Commodities Look Ready To Play Catch Up To Stocks

July 19, 2017, 4:00 pm EST Invest Alongside Billionaires For $297/Qtr

As we know, inflation has been soft. Yet the Fed has been moving on rates, assuming that they have room to move away from zero without counteracting the same data that is supposed to be driving their decision to increase rates.

Thus far, after four (quarter point) increases to the Fed funds rate, the moves haven’t resulted in a noticeable tightening of financial conditions. That’s mainly because the interest rate market that most key consumer rates are tied to have remained low. Because inflation has remained low.

A key contributor to low inflation has been low oil prices (though the Fed doesn’t like to admit it) and commodity prices in general that have yet to sustain a recovery from deeply depressed levels (see the chart below).

But that may be changing.

Commodities have been lagging the rest of the “reflation” trade after the value of the index was cut in half from the 2011 highs. Remember, we looked at this divergence between the stocks and commodities last month. Commodities are up 6% since.

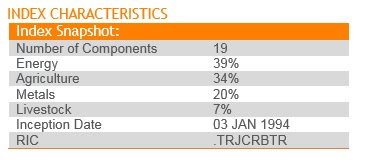

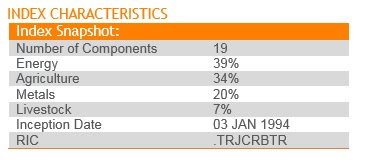

Things are picking up. Here’s the makeup of the broadly followed commodities index.

You can see, energy has a heavy weighting. And oil, with another strong day today, looks like a break out back to the $50 level is coming.With today’s inventory data, we’ve now had 12 out of the past 14 weeks that oil has been in a draw (drawing down on supply = bullish for prices). And with that backdrop, the CRB index, after being down as much as 13% this year, bottomed following the optimistic central bank commentary last month, and is looking like it may be in the early stages of a big catch-up trade. And higher oil (and commodity prices in general) will likely translate into higher inflation expectations.

Join our Billionaire’s Portfolio and get my most recent recommendation – a stock that can double on a resolution on healthcare. Click here to learn more.