Since stocks dipped last week, I’ve heard the chatter (again) about how a 3% 10-year note has suddenly created a high appetite for Treasurys over stocks (i.e. people are selling stocks in favor of capturing that whopping 3% yield).

But in this post-crisis environment, a rise toward 3% promotes the exact opposite behavior. If you are willing to lend for 10-years locked in at a paltry rate, you are forgoing what is almost certainly going to be a higher rate decade than the past decade. If you need to exit, you’re going to find the price of your bonds (very likely) dramatically lower down the road.

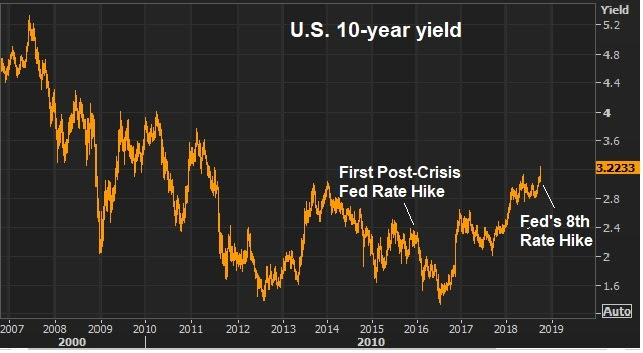

Coming out of a zero-interest rate world, bond prices are going lower/not higher. Here’s the chart of the 10-year Treasury note (price). You can see we’ve now broken the three and a half decade bull market in bonds (yields go up, as bond prices go down) …

stocks

Bottom line: The bond market is the high risk-low reward investment in this environment. And there continues to be plenty of fuel for stock prices as money exits bonds.

October 12, 5:00 pm EST

The S&P 500 has declined more than 5% (from peak to trough) on four different occasions this year. That’s despite an economy that is heating up, finally escaping the slow growth rut of the past decade.

So, should you be fearful when these declines occur, or should you be greedy?

During market declines – with the constant barrage of market analysis and opinion on financial television, in newspapers, or through the Internet – it’s easy to get sucked into drama played out in the media.

And that tends to make many investors fearful.

But while the fearful start running out of the store when stocks go on sale, the best billionaire investors in the world, start running IN.

The fact is, the best investors in the world see declines in the U.S. stock market as an exciting opportunity. And so should you.

Most average investors in stocks are NOT leveraged. And with that, they should have no concern about U.S. stock market declines, other than saying to themselves, “what a gift,” and asking themselves these questions: “Do I have cash I can put to work at these cheaper prices? And, where should I put that cash to work?”

Billionaire Ray Dalio, the founder of the biggest hedge fund in the world, has said what we think is the most simple yet important fact ever said about investing.

“There are few sure things in investing … that betas rise over time relative to cash is one of them.”

In plain English, he’s saying that major asset classes, over time, will rise (stocks, bonds, real estate). The value of these core assets will grow faster than the value of cash.

That comes with one simple assumption. The world, over time, will improve, will grow and will be a better and more efficient place to live than it was before. If that assumption turned out to be wrong, we have a lot more to worry about than the value of our stock portfolio.

With that said, as an average investor that is not leveraged, dips in stocks (particularly U.S. stocks – the largest economy in the world, with the deepest financial markets) should be bought, because in the simplest terms, over time, the broad stock market has an upward sloping trajectory.

This is the very simple philosophy Dalio follows, and is the core of how he makes money and how he has become one of the best, and richest, investors alive.

Billionaires Bill Ackman and Carl Icahn, two of the great activist investors, lick their chops when broad markets sell off on fear and uncertainty.

Ackman says he gets to buy stakes in high quality businesses at a discount when broad markets decline for non-fundamental reasons. Icahn says he hopes a stock he owns goes lower so he can buy more.

What about the great Warren Buffett? What does he think about market declines? He has famously attributed his long-term investing success to “being greedy when others are fearful.”

Bottom line: Declines in the broad market are times to take out your shopping list.

If you need help with your shopping list, join me in my Billionaire’s Portfolio. We follow the world’s bests billionaire investors into their favorite stocks. Click here to learn more.

The move in rates continued to spook markets today. The 10-year yield traded as high as 3.23%.

Now, despite the dramatic tone you’ll find on CNBC when stocks go down, a 10-year yield at 3.23% isn’t a crisis. And a stock market that is down 1% from all-time highs isn’t a crisis or even a “sell-off.”

For perspective, the Fed has now moved 8 times off of zero. The leaves the benchmark (short term) rate set by the Fed at 2-2.25%, still well below long-term average rates. And that leaves the market determined (longer term) interest rate, just below 3.25%, still well below the long-term average. With that, rates are still low. In fact, if we took the record low in the 10-year yield, set in July of 2016, and applied the Fed’s 200 basis points of hikes, we would have a 10-year of 3.34%. We are still south of that. I would argue at current levels, the interest rate market is finally pricing in sustainable economic recovery (pricing out risks of another post-economic crisis shock/slump).

Now, when rates are on the move, people immediately start talking about debt service. On that note, consumers and companies are in as good a financial position as they’ve been in a very long time (record high household net worth, record profits) . Household debt service ratios are at record lows.

Bottom line, the move in rates is a growth story, not a crisis story. We have 3%+ economic growth, with low inflation and solid employment. We may have finally returned to the level of trust and confidence in the economy that fuels “animal spirits.”

Attention loyal readers: The Billionaire’s Portfolio is my premium advisory service. And I’d like to invite you to join today, as we are beginning what I think will be a tremendous run for value stocks into the end of the year. It’s a great deal for the money. Just click here to subscribe, and get immediate access to my full portfolio of billionaire-owned stocks. When you join, you’ll get immediate access to every recommendation–past, present and future–in the portfolio. And I’ll deliver my in-depth notes on our portfolio and the bigger picture every week, directly to your inbox.