|

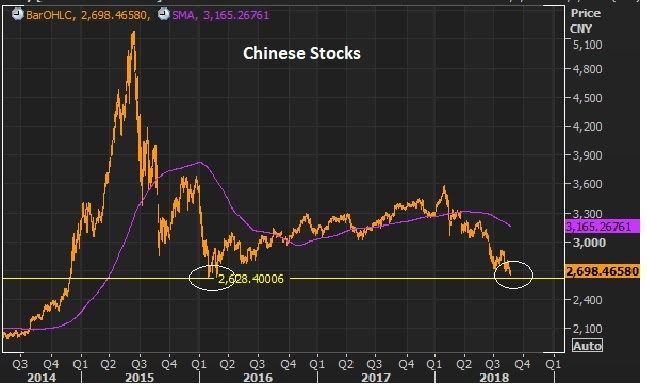

August 20, 5:00 pm EST As we discussed on Friday, with China coming back to the negotiating table on trade, we have a signal that the trade dispute smoke will not end in fire. That is unlocking this rotation we’ve been talking about for the past month or so, where the money that has been plowed into the stocks of the very hot tech giants, starts moving out and into the lagging blue chips. With that, as we sit eight months into the year, with the winds of fiscal stimulus in our sails, the S&P 500 is just now close to recovering the losses from the January highs. And the Dow remains, 3.2% off of the January highs (which were record highs). But I suspect we will now close that gap quickly. Remember, we have two very hot earnings quarters under our belt, and building momentum in the economic data, as fuel for stocks. And I suspect the China news, to break the stalemate on trade negotiations, will also fuel the resumption of the young bull market in commodities, which should offer very attractive investing outcomes in the coming months. Maybe the best signal for commodities is this chart on Chinese stocks, which looks like it may have bottomed TODAY into these 2016 lows (circled). |

|

|

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

|