Importantly, as I said yesterday, the stock declines of this year appear to have everything to do with Saudi capital flows — and less to do with all of the hand-wringing issues you hear and read in the financial media.

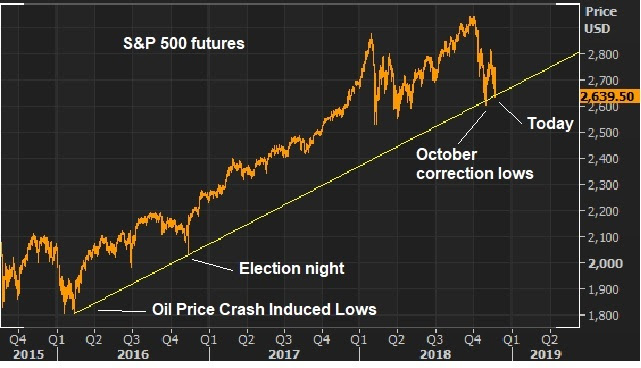

As we discussed last month, the top for stocks in January and the top in October, both align perfectly with the timing of events in Saudi Arabia.

Let’s revisit that timeline from my October note: “Remember, last November the Saudi Crown Prince Salam, successor to the King, ordered the arrest of many of the most powerful Saudi Princes, country ministers and business people in Saudi Arabia on corruption charges. More than $100 billion in assets were claimed to be under investigation (a third frozen) in what was called the “Saudi purge.”

These subjects were detained for nearly three months. The timing of their release and the market correction of early this year is where it all begins to align.

They were released on Saturday, January 27. S&P futures open for trading on Sunday night. Stocks topped that night and proceeded to drop 12% in six days. And rallies in stocks were sold aggressively for the better part of the next seven months.

Fast forward to this month and we have the murder of the journalist who was a public critic of the Crown Prince Salam. As the details of story pointed back to Salam, on October 3, U.S. bond markets got hit (to the hour of news hitting the wires) and stocks topped that day, and have proceeded to drop by more than 8%.

Clearly, the destabilization in Saudi Arabia has put considerable assets in jeopardy. With that, those in control of those assets have likely been scrambling to protect them, as U.S. Congress pushes for sanctions, which could include freezing Saudi assets.”

Now, over the past few weeks, we’ve seen some back and forth onwhether or not the Saudi Crown Prince would be implicated in the Khashoggi murder and/or, most importantly, sanctioned. And the moves in stocks have been reflecting that whipsaw. Remember, the Saudi sovereign wealth fund is worth more than half a trillion dollars. They’ve been heavily invested in the tech giants. And those (the tech giants) have led the way down. Any uptick in the probability that we see more U.S.-based Saudi assets frozen or threatened, has created selling in stocks.

But as we said yesterday, Trump seems to be settled on the sanctions that have already been levied (excluding the Crown Prince and broader government). That’s a positive for stocks.

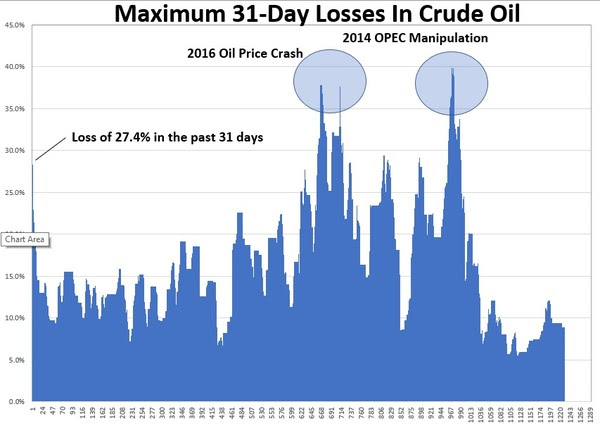

And he’s leveraging the Saudi crisis to get oil prices lower. Remember, we talked about the oil bargaining chip earlier this month. Here’s an excerpt from my November 9 note: “It’s probably no coincidence that the slide in oil prices started the day that the Saudi Crown Prince was implicated in journalist Jamal Khashoggi’s disappearance. Remember, the bond market got hit, to the hour, of this headline hitting …

Stocks topped a few hours later, and that was the top for oil prices too.

When Trump spoke with the Saudi Crown Prince on the phone on October 16, oil was trading above $71. We haven’t seen that level since.

Trump‘s position on high oil prices is no secret. He doesn’t like it. And Saudi Arabia is well aware. Is it possible that Trump has leverage and is using it? Likely. Is it possible that the Crown Prince is willing play ball with U.S. demands (on oil production) in order to avoid sanctions (or worse).“

Interestingly, Trump is now confirming the above with his statements over the past couple of days.

Bottom line: When stocks decline for non-fundamental reasons, it’s a huge buying opportunity. This is one of those moments.

What stocks do you buy? Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

Have a great Thanksgiving!