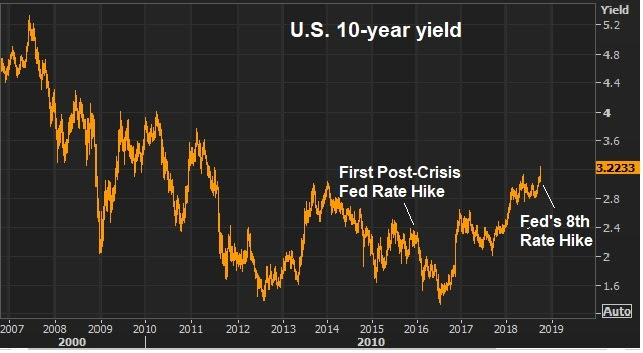

The move in rates continued to spook markets today. The 10-year yield traded as high as 3.23%.

Now, despite the dramatic tone you’ll find on CNBC when stocks go down, a 10-year yield at 3.23% isn’t a crisis. And a stock market that is down 1% from all-time highs isn’t a crisis or even a “sell-off.”

For perspective, the Fed has now moved 8 times off of zero. The leaves the benchmark (short term) rate set by the Fed at 2-2.25%, still well below long-term average rates. And that leaves the market determined (longer term) interest rate, just below 3.25%, still well below the long-term average. With that, rates are still low. In fact, if we took the record low in the 10-year yield, set in July of 2016, and applied the Fed’s 200 basis points of hikes, we would have a 10-year of 3.34%. We are still south of that. I would argue at current levels, the interest rate market is finally pricing in sustainable economic recovery (pricing out risks of another post-economic crisis shock/slump).

Now, when rates are on the move, people immediately start talking about debt service. On that note, consumers and companies are in as good a financial position as they’ve been in a very long time (record high household net worth, record profits) . Household debt service ratios are at record lows.

Bottom line, the move in rates is a growth story, not a crisis story. We have 3%+ economic growth, with low inflation and solid employment. We may have finally returned to the level of trust and confidence in the economy that fuels “animal spirits.”

Attention loyal readers: The Billionaire’s Portfolio is my premium advisory service. And I’d like to invite you to join today, as we are beginning what I think will be a tremendous run for value stocks into the end of the year. It’s a great deal for the money. Just click here to subscribe, and get immediate access to my full portfolio of billionaire-owned stocks. When you join, you’ll get immediate access to every recommendation–past, present and future–in the portfolio. And I’ll deliver my in-depth notes on our portfolio and the bigger picture every week, directly to your inbox.

October 1, 5:00 pm EST

Given the global nature of business within the Dow constituents, the DJIA has been the place for pain, as uncertainty over trade has ebbed and flowed over the past year. So, with a new trade agreement with Mexico and Canada, we get a big rally in the Dow today. That puts the Dow up 7.8% on the year.

Still, we came into the year expecting something much bigger for stocks.

The big tax cuts that came near the end of last year, have indeed translated into big corporate earnings surprises, and a hotter than expected economy. This is something you would expect to be fuel for a much bigger than average year for broader stock markets. And you would expect it to be fuel for a big run in commodities markets. But the stock market performance is sitting right around long-term average gains. And broad commodities performance (if we look at the CRB index) is up just 2% on the year.

This has all been supressed by the uncertainties surrounding trade, and the resulting rising geopolitical tensions.

But with concessions from Europe on trade earlier in the summer, and now a new agreement on North American trade, Trump is clearly winning on trade.

What’s next? Infrastructure. This has been the next pillar of Trumponomics. Gary Cohn, the former White House economic advisor, said he thinks the White House will get it done ($1 trillion+) regardless of who controls the House after November.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

September 28, 5:00 pm EST

Back in May, the populist movement that gave us Grexit, Brexit and then the Trump election, gave us a new government in Italy with an “Italy first” agenda.

Italy first, means EU second. And that puts the future of the European Union and the European Monetary Union in jeopardy. Today, the new government made that clear by rejecting EU fiscal constraints, in favor of running a bigger deficit spending.

This puts the game of poker the European Union has been playing since the financial crisis erupted, front and center (again).

As we discussed back in May, this story is looking a lot like Greece, which used the threat of leaving the euro as leverage to negotiate some relief from austerity and reforms. It was messy, but it gave them a stick, in a world where the creditors (the ECB, Eurogroup and IMF) had been burying the weak economies in Europe in harsh austerity since the financial crisis.

As the third largest euro zone constituent, Italy brings a lot more leverage in negotiating, in this case, the EU rulebook. We may see this all result, finally, in a relaxing of the fiscal constraints that have suppressed the economic recovery in the euro zone in the post-Great Recession era. And Italy’s pushback may lead the way for a euro-wide fiscal stimulus campaign — following the lead of Trumponomics.

A better economy has a way of solving a lot of problems. And Europe has a lot of problems.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

September 26, 5:00 pm EST

The Fed moved again today on rates, as the market expected. This is the eighth quarter point hike in this post-QE normalization on rates. And this now puts the Fed Funds rate at the range of 2%-2.25%.

Now, the markets will pick apart the statement and endlessly parse the Fed Chair’s words in the press conference. But let’s step back and take a look at the impact of these Fed hikes thus far.

We know the economy is running at the best pace since before the financial crisis. We know that the jobless rate is near record lows. We know that consumer credit worthiness is at record levels. This has all happened, despite the Fed’s rate hikes.

What about debt service coverage? As rates are moving higher, are consumers showing signs of getting squeezed?

If we look back at the height of the credit bubble in 2008 (just prior to its burst), 13.22% of household income was going to service debt–within that number, 7.2% of household income was going to service mortgage debt. What about now? Debt service is now 10.2% of household income. And the mortgage piece is down to just 4.4%. This is the result of six years of zero interest rates, a massive QE program (which included the Fed’s purchase of mortgage bonds), and a government program that subsidized banks to refi high interest rate mortgages.

So the big question is, how has the Fed’s exit of QE effected the consumers ability to service debt? Are higher rates hurting?

Well, they started hiking rates in the fourth quarter of 2015. Total debt service at that time was 10.1%. That’s virtually unchanged from today. And the mortgage piece was 4.5%. That’s actually a touch higher than today.

Bottom line: The Fed’s normalization on rates has not damaged the consumer, nor has it killed the housing market.

But that’s only because the yield curve has been flattening. That is, longer term market interest rates have been steady. That means the benchmark rate from which consumer and mortgage rates have been set, has been steady. And those longer term rates have been steady, in large part, because Europe and Japan have remained in QE mode (buying global assets, which includes our Treasurys).

With that, while most have been watching the Fed closely for how it’s delicately handling the exit of QE, the more important spot to watch will be how Europe and Japan manage their exits. Hopefully, the U.S. economy is hot enough, at that point, to withstand the move in longer term U.S. rates that will come with the end of global QE.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.