|

|

|

May 17, 5:00 pm EST China continues to move their currency lower, as a way to offset some of the burden of tariffs (reducing the price of Chinese products in dollar terms). And we’ve seen how the trajectory of the yuan is effecting Bitcoin. Chinese citizens are trying to get their money out and doing so through Bitcoin. Let’s take a look at how it is effecting the price of gold. As you can see in the chart, the yuan and the price of gold have traded in a fairly close relationship.

|

|

|

Of course, there are a lot of unconventional economic times incorporated in this chart (from 2006-present) — like a flight to safety in the financial crisis, which was bullish for gold. But is there anything behind the yuan – gold relationship? It seems so. As we know the Chinese has managed the value of their currency relative to the U.S. dollar for a long time (the currency of its biggest trading partner, the global reserve currency and the global currency of trade). From 1996 to 2005, China pegged the currency at 8.28 to the dollar. In 2005, they went to a managed float (to pacify WTO requirements and U.S. demands), where they allowed for a gradual strengthening of the yuan. But it also seems clear that they have managed it to the value of gold. As they weaken the yuan, they reduce their buying power of gold (i.e. their ability to print yuan, sell it for dollars and buy gold – not to mention other commodities). So manipulating the price of gold to preserve the yuan’s buying power is plausible. If we think to the behavior of gold while China was running the currency peg from 1996 to 2005: Gold was in a sideways range the entire time. Only when they moved to a managed float in 2005, strengthening the yuan, did the price of gold finally break out of the sideways range of the prior decade (higher, along with the yuan). With the above in mind, as China continues to walk the yuan lower, we may find the price of gold making another run toward the $1,000 level. If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here. |

|

|

|

May 14, 5:00 pm EST Yesterday we looked at the big technical support level for the Dow — the 200-day moving average. That level held beautifully, and stocks bounced aggressively today. Here’s a look at that chart now ….

|

|

|

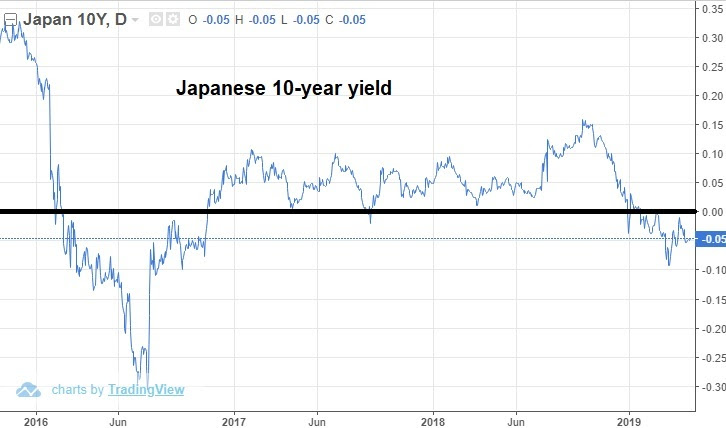

With stocks bouncing after a quick 5% correction, we also have a big technical area of support holding in the interest rate market. As you can see in this next chart, the 10-year yield is holding this big trendline into 2.40%. |

|

|

So, we have a stronger dollar today, strong commodities prices, higher global stocks and higher rates. What’s different today, relative to yesterday? Nothing. We have a market underpinned by better than expected economic data and earnings. And (different than December) we have a Fed that is in a relatively accommodative stand, promising to do nothing to disrupt the trajectory of the economy and stock market. That makes stocks a buy on dips. |

|

|

May 9, 5:00 pm EST

Yesterday we talked about the tool China will use to offset tariffs, if a deal does not materialize and the tariff penalty increases.

They will devalue their currency.

With a “no deal” potential outcome, there’s a lot of wealth in China looking for ways out.

In recent years, they have found a way out through Bitcoin. And, no coincidence, Bitcoin is again on the move.

With that, let’s take a look at the timeline on Bitcoin…

The 2016-2017 ascent of Bitcoin coincided perfectly with the crackdown on capital flight in China. In late 2016, with rapid expansion of credit in China, growing non-performing loans, a soft economy and the prospects of a Trump administration that could put pressure on China trade, capital was moving aggressively out of China.

That’s when the government stepped UP capital controls — restricting movement of capital out of China, from transfers to foreign investment.

Of course, resourceful Chinese still found ways to move money. Among them, buying Bitcoin. And that’s when Bitcoin started to really move (from sub-$1,000 to over $19,000). China cryptocurrency exchanges were said to account for 90% of global bitcoin trading.

Chinese capital flows were confused for Silicon Valley genius.

But in late 2017, China cracked down on Bitcoin – with a total ban. A few months later, Bitcoin futures launched, which gave hedge funds a liquid way to short the madness. Bitcoin topped the day the futures contract launched.

So, as Chinese officials visit the White House for a deal or no deal on trade, China has been moving their currency lower — and bitcoin has (again) been moving higher. Perhaps the Chinese are finding new ways to buy Bitcoin.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

|

May 8, 5:00 pm EST We talked about China’s currency yesterday, as the key proxy on a U.S./China trade deal. Let’s revisit some background and context on the whole trade negotiation.

China’s currency manipulation (i.e. weak currency policy) is at the core of the global trade imbalances that precipitated the global financial crisis. With that, the currency is a key piece of the trade and structural reform demands from the Trump administration.

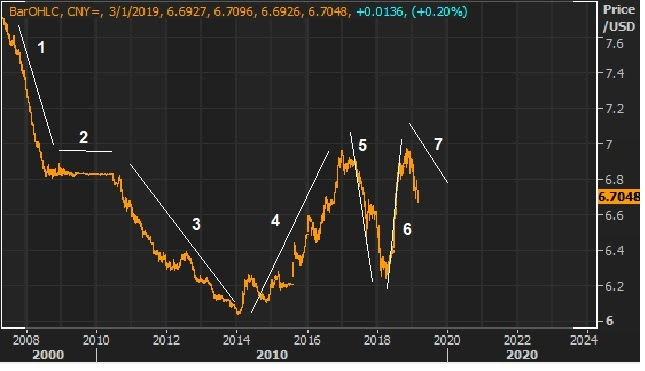

After using its currency to corner the world’s export markets for more than a decade, which led to China’s rise to a global economic power, you can see how China has been maneuvering to pacify currency tensions over the last decade:

|

|

|

(In the chart above, the falling line represents a strengthening yuan versus the U.S. dollar, and vice versa)

1) They slowly allowed the currency to climb (against the dollar) following threats of a big tariff on China from Graham and Schumer (yes, Schumer) back in 2005.

2) When the global economic crisis hit, they went back to a peg to protect their ability to export.

3) They went back to a slow crawl higher as tensions rose, and people began to believe the developed market economies might be passing the torch to China for economic leadership.

4) It became clear that China can’t grow fast enough in a world where developed market economies are struggling. So, they went back to weakening the currency to protect their ability to export.

5) They strengthened the yuan when Trump was elected to try to ward off a trade war.

6) Trump wasn’t placated and tariffs were launched. They weakened the currency with the idea that a threat of a big one-off devaluation in the currency might create some leverage.

7) After trying to hold-out, it seemed clear earlier this year that they needed to get a deal done, as the economy continued to sink. They walked the currency higher again – a signal that they are willing to make aggressive concessions to get a deal done.

But now, with a hard deadline and threat of a tariff escalation, the Chinese made one of the largest devaluations in the yuan in years (a warning shot).

Here’s a look at the chart going into the deadline …

|

|

|

If we get a no deal/ tariff escalation on Friday, we can expect the Chinese to continue weakening the yuan to offset some of the tariff burden.

So, tariffs have been a tool of retaliation for the U.S., to counter nearly three decades of currency manipulation by the Chinese. If we don’t get reform, the Chinese will retaliate with … more currency manipulation.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |