By Bryan Rich

October 13, 2017, 3:30 pm EST

Yesterday we talked about the case for commodities and the opportunity for a rotation into commodities stocks.

Yesterday we talked about the case for commodities and the opportunity for a rotation into commodities stocks.

The valuation of commodities relative to stocks has only been this disconnected (stocks strong, commodities weak) twice, historically over the past 100 years: at the depths of the Great Depression in the early 30s and toward the end of the Bretton Woods currency system.

That supports the case that we’re in the early days of a bull market in commodities, especially considering where we stand in the global economic recovery, underpinned by the “reflation” focus at both the monetary and fiscal policy levels. It’s a recipe for hotter demand for commodities.

With that, let’s take a look at a few charts as we close the week.

Copper

We talked about copper yesterday. This continues to ring the bell, alerting us that better economic growth is coming – maybe a boom.

Copper is up 6.5% in the past two weeks, back of $3 and closing in on the highs of the year – which is a three year high. And remember, we looked at the potential break of this big six-year downtrend back in August. That has broken, retested and confirms the trend change.

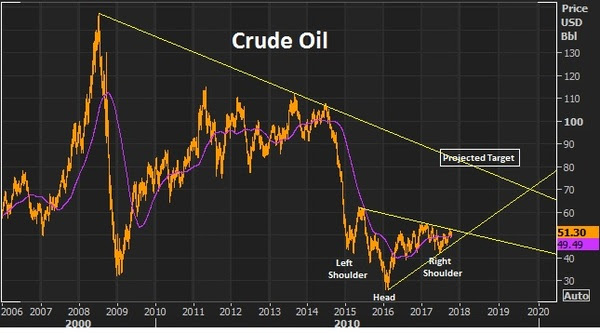

Crude Oil

We talked about the fundamental case for oil this week. And we looked at the technical case, as it made a brief test of the 200 day moving average and quickly bounced back. It’s up about 4% on the week.

We have this inverse head and shoulder (in the chart below) that projects a move back to the low $80s. And as part of that technical picture, we’re setting up for a break of a big two-year trendline that should open the doors to a move back into the $70+ oil area.

Iron Ore

Iron Ore

Iron ore was the biggest mover of the day – up 6% today. This has been a deeply depressed market through the post-financial crisis era. In addition to the broad commodities weakness, iron ore prices have suffered from the dumping of poor quailty iron ore by Chinese producers. Those times seem to be changing.

This week there was a fraud claim on a big Japanese steel maker for fudging it’s quality data. Keep an eye on this one as it could lead to more, and could lead to a supply disruption in industrial metals.

Then today we had Chinese data that showed record imports of iron ore. This is a signal that there’s both an envirionmental movement and an anti-dumping movement against low grade iron ore that has been influencing supply and prices (and crushing producers). This big Chinese data point is also in line with the message copper is sending: perhaps the Chinese economy is doing better than most think.

With that, let’s take a look at a few charts as we close the week. The valuation of commodities relative to stocks has only been this disconnected (stocks strong, commodities weak) twice, historically over the past 100 years: at the depths of the Great Depression in the early 30s and toward the end of the Bretton Woods currency system.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

September 18, 2017, 4:30 pm EST Invest Alongside Billionaires For $297/Qtr

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

As I said on Friday, people continue to look for what could bust the economy from here, and are missing out on what looks like the early stages of a boom.

We constantly hear about how the fundamentals don’t support the move in stocks. Yet, we’ve looked at plenty of fundamental reasons to believe that view (the gloom view) just doesn’t match the facts.

Remember, the two primary sources that carry the megahorn to feed the public’s appetite for market information both live in economic depression, relative to the pre-crisis days. That’s 1) traditional media, and 2) Wall Street.

As we know, the traditional media business, has been made more and more obsolete. And both the media, and Wall Street, continue to suffer from what I call “bubble bias.” Not the bubble of excess, but the bubble surrounding them that prevents them from understanding the real world and the real economy.

As I’ve said before, the Wall Street bubble for a very long time was a fat and happy one. But the for the past ten years, they came to the realization that Wall Street cash cow wasn’t going to return to the glory days. And their buddies weren’t getting their jobs back. And they’ve had market and economic crash goggles on ever since. Every data point they look at, every news item they see, every chart they study, seems to be viewed through the lens of “crash goggles.” Their bubble has been and continues to be dark.

Also, when we hear all of the messaging, we have to remember that many of the “veterans” on the trading and the news desks have no career or real-world experience prior to the great recession. Those in the low to mid 30s only know the horrors of the financial crisis and the global central bank sponsored economic world that we continue to live in today. What is viewed as a black swan event for the average person, is viewed as a high probability event for them. And why shouldn’t it? They’ve seen the near collapse of the global economy and all of the calamity that has followed. Everything else looks quite possible!

Still, as I’ve said, if you awoke today from a decade-long slumber, and I told you that unemployment was under 5%, inflation was ultra-low, gas was $2.60, mortgage rates were under 4%, you could finance a new car for 2% and the stock market was at record highs, you would probably say, 1) that makes sense (for stocks), and 2) things must be going really well! Add to that, what we discussed on Friday: household net worth is at record highs, credit growth is at record highs and credit worthiness is at record highs.

We had nearly all of the same conditions a year ago. And I wrote precisely the same thing in one of my August Pro Perspective pieces. Stocks are up 17% since.

And now we can add to this mix: We have fiscal stimulus, which I think (for the reasons we’ve discussed over past weeks) is coming closer to fruition.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

September 14, 2017, 4:00 pm EST Invest Alongside Billionaires For $297/Qtr

Yesterday we looked at the charts on oil and the U.S. 10 year yield. Both were looking poised to breakout of a technical downtrend. And both did so today.

Here’s an updated look at oil today.

And here’s a look at yields.

We talked yesterday about the improving prospects that we will get some policy execution on the Trumponomics front (i.e. fiscal stimulus), which would lift the economy and start driving some wage pressure and ultimately inflation (something unlimited global QE has been unable to do).

No surprise, the two most disconnected markets in recent months (oil and interest rates) have been the early movers in recent days, making up ground on the divergence that has developed with other asset classes.

Now, oil will be the big one to watch. Yields have a lot to do, right now, with where oil goes.

Though the central banks like to say they look at inflation excluding food and energy, they’re behavior doesn’t support it. Oil does indeed play a big role in the inflation outlook – because it plays a huge role in financial stability, the credit markets and the health of the banking system. Remember, in the oil price bust last year the Fed had to reverse course on its tightening plan and other major central banks coordinated to come to the rescue with easing measures to fend off the threat of cheap oil (which was quickly creating risk of another financial crisis as an entire shale industry was lining up for defaults, as were oil producing countries with heavy oil dependencies).

So, if oil can sustain above the $50 level, watch for the inflation chatter to begin picking up. And the rate hike chatter to begin picking up (not just with the Fed, but with the BOE and ECB). Higher oil prices will only increase this divergence in the chart below, making the interest rate market a strong candidate for a big move.

Join our Billionaire’s Portfolio today to get your portfolio in line with the most influential investors in the world, and hear more of my actionable political, economic and market analysis. Click here to learn more.

August 21, 2017, 6:00 pm EST Invest Alongside Billionaires For $297/Qtr

After a week away, I return to markets that look very similar to where we left off 10 days ago. Stocks lower. Yields lower. The dollar lower. But commodities higher!

Now, this takes into account, another week of political volatility in Washington. It takes into account another week of uncertainty surrounding North Korea.

What’s important here, is distinguishing between a price correction and a real thematic change. If we’re not making new record highs in stocks every day, and stocks actually retrace 5% or so, does that represent the derailing of the slow but steady economic recovery and, as important, the dismissal of potential policy fuel that could finally lift us out of the post-crisis stall speed growth regime?

The narrative in the media would have you believe the answer is yes.

But the reality is, the economic recovery is stable and continuing. The policy stimulus has been a tough road, but continues to offer positive influence on the economy. And there are strong technical reasons to believe we’re seeing the early stages of a price driven correction in stocks.

Remember, we looked at the big technical reversal signal (the “outside day”) back on August 8th. That was the technical signal, and it was about as good a signal as it gets. The Dow had been plowing to new highs for eleven consecutive days — culminating in another new record high before. And the last good ‘outside day’ in the S&P 500 was into the rally that stalled December 2, 2015 and it resulted in a 14% correction.

Here’s another look at that chart, plus the first significant trend line that we discussed in my last note, August 11th.

I thought this line would give way, which it has today, and that we would see a real retracement, which should be a gift to buy stocks. If you’re not a highly leveraged hedge fund, a 5%-10% retracement in broader stocks is a gift to buy. Remember, the slope of the S&P 500 index over time is UP.

Prior to the reversal signal in stocks, we had already addressed the influence of the FAANG stocks. And I suggested the miss in Amazon earnings was a good enough excuse to cue the profit taking in what had been a very lucrative trade in the institutional investment community. Amazon is now down 12% from the highs of just 18 days ago.

What should give you confidence that the economic outlook isn’t souring? Commodities!

The base metals, as we’ve discussed in recent weeks, continue to move higher and continue to look like early stages of a bull market cycle — which would support the idea that the global economic recovery is not only on track, but maybe better than the consensus market view (which seems to be still unconvinced that better times are ahead).

The leader of the commodities run is copper. We looked at this chart in my last note (Aug 11). I said, “this big six-year trend line in copper (below) will be one to watch closely. If it breaks, it should lead the commodities trend higher.”

Here’s an updated chart of Copper. This trend line was broken today.

Join me in our Billionaire’s Portfolio and get my recommendation on a commodities stock with potential to be a six-fold winner in the commodities recovery. Click here to learn more.

March 20, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

We had a heavy event calendar last week for markets, with the Fed, BOJ and BOE meetings. And then we had the anticipation of the G-20 Finance Minister’s meeting as we headed into the weekend.

As I said to open the week last week, markets were pricing in a world without disruptions. But disruptions looked likely. Still, the week came and went and stocks were little changed on the week, but yields came in lower (despite the Fed’s third rate hike) and the dollar came in lower (again, despite the Fed’s third rate hike).

Is that a signal?

Maybe. But as we discussed on Friday, the divergence between market rates and the rate the Fed sets is part central bank-driven Treasury buying (from those still entrenched in QE — Japan, Europe), and part market speculation that higher rates are threatening to the economy, and therefore traders sell short term Treasuries (rates go higher) and buy longer term Treasuries (rates go lower). With that, the Fed has been ratcheting the Fed Funds rate higher, now three times, but the 10 year government bond yield is doing nothing.

As for the dollar, if your currency has been weak, no one wanted to head into a G-20 Finance Ministers meeting and sit across the table from the new Treasury Secretary under the Trump administration (Mnuchin) and be drawn into the fray of currency manipulation claims. With that, the dollar weakened across the board last week.

All told, we had little disruption last week, but things continue to look vulnerable this week. Today we have the FBI Director testifying before Congress and acknowledging an open investigation of Trump associates contacts with Russia during the election. Fed officials have already been out in full force today make a confusing Fed picture even more confusing. And it sounds like the UK will officially notify the EU on March 29 that they will exit.

With all of the above in mind, and given the growth policies from the Trump administration still have little visibility on “when” they might get things done, the picture for markets has become muddied.

This all makes stocks vulnerable to a correction, though dips should be met with a lot of buying interest. Perhaps the clearest trade in this picture that’s become more confusing to read, is gold.

Gold jumped on the Fed rate hike last week, and Yellen’s more hawkish tone on inflation. If she’s right, gold goes higher. If she’s wrong, and the Fed has made a big mistake by hiking three times in a world that still can’t sustain much growth or inflation, gold probably goes higher on the Fed’s self-inflicted wounds to the economy.

In our Billionaire’s Portfolio, we’re positioned in a portfolio of deep value stocks that all have the potential to do multiples of what broader stocks do — all stocks owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and we’ll send you our recently recorded portfolio review that steps through every stock in our portfolio, and the opportunities in each.

February 13, 2017, 3:30pm EST Invest Alongside Billionaires For $297/Qtr

Stocks continue to print new record highs. Let’s talk about why.

Stocks continue to print new record highs. Let’s talk about why.

First, as we know, the most powerful underlying force for stocks right now is prospects of a massive corporate tax cut, deregulation, a huge infrastructure spend and trillions of dollars of corporate repatriation coming. But quietly, among all of the Trump attention, earnings are also driving stocks. More than 70% of S&P 500 companies have reported. About 2/3rds of the companies have beat Wall Street estimates. And most importantly, earnings in Q4 have grown at 3.1% year-over-year. That’s the first consecutive positive growth reading since Q4 2014/ Q1 2015.

Meanwhile, yields have remained quiet. And oil prices have remained quiet. That’s positive for stocks. Take a look at the graphic below …

You can see, stocks and most commodities continue to rise on the growth outlook. Yields and energy should be rising too. But the 10 year yield has barely budged all year — same for oil. Of course, higher rates, too fast, are a countervailing force to the pro-growth policies. Same can be said for higher oil too fast. With that, both are adding more “fuel” to stocks.

On the rate front, we’ll hear from Janet Yellen this week, as she gives prepared remarks on the economy to Congress, and takes questions.

She’s been a communications disaster for the Fed. Most recently, following the Fed’s December rate hike, she backtracked on her comments made a few months prior, when she said the Fed would let the economy run hot. She denied that in December. Still, the 10-year yield is about 10 basis points lower than where it closed following that December press conference. I wouldn’t be surprised to see a more dovish tone from Yellen this time around, in effort to walk market rates a little lower, to take the pressure off of the Fed and to continue stimulating optimism about the economy.

On Friday we looked at four important charts for markets as we head into this week: the dollar/yen exchange rate, the Nikkei (Japanese stocks), the DAX (German Stocks), and the Shanghai Composite (Chinese stocks).

With U.S. stocks printing new record highs by the day, these three stock markets are ready to make a big catch-up run. It’s just a matter of when. And I argued that a positive tone coming from the meeting of U.S. and Japanese leadership, under the scrutiny of trade tensions, could be the greenlight to get these markets going. That includes a stronger dollar vs. the yen. All are moving in the right direction today.

On the China front, we looked at this chart on Friday.

As I said, “Copper has made a run (up 10% ytd). That typically correlates well with expectations of global growth. Global growth is typically good for China. Of course, they are in the crosshairs of Trump’s fair trade movement, but if you think there’s a chance that more fair trade terms can be a win for the U.S. and a win for China, then Chinese stocks are a bargain here.”

Copper is surged again today on a supply disruption and has technically broken out.

This should continue to spark a move in the Chinese stock market.

For help building a high potential portfolio for 2017, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.

Yesterday we talked about the case for commodities and the opportunity for a rotation into commodities stocks.

Yesterday we talked about the case for commodities and the opportunity for a rotation into commodities stocks.

![]()

![]() Iron Ore

Iron Ore

Stocks continue to print new record highs. Let’s talk about why.

Stocks continue to print new record highs. Let’s talk about why.