Watch The Yuan As A Proxy On A Trade Deal

|

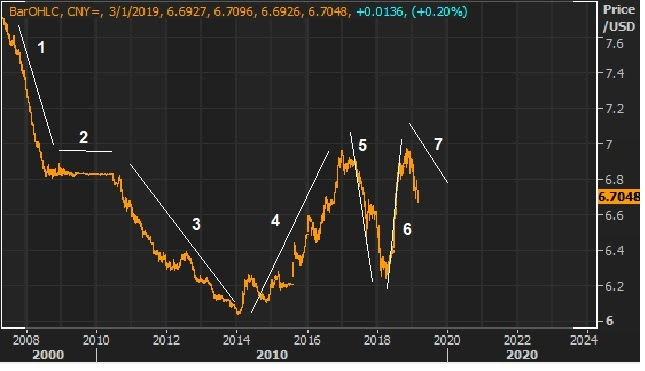

May 8, 5:00 pm EST We talked about China’s currency yesterday, as the key proxy on a U.S./China trade deal. Let’s revisit some background and context on the whole trade negotiation.

China’s currency manipulation (i.e. weak currency policy) is at the core of the global trade imbalances that precipitated the global financial crisis. With that, the currency is a key piece of the trade and structural reform demands from the Trump administration.

After using its currency to corner the world’s export markets for more than a decade, which led to China’s rise to a global economic power, you can see how China has been maneuvering to pacify currency tensions over the last decade:

|

|

|

(In the chart above, the falling line represents a strengthening yuan versus the U.S. dollar, and vice versa)

1) They slowly allowed the currency to climb (against the dollar) following threats of a big tariff on China from Graham and Schumer (yes, Schumer) back in 2005.

2) When the global economic crisis hit, they went back to a peg to protect their ability to export.

3) They went back to a slow crawl higher as tensions rose, and people began to believe the developed market economies might be passing the torch to China for economic leadership.

4) It became clear that China can’t grow fast enough in a world where developed market economies are struggling. So, they went back to weakening the currency to protect their ability to export.

5) They strengthened the yuan when Trump was elected to try to ward off a trade war.

6) Trump wasn’t placated and tariffs were launched. They weakened the currency with the idea that a threat of a big one-off devaluation in the currency might create some leverage.

7) After trying to hold-out, it seemed clear earlier this year that they needed to get a deal done, as the economy continued to sink. They walked the currency higher again – a signal that they are willing to make aggressive concessions to get a deal done.

But now, with a hard deadline and threat of a tariff escalation, the Chinese made one of the largest devaluations in the yuan in years (a warning shot).

Here’s a look at the chart going into the deadline …

|

|

|

If we get a no deal/ tariff escalation on Friday, we can expect the Chinese to continue weakening the yuan to offset some of the tariff burden.

So, tariffs have been a tool of retaliation for the U.S., to counter nearly three decades of currency manipulation by the Chinese. If we don’t get reform, the Chinese will retaliate with … more currency manipulation.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |