May 15, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

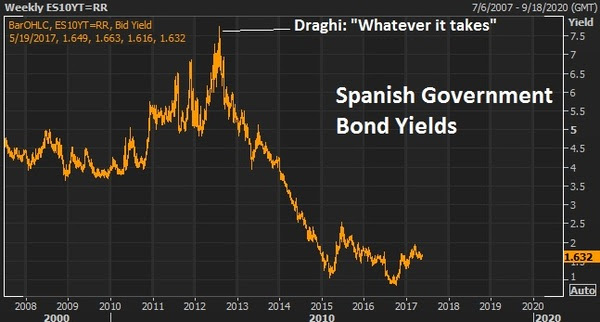

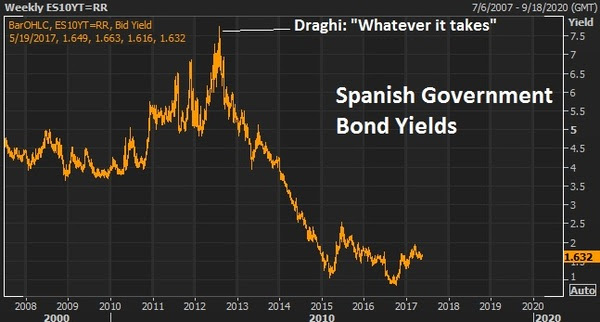

Last week we discussed the building support for a next leg higher in commodities prices. China is clearly a very important determinant in where commodities go. And with the news last week about cooperation between the Trump team and China, on trade, we may have the catalyst to get commodities moving higher again.It just so happens that oil (the most traded commodity in the world) is rebounding too, on the catalyst of prospects of an OPEC extension to the production cuts they announced last November.In fact, overnight, Saudi Arabia and Russia said they would do “whatever it takes” to cut supply (i.e. whatever it takes to get oil prices higher). Oil was up big today on that news.When you hear these words spoken from policy-makers (those that can dictate outcomes), it should get everyone’s attention. Those are the exact words uttered by ECB head Mario Draghi, that ended the bond market assault in Spain and Italy that were threatening the existence of the euro and euro zone. The Spanish 10-year yield collapsed from 7.8% (unsustainable borrowing rate for the Spanish government, and threatening imminent default) to 1% over the next three years — and the ECB, while threatening to buy an unlimited amount of bonds to push those yields lower, didn’t have to buy a single bond. It was the mere threat of ‘whatever it takes’ that did the trick. Last week we discussed the building support for a next leg higher in commodities prices. China is clearly a very important determinant in where commodities go. And with the news last week about cooperation between the Trump team and China, on trade, we may have the catalyst to get commodities moving higher again.It just so happens that oil (the most traded commodity in the world) is rebounding too, on the catalyst of prospects of an OPEC extension to the production cuts they announced last November.In fact, overnight, Saudi Arabia and Russia said they would do “whatever it takes” to cut supply (i.e. whatever it takes to get oil prices higher). Oil was up big today on that news.When you hear these words spoken from policy-makers (those that can dictate outcomes), it should get everyone’s attention. Those are the exact words uttered by ECB head Mario Draghi, that ended the bond market assault in Spain and Italy that were threatening the existence of the euro and euro zone. The Spanish 10-year yield collapsed from 7.8% (unsustainable borrowing rate for the Spanish government, and threatening imminent default) to 1% over the next three years — and the ECB, while threatening to buy an unlimited amount of bonds to push those yields lower, didn’t have to buy a single bond. It was the mere threat of ‘whatever it takes’ that did the trick.

As for oil: From the depths of the oil price crash last year, remember, we discussed the prospects for a huge bounce. Oil prices at $26 were threatening to undo the trillions of dollars of work central banks and governments had done to stabilize the global economy. Central banks couldn’t let it happen. After a series of coordinated responses (from the BOJ, China, ECB and the Fed), oil bottomed and quickly doubled.

Also at that time, two of the best oil traders in the world were calling the bottom and calling for $70-$80 oil by this year (Pierre Andurand and Andy Hall). Another commodities king that called the bottom: Leigh Goehring.

Goehring, one of the best commodities investors on the planet, has also laid out the case for $100 oil by next year. He says he’s “wildly bullish” oil in his recent quarterly investor letter at his new fund, Goehring & Rozencwajg.

Goehring argues that the IEA inventory numbers are flawed. He thinks oil the market is already over-supplied and is in a draw, as of May of last year. With that, he thinks the OPEC cuts will ultimately exacerbate the deficit and send prices aggressively higher. He says “we remain ‘wildly’ bullish and believe that there is a very high probability of oil prices reaching triple digits in the first half of 2018.”

Follow This Billionaire To A 172% WinnerIn our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO.

|

May 9, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Over the past few days, some of the most influential investors in the world have publicly shared views on some of their best ideas.First, over the weekend, it was Buffett at his annual shareholders meeting. The take away, as I said yesterday, “stocks are dirt cheap” if you think rates will stay low for longer (i.e. below long term averages). His assumption in that statement is that the Fed’s benchmark rate goes to 3ish% and done – well below the long run average neutral rate of 5%. Over the past few days, some of the most influential investors in the world have publicly shared views on some of their best ideas.First, over the weekend, it was Buffett at his annual shareholders meeting. The take away, as I said yesterday, “stocks are dirt cheap” if you think rates will stay low for longer (i.e. below long term averages). His assumption in that statement is that the Fed’s benchmark rate goes to 3ish% and done – well below the long run average neutral rate of 5%.

In addition, he was quite vocal on Apple, a stake he picked up as others were selling in fear in the first half of last year (i.e. being greedy when others are fearful). And he doubled his stake earlier this year, now holding north of $20 billion worth of the stock. The analyst community thinks Apple is a juggling act, with balls that will drop if they don’t come up with another revolutionary product every quarter. Buffett thinks Apple is cheap even if they don’t have another single new invention in the future. Why? Because they’ve developed a services business around their hardware that has quickly become one of the biggest and fastest growing businesses in the world.

Remember, back on February 1, I made the case for why Apple could double. You can see that here. It’s gone from a $560 billion company to an $800 billion company since we added it in our Billionaire’s Portfolio early last year. Even at $154 a share (today’s levels) if we strip out the quarter of a trillion dollars in cash, we get the existing business for 12 times earnings.

Now, let’s talk about one of the big ideas presented yesterday at the annual Sohn Conference in New York, where many of top billionaire investors and hedge fund managers give their outlook on the stock market, the economy and talk about their favorite long and/or short picks.

Billionaire investor Jeff Gundlach, who oversees the world’s largest bond fund likes selling the S&P 500 against emerging market stocks. He thinks value is distorted relative to global GDP. But it’s more a view on undervaluation of EM, rather than overvaluation of U.S. stocks. He took to Twitter to defend that view…

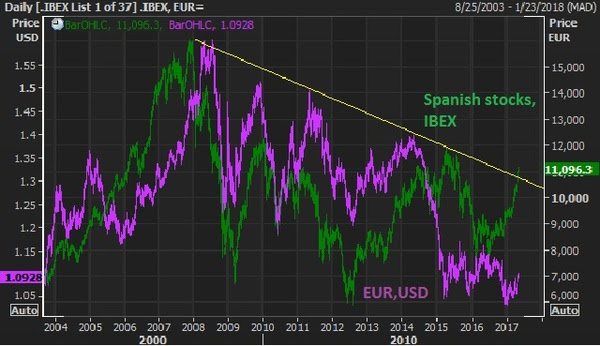

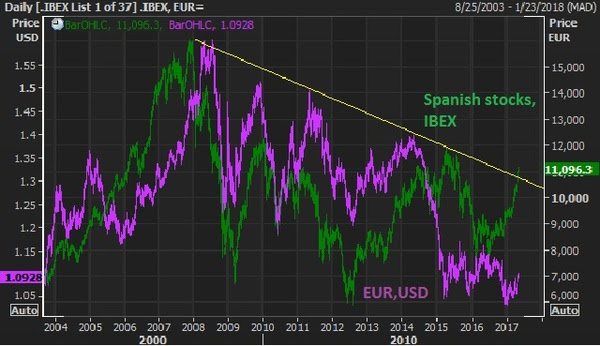

Assuming a stable to improving world economy, emerging market stocks have lagged and offer a great opportunity to catch up with the strength in the U.S. stock market. It also requires that emerging market currencies are a good bet against the dollar, if policy makers around the world are able to follow the lead of the Fed, where rising interest rate cycles follow. This is a very similar view to the one we discussed yesterday, where Spanish stocks (supported by a stronger euro) present a big catch up trade opportunity (to the tune of about 40% to revisit the 2007 highs), with the destabilization risk of the French elections in the rear-view mirror.

Follow This Billionaire To A 172% Winner

In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock!

Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now.

So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip.

Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO. |

May 8, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

For the skeptics on the bull market in stocks and the broader economy, the reasons to worry continue to get scratched off of the list.

For the skeptics on the bull market in stocks and the broader economy, the reasons to worry continue to get scratched off of the list.

Brexit. Russia. Trump’s protectionist threats. Trump’s inability to get policies legislated. The French election.

The bears, those looking for a recession around the corner and big slide in stocks, are losing ammunition for the story.

With the threat of instability from the French election now passed, these are two of the more intriguing catch-up trades.

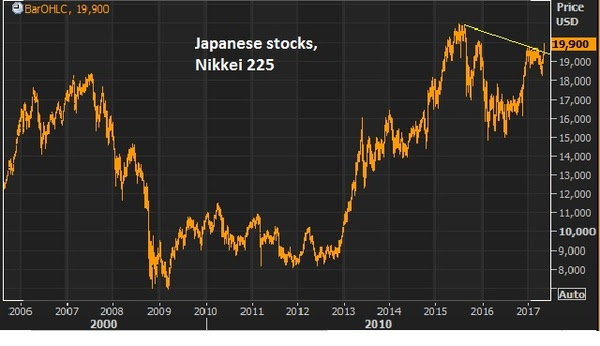

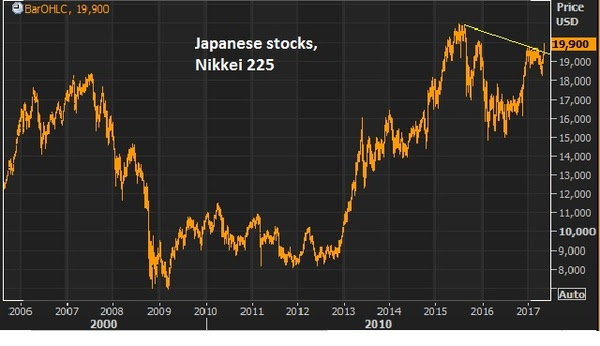

In the chart above, the green line is Spanish stocks (the IBEX). U.S., German and UK stocks have not only recovered the 2007 pre-crisis highs but blown past them — sitting on or near (in the case of UK stocks) record highs. Not only does the French vote punctuate the break of this nine year downtrend, but it has about 45% left in it to revisit the 2007 highs. And the euro, in purple, could have a dramatic recovery with the cloud of French elections lifted, which was an imminent threat to the future of the single currency.Next … Japanese stocks. While the attention over the past five months has been diverted toward U.S. politics and policies, the Bank of Japan has continued with unlimited QE. As U.S. rates crawl higher, it pulls Japanese government bond yields with it, moving the Japanese market interest rate above and away from the zero line. Remember, that’s where the BOJ has pegged the target for it’s 10 year yield – zero. That means they buy unlimited bonds to push the yield back down. That means they print more and more yen, which buys more and more Japanese stocks.

The Nikkei has been one of the biggest movers over the past couple of weeks (up almost 10%) since it was evident that the high probability outcome in the French election was a Macron win.Again, German, U.S., and UK stocks are at or near record highs. The Nikkei has been trailing behind and looks to make another run now, with 25,000 in sight.If you need more convincing that stocks can go much higher, Warren Buffett reiterated over the weekend that this low interest rate environment and outlook makes stocks “dirt cheap.” Last year he made the point that when interest rates were 15% [in the early 1980s], there was enormous pull on all assets, not just stocks. Investors have a lot of choices at 15% rates. It’s very different when rates are zero (or still near zero). He said, in a world where investors knew interest rates would be zero “forever,” stocks would sell at 100 or 200 times earnings because there would be nowhere else to earn a return.

Buffett essentially said at zero interest rates into perpetuity, the upside on the stock market (and any alternative asset class with return) is essentially infinite, as people are forced to find return by taking risk. Why you would buy a treasury bond that has no growth, and little-to-no yield and the same or worse balance sheet than high quality dividend stock.

This “forcing of the hand” (pushing investors into return producing assets) is an explicit objective by the interest rate policies of the Fed and the other major central banks of the world. They need us to buy stocks. They need us to spend money. They need economic growth.

If you have an brokerage account, and can read a weekly note from me, you can position yourself with the smartest investors in the world. Join us in The Billionaire’s Portfolio.

February 27, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

The big event of the week will be President Trump’s speech to Congress tomorrow. We know the pro-growth agenda of the Trump administration. We know the framework is in place to make it happen (with a Republican controlled Congress). That alone has led to a “clear shift in the environment” as Ray Dalio has called it (head of the biggest hedge fund in the world) – I agree.

But we’re at a point now, with European elections approaching and political risk rising there, and with the reality setting in that execution on fiscal stimulus from Trumponomics won’t be coming quickly, markets are calming down a bit. As we discussed last week, yields are falling back, following the lead of record level lows set in the German 2-year bund yield (in deeply negative territory). That dislocation in the German government bond market, as other key market barometers have been pricing in bliss, has come as a warning signal.

Another event of interest: Warren Buffett’s annual letter was released over the weekend, and he was on CNBC for a long interview this morning.

First, I want to revisit his letter from last year: Last year, in the face of an oil price crash, and a stock market that had opened the year with the worse decline on record, Buffett addressed the fears and uncertainty in markets. He said the growth trajectory for America has been and will continue to be UP. “America’s economic magic remains alive and well.”

And the growth trajectory has to do with two key factors: Improvements in productivity and innovation.

On productivity, he said: “America’s population is growing about .8% per year (.5% from births minus deaths and .3% from net migration). Thus 2% of overall growth produces about 1.2% of per capita growth. That may not sound impressive. But in a single generation of, say, 25 years, that rate of growth leads to a gain of 34.4% in real GDP per capita. (Compounding effects produce the excess over the percentage that would result by simply multiplying 25 x 1.2%.) In turn, that 34.4% gain will produce a staggering $19,000 increase in real GDP per capita for the next generation. Were that to be distributed equally, the gain would be $76,000 annually for a family of four. Today’s politicians need not shed tears for tomorrow’s children. All families in my upper middle–class neighborhood regularly enjoy a living standard better than that achieved by John D. Rockefeller Sr. at the time of my birth. Transportation, entertainment, communication or medical services.”

On innovation, he said: “A long–employed worker faces a different equation. When innovation and the market system interact to produce efficiencies, many workers may be rendered unnecessary, their talents obsolete. Some can find decent employment elsewhere; for others, that is not an option. When low–cost competition drove shoe production to Asia, our once–prosperous Dexter operation folded, putting 1,600 employees in a small Maine town out of work. Many were past the point in life at which they could learn another trade. We lost our entire investment, which we could afford, but many workers lost a livelihood they could not replace. The same scenario unfolded in slow–motion at our original New England textile operation, which struggled for 20 years before expiring. Many older workers at our New Bedford plant, as a poignant example, spoke Portuguese and knew little, if any, English. They had no Plan B. The answer in such disruptions is not the restraining or outlawing of actions that increase productivity. Americans would not be living nearly as well as we do if we had mandated that 11 million people should forever be employed in farming. The solution, rather, is a variety of safety nets aimed at providing a decent life for those who are willing to work but find their specific talents judged of small value because of market forces. (I personally favor a reformed and expanded Earned Income Tax Credit that would try to make sure America works for those willing to work.) The price of achieving ever–increasing prosperity for the great majority of Americans should not be penury for the unfortunate.”

And, finally on stocks, he said (my paraphrase): Overtime, with the above growth dynamic in mind, stocks go up. “In America, gains from winning investments have always far more than offset the losses from clunkers. (During the 20th Century, the Dow Jones Industrial Average — an index fund of sorts — soared from 66 to 11,497, with its component companies all the while paying ever–increasing dividends.”

What a difference a year makes. This time, he releases his letter into a stock market that’s UP 6% on the year already. And there’s new leadership and policy change underway.

So all of this in the above was written a year ago, what does he think now?

In his letter released over the weekend, Buffett AGAIN addresses the fears and uncertainties in markets.

We discussed on Friday the stages of a bull market which slowly moves from the state of broad pessimism, to skepticism to optimism and finally to euphoria, which tends to end the bull market. But as Paul Tudor Jones says (one of the great macro investors), the “last third of a great bull market is typically a blow-off, whereas the mania runs wild and prices go parabolic” (i.e. euphoria can last for a while).

The fact that Buffett is still addressing concerns about valuations and the future of the American economy, is more evidence that we’re far from euphoria (bubble-like territory that some like to often talk about) and were probably more like the area between skepticism to optimism.

About Valuation: As we’ve discussed many times here my daily Pro Perspectives piece, when rates are low, historically, valuations run higher than normal (a P/E of 20 or better). At a ten year yielding at 2.4% and fed funds at 75 basis points (well below the long run average) the forward P/E on the S&P is just 17.8x. That’s still cheap, relative to the alternative of owning bonds. That incentivizes money to continue to flow into stocks. And if we apply a 20 P/E earnings estimates for the next twelve months, we get about 12% higher on the S&P 500.

Now, let’s hear from the legend himself on the topic: Buffett said this morning, “We’re not in bubble territory, if interest rates were 7% or 8% then these prices would look exceptionally high, but you measure everything against interest rates, measured against interest rates, stocks are on the cheap side compared to historic valuations.”

By the way, on that “valuation note” for stocks, as you may recall I made the case early this month for why Apple (the largest component of the S&P 500) was cheap (Is Apple A Double From Here?). What does Buffett think? Buffett disclosed that he’s doubled his position in Apple since the beginning of the year. It’s now his second largest position at $17 billion. He thinks Apple will be the first trillion dollar company. Full disclosure: We own Apple in our Billionaire’s Portfolio along with Buffett and his fellow billionaire investor David Einhorn. We’re up 30% since adding it in March of last year.

Follow The Lead Of Great Investors Like Warren Buffett In Our Forbes Billionaire’s Portfolio

In our Billionaire’s Portfolio, we’re positioned in a portfolio of deep value stocks that all have the potential to do multiples of what broader stocks do — all stocks owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and follow the world’s best investors into their best stocks. Our portfolio was up over 27% in 2016. Click here to subscribe.

February 15, 2017, 4:30pm EST Invest Alongside Billionaires For $297/Qtr

Stocks continue to make new highs – five consecutive days of higher highs in the Dow. The Trump administration continues to make new news. And the Fed continues to become less important. Those have been the themes of the week.

Today was the deadline for all big money managers to give a public snapshot of their portfolios to the SEC (as they stood at the end of Q4). So let’s review why (if at all) the news you read about today, regarding the moves of big investors, matters.

Remember, all investors that are managing over $100 million are required to publicly disclose their holdings every quarter. They have 45 days from the end of the quarter to file that disclosure with the SEC. It’s called a form 13F.

First, it’s important to understand that some of the moves deduced from 13F filings can be as old as 135 days. Filings must be made 45 days after the previous quarter ends.

Now, there are literally thousands of investment managers that are required to report on a 13F. That means there are thousands of filings. And the difference in manager talent, strategies, portfolio sizes, motivations and investment mandates runs the gamut.

Although the media loves to run splashy headlines about who bought what, and who sold what, to make you feel overconfident about what you own, scared about what they sold, anxious, envious or all a combination of it all. The truth is, most of the meaningful portfolio activity is already well known. Many times, if they are big stakes, they’ve already been reported in another filing with the SEC, called the 13D.

With this all in mind, there are nuggets to be found in 13Fs. Let’s revisit how to find them, and the take aways from the recent filings.

I only look at a tiny percentage of filings—just the investors that have long and proven track records, distinct approaches, and who have concentrated portfolios. That narrows the universe dramatically.

Here’s what to look for:

- Clustering in stocks and sectors by good hedge funds is bullish. Situations where good funds are doubling down on stocks is bullish. This all can provide good insight into the mindset of the biggest and best investors in the world, and can be a predictor of trends that have yet to materialize in the market’s eye.

- For specialist investors (such as a technology focused hedge fund) we take note when they buy a new technology stock or double down on a technology stock. This is much more predictive than when a generalist investor, as an example, buys a technology stock or takes a macro bet.

- The bigger the position relative to the size of their portfolio, the better. Concentrated positions show conviction. Conviction tends to result in a higher probability of success. Again, in most cases, we will see these first in the 13D filings.

- New positions that are of large, but under 5%, are worthy of putting on the watch list. These positions can be an indicator that the investor is building a position that will soon be a “controlling stake.”

- Trimming of positions is generally not predictive unless a hedge fund or billionaire cuts by a substantial amount, or cuts below 5% (which we will see first in 13D filings). Funds also tend to trim losers into the fourth quarter for tax loss benefits, and then they buy them back early the following year.

As for the takeaways from Q4 filings, the best names had built stakes in financials. That’s not surprising given that the Trump win had all but promised a “de-Dodd Franking” of the banking system, especially with the line-up of former Goldman alum that had been announced by late December.

The other big notable in the filings: Warren Buffett’s stake in Apple.

Remember, as we headed into the Brexit vote last year, the broad market mood was shaky. Markets were recovering after the oil price crash, and the unknowns from Brexit had some running for cover. Meanwhile, some of the best investors were building as others were trimming. They were buying energy near the bottom. They were buying health care. And while many were selling the most dominant company in the world, Warren Buffett was buying from them. The guy who has made his fortunes buying when others are selling, did it again with Apple. He was buying near the bottom last summer, and in the fourth quarter he ramped up big time, more than tripling his stake to a $6.6 billion position.

Follow The Lead Of Great Investors Like Warren Buffett In Our Billionaire’s Portfolio

In our Billionaire’s Portfolio, we’re positioned in a portfolio of deep value stocks that all have the potential to do multiples of what broader stocks do — all stocks owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and follow the world’s best investors into their best stocks. Our portfolio was up over 27% in 2016. Click here to subscribe.

#stocks

August 16, 2016, 3:45pm EST

Yesterday was the deadline for all big investors to submit, to the SEC, a public snapshot of their portfolios for the quarter ended June 30th.

On that note, as we’ve discussed, this information is covered hot and heavy by the media. You often see headlines like these (these are actual headlines from yesterday): “Activist hedge fund ValueAct takes about 2 percent stake in Morgan Stanley” or “George Soros sells off Apple stake during the second quarter.”

On the above stories, if you own Morgan Stanley should you feel good about it? Conversely, if you own Apple, should you be worried? The heavy coverage of the topic both online and on television implies “yes” to both, which likely gets the average investor stirring. But there’s never context given as to whether or not the information is meaningful, and there’s never evidence given as to what the results tend to be for those that follow. The reason is, it requires a lot of hard work, experience, ingenuity and proprietary research to draw any conclusions from the information.

For perspective, these Q2 filings show positioning just five days after the UK voted to leave the European Union. And this event was broadly speculated to be a crushing blow the global markets and the global economy. As you recall, we made the case that it was over-exaggerated and could actually be good for markets and the economy by invoking some much needed fiscal stimulus.

Still, it’s safe to assume the UK event had considerable influence on the holdings of the world’s biggest investors. Global markets swung violently on the news back in June. Remember, between June 23rd and June 27th, the S&P 500 fell as much as 5.7%. It made it all back the subsequent four days.

So given the timing of the portfolio snapshot with the Brexit fears, let’s talk about Apple, the most widely held stock in the world and the largest constituent in the market cap weighted S&P 500. The headlines were scrolling fast and furious on Apple yesterday, following the filings from billionaire investors David Einhorn, George Soros and Chase Coleman – all of which sold Apple shares in the quarter. Now, it’s important to understand that these funds can trade Apple with virtual anonymity between quarters. The stock is too large for anyone one investor to take a 5% “activist” stake, which would trigger the requirement of a 13D filing with the SEC, which would require updated filings (or amendments) within 10 days of any change in the position size (sell one share, you have to report it).

On that note, let’s start some perspective on Einhorn’s Apple stake: Going into the second quarter Einhorn’s biggest position, by far, was Apple. He had 15% of his fund in the stock (a huge position). It would only make since that he would trim the position and neutralize some risk into an uncertain macro event. In fact, in his second quarter letter, Einhorn brags that they have done a good job of “trading” Apple (i.e. managing the downside). Still, as of the end of Q2, Apple was a very large position, at 12% of his fund.

What about the tech investing genius billionaire Chase Coleman? Coleman had 9% of his $7 billion fund (long public equities) in Apple going into the second quarter. By the end, he had cut it by 75%. Again, playing defense into Brexit. Apple stock is 16% higher than it traded on June 30. Coleman may very well have put the full position back on since the June 30 snapshot (likely).

George Soros? First, we should note that Soros is the world’s best global macro investor. He’s an agile investor that will load up on a theme and just as quickly reverse course and position for another probable outcome. For a career, Soros’ bread has been buttered betting on the unexpected outcome. That’s where the big wins come. Brexit was unexpected, thus his trimming of Apple, the stock with the biggest contribution to his view on a slide in the S&P 500.

And then we have arguably the greatest investor of all-time, Warren Buffett. While others ran from Apple, Buffett increased his stake by more than 55%. Why? Buffett has made his living for more than 50 years buying good companies when everyone else is selling. As he says, “be greedy when others are fearful.”

That’s a sliver of perspective on the popular 13F filings of the past few days. As I said yesterday, the presence of a big investor in a stock is rarely valuable information. Only a small percentage of those reporting investors have the powerful combination of size, influence and portfolio concentration to make their presence alone a potential catalyst for change in a company/and a repricing of the stock.

Follow The Lead Of Great Investors Like Warren Buffett In Our Billionaire’s Portfolio

In our Billionaire’s Portfolio, we’re positioned in deep value stocks that have the potential to do multiples of the broader market—all stocks that are owned and influenced by the world’s smartest and most powerful billionaire investors. Join us today and get yourself in line with our portfolio. You can join here.

May 23, 2016, 5:00pm EST

Last week we talked about Warren Buffett’s new stake in Apple. Today we want to talk about the investor that recently sold Apple: Carl Icahn.

In a world where information is abundant, markets are priced quite efficiently. The way a stock re-prices is through CHANGE.

And that’s precisely what the influential investors that we follow in our Billionaire’s Portfolio specialize in. And that’s why they have such a tremendous record in posting consistent superior returns – and, in turn, building tremendous wealth for themselves and their investors.

No one has done a better job at creating change for shareholders than Carl Icahn – certainly not over the span of the past three decades. That’s why we have 20% of our Billionaires Portfolio in stocks owned and controlled by Icahn.

We consider Icahn the god-father of activism. Very early on, Icahn found that, among all of the complications people like to add to investing, there is a very simple opportunity to take advantage and capitalize on the simplicities that we all know about human nature.

In his words, “some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

I’ll interpret that remark with these three simple points: 1) People will take advantage of opportunities to satisfy their own self-interests. 2) People will find ways to justify their self-serving actions. 3) People will be greedy.

Add this human nature to a concoction called the public equity markets, and you find, among many things, a witch’s brew of bad management teams at publicly traded companies.

To most investors, identifying a company that’s run poorly is a red flag – something to stay away from.

For Icahn, it’s opportunity. It’s blood in the water. Why? Because it presents the opportunity for CHANGE. And when you get change, you have a chance to make a lot of money as the stock re-prices to reflect that change.

Icahn has done this over and over throughout his long career. That’s why he has been able to compound money at nearly 30% a year for almost 50-years. That’s the greatest long-term investment track record in history (as far as we know). One thousand dollars with Icahn when he started has gone to $275 million.

Even at the age of 80, Icahn has been as vocal and as influential as ever. He influenced Apple to a near double by encouraging Apple to use their treasure chest of cash to buy back stock. Cash sitting on a balance sheet idle does nothing for shareholders. Share buybacks create shareholder value.

That’s the name of the game. Despite what some CEOs may think, that is precisely why they have been employed, to create shareholder value. And that is often the change that has to take place (the CEO or the mindset of leadership).

Icahn’s continued investing success can be attributed to one important talent: He’s a change-maker. When we follow him, we can be assured that he has a plan for change and that he will fight to make it happen. Plus, when we follow Icahn, we get an added bonus that few, if any, other big time investors summon: Because of his great success, his campaigns tend to attract other influential investors to join in – stacking the odds even more favorably for shareholders.

We’ll talk more about the “Icahn effect” tomorrow.

Don’t Miss Out On This Stock

In our Billionaire’s Portfolio we followed the number one performing hedge fund on the planet into a stock that has the potential to triple by the end of the month.

This fund returned an incredible 52% last year, while the S&P 500 was flat. And since 1999, they’ve done 40% a year. And they’ve done it without one losing year. For perspective, that takes every $100,000 to $30 million.

We want you on board. To find out the name of this hedge fund, the stock we followed them into, and the catalyst that could cause the stock to triple by the end of the month, click here and join us in our Billionaire’s Portfolio.

We make investing easy. We follow the guys with the power and the influence to control their own destiny – and a record of unmatchable success. And you come along for the ride.

We look forward to welcoming you aboard!

This past week we’ve talked about the recent public disclosures made about the investments of some of the world’s best investors.

The biggest news was Warren Buffett’s new $1 billion plus stake in Apple.

Apple’s stock price peaked in April of last year (following a 65% rolling 12-month return). Much of that run up was driven by activist efforts of Carl Icahn. Icahn influenced sentiment in the stock, but also influenced value creation for shareholders by pressuring Apple management to buy back stock.

But since peaking last April (2015), Apple shares had lost nearly 34% as of earlier this month. Icahn dumped his stake and made it public in late April.

And then we find this past week that Buffett is now long (he’s in).

So should you follow Buffett? Is it the bottom for Apple? And what makes Apple a classic Buffett stock?

First, Buffett has compounded money at 19.2% annualized over a 50 year period. That’s made him the second wealthiest man in the world.

Buffett loves to buy low. He has a long and successful record of buying when everyone else is selling. Buffett purchased his Apple stake last quarter when Apple was near its 52-week low.

But he famously stays away from technology. Why Apple? For Buffett, Apple is a global, dominant brand. That trumps sector. He loves brand name companies with a loyal customer base, and there is probably no company on the planet with a more loyal customer base then Apple. Plus, one could argue that Apple is a consumer services company (with 700 million credit cards on file, charging customers for movies, songs, apps …).

Generally Buffett pays less than 12 times earnings for a company. Of course there are exceptions, but Apple fits this criterion perfectly with a P/E of 10.

Buffett loves companies that have a high return-on-invested-capital (ROIC) and low debt. Apple has an ROIC of 28%, extremely high. Companies with a high ROIC usually have a “wide moat” or a competitive advantage over the rest of the world. That gives them pricing power to drive wide margins.

Apple really is the classic Buffett stock. And now that Buffett has put his stamp of approval on Apple, we believe the stock has bottomed, especially since it’s so cheap compared to the overall stock market. And he’s not the only billionaire value investor who loves Apple. Billionaire hedge fund manager David Einhorn also loves Apple. He increased his Apple stake last quarter to 15% of his entire hedge fund, almost $900 million dollars worth.

Don’t Miss Out On This Stock

In our Billionaire’s Portfolio we followed the number one performing hedge fund on the planet into a stock that has the potential to triple by the end of the month.

This fund returned an incredible 52% last year, while the S&P 500 was flat. And since 1999, they’ve done 40% a year. And they’ve done it without one losing year. For perspective, that takes every $100,000 to $30 million.

We want you on board. To find out the name of this hedge fund, the stock we followed them into, and the catalyst that could cause the stock to triple by the end of the month, click here and join us in our Billionaire’s Portfolio.

We make investing easy. We follow the guys with the power and the influence to control their own destiny – and a record of unmatchable success. And you come along for the ride.

We look forward to welcoming you aboard!

(more…)

Buffett’s famed annual letter is due to be released this weekend. With that, today we want to talk a bit about his record, his philosophy on markets and successful investing and the high conviction stocks that he has in his $130 billion plus Berkshire Hathaway stock portfolio.

First, only one living investor has a length of track record that can compare to Buffett’s. That’s fellow billionaire Carl Icahn. Icahn actually has a better record than Buffett, and it spans a little longer. But he gets a fraction of the attention of the man they call the Oracle of Omaha. (more…)

(more…)

Last week we discussed the building support for a next leg higher in commodities prices. China is clearly a very important determinant in where commodities go. And with the news last week about cooperation between the Trump team and China, on trade, we may have the catalyst to get commodities moving higher again.It just so happens that oil (the most traded commodity in the world) is rebounding too, on the catalyst of prospects of an OPEC extension to the production cuts they announced last November.In fact, overnight, Saudi Arabia and Russia said they would do “whatever it takes” to cut supply (i.e. whatever it takes to get oil prices higher). Oil was up big today on that news.When you hear these words spoken from policy-makers (those that can dictate outcomes), it should get everyone’s attention. Those are the exact words uttered by ECB head Mario Draghi, that ended the bond market assault in Spain and Italy that were threatening the existence of the euro and euro zone. The Spanish 10-year yield collapsed from 7.8% (unsustainable borrowing rate for the Spanish government, and threatening imminent default) to 1% over the next three years — and the ECB, while threatening to buy an unlimited amount of bonds to push those yields lower, didn’t have to buy a single bond. It was the mere threat of ‘whatever it takes’ that did the trick.

Last week we discussed the building support for a next leg higher in commodities prices. China is clearly a very important determinant in where commodities go. And with the news last week about cooperation between the Trump team and China, on trade, we may have the catalyst to get commodities moving higher again.It just so happens that oil (the most traded commodity in the world) is rebounding too, on the catalyst of prospects of an OPEC extension to the production cuts they announced last November.In fact, overnight, Saudi Arabia and Russia said they would do “whatever it takes” to cut supply (i.e. whatever it takes to get oil prices higher). Oil was up big today on that news.When you hear these words spoken from policy-makers (those that can dictate outcomes), it should get everyone’s attention. Those are the exact words uttered by ECB head Mario Draghi, that ended the bond market assault in Spain and Italy that were threatening the existence of the euro and euro zone. The Spanish 10-year yield collapsed from 7.8% (unsustainable borrowing rate for the Spanish government, and threatening imminent default) to 1% over the next three years — and the ECB, while threatening to buy an unlimited amount of bonds to push those yields lower, didn’t have to buy a single bond. It was the mere threat of ‘whatever it takes’ that did the trick.

Over the past few days, some of the most influential investors in the world have publicly shared views on some of their best ideas.First, over the weekend, it was Buffett at his annual shareholders meeting. The take away, as I said yesterday, “stocks are dirt cheap” if you think rates will stay low for longer (i.e. below long term averages). His assumption in that statement is that the Fed’s benchmark rate goes to 3ish% and done – well below the long run average neutral rate of 5%.

Over the past few days, some of the most influential investors in the world have publicly shared views on some of their best ideas.First, over the weekend, it was Buffett at his annual shareholders meeting. The take away, as I said yesterday, “stocks are dirt cheap” if you think rates will stay low for longer (i.e. below long term averages). His assumption in that statement is that the Fed’s benchmark rate goes to 3ish% and done – well below the long run average neutral rate of 5%.