|

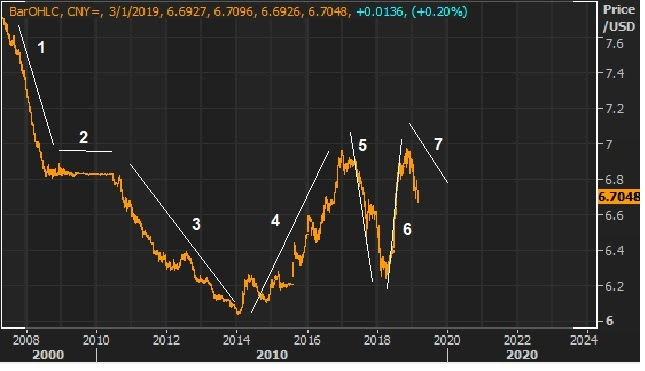

March 8, 5:00 pm EST Overnight, China reported a 20% plunge in its February exports. That was the driver for a big down day for Chinese stocks — down 4.4%. For context, this comes after a 27% run UP in the Chinese stock market since January 4th. The export plunge was the worst reading since February of 2016. What was happening in February of 2016? Global stocks put in a bottom in February of 2016, after a quick and ugly 14% correction. And the bottom was set by some central bank intervention (first the BOJ in the currency markets, then China stoking bank lending, then the Fed and the ECB followed with stimulative policies). This time around, we are coming out of a deep slide in global stocks too, and we’ve had a similar formula of central bank support to fuel the recovery. If anything, this Chinese export plunge is even more reason to believe that China has to make a deal, soon (i.e. a deal is getting closer). Trump and Larry Kudlow (National Economic Advisor) both used the opportunity this morning to make that point. Still, as I said yesterday, when stocks go down, the media is quick to revive the doom and gloom narrative. For example, Reuters ran a story today citing some research from Bank of America. Here’s the headline: Worst start to the year for equity flows since 2008. That sounds scary – the 2008 reference. Let’s take a closer look. Bank of America says $60 billion has been “yanked” out of equities since the start of the year. That’s a big number, until you add some context. Let’s take a look at this historical chart of the total market capitalization of listed domestic companies in the U.S.

|

|

|

The size of the U.S. stock market was just shy of $20 trillion going into the financial crisis back in 2007. Today it’s worth $32 trillion. So the stock market is more than 50% bigger, which on a relative basis, makes the amount of money that has moved OUT of stocks this year closer to half as large as the retreat in 2007-2008. While we are on the topic of shocking headlines, another major financial news company ran this headline and touted it on their TV coverage: U.S. households see biggest decline in net worth since the financial crisis. There was a drop of $3.73 trillion in the fourth quarter, compared to the third quarter. Another scary headline. |

|

|

But as you can see, household net worth is up almost $40 trillion since the pre-financial crisis peak or 58% bigger. That makes a $3.7 trillion contraction a small blip on the chart. And, of course, the driver of the losses was solely a stock market rout in December (which has now been largely recovered). Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment. |