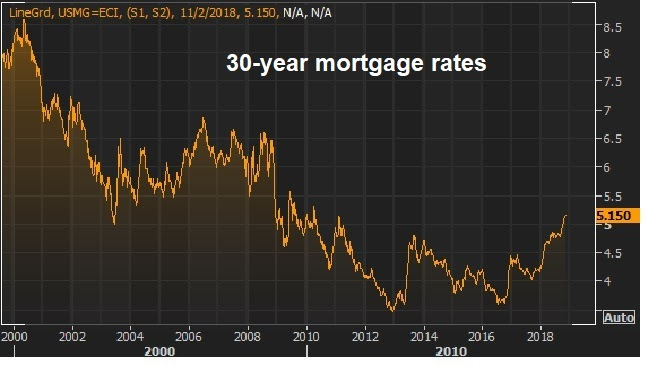

Thus far, the seven quarter-point hikes the Fed has made to the benchmark overnight lending bank rate has NOT choked off economic momentum. But it has, finally, started to get market rates moving. The ten-year government bond yield is near 3.25%, the highest in seven years. And stocks haven’t liked this 3%+ level on rates. And that has a lot to do with what it does to consumer rates, specifically mortgages.

As you can see in the chart below, we now have 30-year mortgages running north of 5% for the first time since 2010.

|

|

| This move in rates has slowed down the housing market. And this is an example of how this path of hotter growth and an aggressively normalizing Fed has been tracking toward growth killing interest rate levels.

Perhaps some gridlock in Washington will slow the speed at which both are adjusting and allow for some time for the economy to sustain at this 3% growth level.

Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now. |

September 18, 2017, 4:30 pm EST Invest Alongside Billionaires For $297/Qtr

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

We constantly hear about how the fundamentals don’t support the move in stocks. Yet, we’ve looked at plenty of fundamental reasons to believe that view (the gloom view) just doesn’t match the facts.

Remember, the two primary sources that carry the megahorn to feed the public’s appetite for market information both live in economic depression, relative to the pre-crisis days. That’s 1) traditional media, and 2) Wall Street.

As we know, the traditional media business, has been made more and more obsolete. And both the media, and Wall Street, continue to suffer from what I call “bubble bias.” Not the bubble of excess, but the bubble surrounding them that prevents them from understanding the real world and the real economy.

As I’ve said before, the Wall Street bubble for a very long time was a fat and happy one. But the for the past ten years, they came to the realization that Wall Street cash cow wasn’t going to return to the glory days. And their buddies weren’t getting their jobs back. And they’ve had market and economic crash goggles on ever since. Every data point they look at, every news item they see, every chart they study, seems to be viewed through the lens of “crash goggles.” Their bubble has been and continues to be dark.

Also, when we hear all of the messaging, we have to remember that many of the “veterans” on the trading and the news desks have no career or real-world experience prior to the great recession. Those in the low to mid 30s only know the horrors of the financial crisis and the global central bank sponsored economic world that we continue to live in today. What is viewed as a black swan event for the average person, is viewed as a high probability event for them. And why shouldn’t it? They’ve seen the near collapse of the global economy and all of the calamity that has followed. Everything else looks quite possible!

Still, as I’ve said, if you awoke today from a decade-long slumber, and I told you that unemployment was under 5%, inflation was ultra-low, gas was $2.60, mortgage rates were under 4%, you could finance a new car for 2% and the stock market was at record highs, you would probably say, 1) that makes sense (for stocks), and 2) things must be going really well! Add to that, what we discussed on Friday: household net worth is at record highs, credit growth is at record highs and credit worthiness is at record highs.

We had nearly all of the same conditions a year ago. And I wrote precisely the same thing in one of my August Pro Perspective pieces. Stocks are up 17% since.

And now we can add to this mix: We have fiscal stimulus, which I think (for the reasons we’ve discussed over past weeks) is coming closer to fruition.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

January 25, 2017, 1:30pm EST Invest Alongside Billionaires For $297/Qtr

The Dow broke 20,000 today. I want to talk about why it’s a big deal.

As we discussed when we entered the new year, “Trump’s Plan Is A Recipe For Restoring Animal Spirits.” Watch out, it’s coming.

Remember, this (animal spirits) is the element that economists and analysts can’t predict, and can’t quantify. It’s not in the forecasts. This is what has been destroyed over the past decade, driven primarily by the fear of indebtedness (which is typical of a debt crisis) and mistrust of the system. All along the way, throughout the recovery period, and throughout a tripling of the stock market off of the bottom, people have continually been waiting for another shoe to drop. The breaking of this emotional mindset has been underway since the night of the election. And that gives way to a return of animal spirits.

Higher stock prices tend to beget higher stock prices. Trust me, individual investors that haven’t been believers will be calling their financial advisors and logging in to their online brokerage accounts over the coming days. Institutional investors that haven’t been believers, that have been underweight stocks, will be beefing up exposure if they want to compete with their peers (and keep their jobs).

And not only do higher stock prices lead to higher stock prices, but higher stock prices tend to make people feel more confident about the economy, which begets a better economy.

Add to this, the psychological value of Dow 20,000 could finally be a turning point in the divergence of sentiment toward the Trump Presidency. It may serve as a validation marker for those that have been on the fence. And for those in opposition, as I’ve said before, growth solves a lot of problems! When the college grad that’s been relegated to a 10-year career as a barista begins to see signs of opportunity for a better career and a better future, in a stronger economy, the sands of Trump sentiment can shift quickly.

Cleary, Trump entered with a game plan that can pop economic growth. And he’s going 100 miles an hour at executing on that plan. For markets, what he’s doing is creating a sense of certainty for investors. They know what he’s promised, and now they know that he appears to intend on delivering on those promises. And the coordination of growth policies, along with ultra-easy monetary policy (even with tightening in view) serves as risk mitigators for markets. It should limit downside risk, which is what investors care most about. How?

Remember, even at Dow 20,000, stocks are still extremely cheap.

Here’s a review on why …

Reason #1: To return to the long-term trajectory of 8% annualized returns for the S&P 500, the broad stock market would still need to recovery another 48% by the middle of this year. We’re still making up for the lost growth of the past decade. And there’s a lot of ground to make up.

Reason #2: In low-rate environments, the valuation on the broad market tends to run north of 20 times earnings. Adjusting for that multiple, we can see a reasonable path to a 16% return for the year. That’s an S&P 500 earnings estimate of $133.64 times a P/E of 20 equals 2,672 on the S&P 500.

Reason #3: The proposed corporate tax rate cut from 35% to 15% is estimated to drive S&P 500 earnings UP from an estimated $132 per share for next year, to as high as $157. Apply $157 to a 20x P/E and you get 3,140 in the S&P 500. That’s 37% higher.

With this in mind, we are likely entering an incredible era for investing, which will be an opportunity for average investors to make up ground on the meager wealth creation and retirement savings opportunities of the past decade. For help building a high potential portfolio for 2017, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

December 5, 2016, 4:00pm EST

On Friday, we looked at five key charts that showed the technical breakout in stocks, interest rates, the dollar and crude oil.

All of these longer term charts argue for much higher levels to come. Remember, the big event remaining for the year is the December 14th Fed meeting. A rate hike won’t move the needle. It’s well expected at this stage. But the projections on the path of interest rates that they will release, following the meeting, will be important. As I said Friday, “as long as Yellen and company don’t panic, overestimate the inflation outlook and telegraph a more aggressive rate path next year, the year should end on a very positive note.”

On that note, today we had a number of Fed members out chattering about rates and where things are headed. Did they start building expectations for a more aggressive rate path in 2017, because of the Trump effect? Or, did they stick to the new strategy of promoting a view that underestimates the outlook for the economy and, therefore, the rate path (a strategy that was suggested by former Fed Chair Bernanke)?

The former is what Bernanke criticized the Fed as doing late last year, which he argued was an impediment to growth, as people took the cue and started positioning for a rate environment that would choke off the recovery. The latter is what he suggested they should move to (and have moved to), sending an ultra accommodative signal, and a willingness to be behind the curve on inflation — letting the economy run hot for a while (i.e. they won’t impede the progress of recovery by tightening money).

So how did the Fed speakers today weigh in, relative to this positioning?

First, it should be said that Bernanke also recently criticized the Fed for the cacophony of chatter from Fed members between meetings. He said it was confusing and disruptive to the overall Fed communications.

So we had three speakers today. New York Fed President William Dudley spoke in New York, St. Louis Fed President James Bullard spoke in Phoenix, and Chicago Fed President Charles Evans speaks in Chicago. Did they have a game plan today to promote a more consistent message, or was it a more of the disruptive noise we’ve heard in the past?

Fortunately, they were on message. Only Dudley and Bullard are voting members. Both had comments today that spanned from cautious to outright dovish. Dudley, the Vice Chair, wasn’t taking a proactive view on the impact of fiscal stimulus — he promoted a wait and see view, while keeping the tone cautionary. Bullard, a Fed member that is often swaying with the wind, said he envisioned ONE rate hike through 2019. That would mean, one in December, and done until 2019. That’s an amazing statement, and one that completely (and purposely) ignores any influence of what may come from the new pro-growth policies.

This is all good news for stocks and the momentum in markets. The Fed seems to be disciplined in its strategy to stay out of the way of the positive momentum that has developed. And that only helps their cause. With that, if today’s chatter is a guide, we should see a very modest view in the economic projections that will come on December 14th. That should keep the stock market on track for a strong close into the end of the year.

We may be entering an incredible era for investing. An opportunity for average investors to make up ground on the meager wealth creation and retirement savings opportunities of the past decade, or more. For help, follow me in my Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio is up 24% year to date. That’s more than three times the performance of the broader stock market. Join me here.

November 16, 2016, 4:00pm EST

Yesterday we talked about the missing piece in the pro-growth rally in markets. It’s oil. A pick-up in demand and growth, tends to also accelerate demand for oil.

But the market is holding out for the November 30 OPEC decision. They’ve told us they plan to cut. The inventories have jumped in recent weeks, suggesting producers are ramping up production into a cut (taking advantage while they can). And Russia’s energy minister said today he thinks OPEC members will agree to terms on a production cut by the November 30 meeting.

With that, oil spiked this morning, but fell back from the highs — still hanging around the $45 area.

Today I want to talk about the performance of small caps over the past week compared to the broader market. If we consider a Trump economy where regulation will be peeled back, a few areas come to mind as being among winners:

Banks: Banks have been crushed by Dodd Frank, made into utility companies. This is the legislation that responded to the global financial crisis — where banks had become hedge funds, taking massive-leveraged-speculative bets against their deposit base. When the black swan event occurred, they became exposed and were bailed out to keep the financial system alive. Those days should never return, but the pendulum swung too far in the other direction on Dodd Frank. In a Trump economy, risk taking will almost certaintly return to the banking system again. The XLF, bank ETF, is up 10% in the past week.

Energy: The energy industry has been crushed under the weight of clean energy policies. Billionaire Carl Icahn, one of Trump’s biggest advocates and once thought to be a candidate for Treasury Secretary, penned a letter to the EPA a few months ago saying their policies on renewable energy credits are bankrupting the oil refinery business and destroying small and midsized oil refiners. Icahn happens to own a controlling stake in one, CVR Energy (CVI). The stock is up 30% in the past week.

Small caps: The common theme in the above two industries is that all companies have been hurt, but the burden of increased regulation has been far a greater economic and financial cost to small companies. That’s why the Russell 2000 (small cap index) is racing higher in the President elect Trump era. The small cap index is outperforming the S&P 500 by 5 to 1 since Tuesday of last week.

Follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio is up 20% this year. That’s almost 3 times the performance of the broader stock market. Join me here.

November 14, 2016, 4:45pm EST

We talked last week about the Trump effect on stocks. With a new President promising aggressive growth polices and a supportive Congress in place to make it happen, the Trump plan is now being coined as Trumponomics.

As we discussed last week, the markets are reflecting this hand-off, from a Fed driven economy to a pro-growth government driven economy, positively — pricing in a period of hot growth. And it couldn’t come at a better time — in fact, it may come at the perfect time.

The Fed has been able to manufacture stability but not demand and inflation. Fiscal stimulus is designed to fill that void — to boost aggregate demand and inflation. That’s why the bond market has shifted gears so dramatically, now reflecting a world with a trillion dollar infrastructure spend on the table, tax cuts, deregulation and incentives to get $2.5 trillion of U.S. corporate capital repatriated. Prior to last week, despite all of the best efforts from global central banks, and a Fed that was telegraphing a removal of emergency policies, the bond market was reflecting a world that was in depression, with the 10-year yield well below 2% in the U.S. and negative rates throughout much of the world. Today the U.S. 10 year traded above 2.25%, returning to levels we saw last December, when the Fed made its first post-crisis rate hike.

As we’ve discussed, growth has a way of solving a lot of problems, including our debt problem. Politicians and economists love to scare people by emphasizing the enormity of our debt (close to $20 trillion). But our debt size is all relative — relative to the size of our economy, and relative to what’s going on in the rest of the world.

Take a look at this table…

| General Government Gross Debt as % of GDP |

|

2007 |

Latest |

Change |

| United States |

63% |

104% |

65% |

| United Kingdom |

44% |

89% |

102% |

| Japan |

187% |

229% |

22% |

| Italy |

103% |

132% |

28% |

| Germany |

64% |

71% |

11% |

| Canada |

64% |

92% |

43% |

Source: Billionaire’s Portfolio, TradingEconomics.com

You can see, in a major economic downturn, debt tends to rise. And it has for everyone. The downturn has been global. And the rise in debt has been global.

The fears that a big debt load will lead to a dumping of the dollar, hyper-inflation and runaway interest rates don’t fit in this picture of a broadly weak recovery from a paralyzing global debt bust. Coming out of the worst global recession since World War II, inflation hasn’t been the problem. It’s been deflation. Inflation will be a concern when the structural issues are on the mend, employment is robust, confidence is high and the real economy is working. That hasn’t happened. But an aggressive and targeted government spending plan can finally start changing that dynamic.

And the markets are telling us, an inflationary environment is welcomed – it comes with signs of life.

Gold is the widely-loved inflation hedge. And gold isn’t rising out of concerns of overindebtedness. It’s falling hard in the past week, in favor of growth.

With this in mind, we may very well be entering an incredible era for investing – after a long slog. And an opportunity for average investors to make up ground on the meager wealth creation and retirement savings opportunities of the past decade, or more. For help, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio is up 16% this year. That’s 2.5 times the performance of the broader stock market. Join me here.

November 8, 2016, 4:00pm EST

As we head into the election, everyone involved in markets is trying to predict how stocks will perform on the results. When the Clinton email scandal bubbled up again, the stock market lost ground for nine straight days, the longest losing streak since 1980. Since the probe has allegedly ended, stocks have been up.

Does it mean Clinton is good for stocks and Trump is bad for stocks? Not likely.

Big institutional money managers think they have a better understanding of what the world will look like under Clinton than Trump, and therefore feel more compelled to go on with business as usual heading into the event (i.e. allocating capital across the stock market) with the expectation of a Clinton win, and conversely, they’re not as compelled to do so with the expectation that Trump might win (i.e. they sit tight and watch).

When they sit on their hands, liquidity in markets shrinks, and speculators can push the stock market around.

With that, is there any predictive value in the either moves in stocks of the past two weeks? Not likely. No matter what the outcome, your 401k money will continue to flow to Wall Street, and stocks will be bought with that money. Moreover, central banks have been in control and remain in control. They’ve been responsible for the global economic recovery of the past nine years, and for creating and maintaining relative economic stability. And stable to higher stocks play a big role in the coordinated strategies of the world’s biggest central banks. Neither the economic recovery, nor the stock market recovery can be credited much to politicians.

If anything, politicians (both parties) have been a drag on recovery, which has lead to the threatening “stagnation forever” malaise that is saddling economies across the globe. From mis-spending early fiscal stimulus, to ignoring central banks cries for much needed targeted spending programs, they’ve proven to be an impediment in the economic recovery.

In this environment, in the long run, the value of the new President for stocks will prove out only if there’s structural change. And structural change can only come when the economy is strong enough to withstand the pain. And getting the economy to that point will likely only come from some big and successfully executed fiscal stimulus.

Now, as we head into tonight’s results, as we’ve been told, a Clinton win remains the clear favorite (a known quantity). And Trump has always represented the vote that the unknown is better than the known.

This vote for some time has looked very much like the Brexit vote (the UK’s vote to leave the European Union), and the Grexit vote (Greece’s vote against austerity). As with the Trump vote, the buildup to both Grexit and Brexit were accompanied by threats from trusted officials of draconian outcomes for the people. But as we know, the Greek and British shocked the world by voting for the unknown, over the known.

Let’s take a look at how things looked going into those votes and how it compares to today’s election…

As we headed into the Greek vote in July of last year. It was thought to be a done deal that the Greek people would vote in favor of another bailout package from the European Union (and accept more austerity for fear of an apocalyptic outcome from voting no). The bookmakers put the “yes” vote at 71% chance of occurring. A UK bookmaker paid out those voting “yes” four days before the vote. The “no” vote won, shocking the world with 61% of the vote.

And then there was Brexit …

The UK vote was about trade, immigration, ability to work and live in other EU countries — perhaps mostly about control and politics.

The bookmakers had the chances of a “leave” vote as slim (at about 70/30 favoring the ‘stay’ camp). When voting day arrived, the chances of a “leave” vote had dropped to just 25%. But the British people shocked the world, voting to leave by 52% to 48%.

Going into today’s vote, the chances they’re giving Trump are spot on with the Brexit odds going into the day of the referendum. Of course, it’s not a popular vote. The electoral vote creates a bigger hurdle for voting the candidate of the “unkown” in this case.

If you haven’t joined our Billionaire’s Porfolio yet, you can click here to get started.

September 27, 2016, 4:30pm EST

The debate last night was entertaining. It’s sad to see how the media manipulates facts and cherry picks quotes to fit their narrative.

But that’s what they do and it ultimately shapes views for voters, unfortunately.

Today, I want to focus on China and Trump’s comments on China’s currency manipulation. Everyone knows the U.S. has lost jobs to China. Everyone knows China has become the world’s manufacturer. But not everyone knows how they did it.

Is it just because the labor is so cheap? Or is there more to it?

There’s more to it. A lot more.

China’s biggest and most effective tool is and always has been its currency. China ascended to the second largest economy in the world over the past two decades by massively devaluing its currency, and then pegging it at ultra–cheap levels.

Take a look at this chart …

In this chart, the rising line represents a weaker Chinese yuan and a stronger U.S. dollar. You can see from the early 80s to the mid 90s, the value of the yuan declined dramatically, an 82% decline against the dollar. They trashed their currency for economic advantage – and it worked, big time. And it worked because the rest of the world stood by and let it happen.

For the next decade, the Chinese pegged their currency against the dollar at 8.29 yuan per dollar (a dollar buys 8.29 yuan).

With the massive devaluation of the 80s into the early 90s, and then the peg through 2005, the Chinese economy exploded in size. It enabled China to corner the world’s export market, and suck jobs and foreign currency out of the developed world. This is precisely what Donald Trump is alluding to when he says “China is stealing from us.”

Their economy went from $350 billion to $3.5 trillion through 2005, making it the third largest economy in the world.

This next chart is U.S. GDP during the same period. You can see the incredible ground gained by the Chinese on the U.S. through this period of mass currency manipulation.

And because they’ve undercut the world on price, they’ve become the world’s Wal-Mart (sellers to everyone) and have accumulated a mountain for foreign currency as a result. China is the holder of the largest foreign currency reserves in the world, at over $3 trillion dollars (mostly U.S. dollars). What do they do with those dollars? They buy U.S. Treasuries, keeping rates low, so that U.S. consumers can borrow cheap and buy more of their goods – adding to their mountain of currency reserves, adding to their wealth and depleting the U.S. of wealth (and the cycle continues).

The U.S. woke up in 2005, and started threatening tariffs against Chinese goods unless they abandoned their cheap currency policies. China finally conceded (sort of). They agreed to abandon the peg to the dollar, and to start appreciating their currency.

They allowed the currency to strengthen by about 4.5% a year from 2005 through 2013. That might sound good, but that was a drop in the bucket compared to the double digit pace the Chinese economy was growing at through most of that period. Still, the U.S. passively threatened along the way, but allowed it to continue.

With that, the Chinese economy has ascended to the second largest economy in the world now – on pace to the biggest soon (though it still has just an eight of the per capita GDP as the U.S.). But China’s currency is a bigger threat, at this stage, than just the emergence of China as an economic power. The G-20 (the group of the world’s top 20 economies) has had China’s weak currency policy at the top of its list of concerns for a reason.

The current global imbalances are the underlying cause of the global financial crisis, and China’s currency is at the heart of it.

And without a more fairly valued yuan, repairing those imbalances — those lopsided economies too dependent upon either exports or imports — isn’t going to happen. It’s a recipe for more cycles of booms and busts … and with greater frequency.

Are big tariffs the answer? Historically that’s a recipe for disaster, economically and geopolitically.

What’s the solution? I’ve thought that the Bank of Japan will ultimately crush the value of the yen, as the answer to Japan’s multi-decade economic malaise and as an answer to the stagnant global economic recovery. It’s an answer for everyone, except China. A much weaker yen could crush the China threat, by displacing China as the world’s exporter.

If you’re looking for great ideas that have been vetted and bought by the world’s most influential and richest investors, join us at Billionaire’s Portfolio. We have just exited an FDA approval stock for a quadruple. And we’ll be adding a two new high potential billionaire owned stocks to the portfolio very soon. Don’t miss it. Join us here.

September 26, 2016, 3:45pm EST

All eyes are on the Presidential debate/face-off tonight. Heading into the event, stocks are lower, yields are lower and the dollar is lower — all a “risk-off” tone.

And the VIX (implied S&P 500 vol/an indicator of uncertainty) has popped higher from the very low levels it had returned to as of Friday. Speculators are out today making bets on a political firework show tonight, and thus betting on more uncertainty in the outcome and in post-election policy making.

If we step back a bit though, given the difficulties in getting through the legislative process, the biggest potential market influence from the election may be more about the prospects of getting a fiscal stimulus package done, rather than the many promises that are made on an campaign trail. Both candidates have been out promising a spending package to boost the economy. And on the heals of a package from Japan, and the unknown risks from Brexit, the idea is becoming more politically palatable.

As we discussed on Friday, the Fed has taken a strategically more pessimistic public view on the economy, in effort to underpin the current economic drivers in place (stability, low rates and incentives to reach for risk).

Following the Fed and BOJ events last week, the 10-year yield is back in the 1.50s and sitting in a big technical level. This will be an important chart to keep an eye on tomorrow.

If you’re looking for great ideas that have been vetted and bought by the world’s most influential and richest investors, join us at Billionaire’s Portfolio. We have just exited an FDA approval stock for a quadruple. And we’ll be adding a two new high potential billionaire owned stocks to the portfolio very soon. Don’t miss it. Join us here.

As I said

As I said