September 26, 5:00 pm EST

The Fed moved again today on rates, as the market expected. This is the eighth quarter point hike in this post-QE normalization on rates. And this now puts the Fed Funds rate at the range of 2%-2.25%.

Now, the markets will pick apart the statement and endlessly parse the Fed Chair’s words in the press conference. But let’s step back and take a look at the impact of these Fed hikes thus far.

We know the economy is running at the best pace since before the financial crisis. We know that the jobless rate is near record lows. We know that consumer credit worthiness is at record levels. This has all happened, despite the Fed’s rate hikes.

What about debt service coverage? As rates are moving higher, are consumers showing signs of getting squeezed?

If we look back at the height of the credit bubble in 2008 (just prior to its burst), 13.22% of household income was going to service debt–within that number, 7.2% of household income was going to service mortgage debt. What about now? Debt service is now 10.2% of household income. And the mortgage piece is down to just 4.4%. This is the result of six years of zero interest rates, a massive QE program (which included the Fed’s purchase of mortgage bonds), and a government program that subsidized banks to refi high interest rate mortgages.

So the big question is, how has the Fed’s exit of QE effected the consumers ability to service debt? Are higher rates hurting?

Well, they started hiking rates in the fourth quarter of 2015. Total debt service at that time was 10.1%. That’s virtually unchanged from today. And the mortgage piece was 4.5%. That’s actually a touch higher than today.

Bottom line: The Fed’s normalization on rates has not damaged the consumer, nor has it killed the housing market.

But that’s only because the yield curve has been flattening. That is, longer term market interest rates have been steady. That means the benchmark rate from which consumer and mortgage rates have been set, has been steady. And those longer term rates have been steady, in large part, because Europe and Japan have remained in QE mode (buying global assets, which includes our Treasurys).

With that, while most have been watching the Fed closely for how it’s delicately handling the exit of QE, the more important spot to watch will be how Europe and Japan manage their exits. Hopefully, the U.S. economy is hot enough, at that point, to withstand the move in longer term U.S. rates that will come with the end of global QE.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

September 18, 5:00 pm EST

Yesterday Trump made good on his promise by announcing another $200 billion in tariffs on China.

To the surprise of many, stocks went up. Why?

Perhaps it’s because reforming the way the world deals with China is a good thing. Remember, China’s currency manipulation over the past two decades led to the credit bubble, which ultimately led to the financial crisis. And as long as the rest of the world continues to allow China to maintain a trade advantage (dictated by their currency manipulation): 1) they will manufacture hot economic growth through exports, 2) the global cycle of booms and bust will continue, and 3) the wealth transfer from the rest of the world to China will continue.

With this in mind, as I’ve said, the trade dispute is all about China – everything else Trump has taken on (Canada, Mexico, Europe) has been to gain leverage on getting movement in China.

With Trump now making it very clear that he won’t back down until major structural change takes place in China, it’s no surprise that one of the biggest winners of the day (following the further economic sanctions on China) was Japan!

The Nikkei was up big today. And it was Japanese stocks that set the tone for global markets on the day. As a signal that China’s days of cornering the world’s export markets may be coming to an end, Japan is in position to be a big winner.

Remember, while much of the world has returned to new record highs following the global financial crisis, Japan remains 40% away from the record highs set nearly 30 years ago.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

January 25, 7:00 pm EST

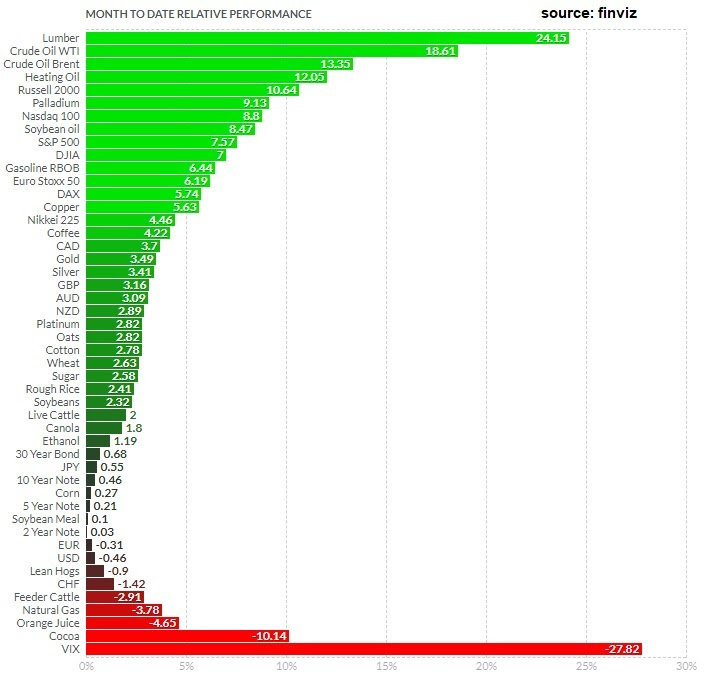

Yesterday we talked about the commodities bull market and the move underway in natural gas.

That all continued today, thanks in part to a comment by the U.S. Treasury Secretary, saying “obviously a weaker dollar is good for us.” When the dollar goes down, commodities prices tend to go up, since they are largely priced in dollars. As such, commodities were the top performers of the day – beginning to gain more momentum at multi-year highs.

But as we’ve seen from this chart, this recovery in commodities, which has dramatically lagged in the reflation trade, has a long way to go.

While the markets reacted as if Mnuchin, the Treasury Secretary, was talking down the dollar, the dollar is already in a long-term bear market cycle.

Remember, we looked at this chart (below) of the long-term dollar cycles back in June…

And I said, “if we mark the top of the most recent cycle in early January, this bull cycle has matched the longest cycle in duration (at 8.8 years) and comes in just shy of the long-term average performance of the five complete cycles. The most recent bull cycle added 47%. The average change over a long-term cycle has been 56%. This all argues that the dollar bull cycle is over. And a weaker dollar is ahead. That should go over very well with the Trump administration.”

The dollar is down about 8% since then and is breaking down technically now.

The dollar index is now down 14% in this new bear cycle. And these are the early innings. Based on the dollar cycle, it has a long way to go, and should last for another 5 to 7 years.

So, this dollar outlook is further support for the case for a big run in commodities we’ve been discussing. And as we observed yesterday, in the case of Chesapeake Energy (CHK), the second largest producer of natural gas in the country, the commodities stocks are still extremely underpriced if this scenario for commodities plays out.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.