May 9, 5:00 pm EST

Yesterday we talked about the tool China will use to offset tariffs, if a deal does not materialize and the tariff penalty increases.

They will devalue their currency.

With a “no deal” potential outcome, there’s a lot of wealth in China looking for ways out.

In recent years, they have found a way out through Bitcoin. And, no coincidence, Bitcoin is again on the move.

With that, let’s take a look at the timeline on Bitcoin…

The 2016-2017 ascent of Bitcoin coincided perfectly with the crackdown on capital flight in China. In late 2016, with rapid expansion of credit in China, growing non-performing loans, a soft economy and the prospects of a Trump administration that could put pressure on China trade, capital was moving aggressively out of China.

That’s when the government stepped UP capital controls — restricting movement of capital out of China, from transfers to foreign investment.

Of course, resourceful Chinese still found ways to move money. Among them, buying Bitcoin. And that’s when Bitcoin started to really move (from sub-$1,000 to over $19,000). China cryptocurrency exchanges were said to account for 90% of global bitcoin trading.

Chinese capital flows were confused for Silicon Valley genius.

But in late 2017, China cracked down on Bitcoin – with a total ban. A few months later, Bitcoin futures launched, which gave hedge funds a liquid way to short the madness. Bitcoin topped the day the futures contract launched.

So, as Chinese officials visit the White House for a deal or no deal on trade, China has been moving their currency lower — and bitcoin has (again) been moving higher. Perhaps the Chinese are finding new ways to buy Bitcoin.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

May 3, 5:00 pm EST

If you are a regular reader of my daily notes, you’ll know we’ve been discussing the setup for positive surprises all year.

As we’re near the end of Q1 earnings season, clearly we’re getting it. With 78% of the companies in the S&P 500 now reported on Q1 earnings, 76% have beat earnings estimates.

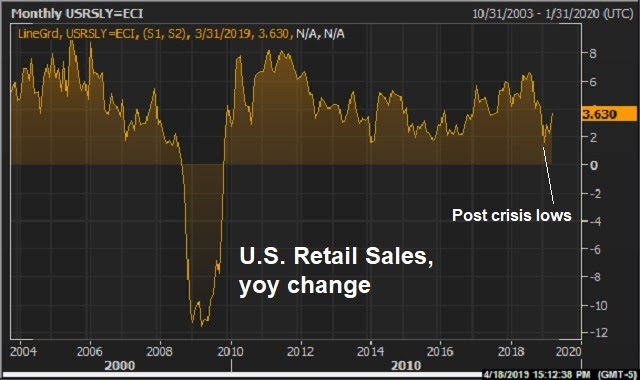

And we’re getting positive surprises in the economic data. We had a huge positive surprise for Q1 GDP this week. And today we had a blow out jobs report.

There were 263k jobs added in April. The market was expecting just 185k. That gives us a 12-month average of 218k, well above pre-financial crisis average monthly job growth! The unemployment number was 3.6% — the lowest since 1969.

Remember, we’ve been told all year long that we were headed for both earnings and economic recession. It’s not happening.

Moreover, the two missing pieces of the economic recovery puzzle, have been productivity and wage growth. And these pieces are emerging. Wage growth has been on the move for the past 18 months, now sustaining above 3%. And we had a huge positive surprise in productivity this week.

With the above in mind, given the contrast of media narrative and reality, how are people getting it so wrong? I suspect we are seeing plenty of people make the mistake of letting politics cloud their judgement on the economy and the outlook for stocks.

April 8, 5:00 pm EST

As we discussed on Friday, the overhang of risks to markets, to the Trump administration and to the economy are as light as we’ve seen in quite some time.

With this in mind, we have a fairly light data week – which means the likelihood of a disruption in the rise in stocks and risk appetite remains low.

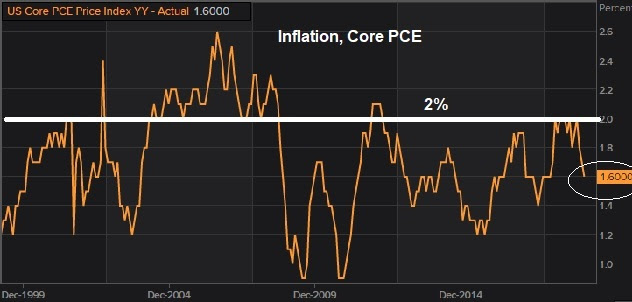

We get some inflation data this week, which should be tame, justifying the central bank dovishness we’ve seen in recent months. The ECB meets this week. They’ve already walked back on the idea that they might hike rates this year. Expect Draghi to hold the line on that. The Chinese negotiations have positive momentum, with reports over the weekend that talks last week advanced the ball. And we have another week before Q1 earnings season kicks in.

So, expect the upward momentum to continue for stocks. Just three months into the year and stocks are up big, and back near record highs in the U.S.. The S&P 500 is up 15% year-to-date. The DJIA is up 13%. Nasdaq is up 20%. German stocks are up 13%. Japanese stocks are up 11%. And Chinese stocks are up 32%.

Remember, we’ve talked about the signal Chinese stocks might be giving us, putting in a low on the day the Fed did it’s about face on the rate path, back on January 4th.

The aggressive bounce we’ve since had in Chinese stocks appears to be telegraphing the bottoming in the Chinese economy. That’s a big relief signal for the global economy. Commodities prices are supporting that view (sending the same signal). Oil is now up 42% on the year. And the CRB industrial metals index is up 24%.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors.

Join now and get your risk free access by signing up here.