|

|

|

January 30, 5:00 pm EST Remember, over the past three weeks, the major central banks in the world (the Fed, the ECB and the BOJ) reminded us of the script they have followed, and continue to follow, since the global financial crisis. They will do ‘whatever it takes‘ to keep the economic recovery going. It took an ugly decline in stocks in December to resurrect the defensive stance from the architects of the decade-long global economic recovery. Confidence matters, as it relates to the economic outlook. And stocks heavily influence confidence. With that, the Fed raised the white flag on January 4th when they marched out Bernanke, Yellen and Powell at an economic conference to reset the market expectations on monetary policy (moving from a four rate hike forecast for 2019 to a ‘wait and see’ approach). They solidified that stance today. Removing this risk, of the Fed offsetting the benefits of fiscal stimulus, is continuing to prime global markets. And we get a break of this trendline today in stocks — from the correction that originated from the record highs of October. |

|

|

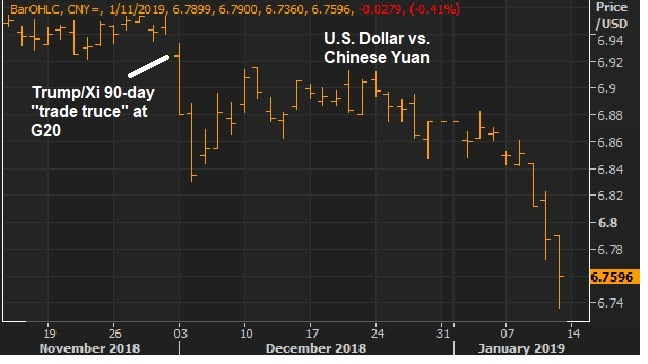

With the Fed behind us, the attention turns to the U.S./China meetings, which are underway. Let’s revisit the one indicator from China that they are working to pacify the Trump administration. It’s the Chinese currency. Remember, we looked at this chart back on January 11 of the U.S. dollar/Chinese yuan exchange rate … |

|

|

In this chart, the falling orange line represents the Chinesestrengthening their currency. And, as we can see, they have been showing a willingness to make concessions, walking it higher since the December “trade truce.” Make no mistake, the trade war is all about China’s currency. Ultimately, a free floating currency in China would be the solution to the trade imbalances and dangerous wealth transfer of the past few decades. To this point, it has been reported that they are presenting a plan to balance trade with the U.S. in six years. Maybe currency is part of it. We shall see.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

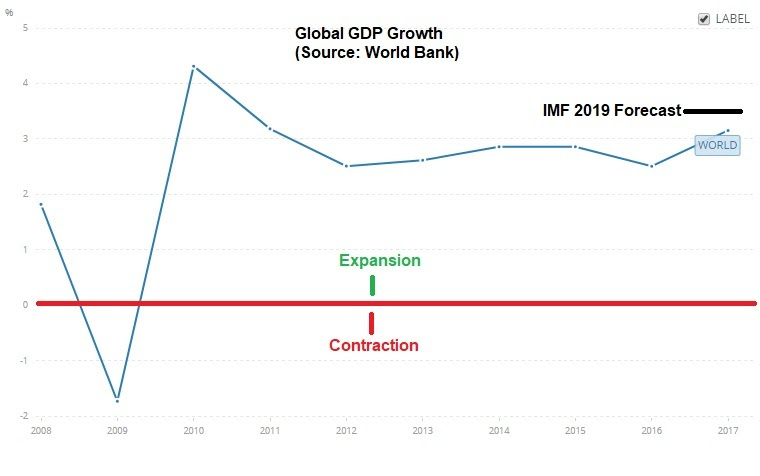

January 23, 5:00 pm EST The financial media has been focused on Davos this week — the host of the World Economic Forum, which is attended by the world’s top global government and corporate leaders. Coming off of an ugly December for global financial markets, it’s no surprise the conversation is all about “slowdown.” It’s an odd conversation, given that the U.S. economy is growing at 3%, corporate earnings are running at record levels, inflation is low and unemployment is low. Even the IMF could only justify a small markdown on their 2019 global GDP forecast — from an already high level. For perspective, the IMF is now looking for 3.5% growth for 2019. Here’s how that looks relative to the past ten years …. |

|

|

So, what’s the story? As we discussed yesterday, it’s China, and the pressure of tariffs and reform demands on a vulnerable large economy that’s already drowning. And the broader view is that trade is being hampered by the Trump/China standoff – and therefore dragging on growth. With that in mind, listening to some interviews from Davos, the one that stuck out to me was the DHL CEO (the world’s leading mail and logistics company). He said trade is not at all on the back foot, rather its flowing more than ever before. So, the global growth slowdown talk is all about what might happen, not about what is happening. It’s about risk. With that, if China does make the concessions necessary to get a deal done (and they seem to have few options), we may end up getting a big upside surprise in global growth – especially given the very accomodative global monetary policy backdrop. Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment. |

|

January 22, 5:00 pm EST China reported the slowest growth since 1990 on Monday (+6.4%). This an interesting period to reference because, at that point, China was in the latter stages of executing on an economic plan. At the core of that plan was currency manipulation — i.e. devaluing it’s currency (i.e. trashing it) so that they would have a distinct advantage on price when competing for world exports (i.e. they would always be the cheapest). It worked. The Chinese economy grew at an average of 12% the following five years (1991-1995). From 1991 to 2009, leading up the global financial crisis, China grew at 10.5% annual rate. That’s 18-years of double-digit annualized growth, on average. That’s why the Chinese economy has ascended from a $350 billion economy to a $12 trillion economy since 1990. Here’s what that looks like in a chart …. |

|

|

Thanks to decades of uncontested currency manipulation, China is now the second largest economy in the world and on pace to be the biggest soon (though it still has just an eighth of the per capita GDP as the U.S.). Why does it matter? When they maintain a cheap currency, to undercut the world on price, they become the world’s sellers to everyone. That means they accumulate a mountain of foreign currency as a result (which they have). China is the holder of the largestsforeign currency reserves in the world, at more than $3 trillion dollars (mostly U.S. dollars). What do they do with those dollars? They buy our Treasuries, which keeps our rates low, so that U.S. consumers can borrow cheap and buy more of their goods — adding to China’s mountain of currency reserves, adding to their wealth and depleting the U.S. of wealth. And so the cycle goes. This has proven to be a recipe for booms and busts (big busts), and a destructive global wealth transfer. So coming out of a decade long global economic slog, U.S. growth (driven by fiscal stimulus) has put us in a position of strength to negotiate reform in China. An economy running at 6% in China is recession territory and makes them vulnerable to an uprising against the regime. And trade tariffs put more and more downward pressure on the growth number. That’s why they’ve been willing to talk. Here’s what President Xi said yesterday about the ruling party’s outlook for retaining power in China: “The party is facing long-term and complex tests in terms of maintaining long-term rule, reform and opening-up, a market-driven economy, and within the external environment … The party is facing sharp and serious dangers of a slackness in spirit, lack of ability, distance from the people, and being passive and corrupt. This is an overall judgment based on the actual situation.” Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment. |

|

December 14, 5:00 pm EST

We’ve talked about the struggling Chinese economy this week.

As I’ve said, much of the key economic data in China is running at or worse than 2009 levels (the depths of the global economic crisis).

And the data overnight confirmed the trajectory: lower.

As we’ve discussed, this lack of bounce in the Chinese economy (relative to a U.S. economy that is growing at better than 3%) has everything to do with Trump squeezing China.

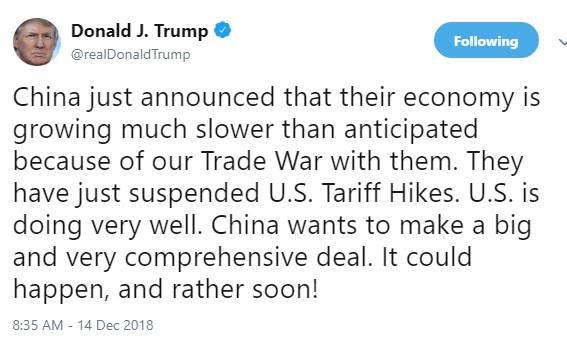

He acknowledged it today in a tweet ….

The question: Has China retaliated with more than just tit-for-tats on trade? Have they been the hammer on U.S. stocks? It’s one of the few, if not only, ways to squeeze Trump. As we discussed last week, when the futures markets re-opened (at 6pm) on the day of mourning for the former 41st President, there was a clear seller that came in, in a very illiquid period, with an obvious motive to whack the market. It worked. Stocks were down 2% in 2 minutes. The CME (Chicago Mercantile Exhange) had to halt trading in the S&P futures to avert a market crash at six o’clock at night.

Now, cleary stocks have a significant influence on confidence. You can see confidence wane, by the day, as stocks move lower. And, importantly, confidence fuels the decisions to spend, hire and invest. So stock market performance feeds the economy, just as the economy feeds stock market performance. The biggest threat to a fundamentally strong economy, is a persistently unstable stock market. In addition, sustaining 3% growth in the U.S. will be difficult if the rest of the world isn’t participating in prosperity.

With that in mind, in my December 1 note, I said “it may be time for Trump to get a deal done (with China) and solidify the economic momentum needed to get him to a second term, where he may then readdress the more difficult structural issues with China/U.S. relations.” That seems even more reasonable now.

We have two 12% declines in stocks this year. And you can see the fear beginning to set in. With that, the best investors in the world have made their careers by “being greedy when others are fearful” (Warren Buffett) or “buying when most people are selling and selling when most people are buying” (Howard Marks). There is clear value in stocks right now.

December 12, 5:00 pm EST

We talked about the China trade story yesterday.

In a nutshell, Trump has capitalized on an aligned Congress (in the first half of the mid-term) to stoke the U.S. economy. And that has strengthened the leadership position of the U.S. coming out of the decade long post-global economic crisis period.

With that, Trump has used the leverage of global economic leadership (in a vulnerable global economic period) to force change in China. And as we observed yesterday (in the charts of Chinese GDP, industrial production, domestic investment and retail sales), he’s getting movement because the Chinese economy was sputtering before the trade crackdown, and is now running out of gas. Much of the key economic data in China is running at or worse than 2009 levels (the depths of the global economic crisis). We get new data on industrial production, domestic investment and retails sales out of China tonight. This should provide more information on how the Chinese economy is being squeezed.

As for stocks, we have eleven trading days remaining for the year. The S&P 500 finishes today down about 1% for the year, and down 3.4% month-to-date. On the quarter, stocks are down 9% — the worst fourth quarter since 2008. If we look back at monthly returns, dating back to 1950, stocks have finished UP in December 75% of the time, for an average gain of 1.5%. Only two times have stocks has worse December performance over the near 70 year period (2002 and 1957).

And remember, as we discussed earlier this week, it’s not just stocks. It’s a zero (or near zero) return year for all major asset classes this year. Stocks, bonds, gold, real estate … nothing is working. The winner on the year has been cash.

|

THURSDAY, DECEMBER 7, 2017

With all that’s going on in the world, the biggest news of the day has been Bitcoin.

People love to watch bubbles build. And then the emotion of “fear of missing out” kicks in. And this appears to be one.

Bitcoin traded above $16,000 this morning. In one “market” it traded above $18,000 (which simply means some poor soul was shown a price 11% above the real market and paid it).

As we’ve discussed, there is no way to value Bitcoin. There is no intrinsic value. To this point, it has been bought by people purely on the expectation that someone will pay them more for it, at some point. So it’s speculation on human psychology.

Let’s take a look at what some of the most sophisticated and successful investors of our time think about it…

Billionaire Carl Icahn, the legendary activist investor that has the longest and best track record in the world (yes, better than Warren Buffett): “I don’t understand it… If you read history books about all of these bubbles…this is what this is.”

Billionaire Warren Buffett, the best value investor of all-time: “Stay away from it. It’s a mirage… the idea that it has some huge intrinsic value is a joke. It’s a way of transmitting money.”

Billionaire Jamie Dimon, head of one of the biggest global money center banks in the world: “It’s not a real thing. It’s a fraud.”

Billionaire Ray Dalio, founder of one of the biggest hedge funds in the world: “Bitcoin is a bubble… It’s speculative people, thinking they can sell it at a higher price…and so, it’s a bubble.”

Billionaire investor Leon Cooperman: “I have no money in Bitcoin. There’s euphoria in Bitcoin.”

Billionaire distressed debt and special situations investor, Marc Lasry: “I should have bought Bitcoin when it was $300. I don’t understand it. It might make sense to try to participate in it, but I can’t give you any analysis as to why it makes sense or not. I think it’s real, as it coming into the mainstream.”

Billionaire hedge funder Ken Griffin: “It’s not the future of currency. I wouldn’t call it a fraud either. Bitcoin has many of the elements of the Tulip bulb mania.”

Now, these are all Wall Streeters. And they haven’t participated. But this all started as another disruptive technology venture. So what do billionaire tech investors think about it…

Billionaire Jerry Yang, founder of Yahoo: “Bitcoin as a digital currency is not quite there yet. I personally am a believer that digital currency can play a role in our society, but for now it seems to be driven by the hype of investing and getting a return, as opposed to transactions.

Mark Cuban: He first called it a “bubble.” He now is invested in a cryptocurrency hedge fund but calls it a “Hail Mary.”

Michael Novagratz, former Wall Streeter and hedge fund manager. He once was a billionaire and may be again at this point, thanks to Bitcoin: “The whole market cap of all of the cryptocurrencies is $300 billion. That’s nothing. This is global. I have a sense this can go a lot further. He equates it to an alternative (or replacement) for the value of holding gold – which is an $8 trillion market… over the medium term, this thing is going to go a lot higher.” But he acknowledges it shouldn’t be more than 1% to 3% of an average persons net worth.

Now with all of this in mind, billionaire Thomas Peterffy, one of the richest men in America and founder of the largest electronic broker in the U.S., Interactive Brokers, has warned against creating exchange-traded contracts on Bitcoin. He says a large move in the price could destabilize the clearing organizations (the big futures exchanges), which could destabilize the real economy.

With that, futures launch on Bitcoin on Sunday at the Chicago Mercantile Exchange. This is about to get very interesting.

That was the top.

What stocks do you buy? Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

October 18, 5:00 pm EST Last week, we talked about the signals coming from China, that the economy is running dangerously slow, and their backs are against the wall. They cut their bank reserve requirement ratio last week for the fourth time this year. And they have been continually walking down the value of their currency (the yuan). The PBOC pegged the yuan to another 21-month low today. Most importantly, it’s getting closer and closer to the 7 yuan per dollar level – a level we haven’t seen since the pre-financial crisis days. As we’ve discussed, they have two options. They can play ball on trade concessions with the U.S. If so, the economy slows. They can continue to holdout/pushback on trade, and the trade sanctions may take the economy off the cliff. Both scenarios mean China’s rapid ascent to economic power gets knocked off path. If holdout is their long term strategy, I suspect we will find that global trading partners will join Trump’s fight against China’s rigging of global trade via its weak currency advantage. That’s not a good outcome for China. More likely, China is trying to holdout to see the outcome of the November U.S. elections. And as we discussed earlier this month, they are likely trying to wield some influence: “they can sell Treasurys, in an attempt to ignite a sharper climb in rates. And a fast move in rates (at these levels) has a way of shaking confidence in equity markets–which has a way of shaking confidence in the economy.” It appears that it may be playing out, but worse for Chinese stocks, which are now down 25% for the year.

|

|

|

If you need help with your shopping list of stocks to buy on this dip, join me in my Billionaire’s Portfolio. We follow the world’s bests billionaire investors into their favorite stocks. Click here to learn more. |