|

|

|

|

Downgrades on growth today weighed on global markets. First, the European Commission slashed growth expectations for 2019 for all the major euro economies. For the EU overall, they are looking for 1.3% growth, versus 1.9% a few months ago. Next up was the Bank of England decision on rates this morning. They left rates unchanged, but downgraded growth for ’19 and ’20. Keep in mind, this all incorporates the reset of expectations on global interest rates that have taken place over the past month (i.e. acommodative and staying that way). So, why the downgrades? It’s all driven by fears of the worst case scenario on Brexit and U.S./China trade negotations. That worst case scenario would be “no deal.” Importantly, if we get these deals, the upgrades will come, quickly. For the moment, though, we’re continuing to see an environment that looks much like 2016. Central banks responded to the crash in oil prices by resetting expectations on monetary policy (easier). And then the growth downgrades followed. By the end of 2016, the U.S. election had swung sentiment from pessimism to optimism, and the growth upgrades came in — the Fed actually raised rates before the year-end. I suspect if the fog of uncertainty clears, we will see the same. But in the meantime, promoting the worst case scenario for growth may get policymakers in Europe motivated to follow the lead of the U.S. with some needed fiscal stimulus. That would be good for European and global growth.

|

|

|

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

We’ve now heard from about half of the S&P 500 companies on Q4 earnings. And about 70% of those companies have beat Wall Street’s earnings estimates. We’ve heard from the banks, early on, which broadly painted the picture of a healthy economy. And now we’ve heard from the dominant tech giants/ disrupters of the past decade. Facebook beat. Amazon beat. Google beat. But times are changing. Remember, the regulatory screws have tightened on the tech giants over the past year. It was a matter of when the market would finally price OUT the idea that these industry killers would be left unchallenged, to become monopolies. With that in mind, back in early October, when market risks were building (from China, to interest rates, to Italy, to Saudi Arabia), we looked at this big and vulnerable trendline in Amazon.

|

|

|

Here’s the chart on Amazon now … |

|

|

The break of that line gave way to a 30% plunge in what was the biggest company in the world. Bottom line: Amazon, Facebook and Google have entered into regulatory purgatory — after being largely left alone for the past decade to nearly destroy industries with little-to-no regulatory oversight. Costs are going UP and will keep going up.. With all of this said, the stocks of these tech giants might take a breather, but given their scale and maturity, more regulation actually strengthens their moat. There will never be a competitor to Facebook Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

|

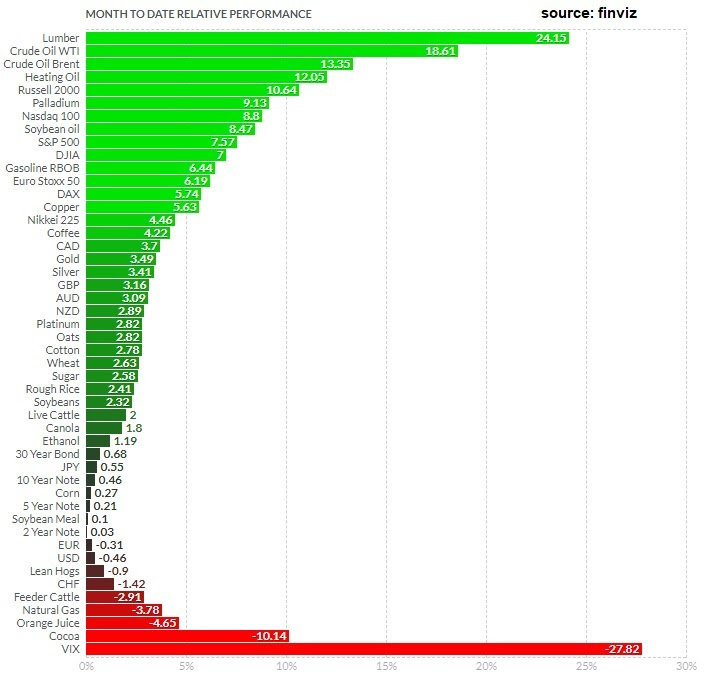

January 31, 5:00 pm EST With the Fed officially on hold, asset prices continue to lift-off. But with U.S./China talks concluding today, there was the potential for a spoiler. Trump quickly stepped in front of that risk this morning, saying that no final deal would be made until he and President Xi meet “in the very near future.” So the expectations of a final “yea or nay” on a China deal today were managed down. And with that, the recovery in global markets finished the month of January on a strong note. What a difference a month makes. In December, people were beginning to worry that collapsing global financial markets would kill the global economic recovery — and maybe fuel another financial crisis. A month later, and the S&P 500 sits just 2% lower than the close of November (before the December rout). And in January, almost every market is in the green (from stocks to bonds to commodities to currencies).

|

|

|

Remember, if we compare this to last year, cash was the best performing major asset class (returning just less than 2% in dollar terms). On Friday, we talked about the set up for a big run in commodities this year. Commodities continue to lead the way. Crude is up close to 20%on the month. Copper is up 6% for January (the commodity known to be a early indicator of turning points in the economy), and gold is up 3.5% just in the past week. We also end the month with another very solid opening to earnings season. Despite all of the pessimism of the past quarter. The Q4 earnings continue to beat expectations. Importantly, the widely held tech giants have posted good reports: Facebook, Apple and Amazon. Importantly, with the expectations bar set low coming into 2019 (for earnings, the economy and a China deal), I’d say we finish the first month of the year in position to exceed expectations on those fronts – thanks, in no small part, to the pivot by the Fed.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

January 30, 5:00 pm EST Remember, over the past three weeks, the major central banks in the world (the Fed, the ECB and the BOJ) reminded us of the script they have followed, and continue to follow, since the global financial crisis. They will do ‘whatever it takes‘ to keep the economic recovery going. It took an ugly decline in stocks in December to resurrect the defensive stance from the architects of the decade-long global economic recovery. Confidence matters, as it relates to the economic outlook. And stocks heavily influence confidence. With that, the Fed raised the white flag on January 4th when they marched out Bernanke, Yellen and Powell at an economic conference to reset the market expectations on monetary policy (moving from a four rate hike forecast for 2019 to a ‘wait and see’ approach). They solidified that stance today. Removing this risk, of the Fed offsetting the benefits of fiscal stimulus, is continuing to prime global markets. And we get a break of this trendline today in stocks — from the correction that originated from the record highs of October. |

|

|

With the Fed behind us, the attention turns to the U.S./China meetings, which are underway. Let’s revisit the one indicator from China that they are working to pacify the Trump administration. It’s the Chinese currency. Remember, we looked at this chart back on January 11 of the U.S. dollar/Chinese yuan exchange rate … |

|

|

In this chart, the falling orange line represents the Chinesestrengthening their currency. And, as we can see, they have been showing a willingness to make concessions, walking it higher since the December “trade truce.” Make no mistake, the trade war is all about China’s currency. Ultimately, a free floating currency in China would be the solution to the trade imbalances and dangerous wealth transfer of the past few decades. To this point, it has been reported that they are presenting a plan to balance trade with the U.S. in six years. Maybe currency is part of it. We shall see.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|