January 22, 11:00 am EST

With a government shutdown over the weekend, today I want to revisit my note from last month (the last time we were facing a potential government shutdown) on the significance of the government debt load.

The debt load is an easy tool for politicians to use. And it’s never discussed in context. So the absolute number of $19 trillion is a guarantee to conjure up fear in people – fear that foreigners may dump our bonds, fear that we may have runaway inflation, fear that the economy is a house of cards. So that fear is used to gain negotiating leverage by whatever party is in a position of weakness. For the better part of the past decade, it was used by the Republican party to block policies. And now it’s being used by the Democratic party to try to block policies.

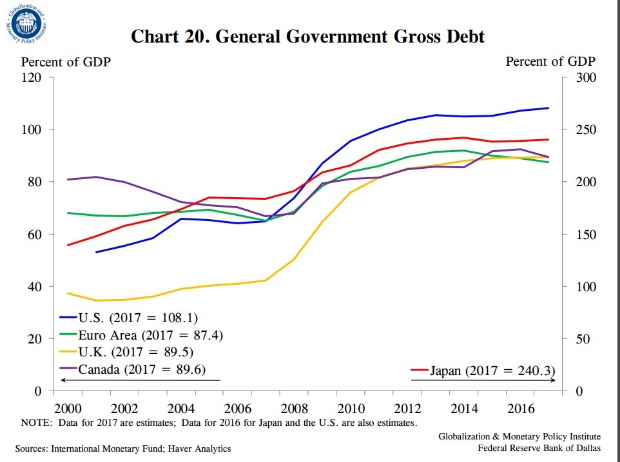

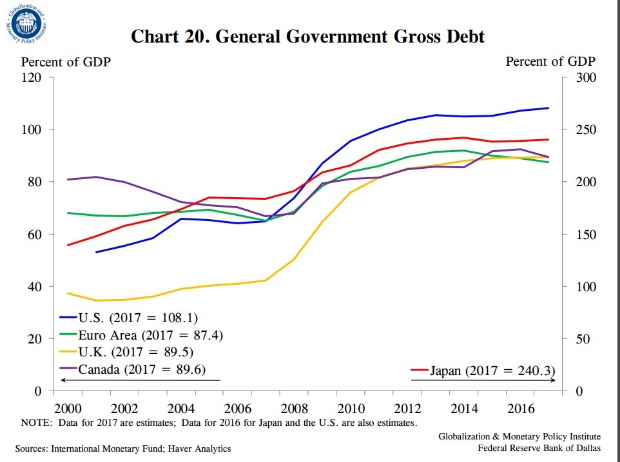

Now, the federal debt is a big number. But so is the size of our economy – both about $19 trillion. And while our debt/GDP has grown over the past decade, the increase in sovereign debt relative to GDP, has been a global phenomenon, following the financial crisis. Much of it has to do with the contraction in growth and the subsequent sluggish growth throughout the recovery (i.e. the GDP side of the ratio hasn’t been carrying its weight).

You can see in the chart below, the increasing debt situation isn’t specific to the U.S.

Now, we could choose to cut spending, suck it up, and pay down the debt. That’s called austerity. The choice of austerity in this environment, where the economy is fragile, and growth has been sluggish for the better part of ten years, would send the U.S. economy back into recession. Just ask Europe. After the depths of the financial crisis, they went the path of tax hikes and spending cuts, and by 2012 found themselves back in recession and a near deflationary spiral – they crushed the weak recovery that the European Central Banks (and global central banks) had spent, backstopped and/or guaranteed trillions of dollars to create.

The problem, in this post-financial crisis environment: if the major economies in the world sunk back into recession (especially the U.S.), it would certainly draw emerging markets (and the global economy, in general) back into recession. And following a long period of unprecedented emergency monetary policies, the global central banks would have limited-to-no ammunition to fight a deflationary spiral this time around.

Now, all of this is precisely why the outlook for the U.S. and global economy changed on election night in 2016. We now have an administration that is focused on growth, and an aligned Congress to overwhelm the political blocking. That means we truly have the opportunity to improve our relative debt-load through growth.

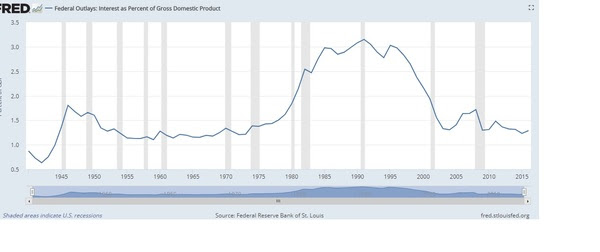

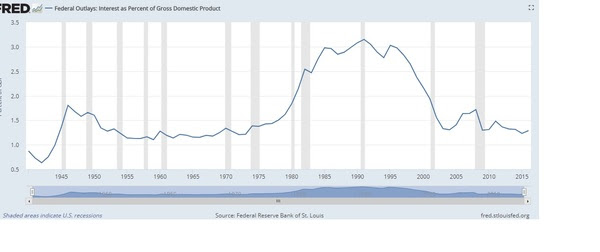

In the meantime, despite all of the talk, our ability to service the debt load is as strong as it’s been in forty years (as you can see in the chart below). And our ability to refinance debt is as strong as it’s been in sixty years.

For help building a high potential portfolio, follow me in our Forbes Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

government shutdown, washington, wall street, economy

January 16, 4:00 pm EST

Stocks reversed after a hot opening today. With a quiet data week ahead, the focus is on the prospects of a government shutdown.

If this sounds familiar to you, it should. Government debt is the, often played, go-to political football.

It was only last month that we were facing a similar threat. But with some policy-making tailwinds on one side of the aisle, the fight was politically less palatable in December. With that, Congress passed a temporary funding bill to kick the can to this month.

And just three months prior to that, in September, we had the same showdown, same result. The “government shutdown” card was being played aggressively until the hurricanes rolled through. From that point, politicians had major political risk in trying to fight hurricane aid. They kicked the can to December to approve that funding.

Now, the Democrats feel like they have some leverage, and their using the threat of a government shutdown to make gains on their policy agenda. So, how concerned should we be about a government shutdown (which could come on Friday)? Would it derail stocks?

If you recall, there was a lot of fuss and draconian warnings about an impending government shutdown back in 2013. The government was shutdown for 16 days. Stocks went up about 2%. Before that was 1995-1996 (stocks were flat), and 1990 (stocks were flat).

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

May 17, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Yesterday we talked about the disconnect between the daily drama from the media in Washington (doom and gloom), and what the markets have been communicating (an economic expansion is underway). Today, you might think that connection is happening — the doom and gloom scenario is finally being realized in markets. Probably not.

Yesterday we talked about the disconnect between the daily drama from the media in Washington (doom and gloom), and what the markets have been communicating (an economic expansion is underway). Today, you might think that connection is happening — the doom and gloom scenario is finally being realized in markets. Probably not.

For perspective: As of the close yesterday, the Nasdaq was up 18% year to date (just five months in). Gold was in the middle of a three year range. Market interest rates (the U.S. 10-year government bond yield) was just above the middle of the range of the past four years. The dollar was not far off its strongest levels in 15 years.

Today the media has explicitly printed the headline of impeachment for Trump (actually, they’ve run those headlines a various times over the past several months). Nonetheless, stocks (the S&P 500) today are off by 1.6%.

This gets the bears very excited. I saw the story about consumer debt, surpassing 2008 levels, floating all over the internet today. People tried to make the bubble connection — implying another debt crisis was coming.

The real story: Total household indebtedness finally surpassed the previous peak from 2008. That’s precisely what the Fed was attempting to do with zero interest rates. Make existing debt cheaper to manage, and at some point, break the psychology of the debt burden and get people borrowing (at ultra-cheap rates), investing and spending again. Otherwise, our economy and the world economy would have gone into a deflationary spiral.

That said, as I’ve found in my 20 years in this business, people tend to find a story to fit the price. The story hadn’t been fitting the price for much of the past six months. Today, it seems pretty easy. See the chart below of stocks ….

We had the first breakdown of the Trump trend in March, but all it could muster was about a 3% correction. This looks much more like a technical correction (a double top, and trend break today) – than a Trump impeachment trade. I suspect with the earnings catalyst behind us, this is the start of a deeper technical correction, which is healthy in a bull market. And it may take significant progress made in tax reform to see new highs in the broad stock indicies. We shall see.This next chart is the dollar index. This too had a significant trend break today. This translates into a higher euro, which would spell out a story where Europe is improving and the ECB is able in start discussing exit from QE.

What about the Trump/Comey saga? Aren’t people dumping dollars because of that? Not likely. If that were potentially destabilizing to the U.S., it would be destabilizing to the global economy, and people would buy dollars not sell them.

With that in mind, here’s gold. Gold sits on the brink of a big trend break (higher). When looking at gold and the dollar, it’s important to remember this: back in the heat of the crisis, gold and the dollar moved

together, higher! That’s opposite of the traditional correlation. They moved higher together because people bought gold and they bought dollars (and dollar denominated assets, like Treasuries) as they viewed it the safest alternative in the world to park money – with the chance of getting it back.

With a break higher in gold looking imminent, and the dollar looking lower, it looks like a more traditional relationship. It’s not communicating crisis.

Follow This Billionaire To A 172% Winner

In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!

Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.

So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO.

Yesterday we talked about the disconnect between the daily drama from the media in Washington (doom and gloom), and what the markets have been communicating (an economic expansion is underway). Today, you might think that connection is happening — the doom and gloom scenario is finally being realized in markets. Probably not.

Yesterday we talked about the disconnect between the daily drama from the media in Washington (doom and gloom), and what the markets have been communicating (an economic expansion is underway). Today, you might think that connection is happening — the doom and gloom scenario is finally being realized in markets. Probably not.