|

|

February 21, 5:00 pm EST

We’re seeing some more December economic data that reflected the souring of economic sentiment from the sharp decline in stocks.

It started with retail sales last week. Stocks dipped immediately on the bad data, which proved to be a valuable buying opportunity. Today the bad number was December durable goods. These tend to be large investments that reflect optimism and these expenditures become the first to be delayed when that optimism wanes.

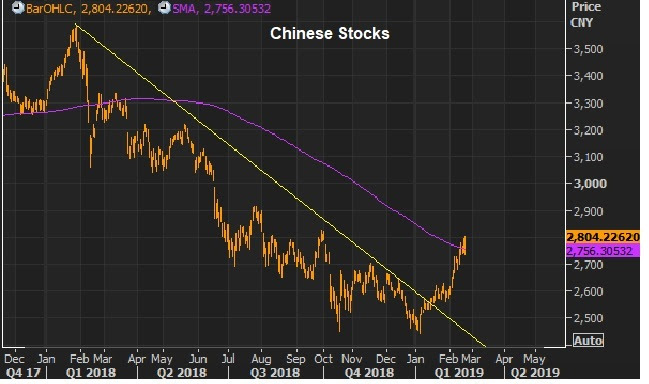

But less than two months later, and we have the v-shaped recovery in stocks. Expect this data to bounce back just as sharply.

We continue to get signals that some form of agreement will come from the latest round of U.S./China talks. As we’ve discussed, some of the best signals are in the commodities markets.

Remember, to end last month, we talked about the setup for a big run in commodities this year. Crude oil was up 20% in January. It’s up another 5% already in February. Copper was up 6% in January. It’s up another 4% this month. And copper is the commodity known to be an early indicator of turning points in the economy.

With this in mind, assuming we get resolution on China, and a continuation of trend growth in the U.S., we should expect this commodities rally to be in the early stages. And that should make emerging market stocks among the most attractive on the year. At the moment the MSCI emerging markets index is performing only in-line with the big developed stock markets.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

|

|

|

|

Downgrades on growth today weighed on global markets. First, the European Commission slashed growth expectations for 2019 for all the major euro economies. For the EU overall, they are looking for 1.3% growth, versus 1.9% a few months ago. Next up was the Bank of England decision on rates this morning. They left rates unchanged, but downgraded growth for ’19 and ’20. Keep in mind, this all incorporates the reset of expectations on global interest rates that have taken place over the past month (i.e. acommodative and staying that way). So, why the downgrades? It’s all driven by fears of the worst case scenario on Brexit and U.S./China trade negotations. That worst case scenario would be “no deal.” Importantly, if we get these deals, the upgrades will come, quickly. For the moment, though, we’re continuing to see an environment that looks much like 2016. Central banks responded to the crash in oil prices by resetting expectations on monetary policy (easier). And then the growth downgrades followed. By the end of 2016, the U.S. election had swung sentiment from pessimism to optimism, and the growth upgrades came in — the Fed actually raised rates before the year-end. I suspect if the fog of uncertainty clears, we will see the same. But in the meantime, promoting the worst case scenario for growth may get policymakers in Europe motivated to follow the lead of the U.S. with some needed fiscal stimulus. That would be good for European and global growth.

|

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|