April 5, 5:00 pm EST

As we end the week, the overhang of risks to markets, the Trump administration and the economy are as light as we’ve seen in quite some time.

With that, stocks are back within sniffing distance of record highs. And I suspect it’s just getting started.

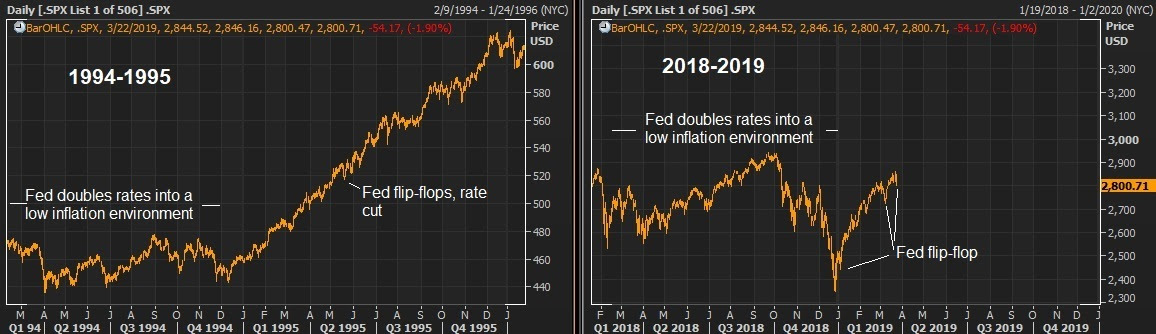

Remember, we’ve talked a lot about the comparisons between today and 1995. But we should also acknowledge how things played out through 2000, after the Fed backtracked on errant policy in the mid-90s.

Let’s revisit an excerpt from my daily notes on the topic …

“Last year (2018) was the first year since 1994 that cash was the best producing major asset class (among stocks, real estate, bonds, gold). The culprit for such an anomaly: An overly aggressive Fed, tightening into a low inflation, recovering economy.

The Fed ended up cutting rates by 1995, and that spurred a huge run up in stocks (up 36%). Fast forward: we now (too) have a Fed that has been overly aggressive, tightening into a low inflation, recovering economy. And just as they did in 1995, the Fed is now doing an about face. Given where the Fed has positioned itself now, compared to just three months ago, I would argue we already have a repeat of 1995 from the Fed … Within a few quarters of the 1995 rate cut, U.S. growth was printing above 4% and did so for 18 consecutive months. Stocks TRIPLED over that period.”

So, just as people are arguing that the expansion cycle of the past decade is coming to an end, we may very well see that the real boom is just getting started.

We continue to have tailwinds of fiscal policy, deregulation and structural reform still working through the economy. And the Fed has now given us the greenlight, with policies designed to fuel higher stock prices!

These are the moments when real wealth can be created in stocks. I want to make sure you are acting, not watching from the sidelines.

With that, today I want to offer you a peak at my premium advisory service for zero risk.

Sign up today and look through my entire portfolio of stocks, all of which are vetted and owned by the best billionaire investors in the world. Listen to my recorded “Live Monthly Portfolio Reviews.” Read all of my past notes to my subscribers. Take it all in. If you find that it doesn’t suit you, just email me within 30 days and I’ll refund your money in full immediately.

Frankly, I know when people join this service, they don’t leave. In fact, they refer their friends. If you can read a weekly note from me, I can help you make money.

You’ll get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors.

Join now and get your risk free access by signing up here.

March 25, 5:00 pm EST

There was a big technical break in the interest rate market on Friday. And the yield curve inverted.

What does it mean, and should we be concerned?

First, when people talk about the yield curve, they are typically talking about the yield on the 3-month Treasury bill versus the yield on the 10-year government bond. The latter should pay more, with the idea that money will cost more in the future (compensating for inflation and an “uncertainty about the future” premium).

When the 10-year is paying you less than you could earn holding a short term T-bill, the yield curve is said to be inverted. And this dynamic has predicted the past seven recessions. Why? Because it typically will be driven by a tighter credit environment, namely banks become less enthused about borrowing in the form of short term loans, to lend that money out in longer term loans. Money dries up. Unemployment goes up. Demand dries up. Economy dips.

With this in mind, today the 3-month treasury bill pays 2.44%. And the 10-year government bond pays 2.41%. The spread is negative which makes for an inverted yield curve.

Now, while an inverted yield curve has preceded recessions with a good record, we’ve also had inverted yield curves and no recession has followed.

What isn’t talked about much, is why the yield curve is inverting this time. It sort of spoils the drama to talk about the “why”. Unlike any other time in history, we have an interest market that has been explicitly manipulated by global central banks for the past decade (via global QE). And we have one major central bank (the Bank of Japan) remaining as a buyer of unlimited global assets (that includes U.S. 10 years, which pushes the 10-year yield lower).

Remember, the Bank of Japan’s policy of targeting their 10-year government bond yield at zero, means they will be a buyer of unlimited bonds to push JGB yields back toward zero (price goes up, yields go down). And when the tide of global rates is rising, pulling UP their yields, they will be a buyer of whatever they need to, to push things back down (and they’ve done just that).

What does that mean? It means, as the Fed has been walking its short-term benchmark rate higher, the “long-end” of the interest rate market (the 10-year yield) has been anchored by central bank buying – buying by all major central banks for the better part of a decade, and now led by the BOJ. That has kept a lid on the U.S. 10-year government bond yield, and global government bond yields in general.

With this at work, there have been few things better telegraphed than a U.S. yield curve inversion, as the Fed has told us for years that they will march their short-term rate beyond the anchored 10-year yield.

It’s often dangerous to say “this time is different”, but I think it’s fair to say that the past yield curve inversion/recession analyses don’t compare, when you have both components (the front-end and the long-end) completely controlled by global central banks for more than a decade. Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, through the end of the year.