Why A Fed Rate Cut Would Steepen The Yield Curve

|

April 30, 5:00 pm EST

As we head into a Fed decision tomorrow, we’ve talked about the prospects of a Fed rate cut. It’s highly unlikely.

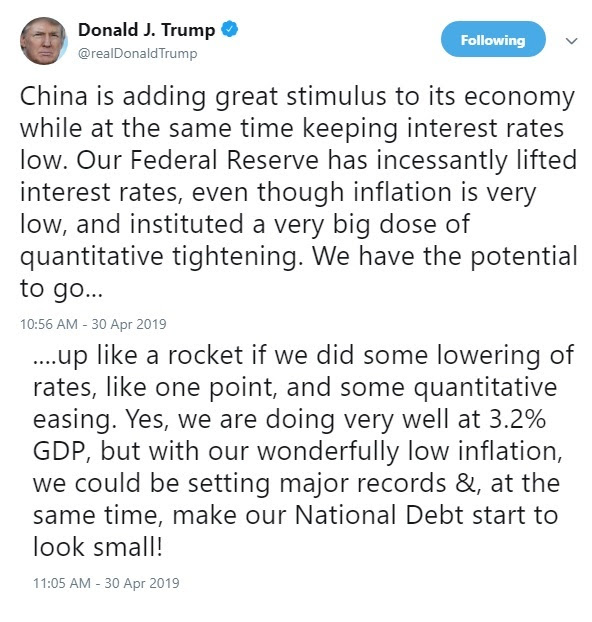

It’s even more unlikely today, after Trump pushed for, not just a cut, but a full point cut …

|

|

Unfortunately, the influence Trump tried to wield late last year, is probably why the Fed hiked in December — just to prove to the world that they (the Fed) wouldn’t be politically influenced.

With that, we now have an economy growing at 3%+, stocks near record highs and subdued inflation. And yet we have a ten-year yield at 2.5%. It doesn’t fit. The interest rate market is still sending the message that the December rate hike was a mistake.

With that, if we did get a cut by this summer, I suspect the interest rate market would adjust to reflect a more optimistic economic outlook. By that, I mean, with a cut in the Fed funds rate, the long end of the yield curve (specifically, 10-year yields) would probably go UP not down –steepening the yield curve.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

|

|

|

|

|