September 19, 5:00 pm EST

Just two weeks ago, the Nasdaq was up 19% on the year, while the “blue-chip” heavy DJIA was up just 4%.

This is in a world where rates are low, corporate profits are growing at 20% and the economy is on pace to have above trend growth.

Great traders love when prices are detached from fundamentals, especially when it’s driven by fear or euphoria. This was a clear disconnect. And you could argue that there has been a bit of both fear and euphoria driving it (fear priced into the Dow about trade wars, and euphoria priced into the tech giants on the idea that the burgeoning monopolies would go unchecked forever until all competition is left for dead).

Both the fear and the euphoria were misguided for all of the reasons we discuss almost daily in my Pro Perspectives note.

And now we’re seeing a convergence. In just two weeks, that performance gap between the Dow and Nasdaq has now closed from fifteen percentage points to nine percentage points. And the Dow still has a lot of room to run. It remains just under the highs from January.

Now, yesterday we talked about the opportunity for Japan to benefit from forced trade reform in China. Other big beneficiaries? Emerging market economies.

In short, all of the countries that have been short-changed on their global trade competitiveness because of China’s weak currency policies, should benefit in a world where China is held to a standard of fair trade.

That’s why Japanese stocks had a huge run yesterday (and expect it to continue). And that’s why EM stock markets were big movers today. The Frontier Markets ETF (FM) is still down 14% on the year. With the idea that these countries may get a better crack at global demand, I suspect these stock markets could be in for a big bounce.

If you haven’t joined the

Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can

join me here.

September 18, 5:00 pm EST

Yesterday Trump made good on his promise by announcing another $200 billion in tariffs on China.

To the surprise of many, stocks went up. Why?

Perhaps it’s because reforming the way the world deals with China is a good thing. Remember, China’s currency manipulation over the past two decades led to the credit bubble, which ultimately led to the financial crisis. And as long as the rest of the world continues to allow China to maintain a trade advantage (dictated by their currency manipulation): 1) they will manufacture hot economic growth through exports, 2) the global cycle of booms and bust will continue, and 3) the wealth transfer from the rest of the world to China will continue.

With this in mind, as I’ve said, the trade dispute is all about China – everything else Trump has taken on (Canada, Mexico, Europe) has been to gain leverage on getting movement in China.

With Trump now making it very clear that he won’t back down until major structural change takes place in China, it’s no surprise that one of the biggest winners of the day (following the further economic sanctions on China) was Japan!

The Nikkei was up big today. And it was Japanese stocks that set the tone for global markets on the day. As a signal that China’s days of cornering the world’s export markets may be coming to an end, Japan is in position to be a big winner.

Remember, while much of the world has returned to new record highs following the global financial crisis, Japan remains 40% away from the record highs set nearly 30 years ago.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

August 17, 5:00 pm EST

Back in July, we talked about the significance of the President of the European Commission coming to Washington to make a deal on trade. That was a big day for Trump’s fight to level the playing field on global trade.

Why? Because concessions out of Europe paved the way to more concessions globally.

That’s what we’re getting. Fast forward a little less than a month and now we have China (the center of the global trade dispute universe) coming back to the table on trade negotiations with the U.S.

This is what happens when you negotiate from a position of strength. Trump has the leverage of a strong economy, and the credibility to act on tough threats. And that is bringing about progress. Trading partners risk being left behind in the global economic recovery if they don’t play ball.

So we should expect “movement” from China. And movement equals success.

With that, as I said, I suspect that will be the catalyst to get stocks back on the path toward double-digit gains by year-end.

July 20, 5:00 pm EST

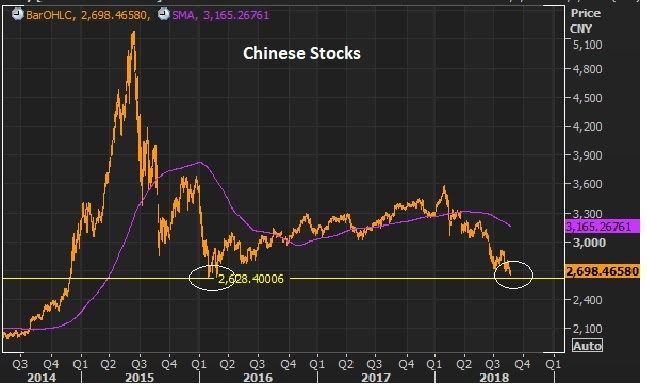

We’ve been watching the Chinese currency very closely, as the Chinese central bank has been steadily marking down the value of its currency by the day, in efforts to offset U.S. trade tariffs.

Remember, in China, they control the value of their currency. And they’ve now devalued by 8% against the dollar since March. They moved it last night by the biggest amount in two years. That reduces the burden of the 25% tariff on $34 billion of Chinese goods that went into effect earlier this month.

But Trump is now officially on currency watch. Yesterday in a CNBC interview he said the Chinese currency is “dropping like a rock.” And he took the opportunity to talk down the dollar.

The Treasury Secretary is typically from whom you hear commentary about the dollar. And historically, the Treasury’s position has been “a strong dollar” is in the countries best interest. But Trump clearly doesn’t play by the Washington rule book. So he promoted his view on the dollar (at least his view for the moment)–and it may indeed swing market sentiment.

The dollar was broadly lower today. We’ll see if that continues. If so, it may neutralize the moves of China in the near term. Nonetheless, the U.S./China spat is reaching a fever pitch. Someone will have to blink soon. Trump has already threatened to tax all Chinese imports. The biggest risk from China would be a big surprise one-off devaluation. As we discussed yesterday, that would stir up a response from other big trading partners (i.e. Europe and Japan). And they may coordinate, in that scenario, a threat to block trade from China all together.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.