|

|

November 14, 5:00 pm EST Later today Fed Chair Powell will be speaking at a Dallas Fed event. We’ve talked over the past two days about the potential for Powell to use this opportunity to dial down expectations of a December rate hike. Overnight, Japan reported a contraction in their economy for the third quarter. And this morning Germany’s GDP report showed the first contraction in more than three years. Meanwhile, U.S. core CPI came in softer than expected this morning. And the headline number will be hit, in the next reading, by a 28% plunge in oil prices. Add this to the outlook for gridlock in Washington on any further pro-growth policy-making, and Powell has the perfect excuse to start telegraphing a pause on rate hikes. If he does, expect stocks to respond very favorably. We will see. He speaks at 6:05pm EST. Here’s a look at stocks and the decline of the past month, as we head into this Fed discussion on the economy … |

|

|

Technically, today the S&P and the Dow both hit a big retracement level and bounced aggressively. This sets up nicely for the Fed discussion.

Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now.

|

November 13, 5:00 pm EST

In the past two notes, I’ve focused on oil. And that does indeed seem to be the tail that is wagging the global markets dog.

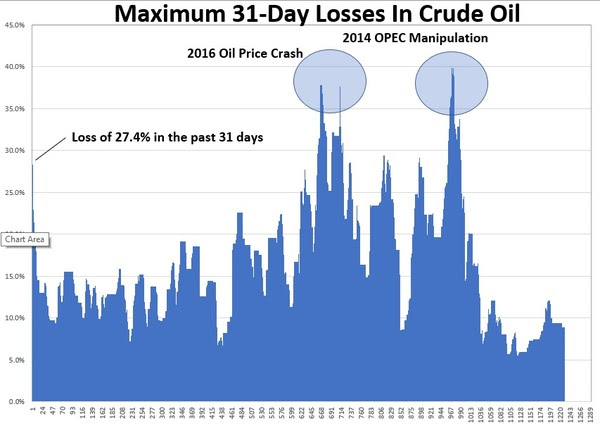

Oil lost another 8% today. Over the past 31 days, crude prices have dropped 27%.

If we look back over the past five years, the magnitude of that move is only matched (or exceeded) in cases where there was significant manipulation in the oil market and/or a systemically threatening oil price crash.

You can see in the chart above, we’ve dropped 27% over the past 31 days. The other big drops in crude were in February of 2016 (the crash) and in November of 2014 (OPEC’s refusal to cut oil production).

Interestingly, these historic crude price declines were occurring as the Fed was preparing markets for the beginning of its normalization campaign (i.e. moving rates away from the emergency zero interest rate level). And it was these price declines that threw a wrench in those plans.

Despite what the central bankers say, oil prices have a big influence on their read on inflation. Lower oil prices put downward pressure on inflation. And as oil prices were plunging from 2014 through 2016, the Fed clearly and dramatically held back on their rate hiking plans.

On that note, remember yesterday we talked about the prospects that Powell (Fed Chair) may use the opportunity to dial down expectations of a December rate hike, if we see some soft data this week (growth data from Japan and Europe and inflation data from U.S., Europe and UK). We now have a big haircut on oil prices to factor into the inflation data. That too, may give him the excuse to pause on rates. We’ll hear from him tomorrow at a Dallas Fed meeting.

|

November 8, 5:00 pm EST The midterm elections are behind us, and I’ve suspected that the lift of that cloud of uncertainty would be the greenlight for stocks to make a run into the end of the year.

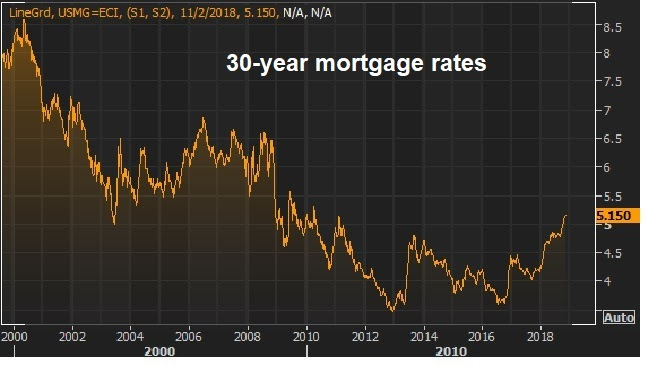

We’re seeing it start today. Remember, the big work on economic stimulus has been done, and that will continue to drive the best growth we’ve had since 2006. Add to that, there is the potential that Trump can get infrastructure done with a split Congress. With that, it would be a matter of how hot the economy will get. But as I said, there’s probably a better chance that the Democrats will block any more progress on the economic front, to best position themselves for a run at the 2020 Presidential election. Interestingly, this gridlock scenario could actually be the optimal scenario for stocks here. The notion that the economy might be on the verge of accelerating too fast/ running too hot, has dialed UP the inflation-risk-premium for the stock and bond markets. The hot trajectory for the economy has kept pressure on the Fed to continue the path higher in interest rates. Thus far, the seven quarter-point hikes the Fed has made to the benchmark overnight lending bank rate has NOT choked off economic momentum. But it has, finally, started to get market rates moving. The ten-year government bond yield is near 3.25%, the highest in seven years. And stocks haven’t liked this 3%+ level on rates. And that has a lot to do with what it does to consumer rates, specifically mortgages. As you can see in the chart below, we now have 30-year mortgages running north of 5% for the first time since 2010. |

|

| This move in rates has slowed down the housing market. And this is an example of how this path of hotter growth and an aggressively normalizing Fed has been tracking toward growth killing interest rate levels.

Perhaps some gridlock in Washington will slow the speed at which both are adjusting and allow for some time for the economy to sustain at this 3% growth level. Join me here to get all of my in-depth analysis on the big picture, and to get access to my carefully curated list of “stocks to buy” now. |

November 6, 5:00 pm EST

In my note yesterday, we talked about the probable outcomes for the elections.

Whether we see the Republican’s retain control of the house, or lose it, both scenarios should be a greenlight for stocks.

Why? Because the cloud of uncertainty will be lifted. Even if we were to have gridlock in Washington, from here forward, the economy has strong momentum already, and the benefits of fiscal stimulus and deregulation are still working through the system.

Now, given today’s midterm elections are feeling a bit like the Presidential election of 2016 (as a referendum on Trump, this time), I want to revisit my note from election day on November 8, 2016.

As I said at that time, central banks had been responsible for the global economic recovery of the prior nine years, and for creating and maintaining relative economic stability. And creating the incentives to push money into the stock market (i.e. push stocks higher) played a big role in the coordinated strategies of the world’s biggest central banks. With that, I said “neither the economic recovery, nor the stock market recovery can be credited much to politicians. In this environment, in the long run, the value of the new President for stocks will prove out only if there’s structural change. And structural change can only come when the economy is strong enough to withstand the pain. And getting the economy to that point will likely only come from some big and successfully executed fiscal stimulus.”

It turns out, Trump has indeed executed on fiscal stimulus. And he’s gone aggressively after structural change too (perhaps too early, and with some success, but at a price he may pay for politically). Still, he’s been able to execute ONLY because he’s had an aligned Congress.

Importantly, the economic policies out of Washington have allowed the Fed to bow-out of the game of providing life support to an economy that was nearly killed by the financial crisis. That’s good!

November 5, 5:00 pm EST

The elections tomorrow are said to be a referendum on Trump’s Presidency.

And given the sentiment, I think it’s fair to say the surprise scenario for markets would be for Republicans to retain control of Congress. For that to happen, it looks like the Republicans would need to win 61% of the “toss up” races in the house. Of those, 84% are currently Republican held.

That scenario would be a vote of confidence for the Trump economic agenda. And for markets, it would be “risk on,” which would likely draw more attention to the inflation outlook, and the speed at which market interest rates will move. Trump would retain his leverage over China on trade concessions.

Scenario two, would be a split Congress. If we get a split Congress, the Trump economic plan would likely turn to infrastructure. The belief is that a Democrat led house would likely be a partner to Trump on a big infrastructure spend.

Though I suspect, given the political atmosphere, they may work to block any further progress on the economic stimulus front, in effort to position themselves for the 2020 Presidential election. On China trade negotiations, I suspect a split Congress would begin to fight against Trump’s executive order-driven trade wars. This scenario would mean, gridlock in Washington.

However, after the cloud of election uncertain lifts, both scenarios should be a greenlight for stocks.

Remember, we already have an economy running north of 3%, with record low unemployment, and consumers are sitting on record high household net worth and record low debt service ratios. Companies are growing earnings at over 20% (yoy), and growing revenues at over 8% (yoy). And corporate credit market debt is near the lowest levels (relative to market value of corporate equities) of the past 70 years.

So there is plenty of fuel in the economy to continue the trajectory of economic boom. Maybe most importantly, following the October correction, the tech giants have been pricing out the “monopoly scenario” which paves the way for a broader-based bull market for stocks.

|

|

October 31, 5:00 pm EST

As we discussed yesterday, it’s very dangerous to let political views influence your perspective on markets and investing.

And I suspect we are seeing plenty of people make that mistake.

That means many will be left behind on a stock market recovery, again. That probably means the bull market for stocks still has a ways to run. John Templeton, know to be one of the great value and contrarian investors of all time, said “bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Incredibly, after a more than four-fold run from the financial crisis bottom, the stock market continues to have a LOT of skepticism. Does this mean we are only half way through this cycle? Maybe.

The arguments for the stock market bears and pessimists on the economy have many holes, but the biggest is the lack of context. That context: the global economic crisis, and the aftermath (up to present day).

You can’t evaluate anything about this economy without taking into account where we’ve been over the past decade, the role central banks have played throughout, the coordinated intervention that has taken place globally (along the way) to avoid a global depression, and the interconnectedness of global economies that continues.

Without this context, the skeptics like to call it “late in the cycle” for an economy that (on paper) is in the second-longest expansion in U.S. history. With context, we’re probably closer to “early cycle,” given that the decade of ultra-slow growth was manufactured by central banks.

October 30, 5:00 pm EST

This violent repricing of the tech giants came with clear warnings (i.e. the tightening of regulatory screws).

Now that we have it. And it is very healthy, and needed.

As we discussed yesterday, I would argue we are seeing regulation priced-in on the tech giants, which can create a more level playing field for businesses, more broad-based economic activity, and a more broad-based bull market for stocks. This is a theme we’ve been discussing in my daily note here for quite sometime.

And I suspect now, we can see the areas of the stock market that have been beaten down, from the loss of market share to the tech giants, make aggressive comebacks.

On that note, here’s another look at the big trendline we’ve been watching in the Dow …

Again, this line holds right at the 10% correction mark. And we’ve now bounced more than 700 dow points.

As I’ve said, it’s easy to get sucked into the daily narratives in the financial media, and it’s especially easy and dangerous (to your net worth) when stocks are declining. They tend to influence people to sell, when they should be buying.

And as someone that has been involved in markets more than 20 years, I can tell you that it’s also very dangerous to let political views influence your perspective on markets and investing. And I suspect we are seeing that mistake made in this environment (by pros and amateurs alike).

If you need help with your shopping list of stocks to buy on this dip, join me in my Billionaire’s Portfolio. We follow the world’s bests billionaire investors into their favorite stocks. Click here to learn more.